As more Bitcoins are being purchased by Asia’s MicroStrategy Metaplanet, the price of BTC is demonstrating strength and breaking over critical resistance at $65,000.

In October of this year, Asia’s MicroStrategy, Metaplanet, went on a big Bitcoin purchasing binge, adding over 300 Bitcoins to its holdings in the last 15 days. As a result, the company’s October BTC holdings increased by 60%. Tuesday saw the Japanese publicly traded company buy an additional 106.976 Bitcoin for an investment of 1 billion Japanese yen, as the price of the cryptocurrency surged sharply to $66,000.

Metaplanet on a Bitcoin acquisition spree

*Metaplanet purchases additional 106.97 $BTC* pic.twitter.com/o8QOiQc5NL

— Metaplanet Inc. (@Metaplanet_JP) October 15, 2024

This news caused the price of Metaplanet’s shares to soar by 15.71%, reaching 1,105 JPY during Tuesday’s trading session. Since the Japanese company has taken a cue from Microstrategy’s Bitcoin playbook, its stock price may rise in line with MSTR’s.

Moreover, Metaplanet can be used by Asian cryptocurrency investors as a stand-in for Bitcoin investments. The company’s stock price has increased by more than 300% since it started using the Bitcoin method in May 2024.

BTC price gears for a parrabolic rally

The price of Bitcoin (BTC) has been rising bullishly, breaking above $65,000, which is a significant barrier level. At $65,500, the price of Bitcoin is up 2.18% as of the time of publication. The price of Bitcoin has fluctuated significantly over the last two weeks, ranging from $58,000 to $65,000.

A significant pattern in the price movements of Bitcoin has been brought to light by cryptocurrency expert Ali Martinez. He has observed that the previous three times that Bitcoin has broken above its 200-day moving average, it has resulted in parabolic bull runs. He so highlights the fact that Bitcoin is attempting to cross this crucial level once more, igniting speculation about a possible rally. Martinez pointed out that a new all-time high of $78,000 may be Bitcoin’s next destination. This may be further fueled by Metaplanet’s recent acquisitions.

drop to $60,000, 🎯

rebound to $66,000, 🎯

retrace to $57,000, 🎯$78,000 next! https://t.co/HwoRrlM0D2

— Ali (@ali_charts) October 14, 2024

There is a lot of hope in the area after Democratic presidential candidate Kamala Harris promised on Monday to support a regulatory framework for digital assets. Aiming to provide Black communities with wealth-building possibilities, this suggestion is made just weeks before the much awaited U.S. elections of 2024. Her group composed:

“She will make sure owners of and investors in digital assets benefit from a regulatory framework so that Black men and others who participate in this market are protected”.

Tron (TRX) price tests resistance zones as momentum shifts

The price of Tron (TRX) is now showing indications of bullish momentum, however it is currently declining as the prices of all the other major cryptocurrencies are rising.

Although a number of indications indicate a positive outlook, there are also signals indicating a significant potential turning point for TRX.

TRX Ichimoku Cloud shows a bullish momentum

The TRX price’s Ichimoku Cloud chart shows a largely positive picture. As of right now, the price of TRX is still above the Kumo (cloud), which is usually a sign of optimism. If a retracement were to happen, the cloud’s modest thickness suggests that there would be a solid level of support below the present price.

Furthermore, a bullish cloud is formed ahead by the green Senkou Span A, which is above the red Senkou Span B, supporting the expectation for additional increases. The Kijun-sen (red line), which is located below the present price and provides support, suggests a stop in momentum due to its flat trajectory.

The Tenkan-sen (blue line), on the other hand, closely tracks price movement and continues to indicate a strong short-term momentum picture; but, if it breaks below the Kijun-sen, a possible negative signal may emerge.

The fact that the green trailing line, or Chikou Span, is above the 26-period price level indicates that positive momentum is supporting the present trend for TRX. But when the Chikou Span gets closer to the present price level, it indicates that the bullish momentum that has been building may run into difficulties and may go into a consolidation phase.

Although the general outlook for TRX is still favorable, the asset looks to be at a turning point where any gains will need to come from either a breach over resistance or solid support.

