Ethereum ETFs come at a “burdened moment” for risk assets, according to Bitstamp’s Bobby Zagotta, but he was hopeful that things would improve by year’s end.

According to the head of Bitstamp’s US operations, Spot Ether exchange-traded funds (ETFs) would have performed better if they had debuted in January with Bitcoin (BTC) ETFs.

Bobby Zagotta, CEO of Bitstamp for the Americas and worldwide commercial head, said at TOKEN2049, “I think they have not lived up to expectations, but I attribute that to this moment in time.”

“Crypto is behaving like any other risk asset right now, which is a testament to the maturity of this market versus a year ago, two years ago even.”

Launched on January 10, 2024, Bitcoin (BTC) exchange-traded funds (ETFs) have seen net inflows of $17.5 billion in the last eight months, as on CoinGlass statistics.

Ethereum (ETH) ETFs started trading seven months later in July, and in the two months since then, net outflows of slightly more than $600 million have occurred.

“The [Ether] ETFs just launched at kind of a, call it a burdened moment, or the markets in general for risk assets,” Zagotta remarked.

“In this moment, poeple are waiting. I think they’re in the wait-and-see mode because of the uncertainty in the election, the regulatory stuff in the US, some of the sociopolitical stuff — everything is a little bit flat right now, relatively speaking.”

“So I think that affected the ETF launch. Had the Ether ETF launched when the Bitcoin ETF launched, I think it would have done better,” he said.

Less than one-third of the 38 trading days for the Ether ETFs resulted in a positive net inflow, according to statistics from Farside Investors. This was mostly because to the Ethereum Trust, which continues to lose value, and the overall poor performance of the ETFs.

“Ethereum is more challenged now than ever before because of other alternatives that are getting a great amount of traction,” added Zagotta.

“Now, they’re not at the Ethereum level yet in terms of application and volume and price, but you know, Solana, some of these protocols are getting a lot of attention,” he said, adding:

“There’s no question that this is the most competitive it’s been for Ethereum ever.”

By year’s end, though, Zagota hinted that Ether would see some light.

“I do personally believe that we’re heading toward a moment of clarity. Election, interest rates, hopefully, regulatory momentum in the US,” he added.

Zagota is cautiously hopeful about some “real price action,” particularly in the altcoin arena, and views the fourth quarter as a “active market.”

The commodity has struggled to carve out a story and steal attraction from tech companies, according to former Wall Street trader Nick Forster, who said earlier this month that Ether would have a small chance of reaching new all-time highs by the end of 2024.

As for cryptocurrencies, including Ether, a rally may be imminent, despite the optimism of some.

BNB faces uphill battle on its road to $600

The price of BNB has made many unsuccessful efforts to move through the resistance zone between $575 and $619 and into the support zone.

Since BNB has only been successful once thus far, it will be difficult for the cryptocurrency to see another breakthrough. This barrier is still a major obstacle preventing the cryptocurrency from continuing its steady upward trajectory.

