Ethereum and Bitcoin options worth $5.26 billion expire today, therefore traders and investors in the cryptocurrency market can expect turbulence.

In particular, the notional value of Bitcoin (BTC) options that are about to expire is $4.25 billion, whilst Ethereum (ETH) options are at $1.01 billion. Markets are now waiting to see how the expiration of such large contracts will affect them.

What $5B Bitcoin, Ethereum options expiry means

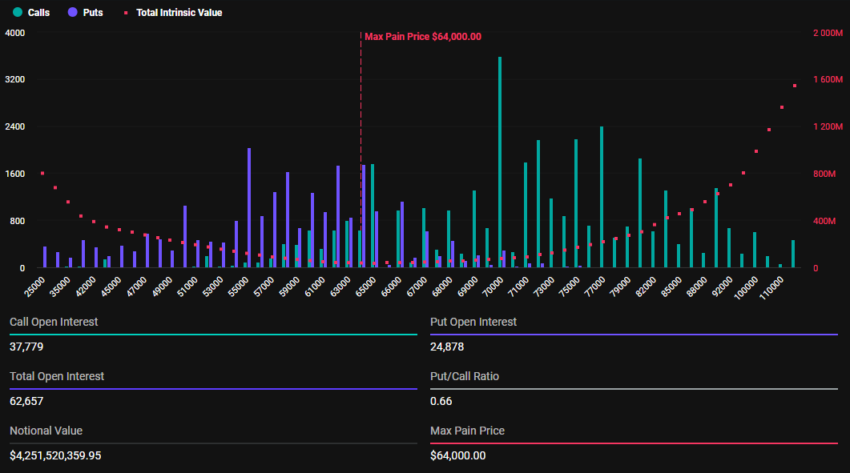

Deribit data indicates that 62,657 Bitcoin options contracts with a put-to-call ratio of 0.66 and a maximum pain point of $64,000 will expire on October 25.

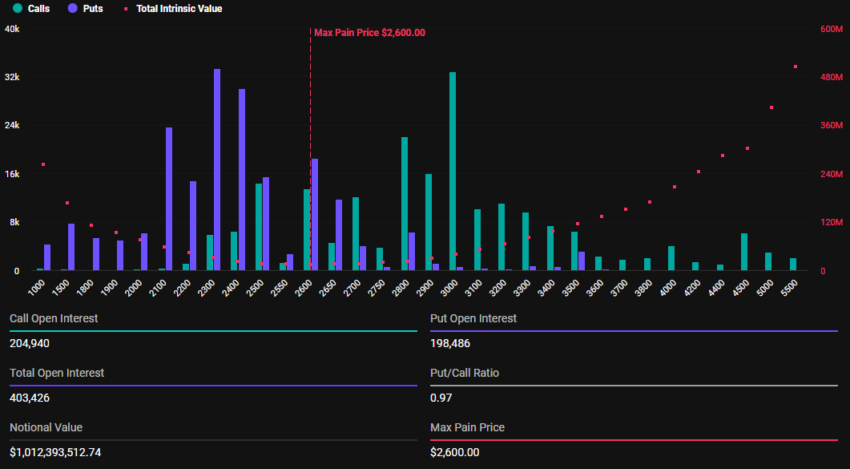

At the same moment, 403,426 contracts on Ethereum’s options market are scheduled to expire. The put-to-call ratio for Ethereum contracts that are expiring today is 0.97, and the maximum pain point is $2,600.

In options trading, the put-to-call ratio is a crucial mood indicator. The volume of put and call options exchanged is contrasted. More investors are anticipating market gains when this score is below 1, which often indicates positive sentiment. Conversely, a ratio greater than one frequently indicates pessimism and worries about a market downturn.

As of this writing, Ethereum is trading at $2,490, while Bitcoin is trading at $67,962, according to data. This indicates that Ethereum is trading below its maximum paint point while Bitcoin is trading above it.

Price implication based on Max Point theory

Given that the price of Bitcoin is now over its maximum pain threshold, options contract holders would typically experience losses if the options expired at the current level. Ethereum, on the other hand, is below its strike price, which is advantageous for option holders. The Max Pain hypothesis underpins this, stating that the pricing of options will tend to converge around the strike prices at which the greatest amount of contracts, both puts and calls, expire worthless.

Consequently, it implies that the values of Bitcoin and Ethereum are likely to approach their respective maximum pain points as the options contracts approach expiration. This implies that in a premeditated move by smart money, the value of Bitcoin may decrease while the price of Ethereum may increase. However, after 8:00 UTC on Friday, when Deribit settles the contracts, the pressure on the values of Bitcoin and Ethereum will lessen.

It’s also important to note that there are a lot more Bitcoin and Ethereum options expiring today than there were earlier in the month. The trade week ending October 4 saw BeInCrypto report $1.4 billion, and the week ending October 11 saw $1.6 billion.

Then, up to $1.62 billion in option contracts expired in the week ending October 18. With a consistent upward trend, the jump to over $5 billion options expiring is noteworthy. A significant shift in implied volatility (IV) is also present ahead of the US elections, according to experts at BloFin Academy.

1. The change in implied volatility first reflects the election’s impact on the expected volatility of the crypto market. Whether it is BTC or ETH options, the implied volatility level of options expiring on Nov 8 has increased significantly and exceeded that of far-month… pic.twitter.com/Rd0R7It2ru

— BloFin Academy (@BloFin_Academy) October 24, 2024

They attribute the shift in IV to the speculative and hedging demands of investors. Additionally, the experts note comparatively greater rises in Bitcoin’s “election day option.” This indicates that Bitcoin is comparatively more susceptible to significant occurrences. However, for the time being, the majority of investors are staying out of the market, which limits the level of volatility that can be anticipated in October.

2. Interestingly, investors seem to believe that there will not be much volatility in the rest of October. As most investors are on the sidelines before the election, the performance of the crypto market is mainly consolidation, which also boosts investors’ confidence in pricing… pic.twitter.com/oogYbqbgoC

— BloFin Academy (@BloFin_Academy) October 24, 2024

The experts also cite the US Federal Reserve’s policy uncertainty as a contributing factor.

Dogecoin creator Billy Markus defends Elon Musk, criticizes media

Co-founder of Dogecoin Billy Markus continues to back Donald Trump’s campaign for the US election while defending Elon Musk against media disinformation.

Co-founder of Dogecoin Billy Markus has spoken his opinions about Elon Musk, supporting the Tesla CEO against what he sees as skewed media portrayals. In a series of tweets, Markus—who goes by the online handle “Shibetoshi Nakamoto”—claimed that Musk is among the most open public people.

Furthermore, Shibetoshi claimed that many people’s perceptions of Elon Musk are influenced by media manipulation. Markus contends that the “Elon Musk bad” narrative has been skewed by individuals with ulterior motives. The Dogecoin enthusiast is continuing to support Donald Trump in the run-up to the 2024 U.S. presidential election, as seen by these remarks.

Elon Musk continues Trump endorsement as Dogecoin creator defends him

Billy Markus, a co-founder of Dogecoin, claimed in a post on X that the public’s opinion of Elon Musk has been misrepresented by the media. According to Markus, people in charge of the media narrative frequently misrepresent Elon and turn his openness against him.

“Yeah, I try to be as literal as possible,” the Tesla CEO replied in response to the DOGE co-founder. Billy Markus, however, reaffirmed his position by responding,

“It makes you an easy target for the spin machine just cuz you give them a lot of content to work with but it feels so lazy and banal of them”