The price of Bitcoin (BTC) has above $60,000 once more, giving investors cause for confidence. The surge is being fueled by predictions of a rate decrease by the Federal Reserve and MicroStrategy’s most recent Bitcoin acquisition. JPMorgan’s changing position on Bitcoin, meanwhile, suggests increased institutional interest.

BlackRock has issued cautionary cautions, but positive momentum is still driving the market, leading traders to speculate as to whether this is the beginning of a long-term rising trend.

MicroStrategy acquires 18,300 Bitcoin, now holding $14.14B in BTC

MicroStrategy purchased 18,300 more Bitcoin in August and September of 2024 for about $1.11 billion. With this, the company’s total Bitcoin holdings now stand at about $14.14 billion, or 244,800 BTC. Since they started buying Bitcoin in 2020, the average price paid per coin has been $38,585.

MicroStrategy has acquired 18,300 BTC for ~$1.11 billion at ~$60,408 per #bitcoin and has achieved BTC Yield of 4.4% QTD and 17.0% YTD. As of 9/12/2024, we hodl 244,800 $BTC acquired for ~$9.45 billion at ~$38,585 per bitcoin. $MSTR https://t.co/WBBRSKxA1U

— Michael Saylor⚡️ (@saylor) September 13, 2024

MicroStrategy sold more than 8 million shares to generate $1.11 billion to finance their most recent acquisition. Under the direction of CEO Michael Saylor, the business keeps making significant investments in Bitcoin despite differing analyst opinions.

The fact that a large organization such as MicroStrategy has made such a substantial investment shows that there is hope for Bitcoin’s future growth.

Bitcoin surges to $60K amid Fed rate cut expectations, BlackRock urges caution

Bitcoin (BTC) reached a high of about $60,000 on Friday, its highest since early September. Investor anticipation that the Federal Reserve may soon cut interest rates, increasing the attraction of riskier assets like cryptocurrencies, was the driving force behind this 2.5% surge.

Rate reductions are becoming more popular as a means of relieving economic stress when inflation declines.

#Bitcoin is up nearly 3% in 24 hours. But, it could be a bull trap. #BlackRock says Fed rate cuts may not come as expected. Here are the key takeaways from their weekly commentary.https://t.co/m8y6xVO0Cj

— Bankless Times (@BanklessTimes) September 12, 2024

A large rate drop of 50 basis points is still doubtful, although some analysts believe it is not completely out of the question. BlackRock has issued a warning, stating that the Fed’s decision to lower rates might be delayed by ongoing inflation and market volatility.

A possible rate cut would increase demand for cryptocurrencies and raise their price.

JPMorgan CEO Jamie Dimon’s shift on Bitcoin: From critic to investor

When Bitcoin was selling for about $4,000, JPMorgan CEO Jamie Dimon reportedly threatened to “fire in a second” any employee who did so.

JPMorgan recently divested its holdings in the iShares Bitcoin Trust, another Bitcoin ETF, and currently owns $42,000 worth of shares in the Grayscale Bitcoin Trust, despite his negative attitude.

Exactly 7 years ago, Jamie Dimon, the head of the most influential bank on Wall Street said he would fire anyone from JPMorgan who thought of trading Bitcoin. The reason for the firing would be “stupidity.”

Today, JPMorgan has an entire division that is responsible for crypto… pic.twitter.com/W7lRD2t65R

— Garry (@St1zze) September 13, 2024

Even the longstanding doubter Dimon, who called Bitcoin “fraud” seven years ago, compared it to the notorious Dutch tulip boom of the 1600s.

But when the cryptocurrency’s value skyrocketed due to institutional acceptance, JPMorgan’s investment in Bitcoin ETFs suggests a slow change in his opinion.

Dimon’s changing stance and JPMorgan’s investments indicate more institutional acceptance, which will probably raise the price of Bitcoin.

Will Bitcoin break key resistance at $58,500?

