A trader who signed a fraudulent permission transaction lost more than $1.28 million in cryptocurrency.

A cryptocurrency investor lost 108 billion PEPE, 73.8 million APU, and 165,000 MSTR tokens on October 14, according to blockchain security startup PeckShieldAlert, after being duped into completing a phishing permission signature transaction.

#PeckShieldAlert The address 0xb0b8…40c7 has been drained of ~$1.28M worth of cryptos, including 108B $PEPE, 73.8M $APU, and 165K $MSTR, after signing a #phishing permit signature.

The #phishing address #Fake_Phishing442846 is linked to the scammers who drained $32M worth of… pic.twitter.com/fq3a4DD0tD— PeckShieldAlert (@PeckShieldAlert) October 14, 2024

This type of phishing assault, known as approval phishing, gives the attacker access to the victim’s wallet and enables con artists to spend all of the funds that are kept there.

In one instance, the victim’s wallet, denoted by “0xb0b..40c7,” lost over $1.2 million in cryptocurrency over the course of six transactions in a matter of minutes. The attackers’ various addresses ended up holding the stolen funds.

Two weeks prior, one of the addresses—designated as “Fake_Phishing442846″—was implicated in another assault in which the wallet that was impacted lost almost $32 million in spWETH tokens as a result of signing a comparable fraudulent transaction.

Inferno Drainer, a multi-chain cryptocurrency fraud service provider, was used to carry out the assault, according to a report at the time by blockchain intelligence firm Arkham. Therefore, it’s likely that the perpetrators of the most recent assault likewise used the fraudulent tools.

For those who do not know, Inferno Drainer is a phishing-as-a-service tool that is available for subscription that enables criminals to build harmful websites and applications in order to fool people into giving up control of their wallets. The developers bill con artists 30% for creating phishing websites and an additional 20% for each assault that is successful.

According to Dune analytics data, Inferno Drainer has so far targeted a number of cryptocurrency-related enterprises and has successfully stolen $237,775,036 from over 200,000 victims. The service’s developers said on November 26, 2023, that it will be discontinued permanently. But in May 2024, the toolkit reappeared due to fresh demand from its “customers.”

**BREAKING**

🚩Inferno Drainer is BACK IN BUSINESS🚩🙃

This isn’t good news, in case you are somehow unaware…

(yes, I know they never really shut down all the way, so I know a lot of you aren’t going to be surprised about this at all) pic.twitter.com/zbWCkXquTd

— Plum (@Plumferno) May 20, 2024

In the world of cryptocurrencies, phishing attacks are becoming a more serious concern, and one of the main causes of victims’ losses is the acceptance of such assaults. A research released in August by Chainalysis claims that since 2021, these assaults have embezzled more than $2.7 billion.

After signing a questionable permission signature, a wallet purportedly associated with a venture capital fund lost more than $35 million worth of fwDETH tokens last week.

The blockchain security company CertiK identified phishing as the most harmful attack vector for the quarter in its Q3 report. Over 65 instances resulted in losses of $343.1 million.

Crypto trader loses $2.53M in panic selling: What went wrong?

A trader lost $2.53 million in a sad crypto trading event when the price of REEF token fell by 71% in a matter of hours.

Numerous factors might lead to success or failure in cryptocurrency trading. One such element that has the power to create or destroy a token is investor mood in the market. The REEF token saw a sharp decline in value in a matter of hours, leading to the collapse of both the token and the holders’ investments. This particular cryptocurrency trader lost $2.53 million in panic sales, making him one of the crash’s largest casualties.

What went wrong with this $2.53M crypto trading loss?

After selling 866 million REEF tokens in a panic, a trader with three cryptocurrency wallets, addresses 0x76e, 0xc49, and 0xfcc, lost $2.54 million in total. This occurrence was published by the well-known analytics firm Spotonchain on their X, showing how a sharp decline in price caused one cryptocurrency trader to lose millions of dollars.

The page disclosed that the three cryptocurrency wallets were financed by a single wallet, each of which had 0.1 Ethereum. This trader withdrew 955.549M REEF, or $5.06M, from Gate.io between September 23 and October 12, 2024, which sparked the big loss episode. After the value of these tokens fell by more than 71.8% in just 27 hours, he sold them for $0.002, having purchased them at an average price of $0.005.

The $REEF price further plunged by 58% today, wiping out a month’s worth of gains in just over a day!

Three wallets (one entity) appear to have panic-sold 866M $REEF ($2.07M) to #HTX, #KuCoin, and #Gateio in the past 2 hours, allegedly losing $2.53M (-55%).

Currently, they hold… pic.twitter.com/KWtgfgiwtu

— Spot On Chain (@spotonchain) October 16, 2024

Nevertheless, the cryptocurrency trader lost $2.53 million when he sold just 866 million tokens ($2.07 million) on three well-known exchanges: HTX, KuCoin, and Geteio. More significantly, he continues to retain 89.45 million tokens ($204K), which represents another $270k unrealized loss for him.

