In order to improve EVM and account security and raise the price of Ethereum above $2,600, Vitalik Buterin unveiled “The Splurge” roadmap.

Despite all of the controversy around Ethereum’s poor performance, co-founder Vitalik Buterin has consistently released new platform improvements. Buterin published a thorough blog post earlier today outlining important steps to improve account security and EVM as part of “The Splurge” agenda. As of the time of writing, the price of Ethereum has increased by 5.5% in response to the development, surpassing $2,600.

Vitalik Buterin: The Splurge roadmap to enhance protocol design

Buterin released another update last week to improve account security and optimize the Ethereum Virtual Machine (EMV), after his sharing of important insights on the Ethereum “The Verge” upgrade. The Ethereum development team’s “Splurge” agenda is centered on improving the Ethereum protocol to guarantee its sustained viability.

According to Vitalik Buterin’s blog post, “The Splurge” upgrade has several lofty goals, including advanced cryptographic research, account abstraction, transaction cost optimization, and EVM optimization.

- Optimizing the Ethereum Virtual Machine (EVM) to reach a more stable and effective “endgame state” is the aim here. The analysis and efficiency of the EVM designs are now problematic. This is intended to be fixed by the future EVM Object Format (EOF), which has characteristics like data and executable code separation.

- To improve code safety, dynamic leaps are prohibited.

- A new subroutine method is introduced to enhance performance.

Performance will be further improved, especially for cryptographic operations, by the development team’s planned improvements after EOF implementation, such as EVM Modular Arithmetic Extensions (EVM-MAX) and possible interaction with Single Instruction Multiple Data (SIMD) capabilities.

- Account Abstraction: Currently, only ECDSA signatures are used for transaction verification, which makes key management and security management quite challenging. Features that enable all users, including those with externally owned accounts (EOAs), will be included in the upcoming EIP-7702. As a result, consumers will gain from increased convenience without establishing distinct ecosystems. Through sophisticated techniques like multi-party computation, this advancement will improve security while streamlining key management.

Key trade-offs and integrations

Vitalik Buterin pointed out that the complexity of the EVM and infrastructure may provide additional difficulties with the implementation of EOF and account abstraction. He did point out that these advancements will improve the effectiveness of other Layer 2 solutions while making higher-level programming simpler.

The use of EVM-MAX in conjunction with SIMD will be essential to lowering gas prices and enhancing overall performance as Ethereum develops further.

By making these calculated improvements, Ethereum will firmly establish itself as a top blockchain platform. Additionally, it will guarantee that it stays safe and flexible in a quickly evolving technical environment.

Ethereum price gains 5.5%

#PeckShieldAlert #VitalikButerin has transferred 400 $ETH to 4 addresses, polymathkids.eth, crystalhearts.eth, 0xbd9b…8c5f & 0xCF344…73F4 pic.twitter.com/q7VqANbee0

— PeckShieldAlert (@PeckShieldAlert) October 29, 2024

Vitalik Buterin justified the Ethereum (ETH) Foundation’s sell-off earlier this week, claiming that it is standard procedure for them to compensate all devs, validators, and other contributors within the ETH ecosystem.

