Over the past few days, Bitcoin Ordinals NFT has regained significant attention from the community with a remarkable growth rate. In particular, Ordinals has ushered in a new wave of non-fungible tokens (NFTs) and entirely new fungible tokens BRC-20, creating FOMO across various blockchains. Everyone is eager to understand what Bitcoin Ordinals NFT is, how it operates, and which projects lead the way in the Bitcoin Ordinals NFT space.

Read more: What are Ordinals? How to Buy Ordinals?

Many may assume that Bitcoin Ordinals NFT is a newly developed project and relatively young. However, built on the mature blockchain of Bitcoin, it can hardly be considered as such. Now, let’s explore the evolutionary journey of Bitcoin Ordinals NFT together with FMCPAY.

What are Ordinals? How to Buy Ordinals?

✍️The $BTC community on Twitter is excited about the recent surge in Bitcoin’s value, hitting a new all-time high at $44k🚀. This upward trend is impacting the entire #Bitcoin ecosystem, highlighting key elements such as Ordinals,…— FMCPAY (@FMCPay) December 8, 2023

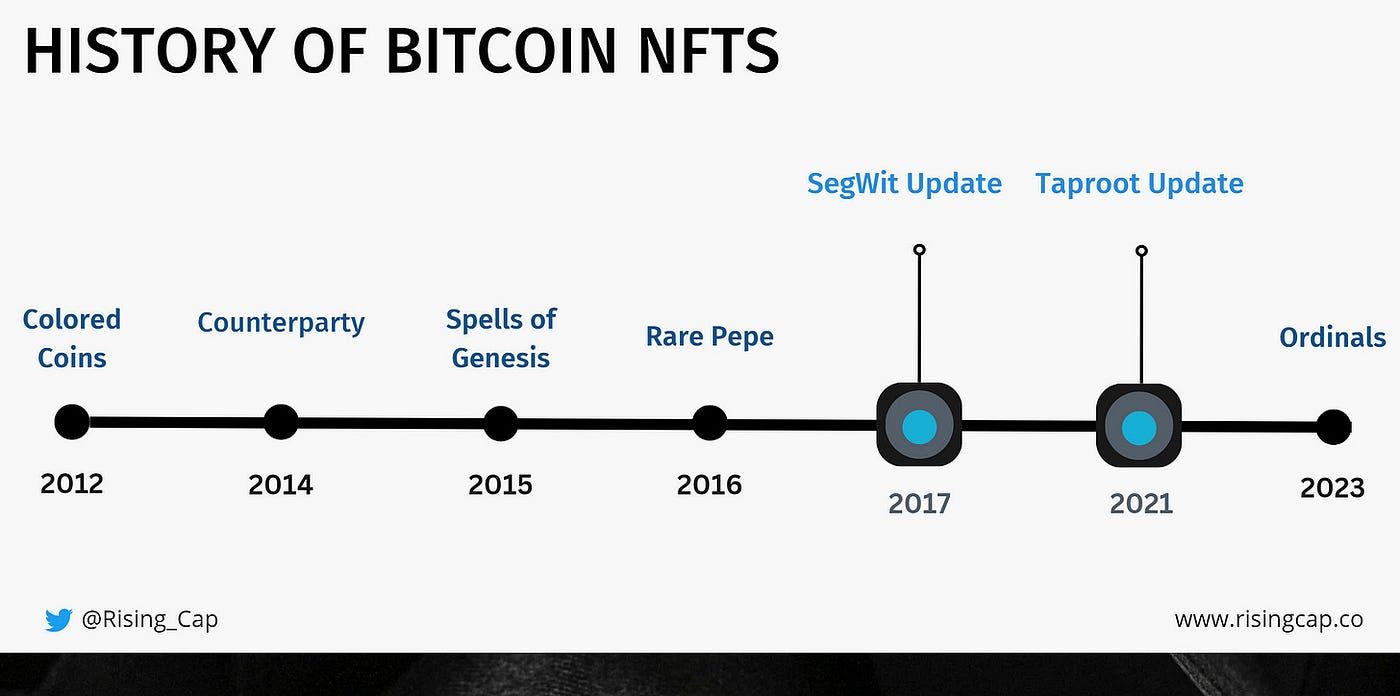

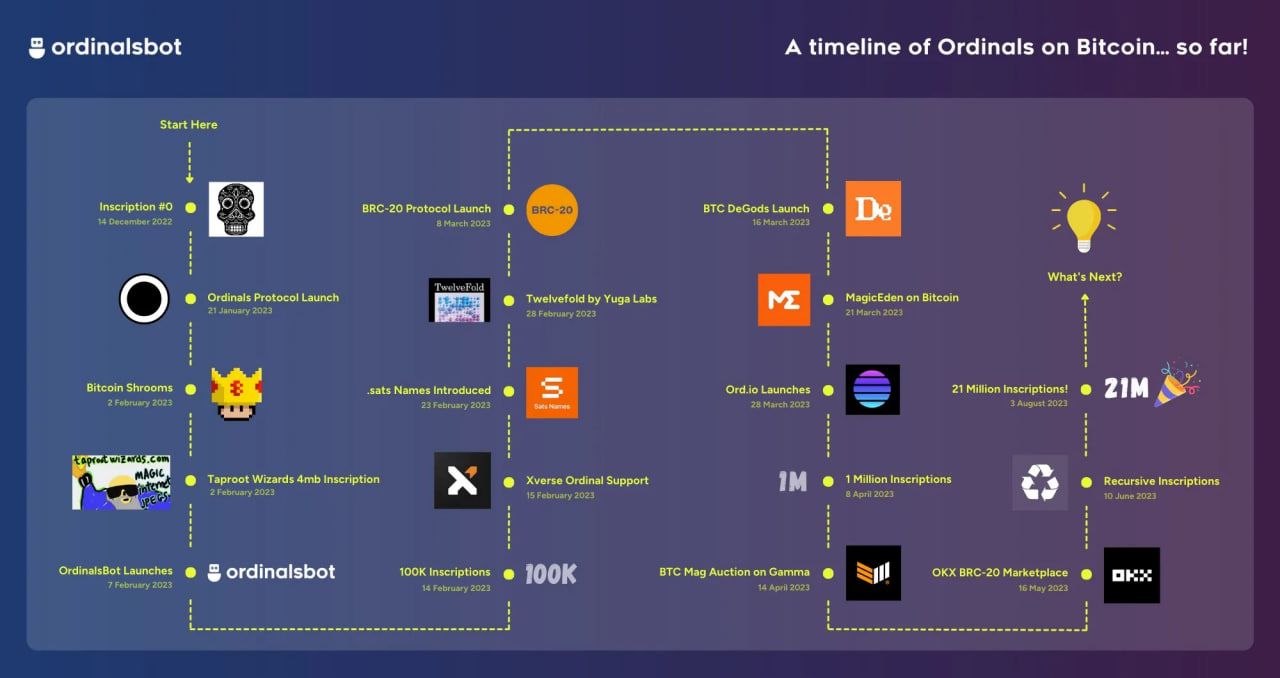

Development Path of Bitcoin Ordinals NFT

Usually, NFTs are associated with Ethereum, BNB Chain, Polygon, Solana, and are seldom mentioned on the Bitcoin network. However, few are aware that Ordinals, a protocol for creating NFTs on Bitcoin, emerged this year and serves as the pioneer for current NFTs, opening up a new trend in the market.

2012 – Colored Coins – History of Bitcoin Ordinals NFT

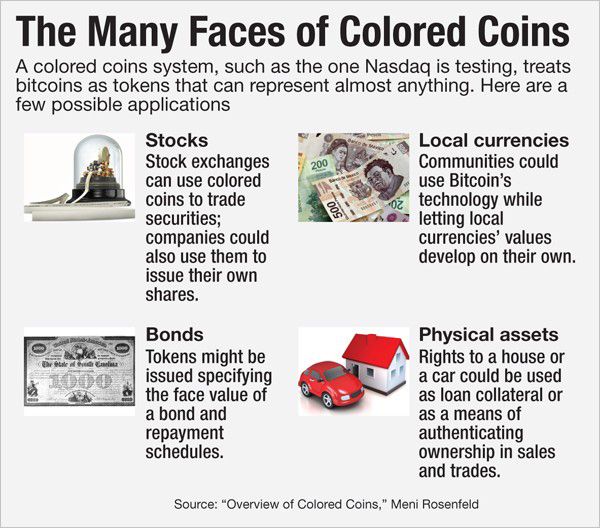

Colored Coins, an open-source protocol built on Bitcoin 2.0, allowed users to encode real-world assets such as stocks, bonds, real estate, on the Bitcoin blockchain. Colored Coins aimed to reduce transaction costs and complexity in the transfer of ownership of real-world assets. The value of Colored Coins was independent of the current price of Bitcoin, determined instead by the value of the actual assets. Notably, NFTs on Ethereum trace their origins back to Colored Coins, and it also served as the foundation for building NFTs on the Bitcoin network later.

