The continuous selling of ETH prices is a result of wallets associated with Vitalik Buterin and the Ethereum Foundation being actively linked to them.

The Ethereum Foundation’s and Vitalik Buterin’s connected Ethereum wallets have been selling aggressively, which has resulted in ongoing pressure to sell ETH. The price of ETH fell to $2,150 last week before partially rising again during the massive sell-off.

Ethereum Foundation and Vitalik Buterin-linked addressed on selling spree

Over the past few hours, the Ethereum Foundation wallet has moved a significant amount of ETH, according to the most recent Arkham Intelligence data. Since the launch of the spot Ethereum ETFs, the Foundation has been selling ether nonstop.

However, wallets connected to Vitalik Buterin, the co-founder of Ethereum, have been selling heavily. Spot On Chain data shows that a multi-signature wallet that received significant Ethereum transfers from Vitalik Buterin is aggressively liquidating its assets.

The wallet has been gradually selling its holdings since receiving 3,800 ETH—roughly $9.99 million—from Buterin in two transactions on August 9 and August 30. Vitalik Buterin refuted the dumping accusations last week, despite his declining Ethereum holdings.

Thus far, 760 ETH have been sold for 1.835 million USDC, or an average price of $2,414 per ETH, by the wallet that received Buterin’s ETH. Just twenty-one hours have passed since the most recent sale, which kept up the trend of selling off a sizable chunk of the ETH holdings. This might give ETH bears the advantage together with the Ethereum Foundation sell-off.

The multi-signature wallet that got $ETH from @VitalikButerin is on a selling streak!

After receiving 3,800 $ETH ($9.99M) from Vitalik on Aug 9 and 30, it’s been cashing out, selling 760 $ETH for 1.835M $USDC at ~$2,414 per ETH. The latest sale happened just 21 hours ago.… pic.twitter.com/ELcjpPSg4K

— Spot On Chain (@spotonchain) September 9, 2024

On the flip side, by transferring their ETH to Tornado Cash, cryptocurrency hackers are also pushing up the price of ETH.

Ethereum Whale liquidations surge amid ETH price drop

An Ethereum (ETH) whale sold over 28,554 ETH worth $64.4 million after the price of ETH crashed on September 7 in order to pay off outstanding debts on the Aave platform. Between December 18, 2023 and July 31, 2024, this whale amassed about 30,500 Ethereum at an average price of $2,850. During the liquidation process, the whale incurred a substantial loss exceeding $17 million.

Well-known cryptocurrency expert Ali Martinez said that Ethereum whales have been releasing ETH since July, when they ceased to accumulate more of the cryptocurrency.

#Ethereum whales stopped accumulating $ETH in early July. Since then, they’ve been selling or redistributing their #ETH holdings. pic.twitter.com/ySmQLL7JCD

— Ali (@ali_charts) September 8, 2024

Not only has Vitalik Buterin and the Ethereum Foundation continued to dump their ETH in recent times, but so have other major actors. An hour ago, Metalpha made a huge deposit to Binance by transferring 10,000 ETH valued at $23 million. Metalpha has deposited 23,589 ETH total, or around $54.1 million, to the exchange in the last three days.

The market cap of Ethereum is $275 billion, and its current price is $2,291. Before ETH resumes a robust climb, it may go below $2,000 if the selling pressure persists.

Bitcoin ETFs need time to be ‘instrument of adoption’ – Bianco Research CEO

Wider adoption of ETFs, according to Bianco Research CEO Jim Bianco, will need the next Bitcoin halving in 2028 as well as substantial on-chain tool development.

A veteran Wall Street analyst predicts that bitcoin exchange-traded funds (ETFs), which debuted in the US early this year, would require more time to develop into a “instrument of adoption” as opposed to a “small tourist tool.”

Since spot Bitcoin (BTC) ETFs became online for trading in January, Jim Bianco, the CEO of analytics firm Bianco Research, stated in a Sept. 8 X post that he doesn’t think they’ve lived up to the pre-approval hype.

