Thus far this month, the Japanese investment group has acquired almost 200 Bitcoin.

After making another Bitcoin acquisition, the Japanese investment business Metaplanet saw a 10% increase in its shares and increased its holdings to about 640 Bitcoin.

Oct. 7 saw the announcement of Metaplanet’s most recent acquisition of Bitcoin (BTC), with the Tokyo-listed company acquiring an additional 108.78 BTC, or around $6.92 million at the current price of nearly $63,600.

After purchasing 107.91 BTC on October 1, Metaplanet, also known as “Asia’s MicroStrategy” after the American corporation that buys bitcoin, has been buying bitcoin rapidly. almost the course of the last week, Metaplanet has acquired almost 215 BTC.

According to its most recent report from October 7, its assets currently amount to 639.5 BTC, or almost $40.5 million.

*Metaplanet purchases additional 108.78 $BTC* pic.twitter.com/Pz2AHupm1T

— Metaplanet Inc. (@Metaplanet_JP) October 7, 2024

According to Google Finance, the share price of Metaplanet increased by more than 11% during trading on October 7 to reach an intraday high of 1,047 Japanese yen, or about $7.

In May 2024, Metaplanet started utilizing Bitcoin as a strategic treasury reserve asset. Since then, the price of its shares has increased by almost three times and by more than 532% since the start of the year.

The company used a tactic involving the sale of put options last week, on October 3, to earn an extra 23.97 BTC, or around $1.46 million at the time.

223 Bitcoin put options contracts maturing on December 27, 2024, with a $62,000 strike price were sold by Metaplanet.

Bitcoin put options are derivatives contracts in the cryptocurrency space that grant the buyer the right, but not the responsibility, to sell at the strike price on or before a certain date at a fixed price.

At the time, Simon Gerovich, CEO of Metaplanet, stated that this approach offered a means of growing its Bitcoin reserves without taking on additional financial risk. He continued by saying that the company uses options methods on a percentage of its assets in an effort to produce income.

Gerovich stated in early September that it will be collaborating with SBI Holdings’ cryptocurrency business to improve its capacity for managing, storing, and trading cryptocurrency. One of the biggest integrated financial organizations in Japan is the Strategic Business Innovator Group.

ZachXBT accuses crypto influencer Ansem of promoting memecoin ‘pump and dumps’

ZachXBT, a cryptocurrency expert, accused Ansem of pushing “hundreds” of low market cap memecoins to his followers, a move he said might have a disproportionate impact on their value.

Blockchain investigator Online user Zachary Wolk, also known as ZachXBT, has attacked cryptocurrency influencer Zion “Ansem” Thomas, claiming that he has enabled a number of memecoin “pump and dumps.”

Thomas and Wolk engaged in a contentious discussion on X on October 5th, during which Wolk claimed that Thomas had played a part in pushing a large quantity of “low cap” Solana memecoins.

Wolk initially brought up Thomas last month when talking about memecoin bull Murad Mahmudov’s “Memecoin Supercycle” speech at Token 2049. Wolk accused Mahmudov of pushing currencies to his fans rather than having a real “edge” in the market.

In March 2020, while the market was collapsing, Mahmudov was the chief information officer of Adaptive Capital, a cryptocurrency hedge fund. Since then, he has amassed a sizable fan base on X by promoting memecoins’ place in the cryptocurrency space and sharing lists of his favorite memecoins.

Wolk asserted that Thomas was also involved in similar practice, saying, “If you resort to promoting new low cap memecoins to followers as a large account it’s [because] you have no edge and have to use your followers instead.”

If you resort to promoting new low cap meme coins every few days to followers as a large account it’s bc you have no edge and have to use your followers instead.

Only thing which changed this cycle is grifting as large accounts became even more normalized than before (EX:…

— ZachXBT (@zachxbt) October 5, 2024

Thomas questioned Wolk about the notion that “talking about lowcaps,” or memecoins with a low market capitalization, constituted “grifting.”

With over 507,000 X followers, Wolk asserted that Thomas had an excessive ability to influence tokens with lower valuations, which he suggested might cause many of his followers to lose money on memecoin pushes.