The trader has lost $2.8M on this cryptocurrency trading experience, including the unrealized loss.

How is REEF toke performing now?

Despite a 6% decline in the past day, Reef, one of the rather well-known cryptocurrencies, is ranked 570th with a market value of $48.90 million. In addition, the 24-hour trading volume has decreased by 65% to $128.18M after the price drop. The token is clearly still having trouble on the charts, as seen by the large decline in these two. It is presently worth $0.00214, down 8% today and 65% this week. This means that the trader’s remaining 89.45 million token stake is only worth $191,000.

But such significant losses are not unprecedented for this token, which has already had difficulty rebounding from a sharp decline at the start of its existence. The price of REEF peaked in mid-March 2021 at $0.05841, then it fell by $0.01254 in July. But that’s not all—the token crashed once again by the end of the year, despite many attempts to reach a new high peak. Since then, there have been intermittent little recoveries interspersed with a persistent downward trend.

Key lesson from this costly crypto trading mistake

Although there are many possibilities to earn from cryptocurrency trading, the market is quite volatile and may change drastically in a matter of minutes. It is possible to go from a loser to a winner and vice versa, therefore it is important to have a thorough understanding of the market and use safe trading techniques. The experience of one cryptocurrency trader, who lost millions in a matter of hours while the price of the REEF token fell by 71%, makes this more evident. More significantly, the trader sold his stake in a panic, which is not usually the wisest course of action, out of fear of suffering more losses. In any case, there aren’t always such severe losses since a trader quadrupled his investment in a different token over this period of time during another cryptocurrency trading event. It makes evident how gains and losses may coexist in this cryptocurrency market.

Dogecoin (DOGE) price could correct by 30% if market loses steam

The price of Dogecoin (DOGE) is rising, rising over 10% in a single day. Additionally, average transaction sizes have gone up, indicating a possible rise in activity from larger market players. This fresh attention may indicate the beginnings of a bullish trend.

Although technical signs are pointing to a promising future, it is yet unclear how strong the trend will be. DOGE might rise more if the current trend continues, but there is also a chance of a pullback.

