The $870 million in inflows were led by the BlackRock Bitcoin ETF (IBIT), whose daily trading volume surged to $3.3 billion on Tuesday.

Thanks to the BlackRock Bitcoin ETF (IBIT), which has caused a significant FOMO among investors, the US spot ETF market for Bitcoin now appears to be unstoppable. The BlackRock IBIT saw a staggering $3.3 billion in trading volumes on Tuesday, reaching its highest levels in six months. IBIT has been driving inflows all by itself for the last two weeks, demonstrating that institutional FOMO has set in ahead of the US election results, which are due in less than a week.

BlackRock Bitcoin ETF leads $870M inflows

Nearly $870 million was invested in US Bitcoin ETFs on Tuesday, October 29, with BlackRock’s IBIT accounting for the majority of the $640 million inflows. With a record of $1.045 billion established on March 12, 2024, this is one of the biggest inflows since debut. A new record could be possible given the current enthusiasm.

This brings IBIT’s net inflows since launch to about $25 billion, more than twice as much as its direct competitor Fidelity’s FBTC. With the price of Bitcoin getting closer to its all-time highs, these enormous inflows have persisted amidst the surge in the cryptocurrency market as a whole.

Eric Balchunas, Bloomberg’s ETF expert, emphasized the $3.3 billion in trading volumes that the BlackRock Bitcoin ETF saw yesterday. Since ETF activity usually spikes during market downturns, he thinks this volume spike is odd.

Balchunas, however, hypothesized that the latest surge may be the result of “FOMO” (fear of missing out) brought on by the recent surge in the price of Bitcoin.

The Bloomberg expert said that other Bitcoin ETFs had a significant spike in trading volumes yesterday, so IBIT wasn’t the only one. He thus thinks that there may be a purchasing surge brought on by FOMO. Additionally, Balchunas stated that significant inflows should occur in the upcoming days if this is, in fact, a FOMO frenzy.

$IBIT traded $3.3b today, biggest number in 6mo, which is a bit odd bc btc was up 4% (typically ETF volume spikes in a downturn/crisis). Occasionally tho volume can spike if there a FOMO-ing frenzy (a la $ARKK in 2020). Given the surge in price past few days, my guess is this is… pic.twitter.com/z44ZfggHVm

— Eric Balchunas (@EricBalchunas) October 29, 2024

Bitcoin all-time high soon?

The price of Bitcoin (BTC) has risen by 8% in the last week, bringing it within 5% of its peak. With a market valuation of $1.429 trillion, the price of Bitcoin is up 1.75% at $72,267 as of this writing. Nevertheless, despite significant inflows into Bitcoin ETFs, the retail FOMO in BTC hasn’t yet materialized, according to crypto expert Miles Deutscher.

#Bitcoin is on the verge of breaking all-time highs, and retail interest is still almost non-existent.

Higher. pic.twitter.com/EH4fWnjIvG

— Miles Deutscher (@milesdeutscher) October 29, 2024

Retail purchasing activity was a major factor in driving Bitcoin to record highs throughout the last two bull run cycles. This indicates that the price activity is now being driven by Bitcoin whales and major investors. As a result, we may witness a surge to $100,000 and higher as retail FOMO takes hold.

The Bitcoin MVRV ratio is another important bullish indicator. It has risen over its 365-SMA, indicating significant bull rallies and a golden cross.

While #Bitcoin $BTC at $72,000 might feel like a late entry, history suggests otherwise. The MVRV Ratio crossing over its 365-SMA has often signaled major bull rallies, and this golden cross just happened again! pic.twitter.com/Awkh0WdIOK