In response, Thomas asserted that it was far “better” for him to call out Dogwifhat (WIF) to his supporters at a $100,000 market cap, which subsequently surged to a peak value of $4.8 billion in March, than it was to support a utility-based token like Chainlink (LINK), which is currently down 90% compared to Bitcoin (BTC) year to date.

In retaliation, Wolk claimed that Thomas had been pushing “hundreds” of low-cap coins, including as ZEUS, WYNN, HOBBES, BODEN, and various celebrity memecoins, such as those belonging to pop singers Davido and Jason Derulo.

If you resort to promoting new low cap meme coins every few days to followers as a large account it’s bc you have no edge and have to use your followers instead.

Only thing which changed this cycle is grifting as large accounts became even more normalized than before (EX:…

— ZachXBT (@zachxbt) October 5, 2024

“The ‘low cap garbage’ you talk about has dominated 90% of retail mindshare in crypto over the past year,” Thomas retorted. “Whether you like it or not that’s what [people] want to trade.”

Memes centered to President Joe Biden, such as BODEN, have dropped over 99% from their peak in April. Similarly, ZEUS, WYNN, and HOBBES have all dropped almost 98% from their peak as well.

Over the past year, memecoins have quickly emerged as one of the most highly contested subjects in cryptocurrency.

Because of their comparatively large returns thus far this cycle, proponents of memecoin argue that fundamentally worthless tokens, such as Dogecoin (DOGE), Pepe (PEPE), and WIF, represent a superior class of assets than utility tokens.

Memecoins, according to critics, are inherently “extractive,” enabling insiders and early investors to benefit handsomely from less experienced retail users before vanishing with the gains.

Notcoin consolidates: Holders eye potential gains up to $145M after breakout

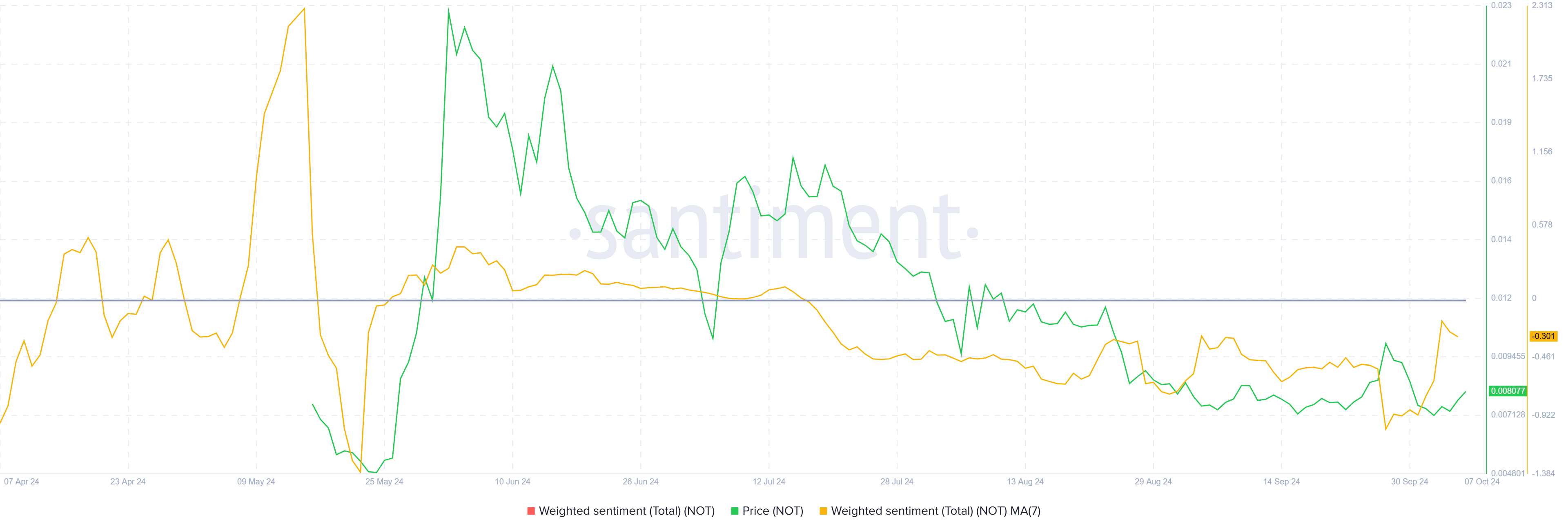

For the most of September, the price of Notcoin (NOT) was consolidating. The Telegram currency soon returned to consolidation even though it momentarily broke over the critical resistance level of $0.0083.

