Fed rate cuts are now less likely, thanks to a strengthening US employment market, which may prevent fresh liquidity infusions from postponing the BTC price spike.

The US nonfarm payroll report (NFP) revealed that the US economy generated more jobs than projected in December 2024. This has reduced the prospects of a Fed rate decrease in March this year, perhaps delaying a BTC price surge to $200K this year.

Fed rate cuts delayed to June 2025

Following December’s employment report, prominent market experts predicted that the stronger-than-expected job market will result in rising inflation, preventing the Fed from announcing rate decreases soon.

The US economy created 256,000 jobs in December, above projections of 164,000. On the other hand, the unemployment rate fell to 4.1%, lower than the expected 4.2%.

Goldman Sachs economists, led by Jan Hatzius, now expect Fed rate decreases in June, December 2025, and June 2026. This revises their prior expectation of cuts in March, June, and September while keeping the terminal rate at 3.5%-3.75%. According to a recent analysis, Bank of America economists led by Aditya Bhave wrote:

“After a very strong December jobs report, we think the cutting cycle is over. The conversation should move to hikes”.

Citigroup economists Andrew Hollenhorst and Veronica Clark indicated in a letter that they are “not overly concerned about scenarios where the Fed refrains from cutting rates this year”. They added:

While employment “is holding up better than we had expected, price and wage inflation are both cooling and should have officials comfortable cutting even in a still-strong economy”.

BTC price recovery to see delays?

Following the all-time highs in December last month, the Bitcoin price has remained under selling pressure, falling below $95,000 levels. However, economists are afraid that the Fed rate reduction may further postpone BTC price recovery in the lack of additional liquidity.

However, Bill Barhydt, founder of Abra Global, sees the resumption of quantitative easing (QE) and looser bank balance sheet policies as vital steps to correct the 30-year US Treasury bubble. In a statement, Barhydt stated that anticipated Federal Reserve rate reduction will not be enough to address the situation.

“QE is coming. Fed rate reductions will not prick the 30-year Treasury bubble. Only QE and looser bank balance sheet policies will do that. Buckle up,” he said.

Furthermore, Wall Street economists believe that Bitcoin’s price will rebound when the global M2 money supply expands. With Donald Trump’s inauguration just 10 days away, the cryptocurrency market is waiting for the Trump effect to kick in.

Bitcoin chop won’t last long

Crypto researcher IncomeSharks believes Bitcoin’s current consolidation period will be shorter and more positive than prior cycles. “Just be lucky we don’t have to chop for 7 months this time,” the expert added. However, the expert cautioned that the current two to three months of consolidation may lead to surrender for many investors.

Despite this, IncomeSharks called the current market action as a “more bullish consolidation pattern than before,” indicating possible optimism for Bitcoin’s trajectory in the months ahead.

Donald Trump: First sitting U.S. President to HODL meme coins

Donald Trump, the Republican Party’s leader and billionaire businessman, will be the first sitting US President to wield meme coins.

Perhaps magical internet money exists, but the President already has some.

Once sworn in as the 47th President of the United States, Donald Trump will be the only sitting US leader in history to own meme coins.

Arkham claimed finding around $8 million worth of meme coins in Donald Trump’s crypto wallet. The White House returnee owns $5.5 million in TROG tokens, $1.5 million in TRUMP memes, 1.3 billion GUA coins worth over $400,000, and $167,000 in TRUMPIUS.

DONALD J. TRUMP WILL BE THE FIRST SITTING US PRESIDENT TO HOLD MEMECOINS pic.twitter.com/ODlNXDaKIT

— Arkham (@arkham) January 10, 2025

Donald Trump used to be skeptical of cryptocurrency. That changed in 2024, when the Republican President officially endorsed Bitcoin (BTC) and promised to safeguard the freedom to hold it.

The tycoon developed non-fungible tokens on the Ethereum network, making thousands of dollars in Ethereum (ETH) from NFTs. His wallet had 496.77 ETH, which was valued around $1.6 million at the time of publication.

Many people assume and hope that the Trump administration would establish a clear regulatory system for digital assets. Donald Trump’s choices for SEC chair, such as Paul Atkins, and appointments like crypto czar David Sacks, indicate to a crypto-focused strategy.

Industry CEOs also allegedly donated to Trump’s inauguration and urged him to issue an executive order during his first 100 days in office. The desired order would establish a US Bitcoin reserve.

XRP News: Ripple whales bag 1B coins sparking optimism. What’s next?

According to the newest XRP news, Ripple whales have just acquired 1 billion coins, with a prominent analyst identifying critical price levels for the coin and forecasting it could flip ETH shortly.

