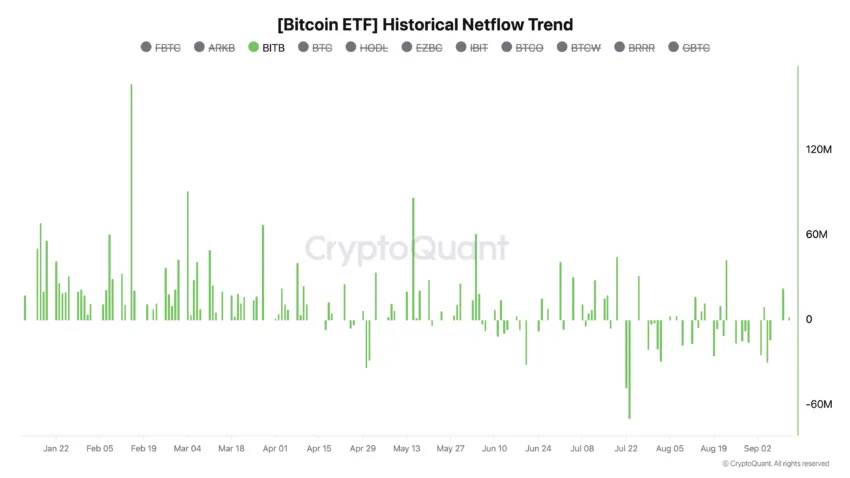

Sept. 16 witnessed a halt in net inflows for spot Bitcoin (BTC) exchange-traded funds in the US, while yesterday saw outflows for spot Ethereum (ETH) ETFs as bearish sentiment dominated the market.

The 12 spot Bitcoin ETFs had net inflows of $12.9 million, which is 95% less than the $263 million inflows saw on the day before trade, according to data from SoSoValue. Once again leading the pack, BlackRock’s largest Bitcoin exchange-traded fund, IBIT, had inflows of $15.8 million after the fund had no positive flows for ten days.

The next was Fidelity’s FBTC, which had $5.1 million enter its fund. Notably, the ETF had $223.1 million join it during the time, making it the only fund to experience net inflows for six consecutive days. $5 million was brought in by Franklin Templeton’s EZBC.

Additionally, there were net positive flows of $4.9 million and $2.8 million, respectively, for VanEck’s HODL and Grayscale Bitcoin Mini Trust during the day.

The only Bitcoin ETF to post withdrawals was Grayscale’s GBTC, with $20.8 million departing the fund, bringing the total outflows since debut to $20.06 billion. There was no trading activity in the six BTC ETFs that were left.

On September 16, the combined trading volume of the 12 Bitcoin exchange-traded funds (ETFs) fell to $1.1 billion, a sharp decline from the $1.82 billion recorded the day before. Since their inception, these funds have seen a total net inflow of $17.31 billion. According to statistics, Bitcoin (BTC) was trading sideways at around $58,521 at the time of writing.

On September 16, however, the nine U.S.-based Spot Ethereum ETFs suffered net outflows of $9.51 million after seeing inflows the day before. Grayscale’s ETHE was the source of the majority of the daily net withdrawals, with $13.8 million leaving the fund. Additionally, $2.1 million was taken out of Bitwise’s ETHW.

Grayscale Ethereum Mini Trust and BlackRock’s ETHA had inflows of $2.3 million and $4.2 million on the day, respectively, offsetting these withdrawals to some extent.

These investment vehicles saw a decline in trading volume as well; on September 16, it was down from $147.64 million to $128.02 million. To far, there has been a total net outflow of $590.73 million from the spot Ether ETFs. When this article was published, Ethereum (ETH) was trading for $2,299 in value.

BlackRock has been bullish on crypto for nearly a decade

BlackRock’s Head of Digital Assets, Robbie Mitchnick, provided details on the company’s cryptocurrency approach. Unbeknownst to many, BlackRock has been refining its strategy for much longer.

Mitchnick talked on ETFs, the future of digital assets, BlackRock’s experience, and Bitcoin’s value as an asset.

A long road to public adoption

BlackRock had been interested in cryptocurrency since 2016, according to Mitchnick, even though the company didn’t think the asset class was “ready for prime time” at the time. BlackRock started its crypto adventure like this, developing its skills in secret before making more significant public announcements.

“The evolution really started to accelerate in the 2021-2022 timeframe. There were three key drivers behind this shift: The infrastructure around the system started to mature; A growing recognition that crypto was here to stay; A durable trend of clients showing increasing interest in the space,” Mitchnick noted.

Since then, BlackRock has been more involved in the cryptocurrency space; this was particularly evident with the introduction of its Ethereum and Bitcoin exchange-traded funds (ETFs), which Ryan Sean Adams called a “Christmas miracle.” BlackRock’s approach has placed a strong emphasis on education since the company wants to introduce the crypto area to an audience that is mainly unaware of it.

Mitchnick underlined the need of dispelling myths, such as the idea that Bitcoin is an asset that carries a high level of risk. Even though Bitcoin is seen as hazardous, in bull markets, riskier assets are usually preferred. The misunderstanding that has arisen from Bitcoin being marketed as “digital gold” has affected newcomers.

