Tokyo-listed Metaplanet has continued its current round of Bitcoin buys, growing its cryptocurrency holdings to more than 1,000 BTC.

After a recent acquisition, Japan’s early-stage investment firm Metaplanet increased its Bitcoin (BTC) holdings to over 1,000 BTC, or around $67.8 million. The business revealed in an X post on Monday, October 28, that it had purchased 156.7 BTC for around 1.6 billion yen ($10.4 million), increasing its overall holdings to 1,018 BTC.

*Metaplanet purchases additional 156.78 $BTC* pic.twitter.com/4zl2LhXvO6

— Metaplanet Inc. (@Metaplanet_JP) October 28, 2024

According to the company, its yield was 41.7% from July 1 to September 30 but jumped to 155.8% from October 1 to October 28. The most recent news caused Metaplanet’s shares to appreciate 7.46% to 1,153 yen, which is a 13.4% increase over the previous month and a 578.2% increase so far this year.

The most recent acquisition was made a few days after Metaplanet, like MicroStrategy, decided to use “BTC Yield” as a key performance indicator to evaluate its approach to acquiring Bitcoin. In an effort to shed light on the company’s Bitcoin strategy, the indicator calculates the percentage increase in Bitcoin holdings over time in relation to the number of fully diluted shares that are outstanding.

Amid Japan’s economic difficulties, notably the fall of the yen, Metaplanet, which earlier this year accepted Bitcoin as a reserve asset, has been boosting its cryptocurrency investments. After the Bank of Japan decided to increase its benchmark interest rate to 0.25% in an attempt to stabilize the yen, the company decided to diversify its reserves into Bitcoin.

US election outcome to shape future of meme coins, experts weigh in

The influence on the meme coin industry is still up for question, despite the fact that most predictions concur that a Donald Trump election will benefit the cryptocurrency market more than a Kamala Harris one.

According to a Columbia Business School professor, if Trump wins the election, meme currencies may see a decline.

How will the election results affect meme coins?

According to Professor Omid Malekan, investors’ dissatisfaction with the unjust tokenomics of venture capitalist-backed businesses is what drives their interest in meme currencies. The Republican Party may loosen regulations if Trump wins, allowing fee swaps and token dividends to profit token owners monetarily. As a result, investors may become less interested in meme currencies.

“Meme coins are simple and people like them because their initial distribution is more fair. But they have little benefit or value. My point is that in a world where coins that have more utility aren’t regulated to death meme coins are less appealing.” – Omid Malekan explained.

To further ingratiate myself with Solana fans, here’s an argument of why a Trump win and/or Republican sweep (which Polymarket has at 50%) is bearish memecoins.

i) Memecoins themselves are a form of economic populism. They are a statement against the unfair ( and often grifty)…

