According to the chief investment officer of Tyr Capital, there is a greater chance that Bitcoin will end September over $60,000 than lower.

Despite historical evidence to the contrary, some Bitcoin traders appear to be dismissing worries about the customary September drop, citing the macroenvironment as a compelling enough argument to refute the popular narrative.

“Although September is historically a negative month for BTC, the combination of a FED rate cut and a relatively robust US economy could surprise the bears,” Tyr Capital chief investment officer Ed Hindi said.

“We believe the chances of BTC settling above USD 60K to be higher than the chances of it settling below it,” Hindi added.

According to CoinMarketCap statistics, as of the time of writing, the price of Bitcoin (BTC) is $56,633, having been below $60,000 since August 30.

Nevertheless, futures traders do not expect a return to $60,000 in the immediate future. Over $584 million in short positions will be eliminated if Bitcoin reaches $60,000 again, according to CoinGlass.

According to cryptocurrency dealer Daan Crypto Trades, the average return in September is around -4%, as reported. Given the volatility of Bitcoin, that’s not as awful as most people think.

September has the worst average Bitcoin losses, according to CoinGlass statistics (4.49%).

According to Daan Crypto Trades, he is keeping an eye out for a “higher high and higher low” on the longer-term price chart of Bitcoin in the near future. This is a positive indicator that suggests purchasers are controlling the market relative to sellers.

“I’m mostly watching for price to flip it’s market structure to bullish,” he explained.

“For now I would want to see BTC trading back above 65K to show strength,” he added.

It happens soon after Bitcoin plummeted below $58,000 on August 30, prompting cryptocurrency expert Matthew Hyland to draw attention to the necessity for comparable price activity.

“We really need to start to bounce out of this and make a higher high to further confirm that we are in this uptrend that we’ve been in since August,” Hyland said in an analysis video on Aug. 30.

Donald Trump talks about crypto, Bitcoin, and Elon Musk’s DOGE role

The Republican front-runner for president, Donald Trump, presented a thorough plan on Thursday at the Economic Club of New York. One of the new ideas in his scheme involved Elon Musk.

Trump and Musk’s possible partnership might usher in a new era of innovative and reformative governance. This alliance has the potential to reshape federal operations and financial policy by utilizing Musk’s knowledge.

Trump talks about Elon Musk’s DOGE initiative

In a hilarious coincidence, Dogecoin’s ticker, DOGE, corresponds with Trump’s proposed Department of Government Efficiency (DOGE). Musk has been asked to spearhead this project and has stated that he is prepared to work for no pay.

I look forward to serving America if the opportunity arises.

No pay, no title, no recognition is needed. https://t.co/5PSNtjBQn7

— Elon Musk (@elonmusk) September 5, 2024

During his extensive speech, Trump underlined that the renewable energy industry will be greatly impacted by the withdrawal of monies that were left over from the Joe Biden administration. Additionally, he proposed measures to prevent unauthorized immigrants from obtaining mortgages, justifying these actions as imperative for fiscal responsibility and governmental efficacy.

In addition, Trump outlined more expansive technical goals, such as elevating the US to the position of the world’s cryptocurrency capital and developing the field of artificial intelligence.

“Instead of attacking industries of the future, we will embrace them, including making America the world capital for crypto and Bitcoin,” Trump asserted.

With this declaration, Trump’s possible government appears to be moving in the direction of promoting digital assets.

Dogecoin’s market value was not significantly affected by this revelation, even with all of the publicity it garnered. With a modest gain, the meme coin is now trading at about $0.098—up 2.53% over the previous day. The media’s portrayal of Musk’s possible participation in politics stands in stark contrast to this minor increase.

Furthermore, Musk rekindled interest last week when he alluded to restoring Dogecoin as a payment method for Tesla items, bolstering momentum for the cryptocurrency.

A case against Musk and Tesla from 2022 that claimed there was a Dogecoin pump-and-dump scam was also just dropped. Musk’s outspoken support for Dogecoin may have been revitalized by this legal approval.

