Cryptocurrency has become a mainstream investment, which comes with tax responsibilities depending on the jurisdiction. Whether you are a long-term holder or an active trader, taxes can impact your profits significantly. However, savy investors can explore several legal strategies to minimize or even avoid these tax liabilities.

In this article, we’ll discuss how to avoid taxes on crypto through legitimate methods that align with tax laws and regulations.

1. The Importance of Tax Planning

Effective tax planning is crucial for any investor, especially in the volatile world of cryptocurrency. While crypto offers enormous potential for high returns, it also comes with complexities regarding tax reporting and compliance. Many jurisdictions treat cryptocurrencies as assets, which means that every transaction may trigger a taxable event. Without a solid tax strategy, investors may find themselves paying more taxes than necessary or, worse, facing penalties for improper reporting.

Tax planning allows investors to:

- Maximize profits by reducing tax burdens through legal means

- Ensure compliance with ever-evolving crypto tax regulations

- Prepare for future audits (if any) by keeping accurate records of all crypto transactions

By developing a well-thought-out tax strategy, you can protect your profits, reduce your taxable income, and ensure that you’re fully prepared to navigate the ever-changing world of crypto tax regulations. Whether you’re a day trader or a long-term holder, taking the time to plan for taxes will pay off in the long run.

2. How Cryptocurrencies Are Taxed?

If your country does not recognize crypto as a currency or does not tax them, then congratulations! However, the taxation of cryptocurrencies varies globally, and many regions have established clear guidelines on how digital assets should be taxed.

In most countries, crypto is considered a form of property or an asset, meaning that gains and losses from crypto transactions are subject to capital gains tax. Income earned through staking, mining, or payments received in crypto is often subject to income tax. Understanding how to avoid taxes on crypto legally within these frameworks can help investors optimize their strategies.

Here’s how crypto taxation typically works in most regions:

2.1. Capital Gains Tax

When you sell or trade cryptocurrency, the difference between the purchase price (cost basis) and the selling price is subject to capital gains tax.

- Short-term capital gains: These apply to assets held for less than a year and are taxed at the same rate as regular income.

- Long-term capital gains: These apply to assets held for over a year and usually offer a lower tax rate.

2.2. Income Tax

Earnings from mining, staking, airdrops, and crypto payments are often considered income and taxed at the individual’s regular income tax rate.

2.3. Taxable Events

The following activities generally trigger a taxable event:

- Selling cryptocurrency for fiat currency

- Trading one cryptocurrency for another

- Using cryptocurrency to purchase goods or services

While the specific tax rates and regulations may differ between countries, these are common principles that global investors should understand. Failing to report crypto transactions accurately can lead to penalties or audits, making it critical to stay informed about the tax obligations in your region.

3. How to Avoid Taxes on Crypto?

As the cryptocurrency market matures, governments worldwide are enacting more detailed regulations to ensure crypto investors pay their fair share of taxes. However, by understanding how to avoid taxes on crypto through proper planning and knowledge of the tax system, investors can adopt legitimate methods to reduce or entirely avoid paying taxes on crypto earnings.

Here are seven comprehensive strategies that can help crypto investors legally lower their taxes while staying compliant with the law.

3.1. Hold for Long-Term Capital Gains

In many countries, the tax system differentiates between short-term and long-term capital gains. Short-term capital gains (earned on assets held for less than a year) are typically taxed at the same rate as ordinary income, which can be as high as 37% in some regions. In contrast, long-term capital gains, which apply to assets held for more than one year, are taxed at much lower rates (ranging between 0% and 20%) depending on your tax bracket and country of residence.

This knowledge is essential for those looking to understand how to avoid taxes on crypto legally, as holding onto your crypto for for more than a year or longer period can substantially reduce the taxes owed when you eventually sell. Investors who anticipate significant future gains and are willing to ride out market fluctuations can consider this strategy. Long-term holding not only lowers tax rates but also allows you to take advantage of potential bull runs and appreciation in value without triggering taxable events in the short term.

However, this strategy requires patience and the ability to withstand market volatility, especially since the cryptocurrency market is known for its price fluctuations. The key benefit here is that it allows you to legally avoid paying higher short-term tax rates while giving your investments more time to grow.

