Elevated open interest indicates increased leverage, perhaps leading to another flush-out in the event that positions are closed.

On October 21, when the price of Bitcoin was on the verge of breaking $70,000, open interest in futures related to the cryptocurrency hit a record high.

Open Interest (OI) on Bitcoin (BTC) futures contracts has hit a record high of $40.5 billion, according to a CoinGlass post on X on October 21.

The amount or quantity of pending futures contracts that have not yet expired is known as the open interest. At any one moment, it quantifies the amount of money invested in Bitcoin derivatives; greater OI suggests that there may be more leverage and volatility in the system.

With 30.7% of the OI, the Chicago Mercantile Exchange (CME) held the largest proportion, followed by Binance (20.4%) and Bybit (15%).

Sharp price movements during periods of high OI may set off cascade liquidations, which may push sellers to engage in “flush outs” on the spot market, leading to abrupt drops in the price of bitcoin.

The most recent flush-out happened in early August, when the price of bitcoin fell below $50,000 and by about 20%, or around $12,000, in less than two days.

According to TradingView, the asset is skyrocketing, hitting $69,380 in early trade on October 21. At the time of publishing, it had retreated to trade at $69,033, having been rejected at resistance.

The asset is only 6.4% off its all-time high of $73,738 according to CoinGecko.

According to a Cointelegraph article from October 20, if Bitcoin (BTC) rises beyond $70,000, it might significantly boost altcoins like Ethereum (ETH) and Solana.

In terms of daily gains, both assets are now exceeding BTC. Solana made 6% on the day and closed just shy of $170 during early trading on October 21, while Ether gained 3.5% to reach $2,750. Nevertheless, since then, both assets have somewhat declined.

Coinbase co-founder backs XRP lawyer John Deaton against Senator Warren

According to Coinbase CEO and co-founder Brian Armstrong, “Massachusetts residents should vote for John Deaton” in order to support a pro-crypto future.

Republican candidate from Massachusetts and XRP lawyer John Deaton is gaining ground on formidable opponent Senator Elizabeth Warren. Brian Armstrong, the CEO and co-founder of Coinbase, is the most recent to back Deaton while criticizing Senator Warren.

Coinbase co-founder supports John Deaton

Coinbase co-founder Brian Armstrong said on the X platform on October 21 that “residents of Massachusetts should vote for John Deaton.” In addition, he blasted Senator Elizabeth Warren and pointed out that she was instrumental in selecting Gary Gensler to lead the US SEC.

Armstrong has charged that Warren pushed Gensler to do things that would damage the US cryptocurrency market. Additionally, he accused Senator Warren of being “anti-freedom” and implied that she supported a banking system under government control.

The co-founder of Coinbase attacked Senator Warren for her ideas, which seriously damaged the nation. He said that despite the industry’s continued growth, her anti-crypto efforts haven’t been very effective. “We and others fought back, so fortunately they did not succeed,” the creator of Coinbaseco stated.

Agreed – Massachusetts residents should vote for @JohnEDeaton1

Crypto holders in MA should realize @SenWarren is the one who got Gary Gensler his job and encouraged him to (unlawfully) try and kill the crypto industry in America. Luckily they did not succeed as we and others… https://t.co/uLcBzIXyTV

— Brian Armstrong (@brian_armstrong) October 21, 2024

Other proponents of the cryptocurrency sector have also shown support for XRP lawyer John Deaton in recent days. renowned crypto attorney MetaLawMan says:

“If you live in Massachusetts you should vote for John Deaton. Deaton has done more for crypto freedom than all other candidates combined. His opponent Senator Warren believes you should be debanked if you make investment choices she disapproves”.

Senator Warren faces huge backlash

The cryptocurrency sector has severely retaliated against Senator Elizabeth Warren for her oppressive stance on the subject. Aside from the co-founder of Coinbase, the majority of seasoned professionals in the cryptocurrency space have charged her with targeting cryptocurrency-friendly financial institutions such as Custodia Bank and Silvergate Bank. Along with her colleagues in the Fed and SEC, many people also think that she was a major architect of Operation Choke Point 2.0.

Leaders in the cryptocurrency sector, including the Winklevoss twins, have also contributed more than $1 million to political campaigns aimed at unseating Senator Warren. Senator Warren attacked crypto-funded organizations last month, accusing them of not wanting “fair regulations” for the sector. They are displeased with me because I have advocated for reasonable industrial restrictions that safeguard working people, she added.

But Kamala Harris, the Democratic nominee, has suddenly adopted a pro-crypto stance, and she intends to replace Gary Gensler with other pro-crypto contenders.