BNB faces potential bearishness

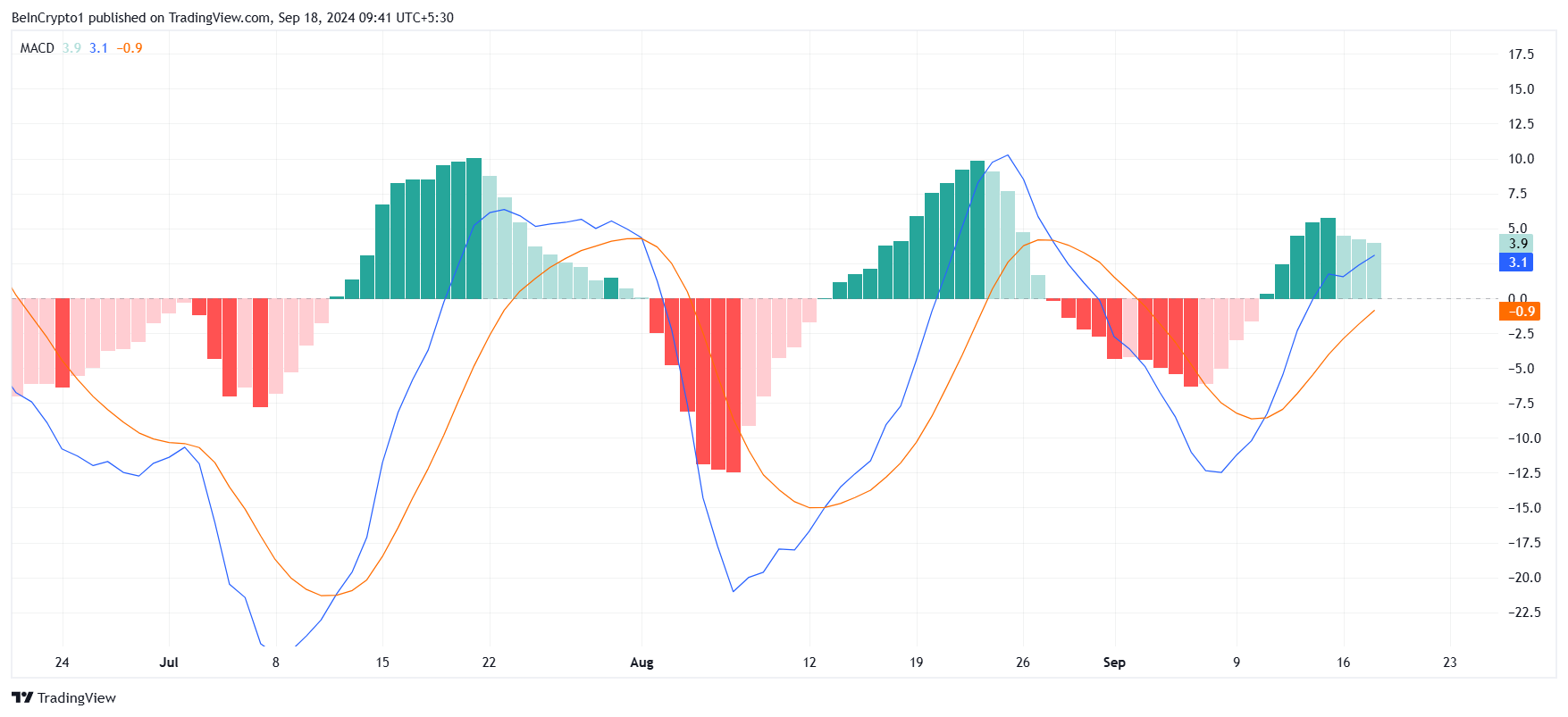

There are conflicting signs in the macro momentum for BNB overall. The Moving Average Convergence Divergence (MACD), one of the technical indicators, indicates a slowing of bullishness. BNB will probably be able to break through the $550 barrier, but it will be difficult to get over the $580 mark.

It is not anticipated that BNB’s momentum would stay over $580, despite some optimistic moves. The cryptocurrency has had difficulty holding onto gains above this point, and the patterns that are now showing signal that the trend may recur and prevent any meaningful upward rise.