— Omid Malekan 🧙🏽♂️ (@malekanoms) October 27, 2024

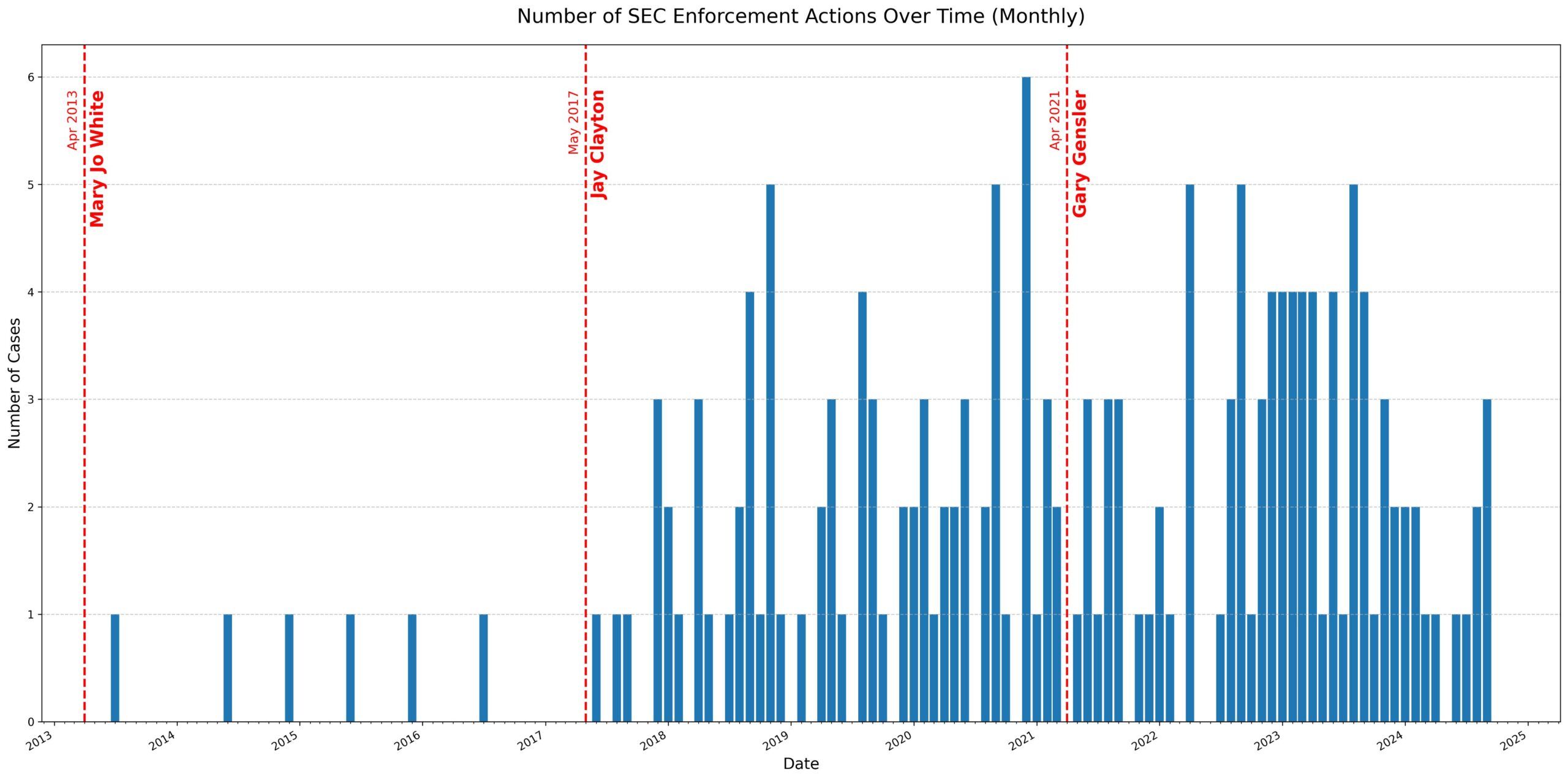

Nic Carter, an investor, concurs with Professor Malekan that the SEC’s restrictive rules are partially to blame for the surge of meme coins. Under Gary Gensler’s direction, Brendan Malone, Head of Policy at Paradigm, has noted an increase in SEC lawsuits.

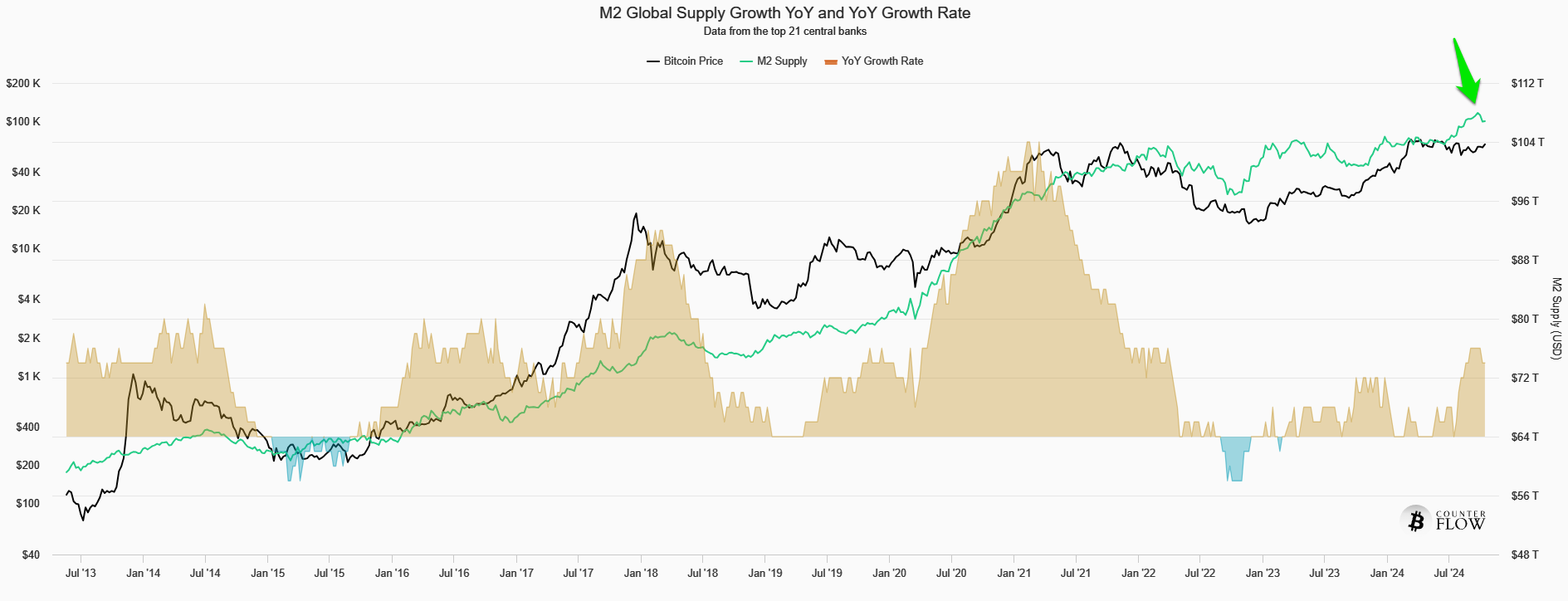

Many industry experts, however, disagree with Malekan. Investor Murad contends that the expansion of the global money supply is what is driving the rise of meme coins, which have nothing to do with politics.