At the psychological $60k barrier, there is now a strong resistance level for bitcoin. A thin candle and a doji candle next to this resistance point point to market hesitation. A firm rising candle that follows suggests that there may be bearish corrective pressure.

In the event that Bitcoin is unable to break over $60,000, there may be more drop towards $58,800, with $58,250 serving as additional support.

Those thinking about taking long positions might find possibilities by purchasing between $58,000 and $58,250. But if Bitcoin stays below $60,000, it could be advantageous to sell.

A clear breach over $60,000 would change the mood of the market and allow for fresh price movement and maybe positive momentum.

Bitcoin adoption grows as Crypro All-Stars nears $1M in presale

The increasing popularity of Bitcoin feeds demand for cutting-edge platforms such as Crypto All-Stars, whose presale is almost at $1.2 million.

The platform has raised $1,245,300 of its $1,485,103 objective, with just one day remaining. For a brief while, investors may take advantage of the present rate, which is 1 $STARS = $0.0014419, before the price rises.

With Crypto All-Stars, holders of meme coins and Bitcoin may take advantage of special options that combine the market power of meme coins with Bitcoin staking.

The site has garnered momentum since its introduction, having raised $730,000 in its first week of operation. To acquire $STARS, investors can use ETH, USDT, BNB, or even a card if they want to diversify.

Solana and Shiba Inu investors eye impressive presale for massive returns

In its sixth presale round, Rollblock makes $3.3 million. It is expected to grow 100 times by 2024, drawing SOL and SHIB investors.

Investors in Shiba Inu (SHIB) and Solana (SOL) are searching for a fresh presale opportunity that offers substantial benefits. Rollblock (RBLK), which is expected to surge 100 times in 2024, has collected $3.3 million in its sixth round of the cryptocurrency presale and is fast emerging as the new favorite of SOL and SHIB investors.

Read on to find out why investors are placing their money in Rollblock rather than SHIB and SOL.

Solana envisages positives despite downturns

While Solana has generally been fortunate in 2024, there have recently been significant market issues. Despite the fact that bitcoin prices reached record highs earlier this year, patterns indicate that problems may still lie ahead, even if SOL’s price briefly rises beyond $135.

SOL attracts substantial inflows despite current market turbulence, bucking general market trends. The SOL network has also improved user experience by making improvements to address performance issues. However, it is more difficult for SOL to continue growing and winning over investors given its history of network congestion, recent whale dumps, and the volatile nature of the cryptocurrency market.

SHIB’s journey balancing success and recent market challenges

It has been challenging for the well-known memecoin Shiba Inu (SHIB) to hold its value due to the volatile market. September has seen a sharp decline in SHIB, with losses of around 3% each day and over 7% per week.

The SHIB token is now fetching $0.00001292 as of this writing. Since March, it has decreased 71.55% from its top support point of $0.00004585. SOL and SHIB are looking for more passive income streams in light of the current crypto market decline. Purchasing fresh cryptocurrencies for online gaming and betting before to debut is one tactic.

In general, the state of the market has impacted sales and put pressure on SHIB’s price. In the quick-paced online betting and bitcoin gaming marketplaces, a lot of investors have reevaluated their SHIB holdings and are shifting their capital to more promising tokens.

Rollblock’s unique GambleFi platform attracts investors in stage 6 presale

Rollblock’s exclusive GambleFi features are revolutionizing the way individuals wager online. It mixes controlled and uncontrolled gaming in a unique way. At the moment, Rollblock’s cryptocurrency presale is in its sixth stage. With almost $3.3 million already raised, it is clear that investors have great trust in the concept.

This special GambleFi protocol has a specific combination of features that address long-standing problems in the online betting business with the goal of bridging the gap between distributed and centralized gaming experiences.

