Ethereum is still very much alive and well! In light of the declining support for ETH/BTC, analyst Benjamin Cowen predicted another 50% decline in ETH prices.

The price of Ethereum has already experienced significant selling pressure, falling by about 10% on the weekly chart and presently trading at $2,366. Considering that the log regression model suggests that the ETH market might drop another 50%, several market experts think that the bear market is only getting started.

Ethereum regression model hints major crash

Renowned cryptocurrency analyst Benjamin Cowen uses the log regression technique to show that the ETH/USD pair has experienced a 70% decline to the lower logarithmic regression trend line each time Ethereum (ETH) has lost support versus Bitcoin. With ETH already down 41%, there are worries that this year might see a repeat of last year’s events. Today, the price of ETH is down 1.14% at $2,366 after losing more over $50 billion in market capitalization over the previous seven days.

These significant drops have historically happened in Q4 2016 and Q4 2019, indicating that Q4 2024 may see the emergence of a similar trend.

While a number of market participants have expressed optimism about a possible “Uptober” rise, other analysts, such as Benjamin Cowen, have cautioned that it would be prudent to take the downside risks into account as well. Cowen cautioned, saying in an August article, “I think it will get a big drop before EOY to ~$1200 and then bounce into C25.”

This suggests that a further 50% decline from the present levels in the price of Ethereum may be imminent. Cowen’s thesis has been dismissed by other market experts, who claim that it is irrelevant in the year of the Bitcoin halving. In response, Cowen penned:

“In Q4 2016 ETH went to the regression band which was a halving year. Honestly, the whole “But this is a halving year!” argument is getting kind of old. You could have said the same thing when ETH was $4k, and it still dropped to $1900″.

ETH price plummets as investors’ sentiment drops

Amidst the intensifying crisis between Iran and Israel earlier this week, Bitcoin and other altcoins plunged, defying everyone’s hopes of a ‘Uptober’ rally. However, the Ethereum ICO whales have persisted in liquidating their holdings, indicating a decline in long-term investor trust in the asset class.

Additionally, because institutional investors choose Bitcoin over Ethereum due to the present market uncertainty, the overall flows into spot Ethereum (ETH) ETFs have been monotonous.

Co-founder Vitalik Buterin, nevertheless, has been concentrating on the ecosystem’s upcoming significant initiatives. He suggested cutting the minimum ETH staking threshold in half, to 16 ETH, the day prior.

XRP whales shift 153M coins as SEC files appeal in Ripple lawsuit

When XRP whales transferred 153 million coins, it raised questions and the US SEC decided to appeal Judge Torres’ ruling in the Ripple dispute.

On Friday, XRP whales attracted a lot of attention from investors and moved hundreds of millions of coins in response to the most recent development in the Ripple v. SEC legal dispute. The U.S. Securities and Exchange Commission (SEC) filed a “notice of appeal” against Judge Analisa Torres’ ruling in the Ripple litigation, despite on-chain evidence showing that whales moved roughly 153 million currencies. In the meanwhile, the price of XRP suffered, reflecting a pessimistic market attitude prevalent in the sector as a whole due to the SEC’s appeal and the recent whale behavior.

XRP whales transfer 153M coins sparking speculations as SEC files appeal

Data from the blockchain transaction tracker Whale Alert shows that three XRP whale transactions had place in the last day, causing more than 153 million coins to be mixed about. Two transactions revealed dumps to cryptocurrency exchanges, while one transaction showed money moving between unidentified wallets, according to the data.

The well-known whale address †Rzn sent 30.38 million coins to Bitso, a cryptocurrency exchange valued at $15.99 million. Concurrently, 19.22 million XRP, valued at $10.12 million, were sent to Bitstamp by the same address. It’s also important to note that 104.38 million coins, or $54.66 million, were transferred by the wallet address r9s.nxL to a new, unidentified wallet, causing investor speculative activity.

Above all, these transactions have sparked conversations among market players since the U.S. Securities and Exchange Commission has filed a notice of appeal against Judge Torres’ ruling in the XRP litigation. “Hereby respectfully appealing to the United States Court of Appeals for the Second Circuit from the final judgment entered by this Court on August 7, 2024,” the plaintiff SEC writes in the appeal.

At the same time, pro-XRP lawyer Bill Morgan recently posted on X, explaining that the appeal comes right before a bull run and so presents a serious setback for the community. According to Morgan, “just at the start of the last bull run and now files an Appeal on the anticipated eve of another bull run,” the SEC sued the American blockchain payments startup.