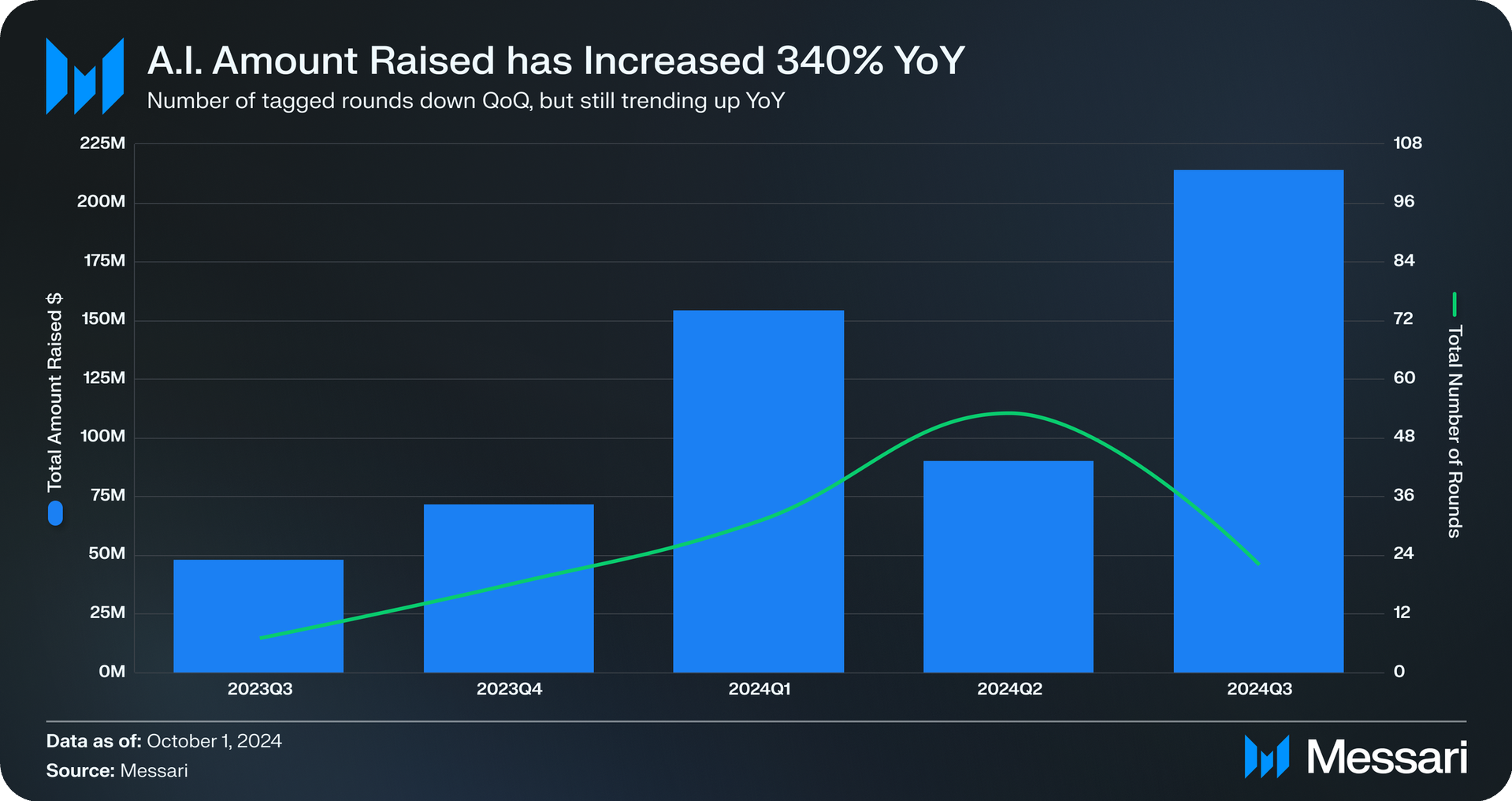

Crypto VCs flock to AI: over $213M invested in Q3

The last quarter saw a sharp increase in artificial intelligence (AI) investment in the cryptocurrency market, which was matched by a notable spike in investor interest this month.

So, it seems that the venture capitalists (VCs) in the cryptocurrency space are placing a large wager on the AI narrative for the upcoming cycle.

Crypto VCs invest over $213M in AI during Q3

According to a new Messari analysis, last quarter saw VCs invest over $213 million in AI-related startups. This number represents a 2.5-fold rise from the Q2 and a 340% year-over-year increase.

Messari claims that other AI projects have penetrated different industry areas in addition to those that are concentrated on using AI for decentralized platforms. These initiatives currently integrate AI with DeFi, DePin, and social networks. Furthermore, according to a recent analysis, AI tokens could perform better than meme currencies.

“While overall venture funding in Q3 2024, totaling $3.8 billion, represented a slight dip compared to previous quarters. The strong focus on AI and DePIN suggests that venture capitalists are positioning themselves for long-term growth in sectors they believe will define the next phase of the crypto industry,” Messari commented.