However, despite being the first cryptocurrency, the Bitcoin blockchain was not suitable for encoding real-world assets into stored assets on the chain. Consequently, Ethereum was created to eliminate these persistent limitations and took on the tasks that the Bitcoin blockchain could not accomplish. As a result, Colored Coins gradually lost its position.

2014 – Namecoin, Omni Layer, and Counterparty – History of Bitcoin Ordinals NFT

Namecoin

In 2014, a Bitcoin token called Namecoin was introduced. Namecoin, the first hard fork of Bitcoin, was praised as “one of the most innovative altcoins to date.”

Namecoin paved the way for various cryptocurrency protocols and features, including merged mining and decentralized domain name system (DNS). It was the first solution to the “Zooko’s Triangle,” a long-standing problem in creating a naming system simultaneously secure, decentralized, and meaningful to humans.

Additionally, Namecoin planned to directly input data into the Bitcoin blockchain. However, the plan was thwarted due to numerous challenges.

Omni Layer

Formerly known as Mastercoin, Omni Layer allowed developers to design various types of digital assets on Bitcoin, extending beyond the use of the network alone. These assets could include additional information through the project’s OP_RETURN function, which still operates in the basic Bitcoin system.

Since its inception, Omni Layer has been the most successful meta protocol on the Bitcoin platform. It is an easily deployable platform that enables stable and uninterrupted trading of custom digital assets and cryptocurrencies for over four years.

Currently, digital assets represented on the OMNI layer have a market capitalization of over $1.2 billion. One of the most famous tokens on Omni is Tether.

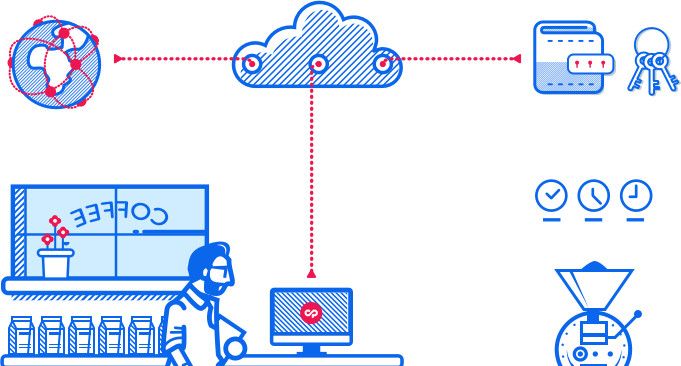

Counterparty

Counterparty is the third factor enhancing digital assets on Bitcoin by encoding arbitrary data through the OP_RETURN function.

Counterparty released an open-source ecosystem, allowing users to create digital assets. This led to a range of new products, including blockchain games. It has become a rapidly growing industry, attracting millions of participants.

