The price of BTC will soon overtake that of MicroStrategy, which is now trading at a 6-month high and is expected to surge to $290.

The world’s biggest corporate Bitcoin holder and investor stand-in, MicroStrategy, is witnessing robust bullish activity on Wall Street. As of Tuesday’s close, the price of the MSTR stock is targeting a significant breakout over $200 and is now trading at a 6-month trading level of $192.20. The price of BTC will eventually surpass the gains of MSTR stock, if history is any guide, and soar to levels beyond $70,000.

MicroStrategy stock on investors’ radar

A remarkable 53% of the MicroStrategy stock has recovered during the last month, indicating that there has been significant purchasing activity recently. Ever since the corporation implemented the Bitcoin strategy in August 2020, this proxied Bitcoin wager has continuously surpassed the increases in BTC prices.

Since then, the MSTR stock has increased by 1208% during the previous four years, compared to a 445% rise for BTC during the same time frame. In addition, it is ranked second in the top ten S&P 500 stocks over the past four years in terms of performance. Businesses all across the world have begun to follow the MicroStrategy Bitcoin playbook, with Japan’s Metaplanet following suit with steady acquisitions of BTC.

The founder of 10x Research, Markus Thielen, said in a study note earlier this week on Monday that even though the stock price is 44% overpriced when compared to Bitcoin, it would continue to rise stronger until it exceeds $180. He penned:

“Market makers may be forced to hedge their short gamma exposure as they likely sold calls to retail investors), and hedge funds holding $4.6 billion in short positions on MicroStrategy shares could face pressure to cover those shorts if the price surpasses the $180 mark”.

This rally could also push Microstrategy to raise even more debt to acquire additional BTC. Thielen added: “Raising even more debt to purchase bitcoin seems logical. A breakout in MicroStrategy’s stock could have a ‘tail wags the dog’ effect, where the momentum in its shares positively impacts Bitcoin’s price, creating a feedback loop.”

Will BTC price catch up?

Analysts at Bernstein predict that the MSTR stock will rise another 64% from its present price to $290. Since its inception, the MSTR stock has served as a prominent predictor of Bitcoin’s future. The price of MSTR is up 54%, while the price of BTC is up 14% on the monthly chart.

With a market valuation of $1.232 trillion, the price of Bitcoin is now trading at $62,363.54 as of the time of publication. That means that if it overtakes MSTR, it has the potential to set off a Bitcoin surge that might reach $70,000 or more.

Is XRP ETF approval imminent in the US?

Even with Canary Capital’s petition and the latest US SEC appeal in the Ripple SEC case, experts are still bullish about the possibility of an XRP ETF launch in the US.

The market has been more optimistic following Canary Capital’s second submission for the XRP ETF, since some analysts have indicated that the investment vehicle may be approved. Meanwhile, this comes immediately after Bitwise submitted the first application for such an ETF in the United States. Furthermore, the most recent filing coincides with the US SEC’s appeal in the Ripple SEC case, which has prompted additional market debate.

Is XRP ETF launch in the US inevitable?

The market is feeling optimistic following Canary Capital’s latest application for the XRP ETF. It is the second file in a row after Bitwise submitted a similar petition earlier this month. The companies’ ongoing efforts are also a reflection of Wall Street participants’ growing faith in Ripple’s native cryptocurrency.

Meanwhile, commenting on the approval scenario, ETF Store President Nate Geraci, a known person in the ETF market, gave an optimistic opinion. According to Geraci, the permission is expected to be forthcoming, but nevertheless, it hinges on a vital condition.

His assurance on a possible launch is demonstrated by the comment, “Yet another XRP ETF file. It’s a question of when, not if, approval IMO. But he went on to say that this “when” depends on the government shift. Stated differently, he has expressed what many people already feel, which is that a shift in the US presidential and SEC administrations would spur growth in the cryptocurrency industry.

Gary Gensler, the chair of the US SEC, has come under fire from many in the cryptocurrency community for his excessive regulatory actions in the space. That being said, it seems Geraci is also optimistic about the possibility of a Ripple ETF introduction in the event that the US SEC’s leadership changes.

Furthermore, a flurry of investors and cryptocurrency market aficionados believe that a Donald Trump victory will encourage innovation in the field of digital assets. For example, market players have taken note of the former US President’s recent turn in interest toward cryptocurrency.