Chang hard fork brings gains for Cardano (ADA) holders, but it may not last long

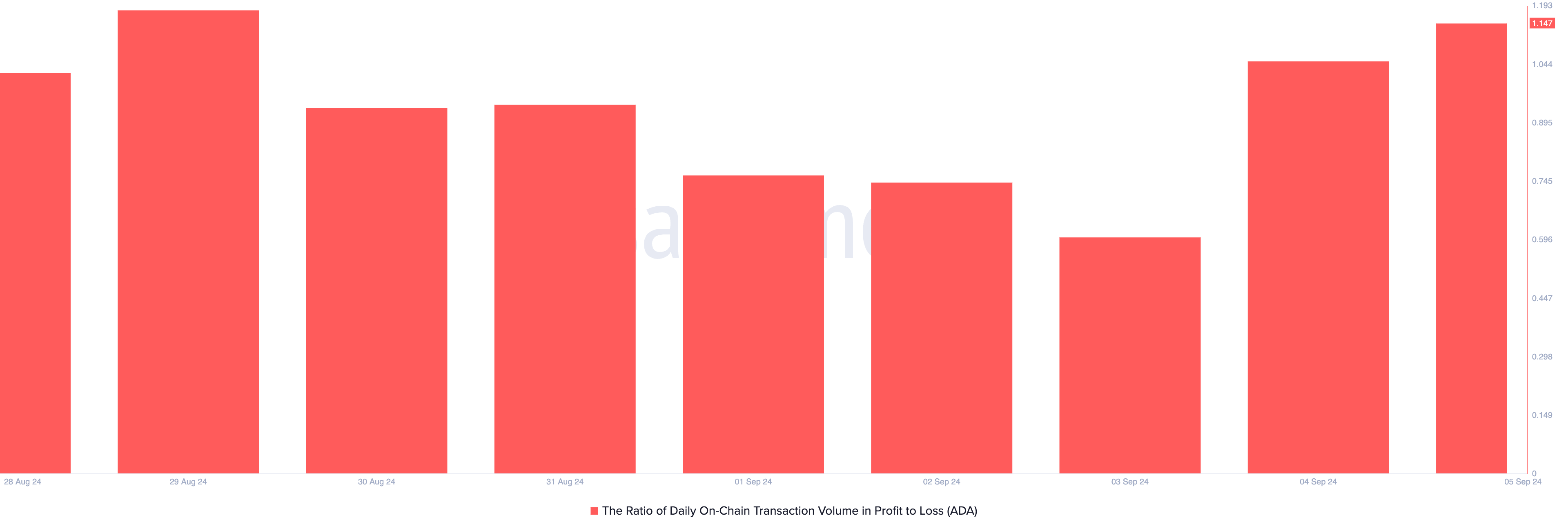

Some of Cardano’s (ADA) investors have made money in the last 24 hours thanks to the highly anticipated Chang hard fork. During that time, more profits than losses have been realized from transactions involving the cryptocurrency.

This could only last temporarily though, as the cryptocurrency approaches its August 5 low.

Cardano upgrade puts holders in profit

Cardano’s September 1st Chang hard fork was a “sell the news” event, as previously reported. When the update was rolled out, its whale investors sold out a sizable portion of their shares, which caused the price to drop.

But since then, things have turned around since regular altcoin transactions are starting to make money. The favorable daily transaction volume profit to loss ratio for ADA is indicative of this. This stands at 1.15 on Thursday, meaning that 1.14 ADA transactions have resulted in a profit for each transaction that ended in a loss.

The explanation for this is not implausible. Over the last day, the price decrease of ADA has paused, providing traders with a chance to sell for profits if they purchased at lower levels. As of right now, ADA is trading at $0.32, up 0.39% during that period.

Although the coin’s negative price daily active address (DAA) divergence suggests that the present upswing in demand for ADA may not last long, traders should be aware of this. As of the time of publication, this indicator, which measures whether a related network activity supports the price movement of an asset, is -30.93%.

A rising asset price that is accompanied by a negative price DAA divergence indicates that there are very few unique addresses involved in trade. This is typically seen as a warning indication that speculative behavior or trading by a few number of investors, or whales, who are artificially inflating the asset’s price, is the cause of the price spike.

ADA price prediction: the troubles are far from over

Despite a little increase over the last day, bearish bias continues to lead ADA. The placement of the dots on its Parabolic Stop and Reverse (SAR) indication makes this evident. These are more expensive than ADA as of press time.

This indicator, which helps determine the trend direction and probable reversals of an asset, indicates a sustained market fall when it is set in this way. This implies that the price of the asset has been declining, and that the downward trend may continue.

The value of ADA may drop back to its August 5 low of $0.27 if this trend keeps up. Nevertheless, the altcoin’s price can rise to $0.39 if there is a surge in fresh demand, refuting the aforementioned pessimistic predictions.