He asserted that the absence of significant institutional investment, recent withdrawals, and individuals losing money on their holdings are indications that the Bitcoin ETF market may require more time to develop.

“The first eight months of Spot BTC trading have shown that build it, and the boomer will come was never ‘a thing,’” he said.

1/8

Spot BTC ETFs update

tl:dr

* Inflows now outflows

* Holders have record losses

* Advisors <10% of holdings (boomers never came)

* Avg trade size now <$12k.It’s not an adoption vehicle. Instead a small tourist tool and on-chain is returning to Tradfi.

See posts #4 and #8

— Jim Bianco (@biancoresearch) September 8, 2024

Based on statistics from Farside Investors, there have been net withdrawals of more than $1 billion from the 11 US Bitcoin ETFs during the previous eight trading days. After peaking at $61 billion in March, the spot Bitcoin ETF market currently has assets under management of about $48 billion.

“Very little new money has entered the crypto space,” Bianco continued, noting that the majority of ETF inflows came from “onchain holders moving back to Trad-fi accounts.”

Samara Cohen, chief investment officer of ETF and Index Investments at BlackRock, estimated in June that self-directed online accounts accounted for around 80% of Bitcoin ETF sales.

7/8

What about the adoption of investment (wealth) advisors?

Small

BTC ETF holdings account for 9% of shares outstanding. Hedge funds add another ~12% (mostly basis trades, not directional bets).

About 85% is NOT from tradfi institutions.

Note that all are holding losses. pic.twitter.com/2MMbmezxUH

— Jim Bianco (@biancoresearch) September 8, 2024

Bianco predicts that before the market really finds its footing, there will probably need to be another Bitcoin halving in 2028 as well as a “significant development of onchain tools.”

“Patience and another couple of seasons, including a winter or two, and development breakthroughs are needed first,” he added.

Other analysts weigh in

Not everyone has accepted Bianco’s evaluation. Following eight months, the Bitcoin ETFs managed billions of dollars’ worth of assets, according to a Sept. 8 X post by Eric Balchunas, a senior ETF analyst at Bloomberg.

Need help: If $IBIT has like >$20b in assets (in 8mo btw) and that’s considered a failure then what word should be used to describe an ETF w $7m in assets?

— Eric Balchunas (@EricBalchunas) September 8, 2024

“If IBIT has like $20 billion in assets and that’s considered a failure then what word should be used to describe an ETF [with] $7m in assets?” he said.

BlackRock’s iShares Bitcoin Trust (IBIT), one of the top four Bitcoin ETFs in the US, is at the top of the rankings and has received inflows totaling over $20 billion.

The around $10 billion Fidelity Wise Origin Bitcoin Fund (FBTC) is held. Both the Bitwise Bitcoin ETF Trust (BITB) and the ARK 21Shares Bitcoin ETF (ARKB) have had net inflows of almost $2 billion thus far.

“If most ETF trades are NOT institutional, this means institutions aren’t even here yet, and we could see massive institutional inflows next time FOMO and greed show up,” asserted Bryan Ross, another cryptocurrency expert who disagreed with Bianco.

Quant, Cardano prices rise as wallet activity spikes: Santiment

On Sunday, September 8, Cardano and Quant prices gradually increased as the previous cryptocurrency sell-off subsided.

The Quant (QNT) token increased for the second day in a row, peaking at $70, its biggest fluctuation since August 26. It is still 54% below its peak this year, but it has increased by more than 23% from its lowest position last week.

Cardano and Quant have higher wallet activity

Cardano (ADA) increased to $0.3390, a significant amount above its $0.30 low on Friday. It has decreased by about 60% from the peak so far this year, much like other currencies.

When the sell-off of Bitcoin (BTC) subsided, these tokens saw a little increase. Bitcoin recovered to $54,500 on Sunday after plunging to $52,900 on Friday, as some speculators snapped up the dip. Altcoins often follow the trend of Bitcoin over most times.