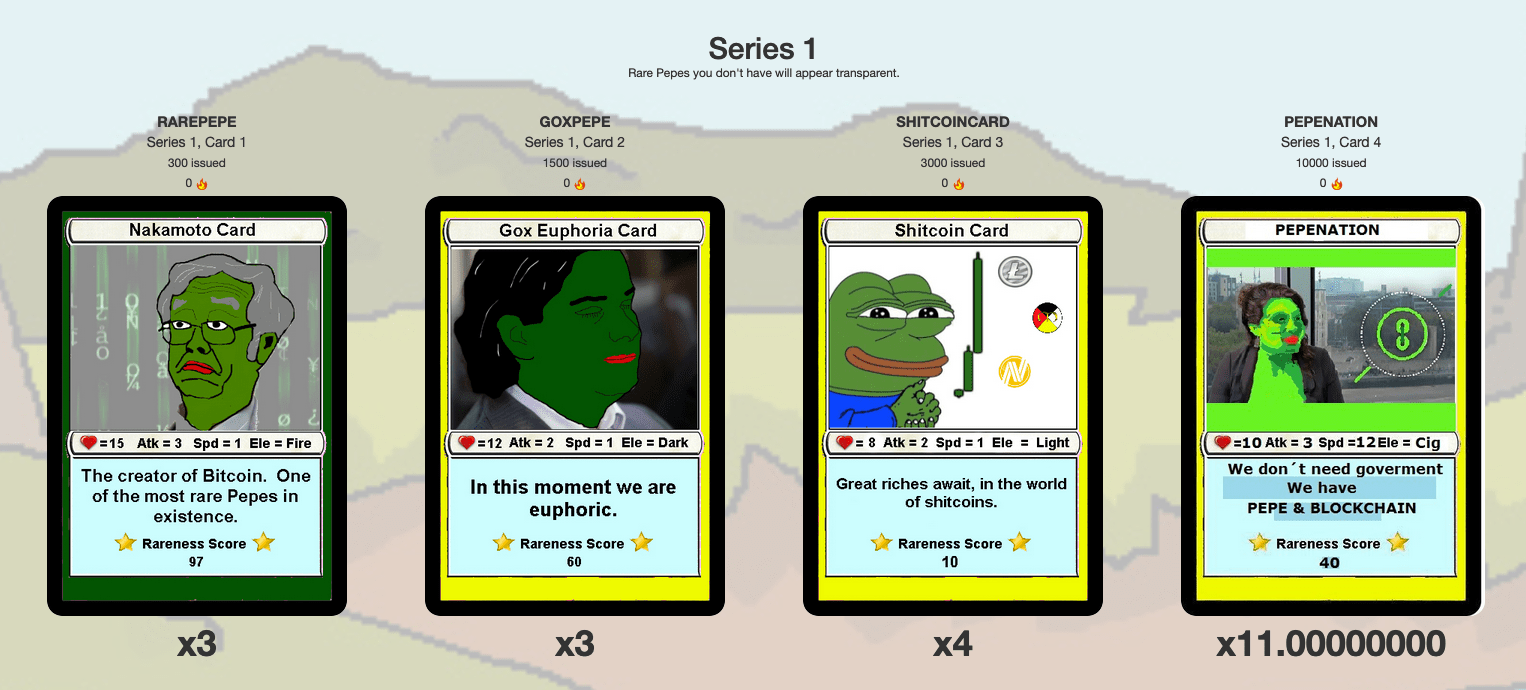

2015/2016 – Everdream Soft and Rare PePe Cards – History of Bitcoin Ordinals NFT

Due to the success of Counterparty, blockchain Bitcoin games experienced a boom, exemplified by the game “Spells of Genesis.” Notably, this game used NFTs for transactions and rewards.

Beyond in-game NFTs, in 2015, a Bitcoin NFT project named “Rare PePe Cards” was born.

This marked the official entry of Bitcoin Ordinals NFT into the cryptocurrency market.

2017 – SegWit – History of Bitcoin Ordinals NFT

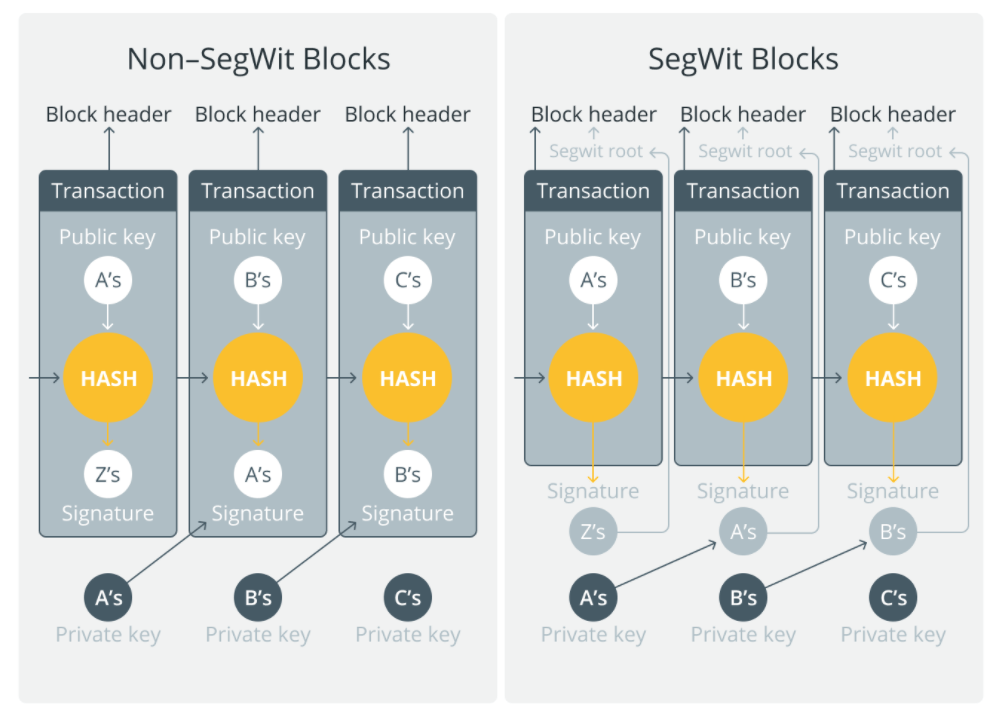

The most crucial event for NFTs on the Bitcoin blockchain was the Segregated Witness (SegWit) upgrade in 2017.

