Today, options contracts worth $1.62 billion for Bitcoin and Ethereum will expire, affecting the cryptocurrency market. Due to the amount of expiring options, there may be short-term price volatility, which might have an impact on traders’ profits.

In particular, the options for Bitcoin (BTC) that are about to expire are valued at $1.25 billion, whilst the options for Ethereum (ETH) are valued at $367 million.

Bitcoin and Ethereum holders brace for volatility

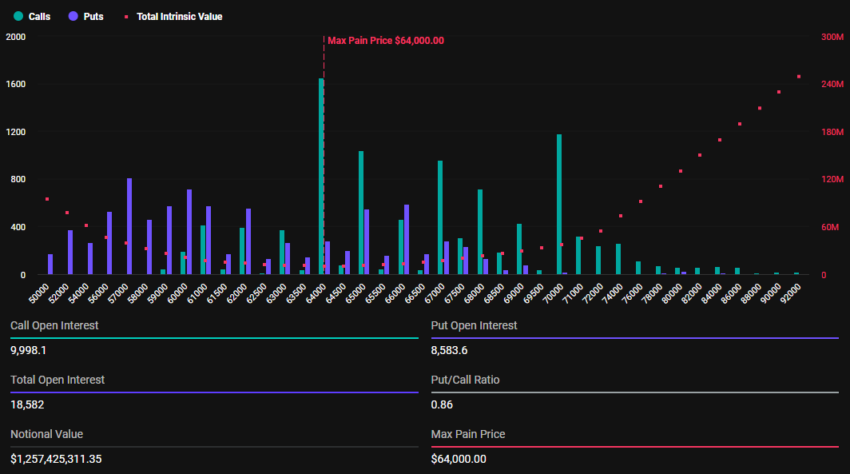

Deribit data indicates that 18,583 Bitcoin options are scheduled to expire today, which is a little more than the 18,271 contracts that failed last week. The put-to-call ratio of the options contracts that are scheduled to expire today is 0.86, and the maximum pain point is $64,000.

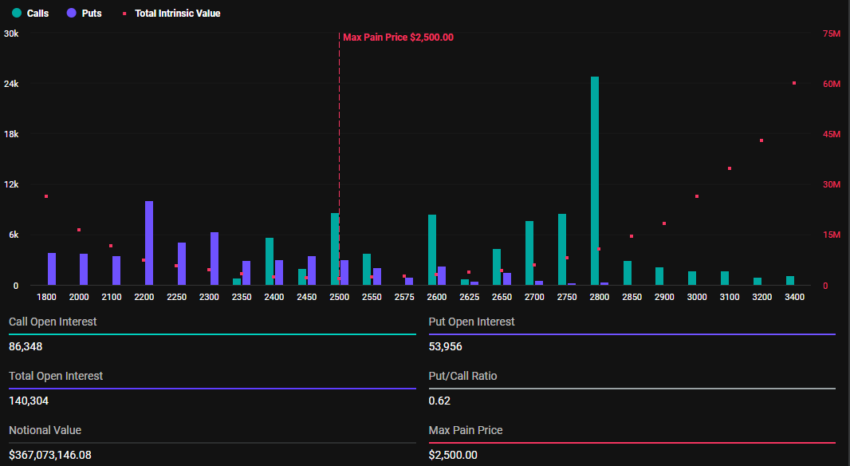

Conversely, today’s expiration of Ethereum options contracts stands at 140,320, a substantial decrease from the previous week. They have a 0.62 put-to-call ratio and a $2,500 maximum pain point when they expire.

Based on these facts, it appears that both futures are typically seen as bearish. At $67,661, bitcoin is trading over its maximum pain threshold. Similarly, as of this writing, Ethereum is trading for $2,617, far more than its strike price.

The values of Bitcoin and Ethereum are anticipated to reach their respective maximum pain points as the options contracts approach expiry. This implies that when smart money is motivated to drive the price toward the “max pain” level, the value of BTC and ETH may decrease. The Max Pain hypothesis underpins this, stating that the pricing of options will tend to converge around the strike prices at which the greatest amount of contracts, both puts and calls, expire worthless.

The suggested adverse attitude stems from the strategy’s tendency to lead option purchasers to lose the greatest value. However, after Deribit settles the contracts on Friday at 8:00 UTC, the pressure on the price of BTC and ETH may lessen.