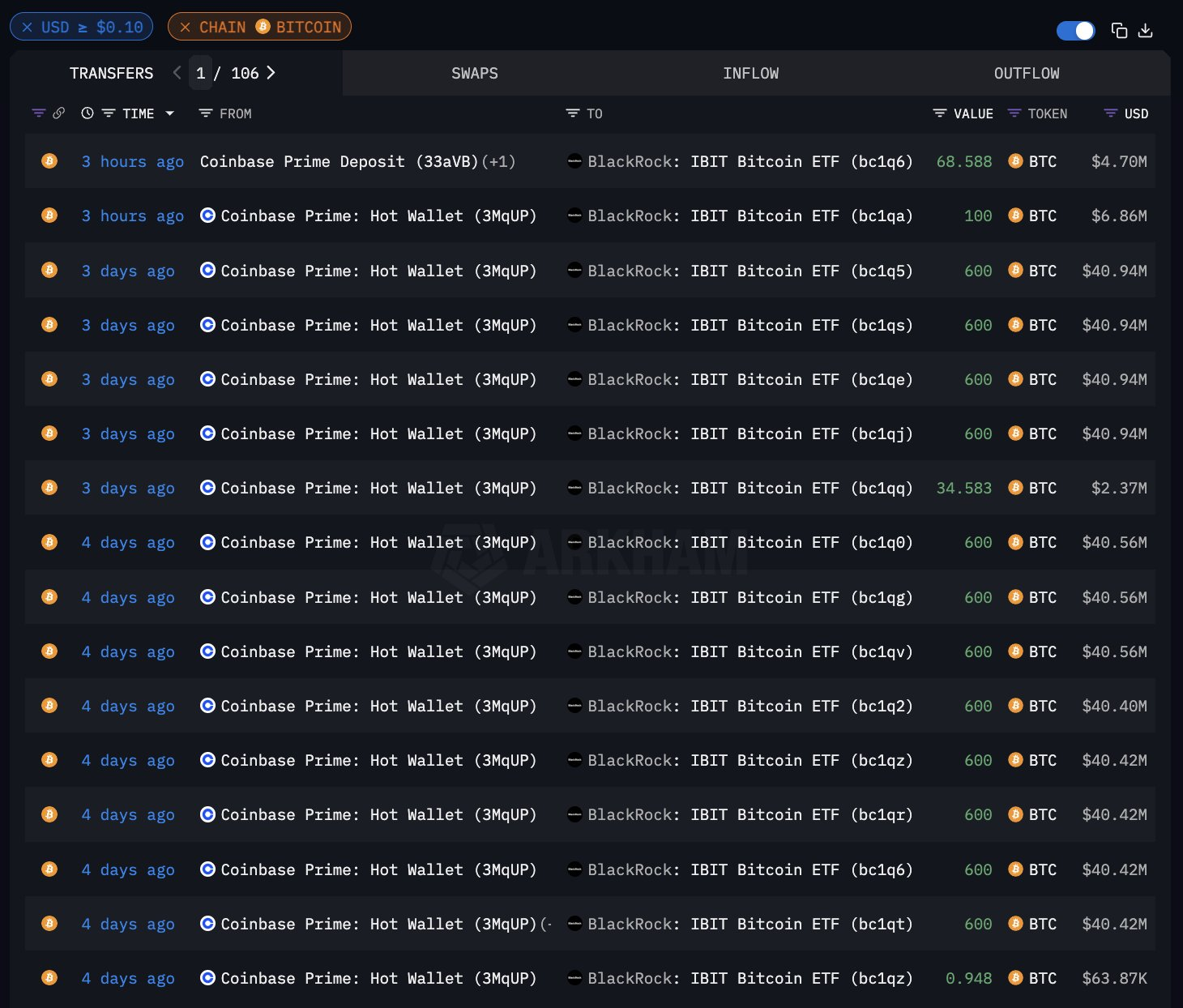

BlackRock ramps up Bitcoin buys, invests in MicroStrategy

According to trade statistics, BlackRock purchased $1 billion worth of Bitcoin last week, and on Monday, it acquired an extra $300 million.

Additionally, the asset management has made an investment in MicroStrategy, indicating a strengthening relationship with the Bitcoin market.

BlackRock’s Bitcoin strategy

BlackRock bought $1 billion worth of Bitcoin (BTC) in the past week, according to data from Arkham Intelligence. It now has 399,525 BTC in total holdings, which is a significant sum but still significantly less than Binance’s 667,526. According to Arkham’s statistics, BlackRock has been consistently purchasing Bitcoin throughout the day, usually in deals totaling 600 Bitcoin.

This October, BlackRock went on a Bitcoin buying binge, first acquiring $680 million worth of the cryptocurrency over two days before switching to a more gradual acquisition strategy. The effectiveness of BlackRock’s substantial BTC investments is demonstrated by the fact that their Bitcoin ETF, IBIT, dominated October ETF inflows. CEO Larry Fink is still a fervent proponent of Bitcoin and has praised it as a unique asset class.

BlackRock’s trend of large acquisitions doesn’t appear to be slowing down. According to Lookonchain data, BlackRock purchased 4,369 Bitcoin on Monday, investing an additional $300 million in the cryptocurrency. The majority of the Bitcoin purchased by all ETF issuers on October 28 came from one source.

BlackRock is broadening its Bitcoin-focused investing approaches, though. It increased its ownership of MicroStrategy to 5.2% last week. Despite not issuing exchange-traded funds (ETFs), MicroStrategy is a major corporate Bitcoin investor, and their values are closely related.

$MSTU is essentially a 4x Bitcoin ETF. Its 30d volatility is 168%. $IBIT is 41%. Notable bc you can’t launch a 4x bitcoin ETF (or a even a 3x bitcoin ETF) in the US but.. by 2x-ing $MSTR (which is 2x btc) they effectively created the ultimate degen trading tool. What a country.. https://t.co/JEC7gInsXO

— Eric Balchunas (@EricBalchunas) October 28, 2024

Compared to an ETF based on the value of Bitcoin, BlackRock’s investment in MicroStrategy is less volatile. Nonetheless, the comparison is still pertinent, particularly since Balchunas openly contrasted the volatility and returns of MicroStrategy with BlackRock’s IBIT. MicroStrategy’s stock has reached a 24-year high thanks to BlackRock’s investment and Bitcoin’s recent good performance.

To sum up, BlackRock has shown a strong preference for ongoing Bitcoin investment. Over an extended period of time, the company has been purchasing enormous amounts of the asset. In addition, it has been investing heavily in Bitcoin-related properties such as MicroStrategy. BlackRock is becoming one of the biggest Bitcoin holders on this trend.