Ripple’s coin takes heat

At press time, XRP pricing recorded a roughly 1% loss in value, indicating a pessimistic attitude in conjunction with whale dumps and the SEC’s appeal. As of right now, the coin is trading at $0.5267; its intraday low and high are, respectively, $0.5101 and $0.5386. Over the previous day, XRP’s trading volume fell 33% to $1.96 billion. The market’s growing fears as a result of the SEC’s appeal filing and the previously stated whale dumps are reflected in this downward swing.

The fact that XRP futures OI fell 7% to $679.21 million in Coinglass data further suggested that investor interest was waning. Concerns were raised when even the volume of derivatives fell 42% to $2.53 billion.

However, according on another post by lawyer Bill Morgan, there’s still a good chance that Ripple may file a cross-appeal. It is also important to note that the SEC has not yet submitted Form C to the Second Circuit, which will reveal the specifics of the regulator’s appeal.

Worldcoin (WLD) drops 24%, but low prices don’t make it a good bet

The price of Worldcoin (WLD) has been under a lot of pressure lately and hasn’t been able to recover above the $2.00 support level. At its current price of $1.65, consolidation seems to be the next likely move for the cryptocurrency.

Given the cautious market attitude around the token, investors are currently evaluating whether Worldcoin would be a beneficial addition to their portfolio this October.

Worldcoin may not be the best choice

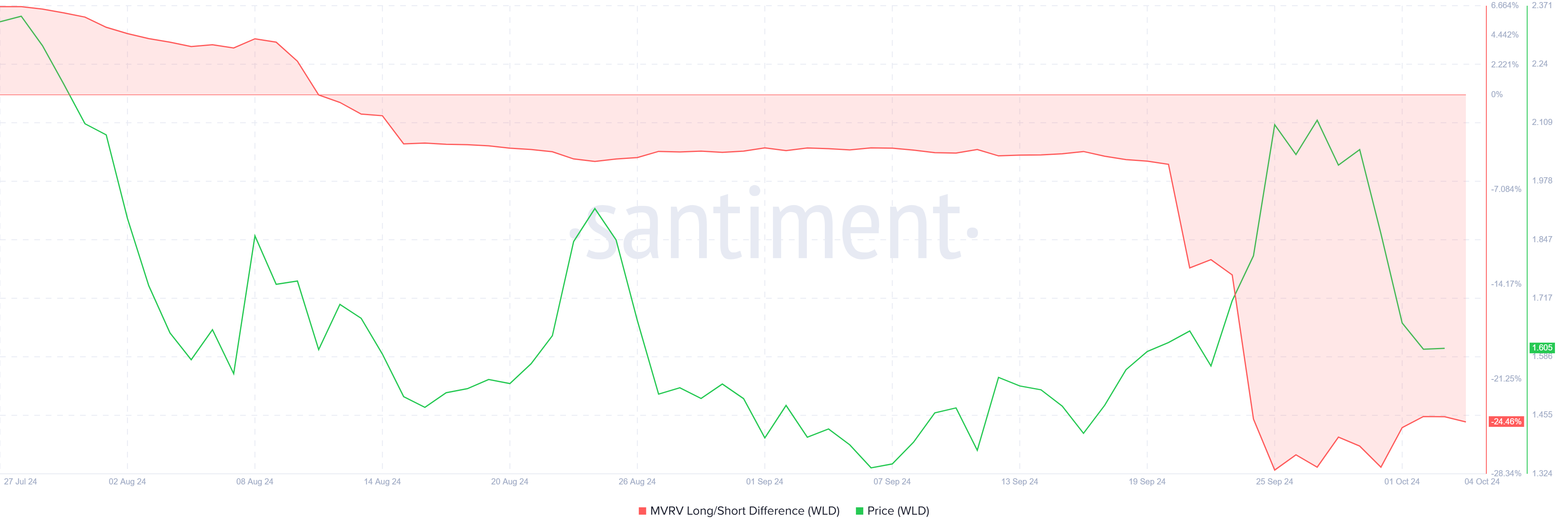

As of right now, Worldcoin’s MVRV (Market Value to Realized Value) Long/Short Difference indicator is indicating a negative outlook. Strongly positive readings usually imply that long-term investors are profitable, which is a stable indicator. Conversely, extremely low values tend to suggest that short-term holders are making money, which heightens selling pressure.

The indicator is now at -24%, indicating that holders of short-term investments are making money. The profits made by these investors are a warning indication since short-term investors are more likely to sell soon, which raises the possibility of a price decrease.

Due to short-term profit-taking, the market’s attitude has changed, and it looks like Worldcoin won’t be able to restore its upward momentum very soon. Many investors are continuing to exercise caution when adding WLD to their portfolios as a result of the negative indications.