“If you look at the Silicon Valley Bank and regional banking crisis in March 2023, that was probably the clearest example of Bitcoin acting as a hedge. The main reason it stood out was that the crypto research community didn’t have time to overcomplicate it,” Mitchnick explained.

BlackRock’s emphasis on education is crucial to changing people’s opinions. Vague opinions have the power to immediately influence market behavior in fast-moving marketplaces.

In addition, Mitchnick noted that BlackRock was about to provide an explanation of risk to a wider range of customers, with traders generally favoring Bitcoin and developers typically favoring Ethereum. Regarding the prospect of a third ETF approval, he currently saw no obvious front-runner.

A future in tokenization?

In discussing BlackRock’s perspective on tokenization, Mitchnick also mentioned that although the notion that “blockchain, not Bitcoin” is losing ground, “tokenization, not Bitcoin” is becoming more and more popular. While there is still uncertainty over tokenization’s long-term sustainability, BlackRock is developing the infrastructure required to enable it.

“Our strategy is to provide clients with cheap and easy access to these markets and to offer technological capabilities. It would be strange if, 10 years from now, we only had seven tokenized funds. It’s more likely we’ll have none, or many,” Mitchnick stated.

BlackRock’s disciplined approach to cryptocurrency is indicative of the company’s dedication to long-term sustainability and education. BlackRock is establishing itself as a pioneer in easily accessible digital asset investing as more and more clients show interest.

Even if tokenization and ETFs have an unknown future, BlackRock’s business plan implies that the company will continue to be a major force in the market regardless of how it develops.

Crypto traders made $2M in 4 days after token surged 1000% overnight

Three cryptocurrency traders struck it rich, earning $2 million from their NEIRO token holdings following a 1000% increase in value in a single night.

The recent surge in panic among cryptocurrency traders has caused a 3% decline in the market value of the whole world, which is now at $2.04 trillion. It is the result of users’ apprehension about engaging in any deals or taking any chances when trading cryptocurrency. Following the second attempt on the life of former President Donald Trump, the situation deteriorated. The NEIRO token surged 1000% overnight, yet few cryptocurrency investors have struck gold despite the bear’s supremacy. One such investor gained $2 million in just four days.

Three crypto traders made $2M on NEIRO token

Not all of the billions of deals that occur every day result in profitable outcomes for the investors, particularly given the state of the market. But three cryptocurrency traders seized the moment with the correct coin, NEIRO, whose value increased by 1000% over night, making them millionaires. One of the most well-known meme coins at the moment is NEIRO, which has been successful despite a sluggish market.

Three cryptocurrency investors with the wallet addresses 0x6ac, 0xc05, and 0x090 have made $2 million in just four days, according to Spotonchain, a well-known analytics company. Among these, wallet address 0x6ac has made 1.77 million, or 45 times, his initial investment, since it started holding the NEIRO. Despite having just spent $5 ETH ($16.5K), the investor made $1.88 million.

⭐️ Smart traders are making big ROIs from the rise of @neiroethcto $NEIRO:

1. “0x6ac” is making $1.77M (x45) thanks to being a super early buyer. He currently holds 4.6B $NEIRO ($1.75M).

2. “0xc05” is making $619K in less than 20 hours. He used #BananaGun bot to snipe 140 $ETH… pic.twitter.com/Sn32u1Iung

— Spot On Chain (@spotonchain) September 17, 2024

In just 20 hours, the second cryptocurrency investor with wallet address 0xc05 gained $619,000 in profit. After Binance announced the listing of the NEIRO coin, the analytics platform disclosed that the trader utilized a BananaGun bot to snipe 140 ETH.

The previous one, who sold 1.057 billion NEIRO for $302K, generated a 603% profit in four days with a wallet address of 0x090. When the NEIRO token increased 1000% in a single night, these three cryptocurrency investors gained a total of $2,031,000.

How these crypto traders are doing today?

Millions of holdings were still present in these wallet addresses, according to Spotonchain statistics; the first wallet address still had 4.599 billion NEIRO, or $1.688 million, in it. In addition, he has USDC, 0.028 BNB, 46.004M LADYS, 0.106 ETH, and USDC, bringing his portfolio value to $1.697 million.

The second investor is holding cryptocurrency valued at $1.259 million. Of which, the lion’s share is in NEIRO; he possesses 2.490B NEIRO ($913.786K) along with other assets like 0.002 BNB, 17.341 USDC, 21.585 ETH, and 316.894B MOG.

The third investor is the last one with $351.739K worth of assets, the most of which are in USDT and a little amount of NEIRO. He has 0.0₈100 NEIRO ($0.0₁₂3669), 0.123 ETH ($282.461), and 351.595K USDT ($351.456K) in his possession.

Ultimately, the fact that all three cryptocurrency traders still own some NEIRO tokens shows how much they value both this token and their approach to cryptocurrency trading. NEIRO was worthless when it first launched and is now trading at $0.0003674. A few hours ago, it reached an all-time high of $0.0004159. Additionally, a large demand for the coin is evident from its $154,324,229 market value and $441,700,360 trading volume.