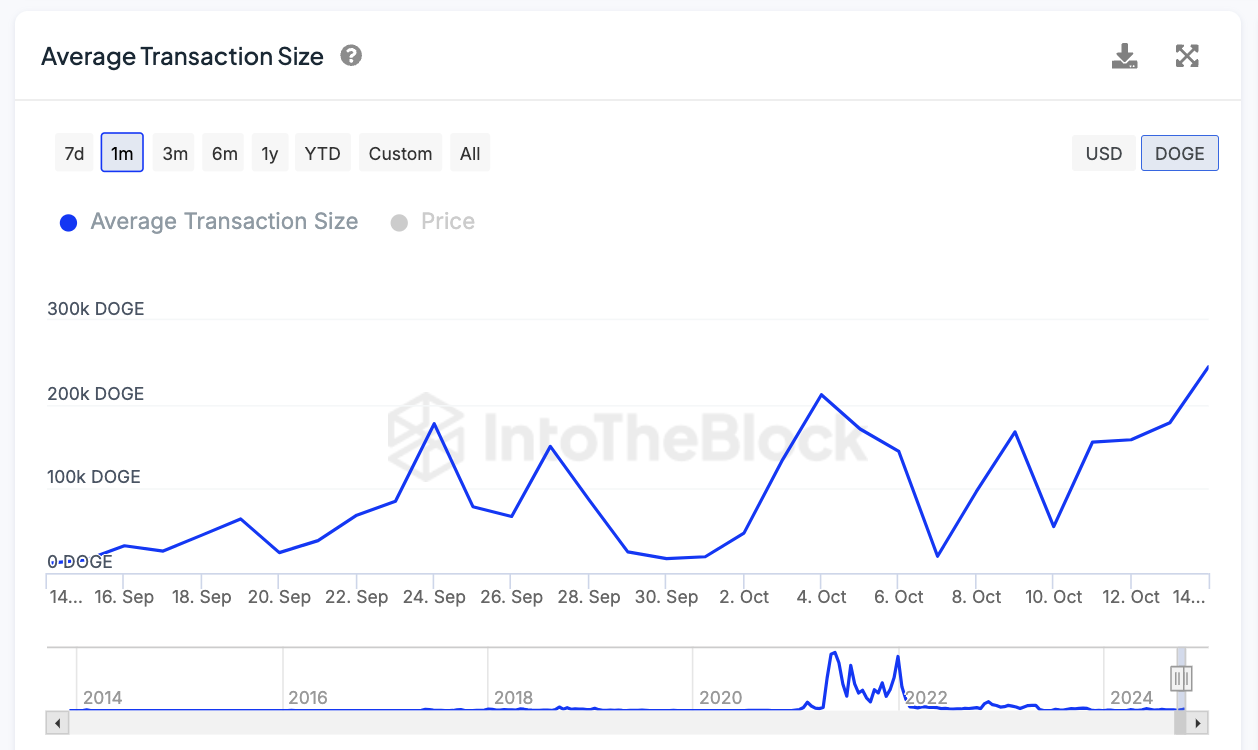

DOGE average transaction size is on the rise

The average transaction size of Dogecoin (DOGE) has increased significantly over the last few days, going from 55,000 on October 10 to 244,000 on October 14. This spike suggests that there may be an increase in demand from larger participants in the market for higher-value DOGE transactions.

A notable increase in transaction size is sometimes an indication of increased activity by whales or institutional investors, which can affect liquidity and eventually influence price movements.

Because it indicates the general level of interest and confidence among market players, the average transaction size is a crucial indicator. An rise in the frequency of larger transactions may indicate greater interest and capital flow, both of which are frequently associated with price increases.

If DOGE’s average transaction size keeps rising or stays over the 200,000 level, the market may be about to heat up even more. Large transactions are increasing, which might lead to greater positive momentum and higher DOGE prices as traders become more optimistic and take note of the rising activity.

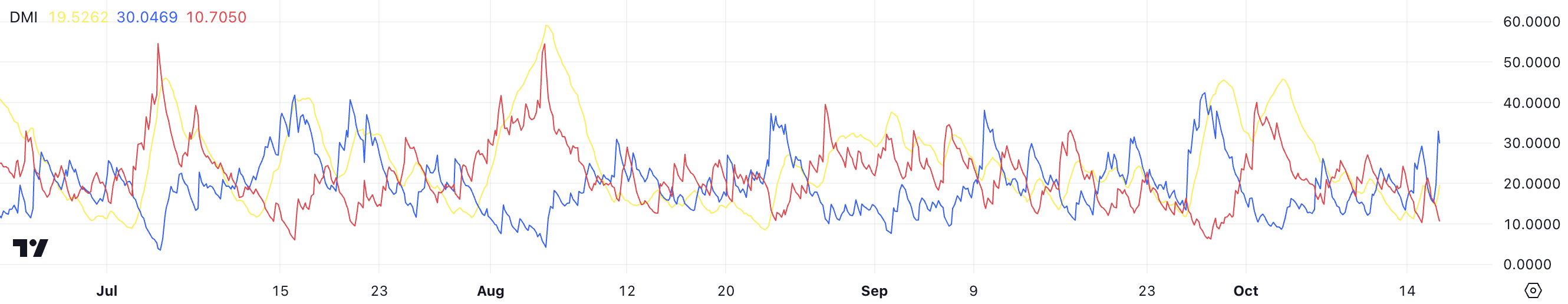

Dogecoin DMI shows a bittersweet signal

The Directional Movement Index (DMI) chart shows that DOGE is presently in an uptrend. The trend strength indicator, the ADX line, is at 19.57. This number shows that even while DOGE is rising, the trend is only moderately strong.

An ADX value below 20 usually indicates that the momentum is not as strong as it is now, indicating that the market’s fervor could not be enough to support a sustained surge.

The ADX line (yellow), the D+ line (blue), and the D- line (red) are the lines that make up the DMI chart. The D-line, at 10.70, denotes selling pressure, while the D+ line, at 30.04, shows positive purchasing pressure. The substantial disparity between D+ and D- indicates a strong purchasing pressure, which has supported the current price increase of DOGE.

But even with this purchasing pressure and a price gain of about 10% in the past day, the comparatively low ADX indicates that the uptrend could not be that robust. Should the ADX reading be greater, the present uptrend could not have the required impetus to develop into a long-term bullish rally.

DOGE price prediction can it go through a 30% correction next?

The exponential moving average (EMA) lines for Dogecoin (DOGE) are now arranged in a bullish manner, with the short-term EMAs sitting above the long-term EMAs. Positive momentum is indicated by this alignment, which implies that the upswing may continue and that recent price movement has been beneficial.

The short-term and long-term EMAs are not very far apart, though, suggesting that even if the trend is positive right now, it is still rather weak and might turn around if buying pressure declines.

Compared to basic moving averages, exponential moving averages (EMA) are more sensitive to short-term price fluctuations because they place greater weight on recent price data. When shorter-term EMAs cross above longer-term EMAs, it is considered a positive indicator. Traders frequently utilize EMAs to pinpoint possible entry and exit positions.

The price of DOGE may go further and test the resistance levels at $0.138 and $0.143 if the uptrend keeps going strong. However, the largest meme currency on the market can have a correction if purchasing enthusiasm wanes and the trend weakens. It might drop to support levels around $0.10 or even $0.088, which would be a 30% reduction.