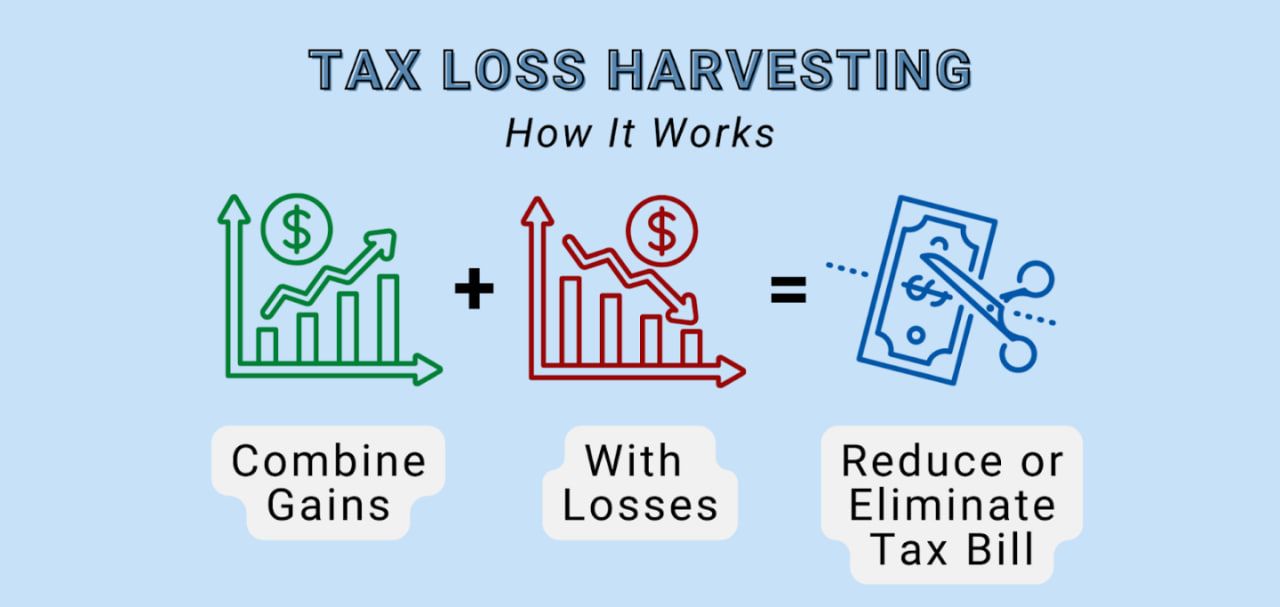

3.2. Tax-Loss Harvesting

Tax-loss harvesting is another popular strategy for those looking to minimize their tax liabilities. If you’ve suffered losses in certain crypto investments, these losses can be used to offset gains from other investments, reducing your overall taxable income. This technique is especially helpful when considering how to avoid taxes on crypto while maintaining an active trading portfolio.

For example, if you made a $10,000 profit from Paynet Coin (PAYN) but lost $5,000 on Dogecoin (DOGE), you could sell the underperforming DOGE and use the $5,000 loss to offset the gain, meaning you would only be taxed on a $5,000 profit. Additionally, if your losses exceed your gains, you can often carry forward the excess losses to future years to reduce taxes on future profits.

This method is especially useful for traders who are active in the market and make frequent trades. However, it requires careful record-keeping and planning, as tax-loss harvesting only works if you properly document all your transactions and losses. It’s also essential to follow any rules around wash sales, which could invalidate the loss deduction if you repurchase the asset within a short period after selling it.