Dogecoin price jumps 14% after Elon Musk’s comment, nears $0.20

Investors are taking notice of Dogecoin’s latest price spike, as the joke coin has experienced a significant upswing in the last day. Elon Musk, often known as the “DOGEFather,” hinted to the cryptocurrency in a tweet that before this surge.

Market observers are hopeful that DOGE will soon surpass the six-month high that its price movement has gotten it near to.

Dogecoin makes a move

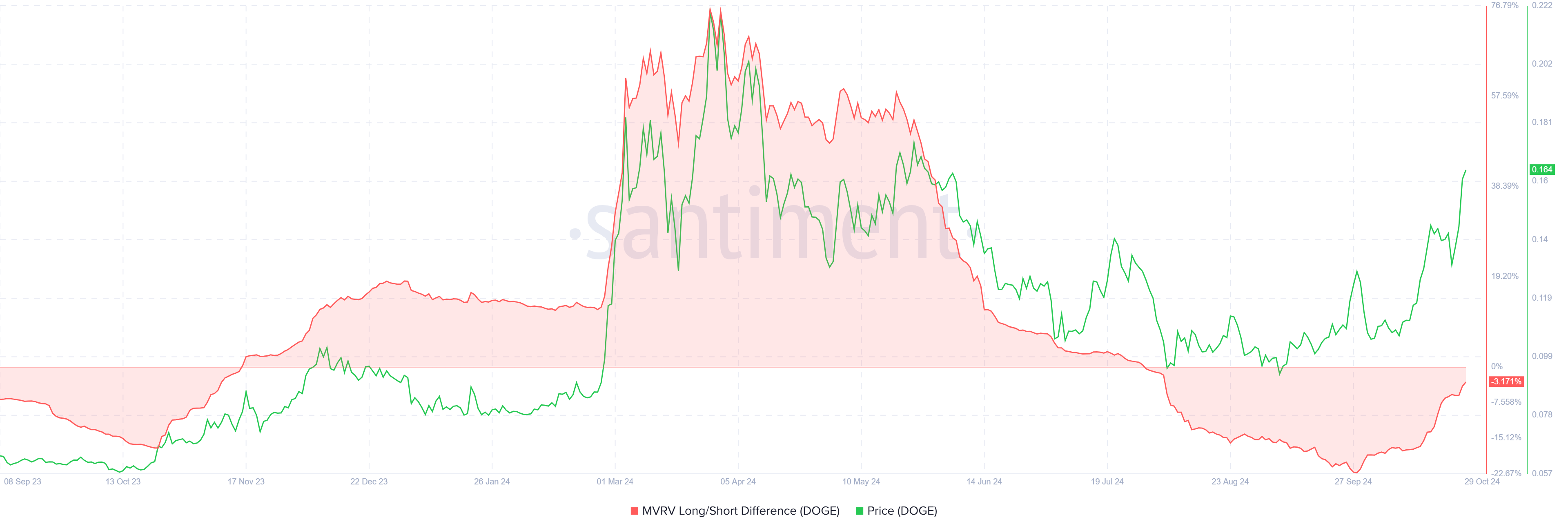

The MVRV Long/Short Difference measure shows that the market sentiment for Dogecoin is stable at the moment. This statistic indicates that the asset is not unduly skewed towards either group because the profit or loss levels of long- and short-term investors are comparable.

Extreme numbers on this indicator usually mean that one group, such long-term holders, makes a lot of money while the other group lags. The current level of equilibrium is encouraging since it shows that there is no dominant advantage held by any one group in a stable environment.

Positive indicators may also be seen in Dogecoin’s macro momentum, especially when looking at profitability and active addresses. Although positive, the fact that 29% of all DOGE investors are currently profitable might lead to selling pressure. Some investors could be tempted to sell when DOGE’s lucrative address share rises beyond the 25% mark, which might affect volatility in the near future.

Because it suggests the possibility of some selling, this rise in successful investors is significant. There may be some short-term negative pressure on Dogecoin if more investors turn a profit.

DOGE price prediction: Six-month high next

Elon Musk’s DOGE tweet caused Dogecoin’s price to rise 14% in the last day, and the joke coin is taking advantage of the bullish momentum that might push it toward $0.20. Reaching this goal would be noteworthy since it is almost 21% higher than DOGE’s current trading level.

Notwithstanding the favorable aspects, DOGE can run into opposition at $0.17 before reaching its peak of $0.20, six months away. If the asset is unable to break through, this resistance level may momentarily halt the rally, postponing more upward momentum and reducing short-term optimism.

A pullback to $0.14 might happen if DOGE is unable to overcome the $0.17 barrier, which would cast doubt on the bullish prognosis. This decline would prolong DOGE’s upward trajectory, indicating that fresh impetus is required to resume the upward trajectory.