Analysts argue that in the meanwhile, a significant rally is needed for both Bitcoin and the market as a whole, which may allow the original cryptocurrency to recapture its record high above $73,777. Macroeconomically speaking, tailwinds are nowhere to be found. The US elections, according to CoinShares experts, continue to be the primary factor influencing market sentiment.

“…investor decisions have likely been more influenced by the upcoming US elections than by monetary policy outlooks. This trend is evident in the fact that stronger-than-expected economic data had little impact on stemming outflows, whereas the recent US vice presidential debate and a subsequent shift in polling towards the Republicans, perceived as more supportive of digital assets, led to an immediate boost in inflows and prices,” a paragraph from the recent report stated.

Fantom (FTM) price shows signs of slowing after 14% weekly surge

Although the Fantom (FTM) price has lately increased in a positive way, it is still unclear how long this rise will stay. Important signs are beginning to suggest that momentum may be waning despite the initial spike. The drop in ADX levels indicates that the strong bullish trend could be waning.

Furthermore, even if the recent decline in exchange supply gave a boost, the metric’s following stability casts doubt on the urge to keep rising. The next several days will be critical in deciding if FTM can continue to make progress or experience a decline in support.

Fantom price current trend may not last

The ADX for FTM is at 28.85, down from 32 only one day ago. This follows a brief but intense spike in which the ADX increased from 15 to 32 in two days, indicating a sharp and quick increase in trend strength.

Traders are keeping a tight eye on the trend to see if it goes down, since the latest dip suggests that the momentum may be losing some of its strength.

Regardless of whether a trend is bullish or bearish, the Average Directional Index, or ADX, gauges its strength. Its values range from 0 to 100, where anything above 20 denotes a market that is trending and anything above 30 denotes a significant trend. This robust upswing has caused the price of FTM to rise by 14% during the last seven days.

The ADX’s decline from above the 30-point mark, however, raises the possibility that the present rising impetus is waning. The recent bullish rise may be coming to an end if the ADX keeps declining, which would indicate that the trend is becoming weaker.

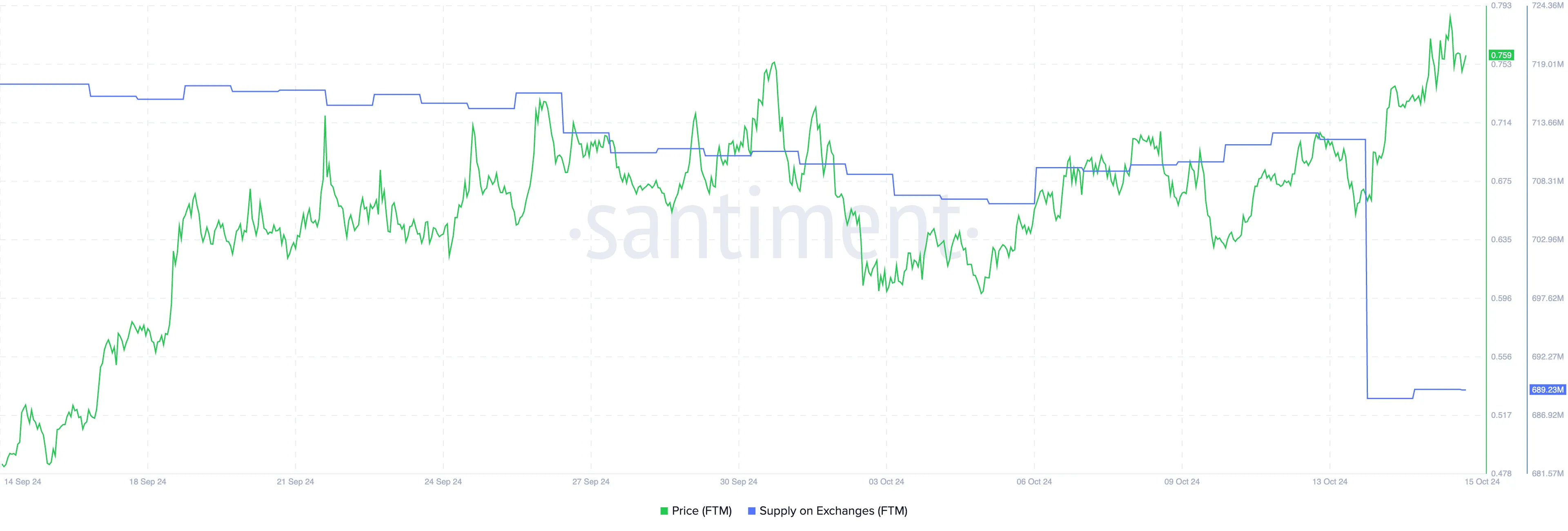

FTM supply on exchanges dropped heavily before the recent surge

FTM’s supply on exchanges decreased from 712 million to 688 million between October 13 and October 14. This was accompanied by a price rise; on October 15, FTM had increased from $0.66 on October 13 to $0.78.