— Ali (@ali_charts) October 29, 2024

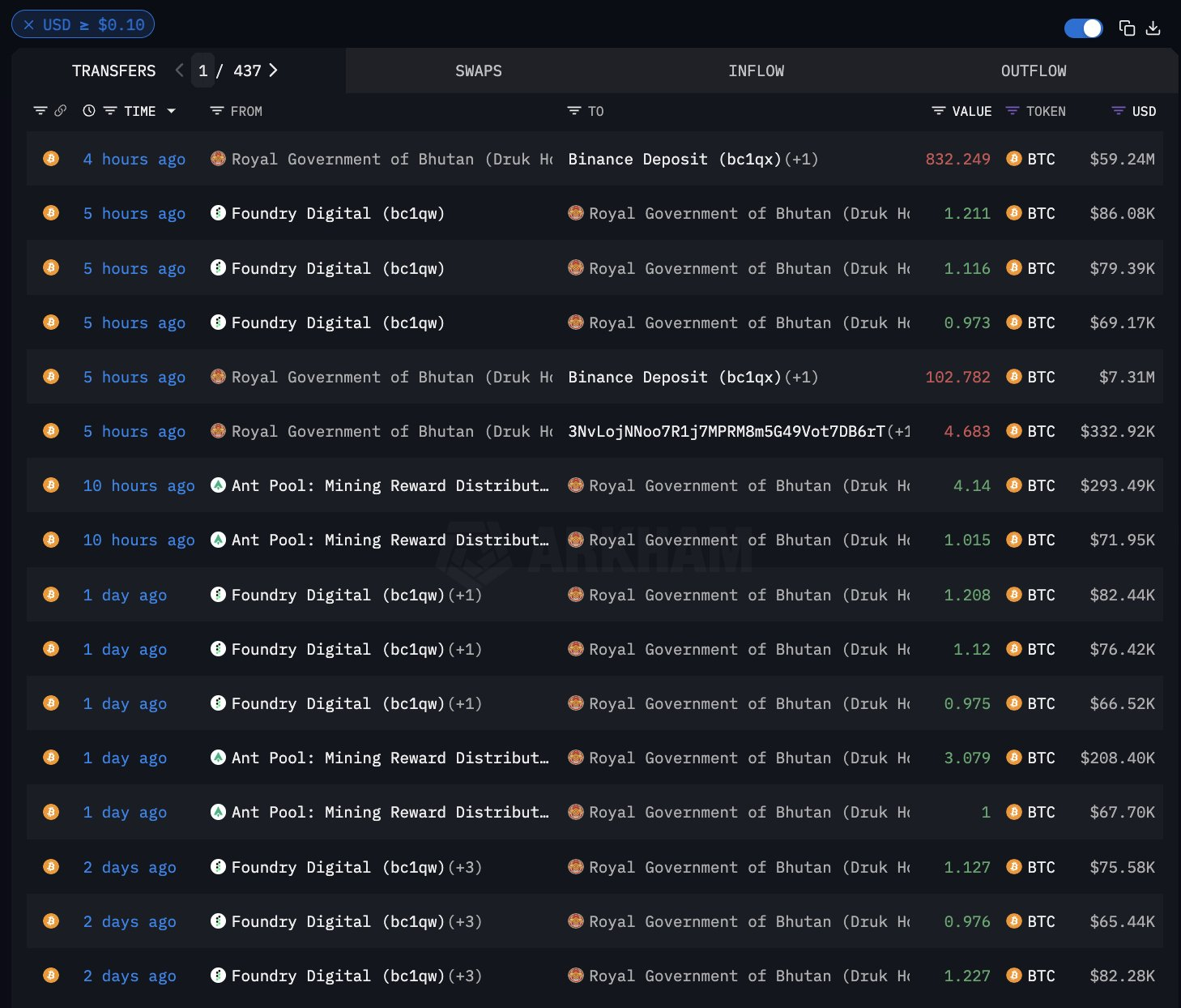

Bhutan transfers $65M in Bitcoin to Binance, prepares for sale

According to on-chain statistics, the Kingdom of Bhutan moved $65.66 million in Bitcoin to Binance accounts. Although state-run mining activities are still being carried out, Bhutan probably plans to sell these assets.

Bhutan is the first government to use Binance for the transactions, but it is also one of several that are selling off Bitcoin holdings this year.