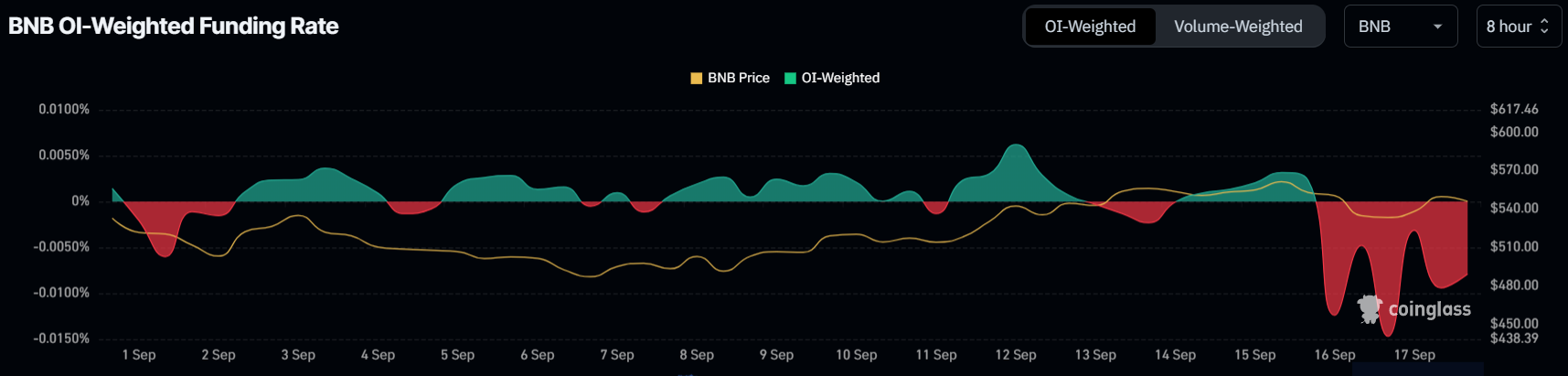

The extremely negative funding rates indicate that the market is especially pessimistic about BNB. More than they have in the previous two weeks, traders now have a negative outlook on BNB. Traders appear to have anticipated a price reduction due to the persistent pattern of unsuccessful breaches, which has caused them to position themselves to profit from a future collapse.

More obstacles to the price increase of BNB are created by this pessimistic attitude. Its prospects of reaching $600 may be further complicated by the altcoin’s inability to gain sufficient momentum to overcome significant resistance levels, as many traders are already factoring in a reversal.

BNB price prediction: Repeating history

As of this writing, BNB is likely to break over the $550 barrier around $545 in trade. But the cryptocurrency is going to run into trouble as it gets closer to the $575–$619 resistance level. There might be a reversal if the bullish momentum is insufficient to push BNB over this level.

These reasons suggest that BNB, having failed to maintain a surge over $580, will probably return to $550. This will reduce the likelihood that it will hit $600 in the near future.

Though BNB has broken through $580 several times in the past, it might yet close above that barrier if overall market circumstances become more optimistic. In this case, BNB may reach $600, negating the pessimistic forecast that is now in effect.

Tron’s Justin Sun demands Proof-of-Reserve from Coinbase and Controversy

In light of the recent BlackRock incident, Justin Sun stated that the cryptocurrency community expects Coinbase to be transparent about its Bitcoin reserves.

Justin Sun, the inventor of Tron, has emphasized once more how important he believes Coinbase should provide a Proof-of-Reserve in light of the company’s recent introduction of cbBTC. He asked further, “Why is the exchange claiming that Proof-of-Reserve (PoR) is not feasible, when all other exchanges in the industry have implemented it?”

Tron founder Justin Sun slams Coinbase on PoR approach

According to Justin Sun, major market participants like Binance are implementing the Proof of Reserves (PoR) approach, which is becoming more and more popular in the cryptocurrency space. He was perplexed as to why the exchange was stating that it was not possible. Sun made these remarks shortly after Coinbase refuted reports that it had sent Bitcoin IOUs to BlackRock.

Credibility is increased, according to senior Bloomberg ETF analyst Eric Balchunas, by BlackRock’s participation in the cbBTC initiative. The biggest asset manager, he continued, will not put up with any mishandling of Bitcoin reserves.

Justin Sun emphasized that the crypto community is looking for openness rather than perfection. He also mentioned how easy it is to disclose every wallet address.

The founder of Tron continued by saying that depending on audit companies for security does not ensure that money would remain on-chain, as demonstrated by the FTX example. He further stated—citing the failure of the Signature Bank—that being a publicly traded corporation does not provide protection against bankruptcy. Therefore, Sun thinks that Coinbase putting PoR into effect would be a step toward self-regulation, enhancing industry confidence.

When all exchanges in the industry have already implemented PoR, we are puzzled that Coinbase claims PoR is not feasible. You can see Binance’s full PoR here: https://t.co/5hkfZPhhs8. The community isn’t expecting Coinbase to provide a perfect solution all at once, but simply… https://t.co/xQHf8ZxVNR

— H.E. Justin Sun🌞(hiring) (@justinsuntron) September 18, 2024

Will BlackRock continue to borrow Bitcoin without collateral?

Tyler Durden, a well-known cryptocurrency analyst, questioned Coinbase’s decision to let BlackRock borrow Bitcoin without collateral over the weekend. He also questioned if BlackRock was able to profit from the ensuing price swings due to market manipulation.

While the exchange has not yet provided a response to these accusations, the cryptocurrency community anticipates that it will clarify its position about Bitcoin reserves.

On the other hand, in advance of the FOMC meeting on Wednesday, the price of Bitcoin has been shown strength, rising beyond $60,500 levels. The next course of the Bitcoin (BTC) price would be determined by the Fed rate decrease, which would be significant.