According to blockchain analytics company Santiment, a drop in Bitcoin whale activity is not always a bad indicator.

According to current statistics, Bitcoin whales have reduced their activity since the cryptocurrency reached a record high in March and are waiting for the next significant buying or selling opportunity.

“Cryptocurrency’s whale transactions have seen a noticeable drop-off since mid-August,” blockchain analytics platform Santiment wrote in a Sept. 11 X post.

Bitcoin whales cut back on activity

Bitcoin (BTC) weekly transactions of $100,000 or more have decreased 33.6%, according to Santiment, since March 13, the day of the cryptocurrency’s all-time high of $73,679, on March 13.

It was mentioned that over the same time frame, Ethereum (ETH) suffered an even more notable decrease of 72.5%.

The analytics company pointed out that whales, or wallets with at least 10,000 Bitcoin, may be equally as active in bull and downturn markets, so this isn’t always a bad indication.

In times of high crowd greed or fear, “large key stakeholders continue to bide their time as they wait to make their next moves,” it was said.

According to the Crypto Fear & Greed Index, which presently has a score of 31 out of a potential 100, the general attitude in the crypto market is still “fear.”

Fear in the market is usually interpreted by investors as a buying opportunity. Even though Bitcoin has decreased by 0.97% since August 13 and is currently trading at $58,360, some analysts think the asset still has room to go before hitting its cycle bottom.

According to Markus Thielen, head of research at 10x Research, on August 7, Bitcoin should drop to the “low 40,000s” in order to properly pace the “next bull market entry.”

According to Santiment, if Bitcoin drops to $45,000, it may cause fear, uncertainty, and doubt (FUD), but if it rises back to about $70,000, it may cause a significant case of FOMO.

Crypto traders not concerned about market volatility

Meanwhile, crypto traders expect the current market volatility to be short-term and nothing they haven’t seen before.

Reflexical founder Ajeet Khurana explained in a Sept. 11 X post, “In times of market turbulence, it’s easy to lose sight of the bigger picture.”

“Bitcoin price is volatile, but focus on fundamentals, stay grounded in common sense, and keep a long-term vision. True value stands the test of time,” Khurana stated.

“Quite a lot of volatility but nothing we’re not used to the past few weeks,” pseudonymous crypto trader Daan Crypto Trades added.

#Bitcoin CPI traders having a lot of fun again today I see.

Both sides stop hunted multiple times. Quite a lot of volatility but nothing we’re not used to the past few weeks. pic.twitter.com/EzUAkgFtEz

— Daan Crypto Trades (@DaanCrypto) September 11, 2024

FTX ready to dump 177,693 Solana coins after recent staking unlock

Solana valued at $23.75 million was redeemed from the Proof-of-Stake (PoS) network by a wallet connected to FTX/Alameda. SOL price reduction coming up?

H4y, a cryptocurrency walletRecently, gFZ, purportedly associated or owned by FTX/Alameda, redeemed 177,693 Solana tokens from the Solana Proof-of-Stake (PoS) network. FTX, a cryptocurrency exchange, was among the largest holders of Solana (SOL) coins until it experienced a significant sell-off during the November 2022 crisis.

Will FTX dump all Solana coins to CEXs?

The FTX/Alameda-affiliated wallet is said to have moved $23.75 million worth of Solana coins from its Proof-of-Stake (PoS) network today, according to the Solscan data. This has sparked a heated debate in the cryptocurrency world on whether or not redeemed SOL will soon be moved to centralized exchanges (CEX).

Still, this wallet’s recent activity pales in contrast to the overall number of SOL tokens it possesses. Up to 7.057 million SOL, or $943 million, are presently staked in the FTX wallet H4y.gFZ. According to some earlier claims, over-the-counter (OTC) transactions must have been used to sell the majority of the Solana coins that cryptocurrency exchange FTX now owns.

With a market valuation of $63.57 billion, Solana (SOL) is still trading at $135, up 1.93% from its previous close. On the annual chart, the price of SOL has increased by more than 650% and by 35% since the start of 2024.

The latest SOL effort by the wallet connected to FTX and Alameda coincides with Caroline Ellison, the former CEO of Alameda, being slated to testify on September 24. According to reports, she may receive a sentence reduction as a result of her cooperation and testimony.

Will SOL price rally continue in 2024?

SOL has produced moderate returns this year in 2024 following a significant upswing in 2023. But, the price of Bitcoin (BTC) has started to decline after rising all the way to $209 in March, when it reached a new all-time high. The price of SOL is now building a foundation at $130 and is expected to reverse from this point on.

To raise the price, though, a combination of events is required for the Ethereum (ETH) competitor. This covers prospective ETF launches, institutional investments, network upgrades, and the comeback of meme coins. One of the main causes of the Solana meme coin hysteria was its surge above $200 in March. But if other sectors of the economy increase together, it’s possible that the price of SOL may rise to $1000 by 2025.