Will Ripple SEC case hinder the potential launch?

Certain investors’ opinion has been affected by the most recent US SEC appeal in the Ripple SEC case. The traders anticipate that the current legal dispute will last longer in light of the new appeal. Furthermore, Stuart Alderoty, the CLO at Ripple, has stated that the company could take a cross-appeal in this instance.

Nevertheless, a lot of people in the Ripple ecosystem seem to be still optimistic about the possibility of an XRP ETF debut in the US. For example, in a recent X post, pro-XRP attorney Bill Morgan praised Canary Capital’s creation of filing for the investment instrument. In response to his article, a user questioned if the filings—given the recent appeal—were real or merely an attempt to “troll the SEC.”

Morgan retorted that trolling by the US SEC is common in the cryptocurrency field, particularly in light of the agency’s recent severe criticism from the digital assets space. However, Brad Garlinghouse, the CEO of Ripple, also voiced confidence in the situation. He just posted an update on X that said, “It’s happening again.”

https://t.co/h6etwkp59c pic.twitter.com/1WiBNcIo7H

— Brad Garlinghouse (@bgarlinghouse) October 8, 2024

It’s important to remember, though, that Brad Garlinghouse has expressed optimism about the possibility of an XRP ETF introduction in the US in the past. Taking all into account, it seems that even if the Ripple SEC fight has recently intensified, raising some fears, the XRP community is still optimistic about the possibility of an ETF launch.

What’s next for XRP price?

The price of XRP increased by over 1% today to $0.5301, but its trading volume decreased by 25% to $863.39 million. Notably, the currency has achieved a 24-hour high of $0.5341 and a low of $0.5216. Additionally, the fact that XRP Futures Open Interest remained close to the flatline suggests that investors are holding off on making cryptocurrency wagers until there is more clarity.

Investor confidence seems to have been affected by the latest US SEC appeal. The cryptocurrency briefly exceeded $0.66 before dropping to its present value in the wake of the appeal. The market is still tense right now because to high expectations for a possible settlement and a cross-appeal in the Ripple v. SEC case.

But an ex-SEC attorney recently pointed out a number of reasons why a Ripple SEC settlement is implausible. Despite that, many prominent market professionals remain positive on the coin, especially with the new XRP ETF registrations. For example, the market was optimistic lately when one expert said that the price of XRP would rise to $3 before Christmas.

PEPE price stability in doubt as market momentum fades

The price of PEPE appears to be losing pace. Important technical signs point to a slowdown in the current advance. The currency has therefore dropped by about 10% during the past day.

Furthermore, neutral short-term price indicators like the EMA lines suggest that PEPE could soon challenge significant support levels. Although a decline is conceivable, a rebound in bullish momentum may force PEPE to retesting important resistance levels.

PEPE ADX shows the current uptrend is fading away

When PEPE was trading at $0.00001147 on September 30, its ADX peaked at 58.52. Since then, it has sharply declined to 17.89. One important technical indicator for determining a trend’s strength is the Average Directional Index, or ADX. Regardless matter whether it is bearish or bullish, that metric applies.

A strong market trend is indicated when the ADX is over 25. This implies that the price is probably moving in a single, obvious direction due to momentum. Conversely, if the ADX drops below 20, it indicates that there is either no trend at all or very little.

That suggests either consolidation or a period of hesitancy in which there isn’t any discernible price change. With PEPE’s ADX now at 17.89, it appears that the market is missing strong directional momentum and is in a consolidation period.

With a low ADX number, the price is probably fluctuating within a small range, not rising or falling significantly. This supports the theory that, despite being one of the most popular meme currencies on the market, PEPE is now seeing less volatility.

The sudden decline in ADX further supports the notion that the robust trend that was seen in late September has waned, leaving PEPE without a distinct directional impetus. This means that until a new trend develops, it is more prone to sideways trading or small changes.