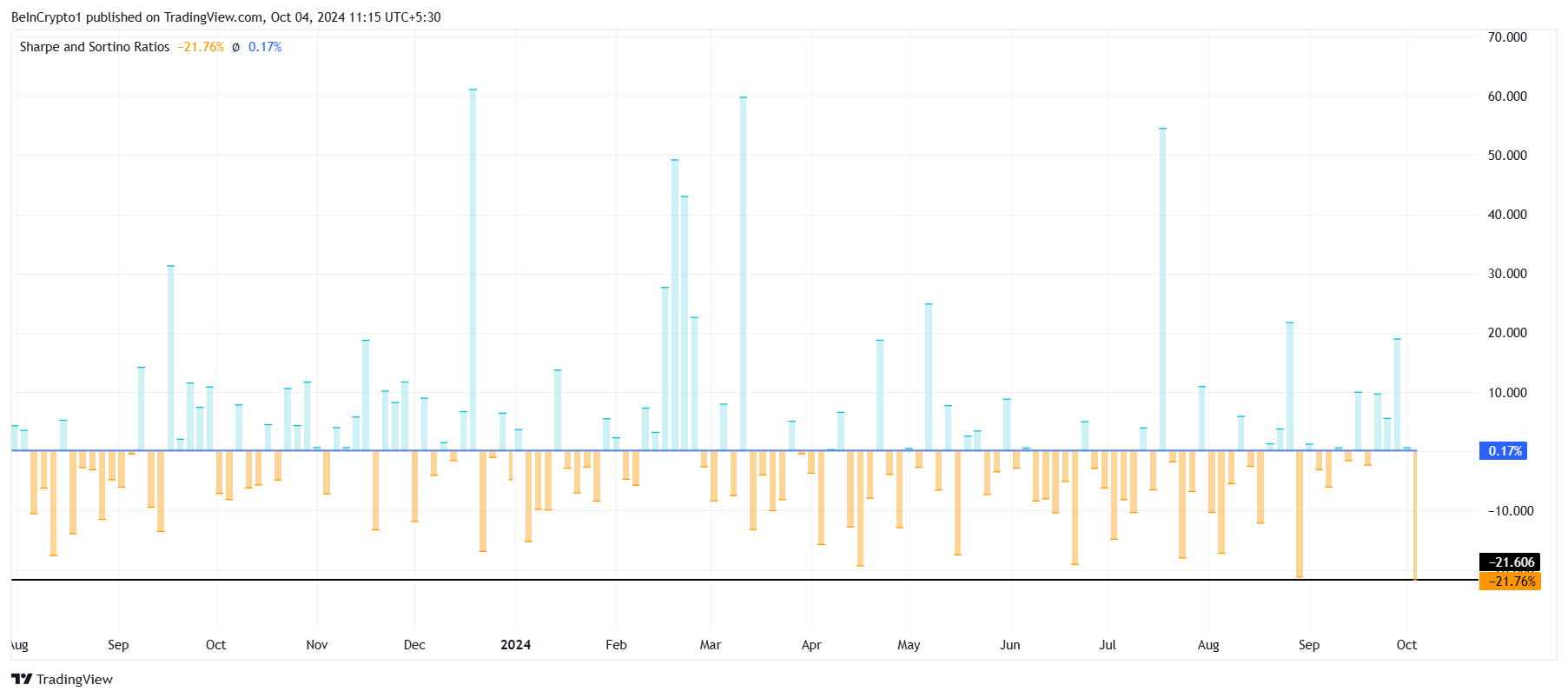

Moreover, Worldcoin’s overall macro momentum isn’t doing any better. The asset’s risk-adjusted returns are measured by an indicator called the Sharpe Ratio, and WLD’s has reached its lowest position since the altcoin’s launch. This suggests that investing in WLD is presently less appealing to investors since the risk involved exceeds the possible returns.

The low Sharpe Ratio shows that Worldcoin may not be the greatest investment at the present. This is due to the possibility of more losses due to the present risk climate. It is recommended that investors exercise caution when joining the market in these circumstances, as WLD might continue to decline in the absence of noteworthy bullish triggers.

WLD price prediction: Barriers ahead

The price of Worldcoin (WLD) is currently trading at $1.65 after falling by 24% in recent days. For the foreseeable future, it is probable that WLD will stay below the $2.00 barrier given the state of the market and macro indices.

Additionally, the cryptocurrency comes up against resistance around $1.74, which might not be a big obstacle, but failing to overcome it might result in more drops. A dip towards $1.34, the lower limit of the consolidation zone between $2.00 and $1.34, is probable if negative conditions prevail. Due to this potential, Worldcoin is not included in the list of “must-have altcoins for your portfolio in October.”

But a shift in market dynamics and a good break over $1.74 would allow Worldcoin to surge above $2.00. Should this happen, the present bearish-neutral prognosis would be invalidated, and the price of WLD may move closer to $2.50.