2 lesser-known indicators predict Dogecoin (DOGE) price fall under $0.10

Two small but significant indicators point to a possible decline in Dogecoin’s (DOGE) price as market mood slides to the sideways. The DOGE touched $0.11 last month.

But since the start of September, the meme coin has been trading below this level. These indicators show potential price impacts resulting from the present trajectory of the coin.

Dogecoin sees low traction, high sell-offs

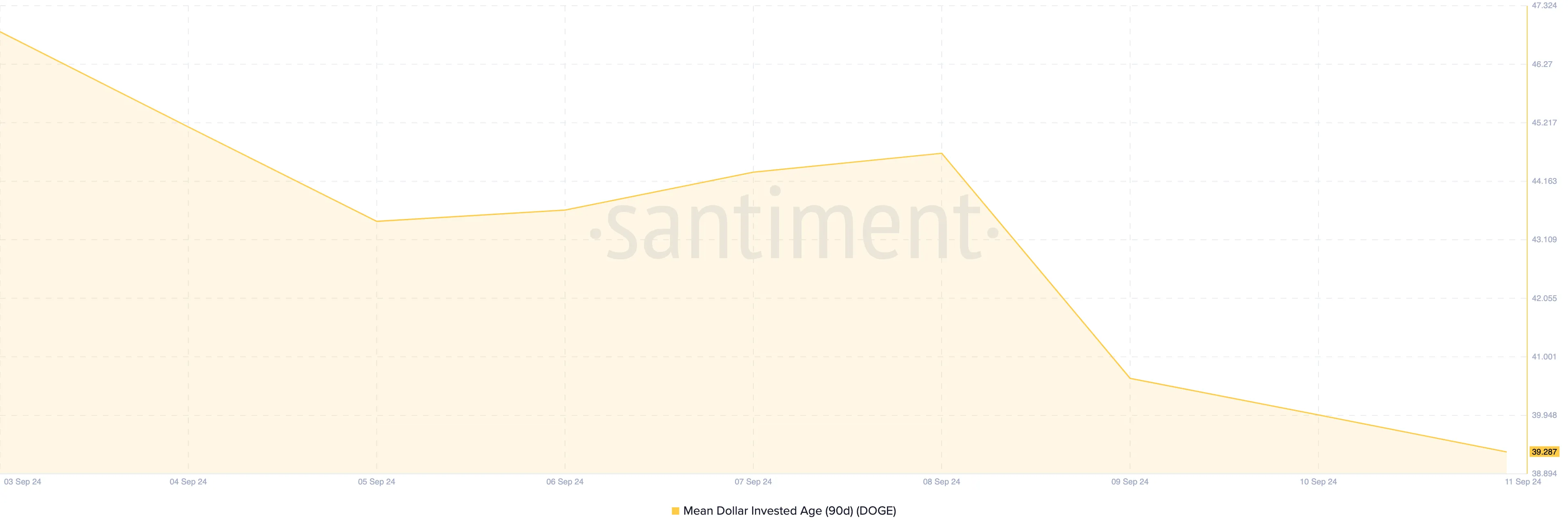

The first important measure to keep an eye on is Dogecoin’s Mean Dollar Invested Age (MDIA). The average age of each dollar deposited in the coin is calculated by MDIA. An increasing MDIA indicates long-term ownership, i.e., no selling by holders. On the other hand, a decreasing MDIA suggests that more users are exchanging their coins, which frequently denotes large sell-offs.

The graphic illustrates how MDIA has fallen precipitously after September 8, suggesting a decrease in the amount of money invested in Dogecoin. Because of this, the price of Dogecoin (DOGE) may be susceptible to falling below its current $0.10 level.

The Address Birth-Death ratio is the second important but little utilized metric. The ratio, as its name suggests, compares the rate at which new addresses are embracing cryptocurrencies versus the rate at which existing addresses are liquidating all of their holdings.

When a cryptocurrency has a high Birth-Death ratio, it means that more people are using it than leaving. As of this writing, the ratio has dropped to 0.11%, indicating that a larger percentage of retired DOGE wallets than freshly formed ones exist.

DOGE price prediction: Breakout invalidated

The daily chart shows that three days ago, Dogecoin broke above the descending triangle. Breaking above this technical pattern is often a positive indication, as seen by DOGE’s price effort to rise further higher.

But the coin, which was aimed at $0.11, was rejected. The price of DOGE is about to drop below the 61.8% Fibonacci retracement level, as seen in the following graphic.

When this occurs, the negative prediction may be validated, which might cause the price to drop below $0.091. The gloomy forecast, however, may be refuted if bulls are able to keep the price above this mark, and Dogecoin might reach $0.12.