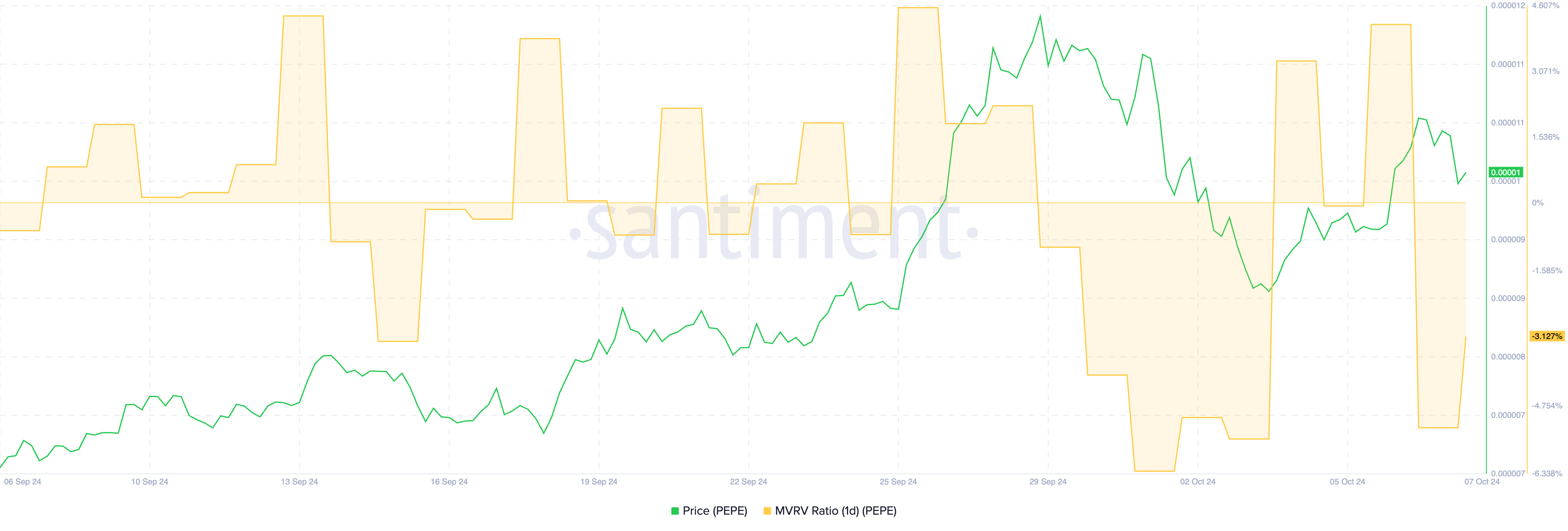

PEPE MVRV Ratio is now negative

With a 1D MVRV Ratio of -3.12%, PEPE’s recent investors are, on average, holding the stock at a loss in relation to its current price. By contrasting an asset’s market value with its realized value, the 1D MVRV (Market Value to Realized Value) Ratio is a crucial indicator that helps determine if a coin is overpriced or undervalued.

A positive MVRV ratio indicates that holders are often making money, whilst a negative ratio means they are losing money. Abnormally high levels indicate that a sell-off may be about to happen because investors may begin to take profits.

Conversely, a negative MVRV ratio—such as the one that stands at -3.12% at the moment—indicates that the market is cheap. This can be a good time to buy because the sellers have pretty much run out of options. The abrupt turnaround is seen in the dip from 4.17% to -3.12% in a single day. That suggests that a large number of investors have quickly gone from holding profits to carrying losses.

This abrupt change implies a sudden sell-off or price decline, most likely caused by market turbulence or outside variables affecting PEPE’s value. When traders wait for the MVRV to stabilize or reverse higher once more, this might lead to even more cautious trading behavior in the market.

PEPE price prediction: A potential downtrend ahead?

The market’s indecisiveness is reflected in PEPE‘s EMA lines, which are now neutral and do not clearly indicate an upward or downward trend. Technical analysts frequently employ EMA (Exponential Moving Average) lines to smooth out price data and spot patterns by emphasizing recent price moves.

Long-term EMA lines provide a more comprehensive picture of the trend, but short-term EMA lines respond to price fluctuations more swiftly. The short-term EMAs in PEPE’s instance remain higher than the long-term ones. They are beginning to slope down, although this is still typically regarded as a positive indicator.

This decline implies that the bullish momentum is waning and that a change in direction may be imminent. PEPE may challenge the support level around $0.00000835 in the upcoming days if the present market movement keeps moving in this neutral to slightly negative trend. If this support breaks, there is still a chance that the price may decline, and $0.00000776 is the next significant support.

But if positive momentum increases once again, the price of PEPE can test the barrier of $0.0000119. As things stand right now, traders are probably waiting for a more definitive signal before deciding what to do next because the market is still unclear.