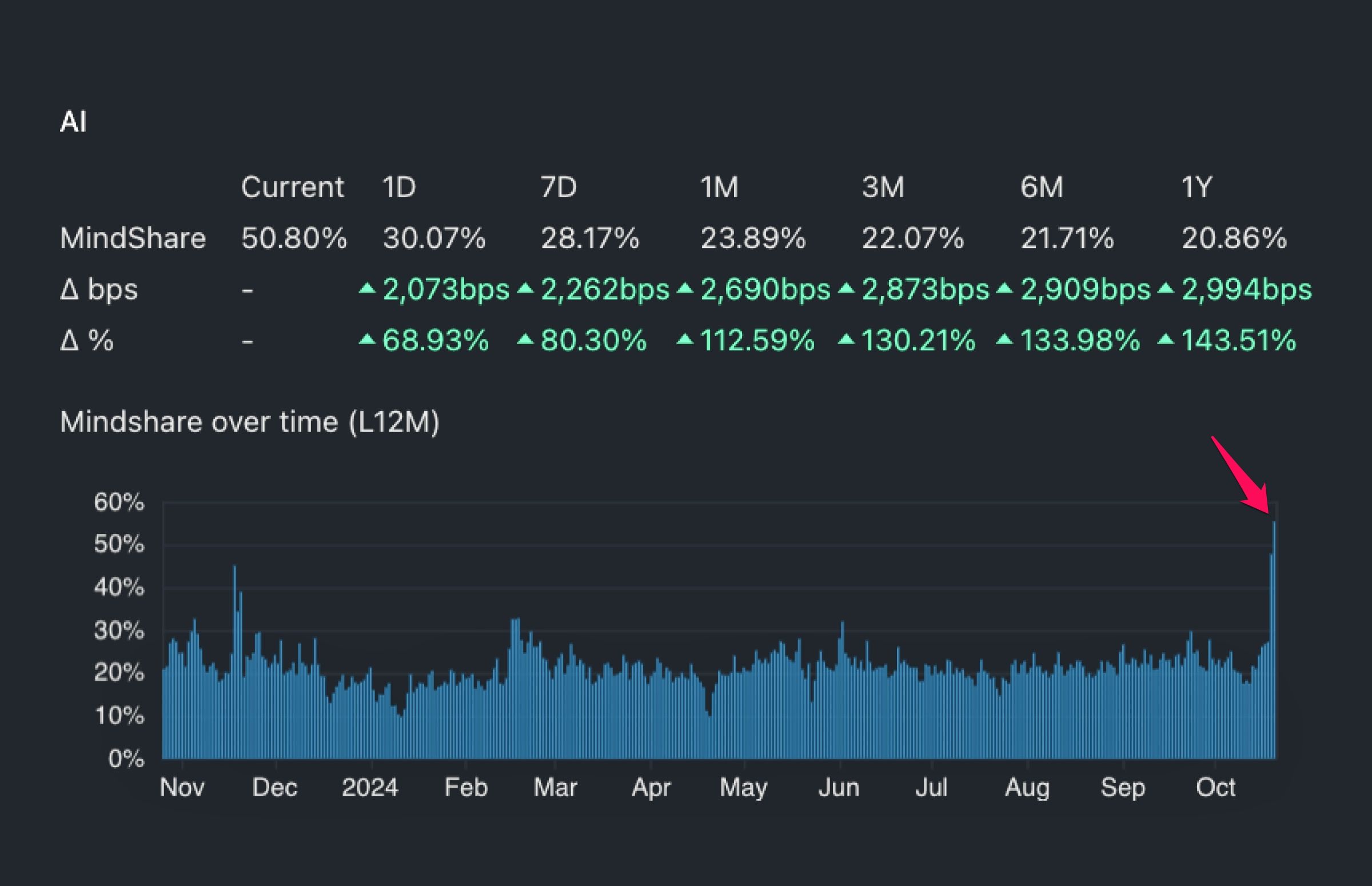

Investor interest in AI rises in October

According to data from Kaito, conversations around AI hit a record high in October, with mindshare rising beyond 50%. The bigger the proportion, the higher the amount of investor interest in the issue being tracked by this indicator, which measures the volume of community conversations on it.

Furthermore, the rebound in Nvidia’s (NVDA) stock price to all-time highs coincides with the growing interest in AI. With its all-time record market capitalization of $3.41 trillion last week, Nvidia is now the second-largest business in the world by market value.

As per The Kobeissi Letter, Nvidia has surged in value by 190% so far this year, positioning it as the second most performing firm within the S&P 500.

This chart demonstrates the relationship between the rising value of AI in the cryptocurrency market and Nvidia’s stock. As a result, the pricing of AI tokens may be impacted by Nvidia’s impending earnings announcement in November.

The market capitalization of AI tokens has increased 100% from its August low to $36.7 billion as of this writing. The daily trading volume of AI tokens has reportedly surpassed $1.7 billion, according to CoinMarketCap.