Rollblock is now selling at $0.025, but experts predict it will be worth a hundred times more by December. Many even think it might reach $1 if it is listed on major marketplaces. Because it distributes earnings to token users, who receive a cut of the casino’s profits, this cryptocurrency presale star stands out. It is anticipated that by 2028, the industry for online gaming would reach a value of $744.8 billion. Rollblock is well-positioned to benefit from this expansion.

Because it is simple to use, doesn’t require Know Your Customer (KYC) information, and offers more than 150 real-time games, Rollblock is popular among both novice and seasoned gamers. Don’t pass up this fantastic opportunity to participate in the development of online betting.

There is a genuine opportunity to make millions of dollars with Rollblock, since the market has just 50% of the entire RBLK available.

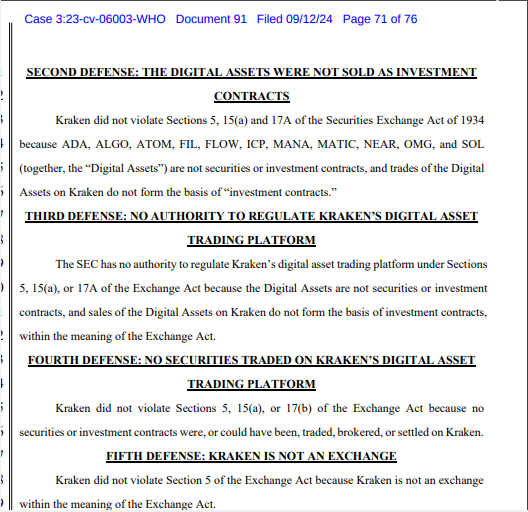

Kraken challenges SEC securities label against digital assets

The US Securities and Exchange Commission (SEC) was targeted by the centralized cryptocurrency exchange Kraken, which responded by contesting the SEC’s securities designation on digital assets.

Kraken was accused by the SEC of offering some digital assets that are considered unregistered securities, in violation of federal securities regulations.

Kraken disputes SEC allegations against digital assets

According to Kraken, under US law, ADA, ALGO, SOL, and other assets do not qualify as securities. In addition, the exchange criticized the SEC for regulatory overreach and the lack of transparency.

Kraken uses the Howey rule, a significant Supreme Court decision that acts as a benchmark for defining what qualifies as an investment contract, as part of its defense. With this reference, the exchange contests that the SEC was unable to provide proof that the designated tokens satisfy the Howey framework’s requirements and are not under the SEC’s purview.

“The SEC has no authority to regulate Kraken’s digital asset trading platform […] because the Digital Assets are not securities or investment contracts,” the filing read.

As a result, Kraken is advocating for a jury trial, claiming that the SEC is impeding its attempts to collaborate or register. It contends that the regulator “stonewalls” it on a regular basis by making contradictory decisions and recommendations.

The Howey test has drawn criticism from certain community members who claim it is overly wide and fails to take into consideration the complexity of contemporary investment structures and technology. Because of this, in the increasingly complicated financial environment of today, the test might not always correctly categorize certain kinds of transactions.

“The problem is really that the Howey test is far too generic. The truth is that many cryptocurrencies do not pass that specific test. But that doesn’t take in the nuance of what securities were meant to be,” one X user commented.

The problem is really that the Howey test is far too generic. The truth is that many cryptocurrencies in fact do not pass that specific test. But that doesn’t take in the nuance of what securities were meant to be.

— Knowledge Up Only (@KnowledgeUpOnly) September 13, 2024

The SEC has previously come under fire for classifying digital assets as securities. Crypto leaders swiftly refuted the regulator’s June 2023 allegation that a number of cryptocurrency assets traded on Binance, Coinbase, and Robinhood qualified as securities.

The SEC recently changed their complaint over “Third Party Crypto Asset Securities” in order to reflect its new stance. The regulator made it clear that the phrase relates to agreements related to the selling of cryptocurrency assets, not the actual assets. The language in Footnote 6 of their revised lawsuit against Binance served as the source for this modification.