As evidence indicates more address activity, the prices of Cardano and Quant increased as well. Santiment claims that this suggests that some investors are building up, which frequently results in a recovery.

📊 As traders await a potential Bitcoin/crypto rebound, Cardano, Quant, and Holo are three notable assets seeing a sudden surge in address activity. When coins that are declining in value suddenly see rises like these, it historically raises the likelihood of a bounce. 📈 pic.twitter.com/udBULCmZYa

— Santiment (@santimentfeed) September 7, 2024

Cardano’s increasing open interest in the futures market is another piece of proof. According to CoinGlass data, the open interest increased to $177 million on Sunday, marking the third day of rises in a row.

It was little more than the $167 million on Friday. DeFi Llama reports that Cardano now has over 31,000 active addresses.

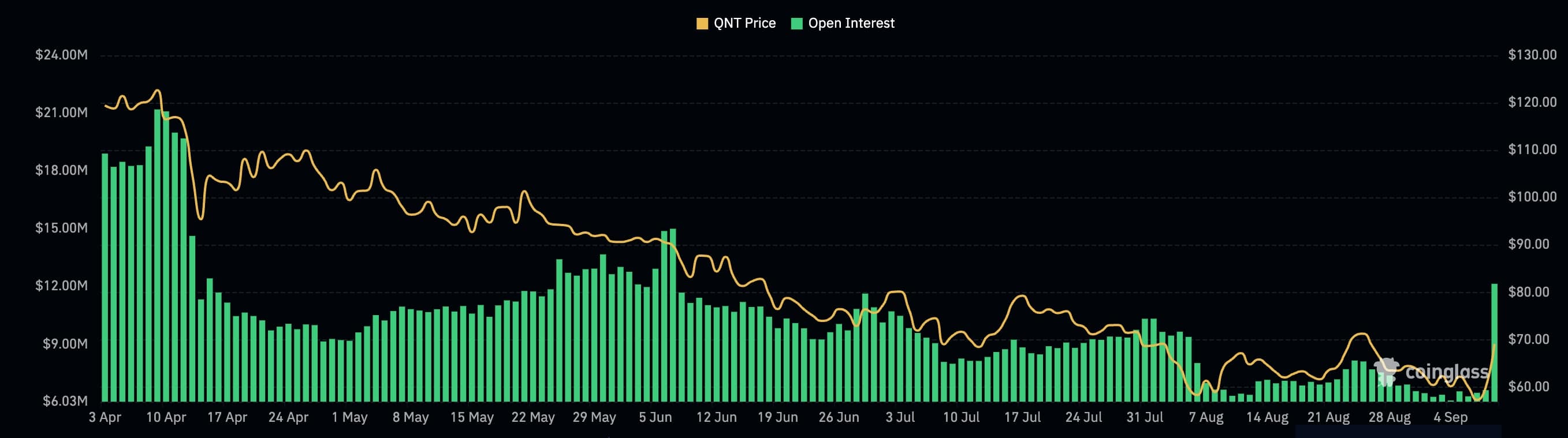

Quant’s futures open interest also had a parabolic rise, peaking at $12.15 million, the largest since June 7 and far higher than the low of $6.50 million last week.

The number of unfilled orders is shown by the futures open interest indicator, which is significant in the financial market.

Quant, Cardano: Big players in crypto

Among the largest companies in the cryptocurrency space are Cardano and Quant. With a $12 billion market capitalization, Cardano is the eleventh currency and aims to outperform Ethereum (ETH).

But the network has had trouble drawing in users and developers over time. It has just a few DeFi dApps and a locked total value of $191 million as a result. Because of this, it is smaller than other more recent layer-1 and layer-2 networks, such as Sui and Arbitrum (ARB).

The Chang hardfork was just released, and its creators are hoping that it will spark greater activity.

Another network called Quant assists businesses in creating blockchain-enabled apps, particularly in the payment services industry.

Thanks in part to its overledger technology, it is frequently regarded as one of the leading companies in the rapidly expanding Real World Asset tokenization market.