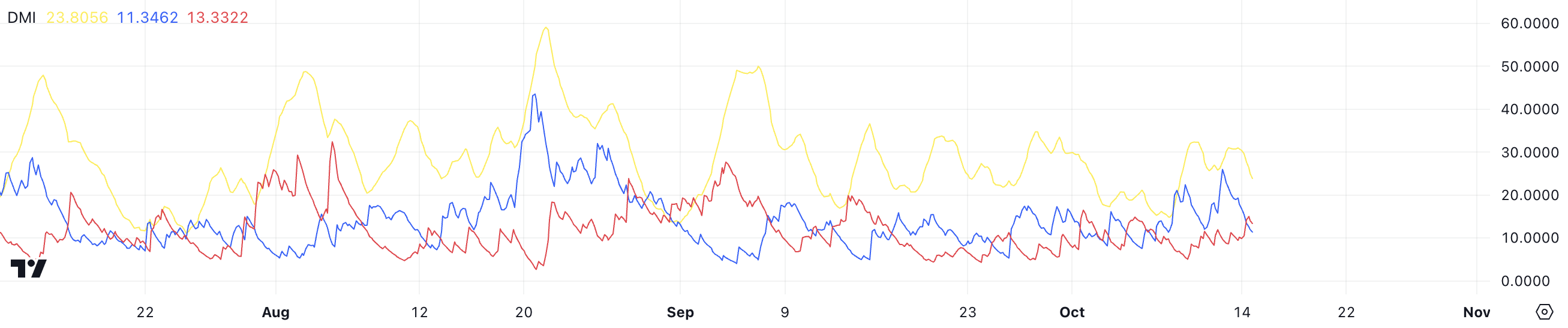

DMI suggests moderate trend strength

Tron (TRX)‘s Directional Movement Index (DMI) offers important information about the strength of the current trend. The Average Directional Index (ADX), shown by the yellow line, is presently at 23.8, indicating a moderate but not very strong trend strength.

At 11.3 points, the blue line (+DI), which gauges the strength of upward price moves, shows comparatively little purchasing pressure. The red line (-DI), which gauges the strength of negative price movements, is somewhat higher at 13.3, indicating that, for the time being at least, selling pressure is more than purchasing pressure, but not by much.

The trend strength of TRX has varied, as seen by the ADX, which has seen significant volatility in recent months. There have been times of high volatility followed by periods of lower volatility. The +DI and -DI lines’ present positions below 20 suggest that neither bulls nor bears have much momentum, suggesting a range-bound or consolidating phase.

The +DI would need to cross above the -DI and the ADX value would need to rise above 25 to indicate a stronger trend for TRX to resume a more definite upward trajectory. Overall, the DMI indicates that although the general mood is a little negative, a change in direction is possible, provided that purchasing pressure picks up and the trend strength strengthens.

TRX price prediction: potential trend reversal in play

The short-term EMAs are now above the long-term EMAs in TRX’s EMA lines, indicating a bullish signal. Usually, this configuration suggests strong momentum and an extension of the upward trend.

The short-term EMA lines, however, are beginning to slant lower. This can point to a possible reversal of the present trend. Should this negative trend persist, it may signify a waning of purchasing demand and a shift in TRX’s outlook toward something more pessimistic.

Compared to Simple Moving Averages (SMAs), Exponential Moving Averages (EMAs) are a sort of moving average that place greater weight on recent data, making them more sensitive to the most recent price moves. Long-term EMA lines offer a more comprehensive picture of the general trend, whereas short-term EMA lines just show current price action.

Australia’s first ETF directly holding Ether goes live

The issuer launched a spot Bitcoin ETF in June, and on October 15, the Monochrome Ethereum ETF (IETH) became live on Cboe Australia.

With $176,600 in assets under management, Monochrome Asset Management has introduced Australia’s first exchange-traded fund (ETF) that holds Ether directly.

The Sydney-based stock market Cboe Australia launched the Monochrome Ethereum ETF (IETH) on October 15; at 2:00 pm local time, the fund’s total net assets had increased to $176,600 (262,500 Australian dollars).

The fund is the only dual-access spot Ether ETF in Australia, with a 0.50% management fee. It also allows for in-kind applications and redemptions, with transactions in cash or Ethereum (ETH).

The cryptocurrency custodians for the ETF are BitGo and Gemini, while State Street Australia is the fund administrator.

Introducing the Monochrome Ethereum ETF (Ticker: IETH).

IETH is Australia’s first ETF that provides direct access to Ethereum with an in-kind subscription and redemption facility.$IETH begins trading today, under the ticker ‘IETH’.

Full announcement 🔽https://t.co/dv0Ggiltc3 pic.twitter.com/NAbZ6yoKaO

— Monochrome (@MonochromeAsset) October 14, 2024

The company’s Monochrome Bitcoin ETF (IBTC), which debuted in June and has garnered about $10.7 million (16 million Australian dollars), was launched before IETH.

The largest increase for Monochrome Asset Management’s Bitcoin ETF, according to CEO Jeff Yew, came from investors transferring their cryptocurrency from exchanges into the fund last month, as reported.

“Now more and more crypto that had been previously held on exchanges is now being funneled into a regular structure like an ETF,” he said at the time.

Yew was confident that spot crypto ETFs would perform well in the Australian market because it is “on a very different trajectory with ETFs […] with a bigger pie to carve out,” he said.

VanEck introduced the first Bitcoin exchange-traded fund (ETF) in Australia in June, and as of right now, it has about $35 million in net assets (52 million Australian dollars).

With 11 spot Bitcoin funds trading in the US and a total of $19.3 billion in assets under management so far this year, the US leads the world in cryptocurrency exchange-traded funds.

Based on early statistics from Farside Investors, Oct. 14 is expected to be a record day for inflows into the ETFs, with a combined net inflow of $556 million into the funds.