In recent XRP news, the whales have made headlines for their huge transactions. According to recent estimates, significant investors have lately accumulated approximately 1 billion coins, demonstrating their great faith in the asset. In the midst of this, a leading expert has identified critical price levels to monitor for Ripple’s native cryptocurrency in the coming months, which has piqued the interest of investors.

XRP News: Ripple whales making big move

Recent sources indicate that the Ripple whales are once again on a purchasing binge. This XRP news has strengthened bets on a potential increase in the cryptocurrency’s price in the coming days. So, here’s a careful look at the most recent market developments.

Whales accumulate 1B coins

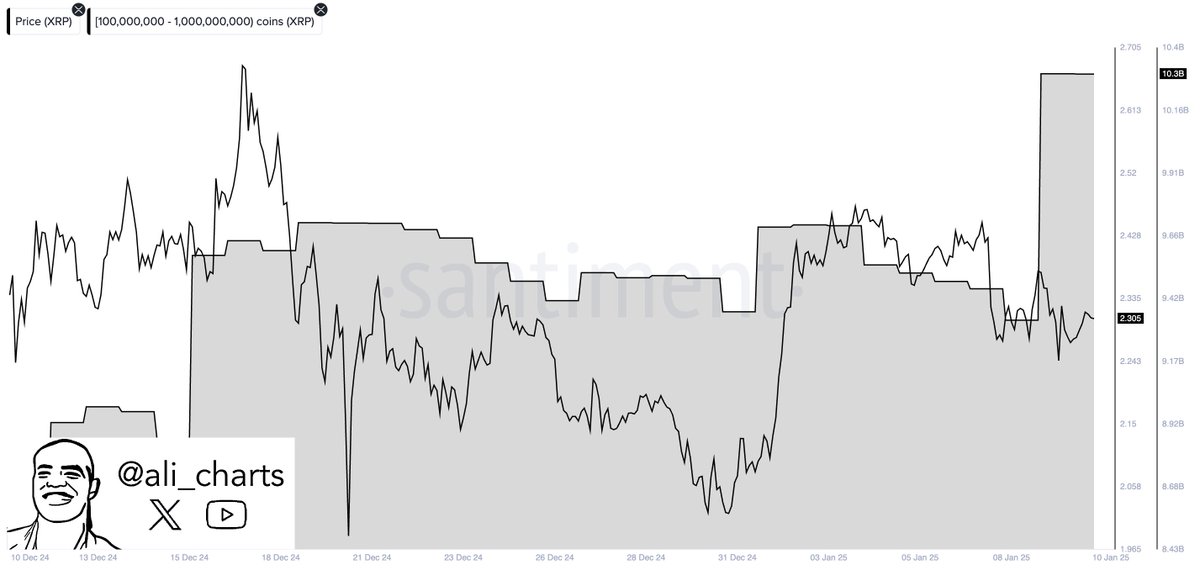

In a recent X article, leading market analyst Ali Martinez provided light on the accumulating pattern among huge investors, sometimes known as whales. According to his social media post, Ripple whales bought 1 billion XRP tokens in only two days, demonstrating their strong interest in the asset.

Meanwhile, this event has had an influence on the cryptocurrency’s price, as indicated by recent performance. However, this enormous accumulation tendency follows Ripple Labs’ recent transfer of 300 million XRP to an undisclosed wallet worth around $682 million, which has fanned market speculation.

How’s XRP price performing?

Today’s XRP price was up around 1.2% at $2.35, but trading volume declined 9% to $4.9 billion. Notably, the cryptocurrency has fluctuated between $2.36 and $2.26 in the previous 24 hours, indicating the influence of Ripple whales’ purchases on the market. Furthermore, CoinGlass data revealed that the asset’s Futures Open Interest increased by 3% to $4.37 billion.

Notably, we look at the crucial levels to watch for in cryptocurrency, as identified by a top market analyst.

Key levels to watch for Ripple’s native crypto

In a recent research posted on the X platform, famous expert Dark Defender identified crucial levels to monitor for XRP. He also hinted at a possible “upside break-out” for the cryptocurrency in the near future. According to the report, the analyst’s primary objectives for XRP are $2.40, $2.86, $4.55, and $5.85.

Having said that, it is projected that the cryptocurrency will rise to about $6 in the following days. The expert observed that the cryptocurrency’s support levels for a potential slide south are $2.23 and $2.13.

In a separate X article, Dark Defender contrasted XRP’s increase to Ethereum. He pointed out that since September 24, “XRP has appreciated three times more than Ether.” Comparing the price increases, he predicted that XRP will soon reverse in the “3rd wave we are in.”