The decrease in the exchange supply implies that there were less tokens available for sale, which corresponded with the price increase that followed.

Users transferring bitcoin to exchanges are usually regarded as pessimistic since they could be getting ready to sell. On the other hand, the removal of coins from exchanges frequently denotes a positive attitude as it suggests that the holders are not going to sell very soon and may even be anticipating a price gain.

Although the amount of FTM’s exchange supply has steadied after the first decline, it is still important to keep an eye on this indicator. Variations in supply on exchanges might reveal important information about future mood swings in the market.

Fantom price prediction: Can it rise back to $0.96 in October?

The EMA (Exponential Moving Averages) lines of FTM are bullish right now, with a good distance between the long- and short-term lines. Given that the price has kept a commanding lead in the current trend, this suggests significant upward momentum.

A positive feeling in the market is indicated when short-term EMAs are positioned considerably above the long-term ones. This indicates that recent price action has been more favorable than the longer average.

By emphasizing current prices, EMA lines are used to smooth out price data. This makes it easier for traders to determine a trend’s direction and recognize shifts in momentum sooner.

Nevertheless, FTM’s short-term EMAs have begun to curve lower following the recent price increase. A bearish signal known as a “death cross” will occur if they cross below the long-term EMAs, indicating a possible trend reversal and more downward.

In the event that this occurs, the price of FTM may challenge the $0.65 and $0.59 support levels. However, if the upswing picks up steam, FTM may keep moving higher and take on resistance around $0.76, a level it hasn’t been able to cross previously. If that is broken, FTM may return to $0.85 or possibly $0.96, which is its highest price since May.

Worldcoin unveils new Layer-2 network ‘World Chain’

World, the former Worldcoin, claims that verified human users would have preferential access to block space and free gas on the World Chain, providing them an advantage against bots.

The “proof-of-humanity” project Worldcoin, which changed its name to World after being formed by Sam Altman, has introduced World Chain, an Ethereum layer 2 blockchain.

The 15 million users who have confirmed their identities by scanning their iris for a “World ID” can now access the network, according to a statement released by World on October 17.

As it tries to extend its onboarding efforts, the business established World Chain to assist increase efficiency and deliver additional capabilities for users of its Worldcoin (WLD) token.

World said that its new blockchain will give verified human users—those with World IDs—priority over bots, granting them access to block space and a free gas allocation.

Furthermore, World said that a number of high-profile apps and projects will be available on its blockchain, such as Uniswap for asset exchanges, Zerion for real-time APIs, Alchemy for development, and Optimism for interoperability.

World Chain is now open to every human 🫡 pic.twitter.com/5lVdVM9Em0

— World (@worldcoin) October 18, 2024

In April of this year, World made its initial announcement about World Chain, stating that the network advanced its “human-centric” strategy for promoting the use of cryptocurrencies. World rebranded itself and revealed a new iteration of its “Orb” biometric gadget, which resembles a chrome spherical and is used by the firm to scan people’s eyes, coinciding with the debut of World Chain.

The business also disclosed additional choices for identity verification as well as alliances with social media platforms including Zoom, FaceTime, and WhatsApp.

It stated that the new Orb, which is powered by Nvidia hardware, will have fewer parts and a smaller footprint than its predecessor while being “five times” more powerful and efficient.

Sam Altman, the CEO of OpenAI, Alex Blania, the CEO of Worldcoin today, and Max Novendstern, the CEO of biometrics research company Mana, established the cryptocurrency, which came out of beta in July 2023.

A digital identification project called Worldcoin uses cryptocurrency and claims to be able to solve identity problems caused by the quick advancements in artificial intelligence. Furthermore, the company claims that by launching its WLD cryptocurrency, it hopes to provide a new universal basic income model.

By scanning their iris at an Orb device, Worldcoin users create a unique identity with the company’s “World App.” Users can choose to accept or decline the offer of receiving a free allotment of WLD tokens after authenticating at an Orb.

The launch of a new network by World seems to have no impact on the WLD token, as its price dropped 2.1% for the day, according to CoinGecko.