In terms of Bitcoin, the price of Ethereum (ETH) has also dropped to its lowest point since April 2021.

Amidst concerns in the cryptocurrency market, Ether’s price fell 6% in the last day, from an intraday high of $2,425 on September 15 to a low of $2,260 on September 16.

During the Aug. 5 and Sept. 7 flash crashes, the asset fell below $2,200 for a brief period of time; it is currently back at levels not seen since January.

The entirety of the cryptocurrency market has dropped 4.5%, with Ethereum (ETH) bearing the brunt of this decline, bringing the overall capitalization down to $2.12 trillion.

The action was taken in the midst of what appears to be a “FUD” wave on X, with analysts and watchers of the cryptocurrency business even seeming to join the Ether-bashing bandwagon.

“Half of my feed is ETH FUD at this point,” exclaimed Ethereum developer ‘antiprosynthesis’ in a post on X on Sept. 15.

Ethereum has been likened to Brazilian football player Neymar Junior by economist Alex Krüger.

If Ethereum were a football player pic.twitter.com/OZLwpye8R4

— Alex Krüger (@krugermacro) September 16, 2024

James Check and “KALEO,” two cryptocurrency analysts, joined in on the ETH-bashing, sharing memes about the market’s fall and its drop relative to Bitcoin (BTC).

On September 15, “The Crypto Dog” informed his 820,000 X followers that, over the past year, even Bitcoin Cash (BCH) had outperformed Ether.

As of September 16, the ETH/BTC ratio dropped 0.038, the lowest since April 2021, according to TradingView.

The Federal Reserve is expected to announce a rate drop on Wednesday, September 18, which coincides with the start of a busy week for the US economy and the ETH price decline.

The odds presently favor a 25 basis point rate drop by 41% and a greater 50 basis point cut by 59%, according to the CME Fed Watch tool.

Analysts at Bitfinex forecast earlier this month that the cryptocurrency market may decline as a result of the US central bank’s widely anticipated rate decrease.

Furthermore, on September 15, former US President Donald Trump escaped what the mainstream media is referring to as a second attempt at his assassination.

Trump escaped unscathed, and Ryan Wesley Routh, 58, was apprehended as the culprit who had left the scene.

Given the spike in cryptocurrency prices that followed the presidential candidate’s most recent assassination attempt in mid-July, it is unclear if the incident had any effect on the ETH markets.

Will AAVE price pump or dump as Trump’s DeFi project goes live?

Aave leads the market with a 66% gain over the last 90 days as Trump’s DeFi initiative debuts today, and its positive momentum holds despite a little correction.

Prior to the debut of Trump’s DeFi project, the average price is still high since Donald Trump escaped his second assassination attempt in as many months at his Florida golf club. The FBI swiftly arrested the culprit and verified that Trump is uninjured.

Aave has been the talk of the town, outperforming the majority of the cryptocurrency market with an 11% rise over the last week, even though Trump’s World Liberty Financial (WLFI) DeFi initiative started today. The market’s highest price for Aave has increased by 66% in the last ninety days due to conjecture that WLFI would use Aave’s protocol. 93% of Aave’s supply is already in use, and analysts anticipate more price increases. AAVE is currently trading at $140.67 following a little 3% decline.

Aave price retraces as WLFI launch follows Trump assassination attempt

At his Florida golf club, Donald Trump escaped an attempted assassination attempt, the second such event in as many months. Trump is still uninjured, according to the FBI, and the suspect was swiftly taken into custody when he ran from the scene. An AK-47-style firearm was found by the authorities, proving the crime was planned.

In the meanwhile, as stated in the official release from last week, Donald Trump’s World Liberty Financial (WLFI) DeFi initiative is set to debut today, much to everyone’s excitement.

.@WorldLibertyFi pic.twitter.com/rHEGQXl4jL

— Donald J. Trump (@realDonaldTrump) September 12, 2024

With the launch of this new crypto initiative, Trump is reportedly “embracing the future with crypto and leaving the slow and outmoded large banks behind,” according to a video statement on his X account. Leading World Liberty Financial are Donald Jr. and Eric Trump, the president’s sons. The company has been in development for a few months.

When reports surfaced that the WLFI will operate on the Aave protocol on top of the Ethereum mainnet, the price of Aave skyrocketed. Furthermore, 93% of the Aave supply is in use, indicating that inflation will soon come to a stop and that the DeFi platform will see a massive price increase as demand continues to surge.

AAVE price is currently trading at $140.67 following a minor 3% retreat during the previous day.

AAVE technical analysis: Why the pump is not over

One of the few positive charts in the cryptocurrency market right now is the Aave price movement. It has a robust upward trend, which started in the middle of 2023 and is shown by a string of higher highs and lows. The price has confirmed the positive momentum by breaking above important resistance levels.

The next major hurdle, $186, may provide resistance for the price of AAVE. Based on the measured move forecast from the breakout point, the chart indicates that this level is the next big objective for the bulls. It represents a 32% increase in value over the current price.

Aave might hit the $200–$220 level in a 55% rise, opening the door for a far greater upward move if it can stay above $186.

The price of average has support between $130 and $135, which was formerly a barrier and is an important basis for additional upward movement. The next lower support is at $100 and $80 if the price falls below $138 in the event that market circumstances alter. As a result, the present bullish argument would be refuted and AAVE would return to consolidation.

CKB skyrockets 111% in a week following Upbit listing, hits highest level since June

The recent launch of Nervos Network’s native token, CKB, on the South Korean market Upbit has caused a spike in value of over 111% in the previous seven days.