“Meme coin buyers don’t even care about buying things with legit revenues and turned on fee switches either. In fact turning on fee switches accelerates the collapse of the altcoin complex because no one comes to crypto because they want to trade equities. Everyone comes to crypto to find parabolas. As Global Money Supply increases, the importance of Attention will increasingly predominate over Fundamentals and Cashflows. This road only goes one way.” – Murad commented.

Since the start of the year, the global M2 money supply has increased from $104 trillion to over $107.1 trillion. It has the greatest year-over-year growth rate since December 2021, at 7%.

Toly, a co-founder of Solana Labs, disagrees with Malekan as well, presenting an argument that is more based on trading psychology.

“Trading meme coins is entertainment. It’s a Keynesian beauty contest of what people will find the most entertaining. Trading everything else is work. If anything people are gonna want to do less work.” – Toly commented.

The market value of meme coins was above $56 billion at the time of these talks and remained above $50 billion all month long.

As Bitcoin Dominance (BTC.D) rises to almost 59.7%, investors are still interested in Solana and AI meme currencies.

Altcoin news: DOGE, ETH, POL prepare for major rally this week

With DOGE, ETH, and Polygon’s POL aiming for a huge breakout on the technical chart, the altcoin market may start to recover.

Altcoins have recently seen a more severe correction amid the general market instability. Nevertheless, certain sectorial wagers, such as Dogecoin (DOGE), Ethereum (ETH), and Polygon (POL), may be preparing for a significant surge later this week. The technical charts of these three cryptocurrencies have been shown significant strength, which may result in a possible breakout.

DOGE leads the altcoin market

Dogecoin has seen significant increases over the past day, with the price of DOGE rising 4.5% to $0.1443 with a market value of $21.146 billion. As a result, the biggest memecoin in the world has nearly recovered from its decline from the previous week, showing gains of 14.55% on the monthly chart.

The price of Dogecoin is displaying a flag and pole pattern on the charts, according to well-known cryptocurrency expert Ali Martinez. Therefore, a break over $0.1443 might result in a further 25% gain for the meme currency.

If #Dogecoin $DOGE breaks above the $0.143 resistance, we could see a 25% rally up to $0.175! pic.twitter.com/n06ZYKvrCT

— Ali (@ali_charts) October 27, 2024

Elon Musk shared a picture of him from a Trump rally along with a picture of DOGE, which is another factor contributing to today’s spike in Dogecoin’s price. As a result, the altcoin has increased even further. In the past, Musk teased the meme currency and suggested the Department of Government Efficiency (D.O.G.E.) in the Trump administration.

— Elon Musk (@elonmusk) October 28, 2024

Meme coin alternatuves. set for rally – ETH and POL

Additionally, investors should be aware of various meme coin substitutes like as Ethereum (ETH) and Polygon (POL). Due to Ethereum’s dismal performance and the ETH/BTC pair reaching multi-year lows, investors have been losing hope in the cryptocurrency.

The price of Ethereum has plummeted by about 10% in the last week, falling below $2,500. But the door is still open for a rise above $6,000 as long as the price of ETH stays over $2,400.

#Ethereum is testing a key support zone at $2,400. If this level holds, we might see $ETH aiming for the channel’s upper boundary near $6,000! pic.twitter.com/W8J8WVy5CL

— Ali (@ali_charts) October 26, 2024

However, leading market participants have begun to liquidate ETH, indicating a stronger preference for Solana. On-chain data, however, point to ETH’s improvement. Over 300,000 Ethereum (ETH), valued at about $750 million, were taken out of cryptocurrency exchanges in the last week, according to cryptocurrency expert Ali Martinez. This significant movement points to possible changes in investor approach. Significant withdrawals also indicate a tendency for long-term holdings rather than selling off.

According to expert Ali Martinez, Polygon’s POL is another cryptocurrency to keep an eye on this week. Martinez pointed out that with a stop-loss placed at $0.28, the downside for POL appears to be constrained at 15%. He does, however, think that the price of POL has a great chance of rising significantly.

His initial price objective of $0.89 suggests a possible gain of 167%, while a long-term aim of almost $8 may yield a return of 2,387%.

I’m liking #Polygon $POL (formerly $MATIC) at this price. With a stop loss at $0.28, downside risk is 15%, but upside potential?

First target at $0.89 for a 167% gain, and second target around $8 for a 2,387% gain! pic.twitter.com/7PAhztx4h1

— Ali (@ali_charts) October 27, 2024