Bhutan’s Bitcoin selloff

According to blockchain analytics company Arkham Intelligence, Bhutan could be preparing to sell $65.66 million worth of Bitcoin (BTC). According to on-chain statistics, the Bhutanese government made its first asset transfer to exchanges since July earlier today when it put this sum onto Binance.

Arkham has a track record of keeping an eye on government coffers in anticipation of possible asset sales. For instance, it broke the news of a $20 million hack earlier this week thanks to its attention to US government accounts. Additionally, the business asserted that it has observed independent mining activities that provide a significant amount of Bhutan’s stockpile.

“The Royal Government of Bhutan operates a large Bitcoin mining operation through its national investment company, Druk Holdings and Investments. In the second half of 2023, Bhutan’s Bitcoin mines were mining around 780 BTC per month (~26 BTC/day). Geographical data combined with on-chain data shows that Bhutan’s Bitcoin mines are still active,” the firm said.

For a while now, the government of Bhutan has been making significant investments in cryptocurrency. In early 2023, for instance, Druk Holdings and Investments covertly purchased millions of Bitcoin and other assets. The kingdom’s cryptocurrency mines and stockpile were only made public this year, and the corporation kept its broader plan a secret.

Government Bitcoin sales in 2024

A unique option for a significant government asset sale is Binance. Similar multimillion-dollar selloffs have been carried out this year in the US and Germany, and rivals like Coinbase and Kraken have been regularly employed. Bhutan has no dispute with Binance, although the company’s legal issues with the US and Germany could have affected this choice.

In the end, it seems doubtful that this specific selloff will have a significant effect on the price of Bitcoin globally. When Germany sold $425 million worth of Bitcoin in June, it created selling pressure, but this was different for a number of reasons. To begin with, it disposed of much larger quantities. Crucially, it also planned to sell off all of its cryptocurrency assets.

In contrast, Bhutan continues to carry out mining activities on a daily basis. As of this writing, the government owns more than $900 million worth of Bitcoin and more than $1 million worth of Ethereum. Bhutan doesn’t seem to have any intentions to completely stop participating in cryptocurrency projects.

Coinbase brings real-time deposits via debit cards by partnering with Visa

A recent connection with the Visa Direct network has made it possible for Coinbase customers to fill their accounts instantly using Visa debit cards that qualify.

As a result of a recent cooperation with Visa, Coinbase customers in the United States and Europe can now make deposits to their accounts using an approved Visa debit card. Visa stated in a news statement on October 29 that the connection gives Coinbase users the ability to deposit money instantly, providing flexibility for individuals who want to react fast to changes in the cryptocurrency market.

Excited for Visa to partner with @coinbase to help them utilize Visa Direct to fund Coinbase accounts and enable real time cash outs https://t.co/aA9l6ZvwHm

— Cuy Sheffield (@cuysheffield) October 30, 2024

By cutting down on wait periods often connected with cryptocurrency financing, the function seeks to expedite access to trading money. Users may top up accounts or make cryptocurrency transactions nearly instantaneously because to the Visa Direct network’s ability to support fast deposits. In order to reduce delays in all significant transactions on the platform, Visa debit cardholders may also cash out to their bank accounts instantly.

“Providing real-time account funding using Visa Direct and an eligible Visa debit card means that those Coinbase users with an eligible Visa debit card know that they can take advantage of trading opportunities day and night.”

Yanilsa Gonzalez Ore, head of Visa Direct, North America for Visa

This new collaboration builds on Visa’s recent launch of a blockchain platform that enables banks to handle fiat-backed tokens, further solidifying the company’s growing position in the cryptocurrency sector.

Visa introduced the Visa Tokenized Asset Platform earlier in October. This network allows financial institutions to manufacture, burn, and transfer stablecoins and other fiat-backed tokens. The platform’s first customer was the massive Spanish bank BBVA, and in 2025, it intends to test the technology on the open Ethereum (ETH) blockchain.