Nervos Network, whose price increased from $0.159 to $0.0176 on September 16, is now the best-performing cryptocurrency among the top 100 digital assets by market value as a result of the price increase.

According to CoinGecko statistics, the token’s market valuation has surged to $729 million, making it the 92nd largest digital asset globally. This is the token’s highest level since June 10.

The main factor for the recent price increase of CKB is that it is now listed on Upbit, a significant South Korean exchange. Demand has increased significantly as a result of the new listing, which has made it simpler for traders to buy CKB with US dollars, South Korean won, or Tether (USDT).

South Korean traders are becoming more active, according to CoinGecko data; the CKB/KRW trading pair alone accounts for approximately $331.6 million of Upbit’s 24-hour volume. With $134.7 million in trade volume, Binance came in second.

Its entire daily trading volume increased 100% as a result of the revived optimism, and it is presently trading at over $381 million.

Coinglass data reveals that while writing, CKB’s daily open interest increased by 13.4% to $116.6 million. This signals a jump in investor activity, which might feed the current rally in CKB, along with an increase in trading volume.

With the use of the RGB++ protocol, Nervos Network is a proof-of-work layer-2 project that aims to improve Bitcoin (BTC) by making it more programmable and scalable.

CKB price action

The price spike of CKB has also been accompanied by the convergence of two lines that create a falling wedge formation, as previously reported by crypto.news. This technical configuration usually indicates more upward potential.

Additionally, it has broken through the upper Bollinger Band, which is now at $0.0153, indicating a strong upward surge. Furthermore, the Relative Strength Index, which is now at 78, indicates that there has been significant purchasing pressure and is showing an overbought state.

An RSI over 70 historically denotes overbought conditions, but it can also coincide with further stock gains, especially when strong momentum is at work.

Traders should monitor the $0.02 level, which may act as the next psychological obstacle, given the current trend. Strong volume and a successful breach of this barrier might drive the price up toward $0.025 or higher.

The overbought RSI does, however, suggest that a pullback or consolidation may occur soon. The middle Bollinger Band, which is located close to $0.0096, can serve as a possible level of support in the case of a reversal.

It is advisable for traders to be cautious and keep an eye on the momentum, as a decline to this level may signify the start of a brief period of consolidation.

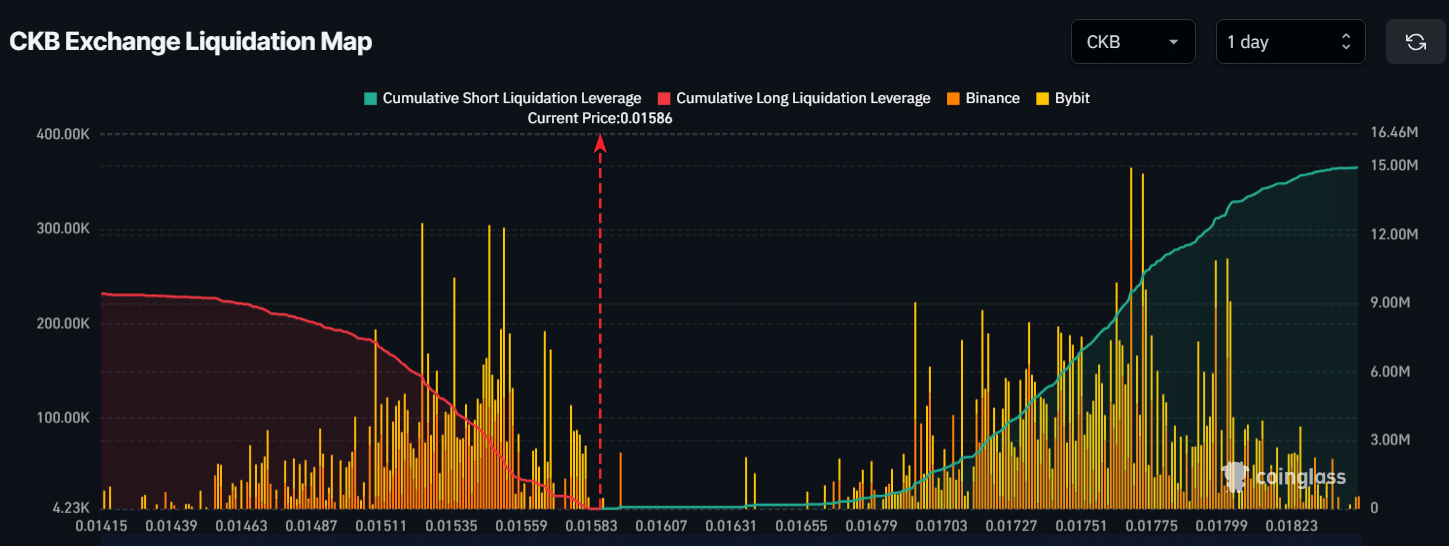

Major liquidation levels

According to Coinglass, the crucial liquidation thresholds for CKB are currently at around $0.0152 on the lower side and $0.0176 on the upper side. At these values, a high degree of leverage has been seen among intraday traders.

In the event that the dynamics of the market change and CKB’s price drops below $0.0152, around $5.77 million in long bets may need to be liquidated. Alternatively, almost $9.5 million in short positions may be liquidated if the price increases to $0.0176 and the market mood improves.

Data at the time of publication showed that bulls were in charge and may force short position liquidations at higher levels.