SegWit, short for Segregated Witness, is a process to increase the block size limit on the Bitcoin blockchain by removing signature data from Bitcoin transactions. When specific parts of the transaction are removed, this frees up space or enables more transactions to be added to the chain.

The reason for SegWit’s existence is that the average Bitcoin network confirms a new block every 10-15 minutes, with each block containing a certain number of transactions. Therefore, the block size affects the number of transactions that can be confirmed in each block. Additionally, SegWit fixed security vulnerabilities in the Bitcoin network, making the blockchain safer and more stable overall.

As a result, the SegWit upgrade brought many positive impacts to Bitcoin.

In fact, the introduction of SegWit was a significant step forward in addressing many issues related to the scalability of Bitcoin and similar blockchain networks like Litecoin. It also paved the way for new features on the Bitcoin network, including the creation and trading of NFTs.

2021 – Taproot and Stacks – History of Bitcoin Ordinals NFT

Following SegWit, the Taproot upgrade was the next significant development, implemented on November 14, 2021.

Taproot’s goal was to change how Bitcoin’s commands operate to improve privacy, scalability, and security. Importantly, the upgrade also allows Bitcoin to perform more complex transactions and expand use cases to compete with Ethereum, particularly in smart contracts and support for decentralized finance (DeFi) and non-fungible tokens (NFTs) on the network.

Apart from Taproot, the Layer2 blockchain project Stacks (STX) also represents a crucial milestone in the development journey of Bitcoin Ordinals.

Stacks, formerly known as BlockStack, is an open-source network of decentralized applications (dApps) and smart contracts built on Bitcoin. Additionally, this Layer2 blockchain provides programmability for Bitcoin. In other words, Stacks is constructed on Bitcoin, aiming to enhance the scalability of Bitcoin, allowing developers to create smart contracts and dApps on Bitcoin without altering any fundamental aspects.

However, when trading NFTs on Stacks, users can only transact using the project’s native token (STX) and not Bitcoin.

Present – Inscriptions and Ordinals – History of Bitcoin Ordinals NFT

Thanks to the features of Ordinals, Bitcoin has been “ushered in with a breath of fresh air” as users can mint and trade NFTs directly on Bitcoin.

Bitcoin Ordinals NFT is a mechanism that allows users to attach data (images, text, etc.) to a unit of Bitcoin’s satoshi. Each Bitcoin consists of 100,000,000 satoshis, meaning users can mint 100 million NFTs on 1 Bitcoin.

Currently, Bitcoin remains the “king” of the crypto market with the leading market capitalization. However, in contrast, the Bitcoin ecosystem lags far behind compared to other major competitors such as Ethereum, Solana, Polygon.

This can be explained by Bitcoin’s limitations in implementing Smart Contracts, leading to a lack of many decentralized applications (DApps) that can be built on Bitcoin.

As a result, instead of developing on Bitcoin, most decentralized applications related to DeFi or NFTs are developed on platforms other than Bitcoin, such as Ethereum, Solana, Polygon. This is the reason why the Bitcoin ecosystem is currently lagging and needs a new solution that can bring a “breath of fresh air” to Bitcoin. Hence, Bitcoin Ordinals NFT comes into existence.

It is worth noting that, since its explosion, the revenue of NFT projects using Bitcoin Ordinals NFT, such as Yuga Labs, DeGods, Taproot Wizards, Twelvefold, or various token types like $ORDI, $SATS, is experiencing a significant surge, with NFT transaction volumes growing rapidly.

With such massive sales figures, it is not surprising that experts predict Bitcoin NFTs will reach a market capitalization of $4.5 billion by 2025.

Conclusion

Bitcoin Ordinals NFT is a trend that the cryptocurrency community is particularly interested in. However, it has not yet fully developed due to infrastructure limitations, approach methods, and practical application aspects compared to NFTs in other ecosystems.

Especially, every innovation faces opposing opinions, and Ordinals are just in the early stages. In the future, we can expect an explosion that will “Make Bitcoin magic again”.

FMCPAY RESEARCH (VINCΞ)