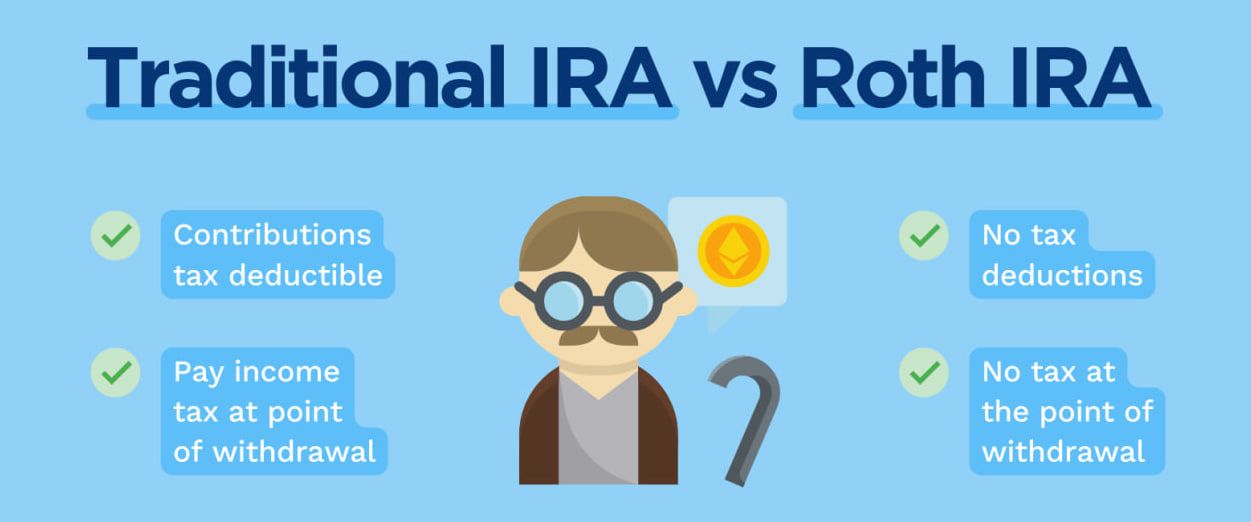

3.3. Use a Crypto IRA (Individual Retirement Account)

For crypto investors who are serious about long-term wealth building, investing through a retirement account can be a smart answer for the question how to avoid taxes on crypto. In the U.S., for example, self-directed IRAs allow individuals to invest in a variety of assets, including cryptocurrency. By placing your crypto investments inside a tax-advantaged retirement account, you can defer taxes on any gains until you withdraw the funds in retirement.

There are two types of tax-advantaged retirement accounts to consider: Traditional IRAs and Roth IRAs. With a Traditional IRA, you don’t pay taxes on your crypto gains until you withdraw the funds in retirement, at which point the withdrawals are taxed as ordinary income. With a Roth IRA, on the other hand, you pay taxes upfront when contributing to the account, but your gains grow tax-free, and you won’t owe any taxes on withdrawals during retirement.

For those looking to reduce their tax liability over the long term, crypto IRAs offer a powerful way to build wealth while legally avoiding taxes on crypto gains. However, these accounts come with limitations on contributions, and early withdrawals can result in penalties, so it’s important to fully understand the rules before committing to this strategy.

3.4. Gifting Your Cryptocurrency

One effective method for those wondering how to avoid taxes on crypto is by gifting them. In some countries, the tax system allows individuals to give away a certain amount of assets, including cryptocurrency, to family members or friends without triggering a tax event. In the U.S., for example, you can gift up to $16,000 per person annually without incurring any gift tax.

This strategy can be especially useful for individuals looking to transfer wealth to their children or other relatives. By gifting crypto assets instead of selling them, you can avoid paying capital gains taxes on the appreciation of the assets.

It’s important to note that the recipient of the gift would inherit the original cost basis of the asset, meaning they would be responsible for paying capital gains tax if they sell the asset in the future. Because the gift tax threshold and rules vary by country, so be sure to check the regulations in your specific region to ensure that your gift falls within the allowable limits.

3.5. Move to a Crypto-Friendly Tax Jurisdiction

This strategy is well-suited for those who seeking how to avoid taxes on crypto and have significant holdings or the flexibility to relocate. Several countries have established themselves as crypto havens, offering tax exemptions or favorable treatment for cryptocurrency gains. Portugal, for instance, has become popular among crypto investors because it doesn’t tax individuals on crypto gains. Similarly, the United Arab Emirates, Malta, and Germany also offer tax-friendly policies for crypto traders and investors.

But keep in mind that relocating is a big decision that requires careful planning. You’ll need to consider not just the tax laws but also the cost of living, the ability to establish residency, and other lifestyle factors. Additionally, depending on your home country, you may still be subject to taxes on worldwide income even after you’ve relocated, so it’s essential to work with a tax advisor to understand the full implications.

3.6. Donate to Charities

For those looking to understand how to avoid taxes on crypto legally, donating to registered charities can be highly beneficial. It offers a dual advantage: supporting a good cause and reducing your tax burden. In many countries, U.S. for example, charitable donations are tax-deductible, meaning you can lower your taxable income by the value of the crypto you donate.

This strategy can be especially beneficial for individuals with substantial crypto holdings who want to give back to the community while lowering their taxes. However, to claim the deduction, it’s crucial to donate to a qualified charitable organization and ensure that the proper paperwork is filed with your tax return.

3.7. Use Stablecoins to Avoid Taxable Events

Stablecoins like USDT or FDUSD are pegged to traditional fiat currencies like the U.S. dollar, offer a way to preserve your crypto holdings without triggering a taxable event. Unlike cryptocurrencies which often have more volatile, stablecoins maintain a relatively consistent value, making them a useful tool for avoiding taxable events while keeping your assets liquid.

By converting your cryptocurrency into stablecoins rather than selling for fiat currency, you can defer taxes until you actually need to cash out. This approach is beneficial for investors looking for ways on how to avoid taxes on crypto while minimize portfolio volatility.

Conclusion

In summary, knowing how to avoid taxes on crypto requires careful planning, a solid understanding of your local tax laws, and a proactive approach to exploring legal strategies. By applying the methods discussed in this article, investors can significantly reduce their tax burden and retain more of their hard-earned profits.

Stay tuned with FMCPAY for more crypto insights and tips on optimizing your investments and staying ahead in the evolving financial landscape.