Memecoins are risky – almost all of them are scams. What motivates crypto buyers to continue investing in this reason?

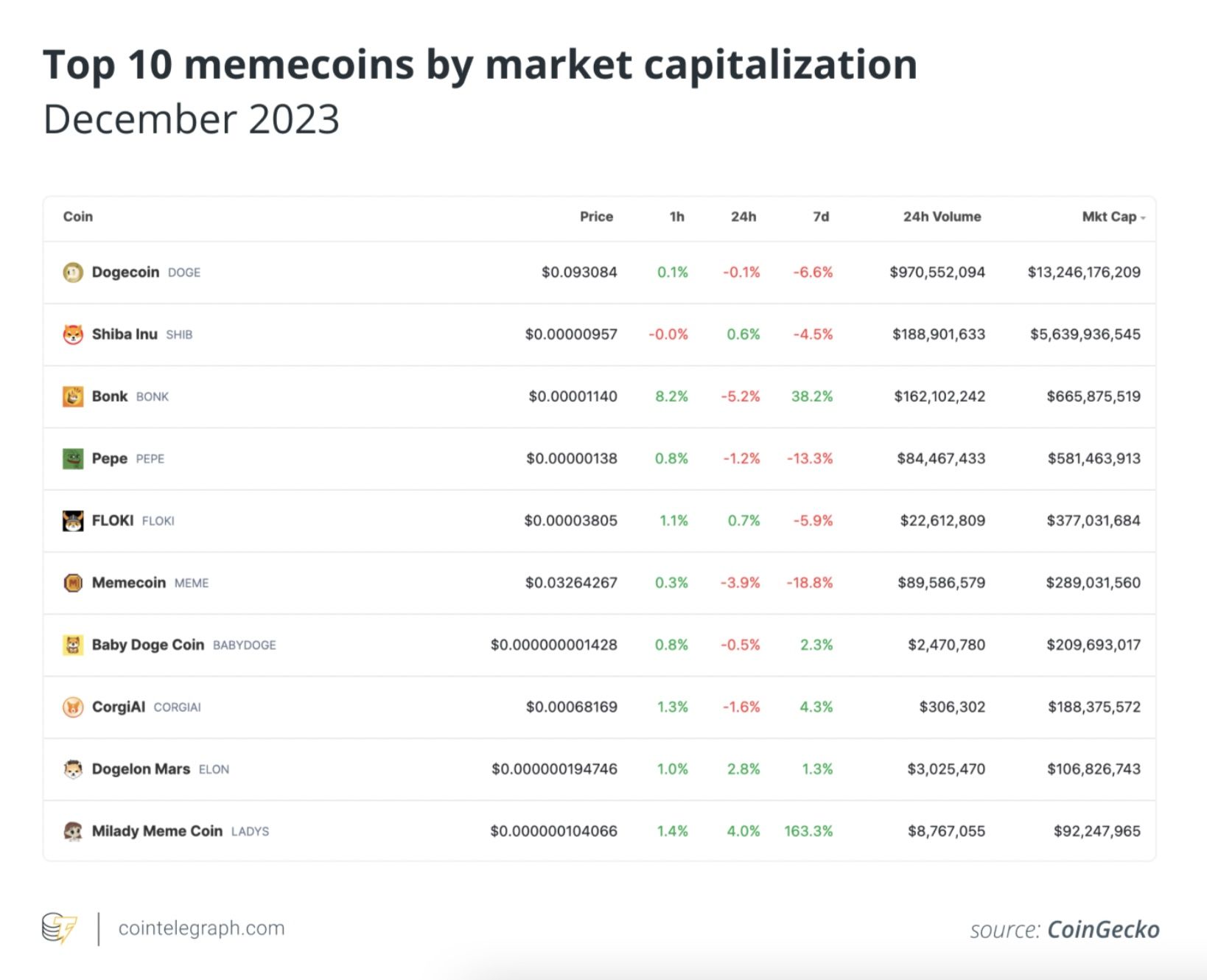

In 2013, Dogecoin was created as a lighthearted crypto token by software developers, initially intended as a private joke. Surprisingly, Dogecoin has grown to have a market capitalization exceeding $13 billion as of December 13. While its enduring popularity is puzzling to many investors, it appears to be a lasting presence. Nevertheless, the broader sector inspired by Dogecoin is seen as a potential threat to the cryptocurrency industry’s necessary evolution.

Read more: What is a meme coin? Which meme coin will explode in 2024?

Memecoins are deemed dangerous for several reasons:

- A significant majority of investors who engage with them end up losing their money.

- Their presence poses a risk to the credibility of the entire cryptocurrency industry. Thirdly, ownership of memecoins is often highly concentrated, contributing to potential market manipulation.

- The proliferation of memecoins raises concerns. As of December 13, there are approximately 1,300 memecoins with a combined market cap of around $22 billion. However, scrutiny of the CoinMarketCap memecoin sector reveals nine listing pages featuring entirely worthless coins.

The prevalence of scams in the memecoin space is attributed to their often fraudulent nature. Created by individuals without proper oversight, these tokens exploit the association of cryptocurrency with social media to quickly defraud investors. Examples include tokens like Squid Games, which saw $3.38 million stolen, or coins launched to coincide with events like the deaths of notable figures. These memecoins engage in rapid pump-and-dump schemes over a short period, resulting in substantial financial losses for investors, with millions of dollars being taken away in the process.

BONK, PEPE and SHIB memecoins

While projects like Shiba Inu (SHIBA), Pepe (PEPE), and Bonk (BONK) may not appear to be outright scams, investors in these coins have still experienced losses. For instance, PEPE witnessed a significant 62% drop in one week in May and has not recovered since. Bonk, on the other hand, entered the Solana ecosystem during a challenging period and has seen a notable pump. However, even seemingly promising projects can be volatile. A notable example is the rise and fall of Bald (BALD) in August, a meme coin built on Coinbase’s Base layer-2 blockchain. BALD quickly reached an $85 million market cap after its Sunday morning launch, but by Monday, the lead developer’s withdrawal of liquidity caused the token’s price to plummet by around 90%. These instances highlight the unpredictable and risky nature of investments in certain meme coins.

Memecoins, beyond being a speculative financial endeavor, lack utility and differ significantly from established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) in both structure and application. Despite this, mainstream media often sensationalizes their volatility, portraying digital assets as mere cynical pranks. In the realm of memecoins, the issue of strong concentration exacerbates concerns. Due to their low individual values, large investors tend to accumulate significant holdings, allowing them to influence the market with a single trade. For example, Ethereum creator Vitalik Buterin’s decision to burn $6.7 billion worth of SHIB removed half of its circulating supply, disrupting market dynamics and prompting questions about potential market manipulation.

In summary, the increasing frequency of memecoin disasters is diminishing their humor, leading to substantial financial losses for many. Despite this, the author argues against an outright ban on memecoins in the crypto space. They acknowledge that users should have the freedom to make their own financial decisions, even if it involves speculative and risky ventures. However, the author emphasizes that memecoins are essentially a form of gambling, not investments, lacking intrinsic value. While they acknowledge the possibility of extraordinary gains, they caution that the majority of participants are likely to experience losses. Ultimately, the author suggests that memecoins should be approached with caution and highlights the negative attention they attract, making the entire cryptocurrency industry look unfavorable.

By Lucas Kiely

Also read: The influence of social media on Memecoin frenzies and price surges