In spite of this, there is hope that a rally may be approaching if certain market circumstances come together.

Notcoin investors await gains

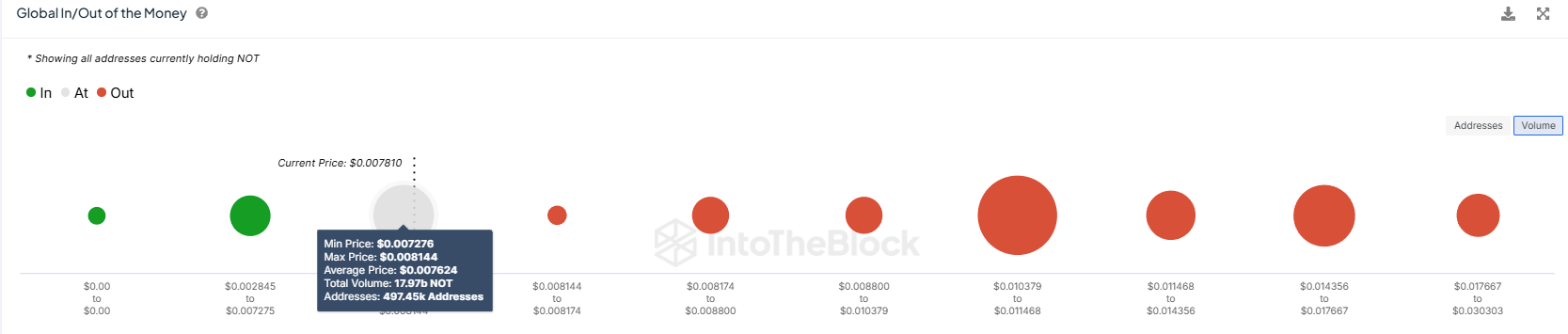

The Global In/Out of the Money (GIOM) indicator shows that investors bought almost 17.97 billion NOT, or over $145 million, between $0.0081 and $0.0072 in price range. The need to make these investments viable might drive up the price of these tokens, which make up a sizeable amount of the market supply. It is probable that investors who made their purchases in this area are waiting for a breakout over the $0.0083 barrier in order to start receiving returns on their capital.

Because so many tokens have been bought, there will probably be more purchasing pressure and a greater probability of breaking over the barrier. Notcoin may see an uptick after this, maybe pushing it closer to a trading range that is more rewarding for these investors.

This can be a positive scenario, but the general mood of the Notcoin market is still negative. Some investors’ rising pessimism as a result of the prolonged consolidation phase may offset the upward pressure brought on by the accumulation of 17.97 billion NOT. Because there hasn’t been much of a price movement, traders are hesitant because they are concerned about the token’s prospects. This might lead to further muted price activity.

Should the negative outlook persist, Notcoin’s value may be stuck below the $0.0083 barrier level. Long-term consolidation may deter purchasers from joining the market, which would restrict the possibility for short-term rising momentum.

NOT price prediction: Attempting a breach

Notcoin (NOT) is trading at $0.0080 as of this writing, trapped in a narrow range between $0.0083 and $0.0070. Price may move above $0.0094 if there is a breakout over the resistance level at $0.0083, which would indicate the beginning of a rally.

Yet, the conflicting signals coming from bearish and optimistic elements imply that consolidation may go on for some time. Profits from the previously indicated 17.97 billion NOT supply might still be made as long as the price remains over the upper bound of the cumulative range, which is $0.0081.

Notcoin might see a 17% price gain and reach $0.0094 if it is able to break past the obstacle. A rise like that might disprove the bearish-neutral forecast and pave the way for more advances.