Bitcoin exchange-traded funds (ETFs) in the United States saw their third consecutive day of net outflows, while Ethereum ETFs also experienced a return to negative flows. Data from SoSoValue shows that on August 29, the 12 spot Bitcoin ETFs recorded net outflows of $71.73 million, marking the third straight day of outflows.

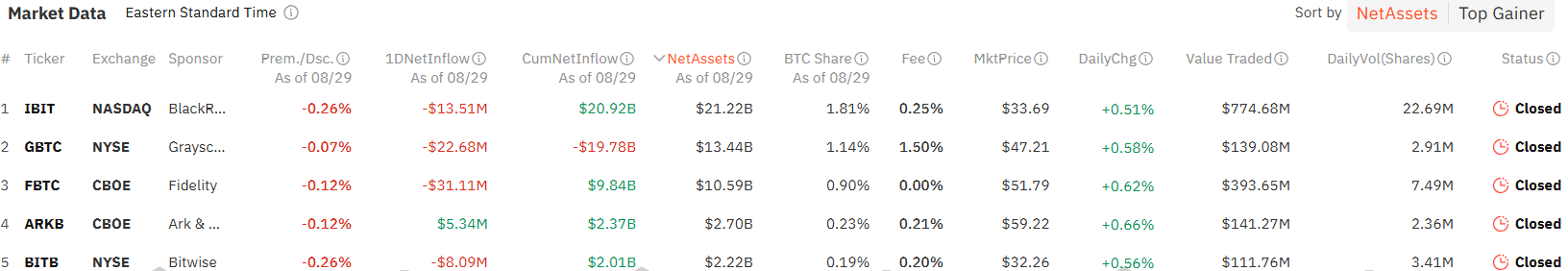

Fidelity’s FBTC led the way, with $31.1 million in outflows that day—the highest since August 6. Grayscale’s GBTC continued its streak of outflows, with $22.7 million exiting the fund, bringing its total outflows to $19.78 billion.

BlackRock’s IBIT, the largest spot Bitcoin ETF by net assets, registered its first net outflows since May 1, totaling $13.5 million. Despite this, the fund’s total net inflows still stand at $20.91 billion.

Other funds like Bitwise’s BITB and Valkyrie’s BRRR experienced outflows of $8.1 million and $1.7 million, respectively. Ark and 21Shares’ ARKB was the only spot Bitcoin ETF to report net inflows, adding $5.3 million.

The total daily trading volume for the 12 spot Bitcoin ETFs dropped to $1.64 billion on August 29, down from $2.18 billion the previous day. At the time of writing, Bitcoin (BTC) was down 0.4% over the past day, trading at $59,342.

Meanwhile, U.S. spot Ethereum ETFs returned to negative flows, recording $1.77 million in net outflows on August 29, following modest inflows of $5.84 million the day before.

Grayscale’s ETHE was the only spot Ethereum ETF to report outflows, losing $5.3 million, which was partially offset by $3.6 million in net inflows into the Grayscale Ethereum Mini Trust. The remaining seven spot Ether ETFs had no activity that day.

The total trading volume for the nine Ethereum ETFs fell to $95.91 million on August 29, down from $151.57 million on August 28. At the time of writing, Ethereum (ETH) was up 0.9%, trading at $2,529.

Elon Musk and Tesla Win Lawsuit Over DOGE Price Manipulation

A judge has ruled in favor of Elon Musk and Tesla in a lawsuit alleging price manipulation of Dogecoin (DOGE), filed by a group of investors. The judge deemed Musk’s social media posts “innocuous” and stated that no reasonable investor would base their investment decisions on them.

In June 2023, a class action lawsuit was filed against Tesla’s CEO, Elon Musk, accusing him of “insider trading” and manipulating the price of DOGE, which allegedly led to investor losses amounting to hundreds of billions of dollars.

The lawsuit claimed that in 2021, Musk took various actions to promote Dogecoin, including repeatedly mentioning it on his Twitter account, promoting it on American television, and using other tactics to drive up the cryptocurrency’s price. It was alleged that Musk profited through a series of Dogecoin wallets under his control.

The plaintiffs accused Musk of inflating DOGE’s price by 36,000%, only for the coin to crash afterward.

The lawsuit also condemned Musk’s decision to replace Twitter’s logo with the Dogecoin logo, which caused a 30% spike in DOGE’s price at the time, arguing it was an act of manipulation for profit.

However, on August 29, 2024, Manhattan District Court Judge Alvin Hellerstein dismissed the lawsuit, marking a victory for Musk and Tesla. The judge reasoned that no rational investor would rely on Musk’s tweets for making investment decisions.

The judge described the claims as “ambitious and hyperbolic,” lacking a factual basis, and argued that they could easily be proven false. This argument aligned with the defense put forward by Musk’s attorneys, who contended that the billionaire’s social media posts were simply “harmless and silly tweets,” no different from those of any other user.

The defense emphasized that these posts did not constitute investment advice or signals, nor could they manipulate the price of DOGE. Many experienced investors in the cryptocurrency market have long warned, “Trust anyone but not Elon Musk!”

Additionally, some observers view the lawsuit as merely the result of disgruntled investors who suffered losses from buying DOGE and chose to file an unreasonable lawsuit in court. As such, the case is not seen as particularly noteworthy.

Altcoin Season Delayed as Traders Rush to Memecoins, Says Analyst

A crypto analyst believes that the anticipated altcoin season hasn’t materialized because traders are too quick to invest in speculative memecoins. As traders eagerly await an altcoin season, the analyst argued that it may not happen as expected because newcomers to the crypto market are jumping straight into the most speculative assets.

In the August 29 episode of the Rough Consensus podcast, James Check, lead analyst at Glassnode, explained, “The joke has already been made, everyone knows the punchline, and they’ve skipped right to it, which just isn’t funny anymore.”

Analyzing market behavior during the 2021 bull run compared to 2024, Check observed that traders have been trying to outsmart the market by quickly buying the most hyped memecoins. Typically, in previous bull runs, memecoins would surge toward the end of a broader market rally, but this time, these assets have been rallying faster than before.

“In 2021, we had an everything bubble, where there was a beautiful capital waterfall—starting with Bitcoin, Ethereum, Layer 1s, DeFi, and all the way down to monkey JPEGs,” Check said. He pointed out that many crypto insiders have learned that the quickest way to profit is by buying the “most ridiculous coin.”

Following the approval of spot Bitcoin exchange-traded funds (ETFs) on January 10, traders took advantage of the sharp rise in Bitcoin’s price by betting big on memecoins.

Traders Shift Focus to PEPE Instead of investing in utility tokens or other higher-risk assets, traders jumped straight into the PEPE token. PEPE saw massive gains in the first half of 2024, with some traders making substantial profits. On May 15, one savvy PEPE trader made $46 million, a 15,718-fold return on an initial $3,000 investment made in April.

However, despite the soaring prices of PEPE and other major memecoins like Dogwifhat (WIF), Check noted that there was a “gap in the middle where no one touched anything.”

Meanwhile, other traders and analysts view the declining prices of altcoins and lower-than-expected trading volumes as a bullish sign for future price movements. On August 29, crypto trader Luke Martin told his 331,500 followers on X that “altcoins [are] currently at the ‘sell your house to buy more’ level.”

Martin pointed out that when Bitcoin was at this level in the summer of 2020, its price increased sixfold in the latter half of the year, going “vertical from 10k to 60k over the next six months,” he said.