Launching its governance token, MODE, Mode Network is a modular Decentralized Finance (DeFi) Layer-2 solution based on the Optimism Stack.

550M crypto airdrop

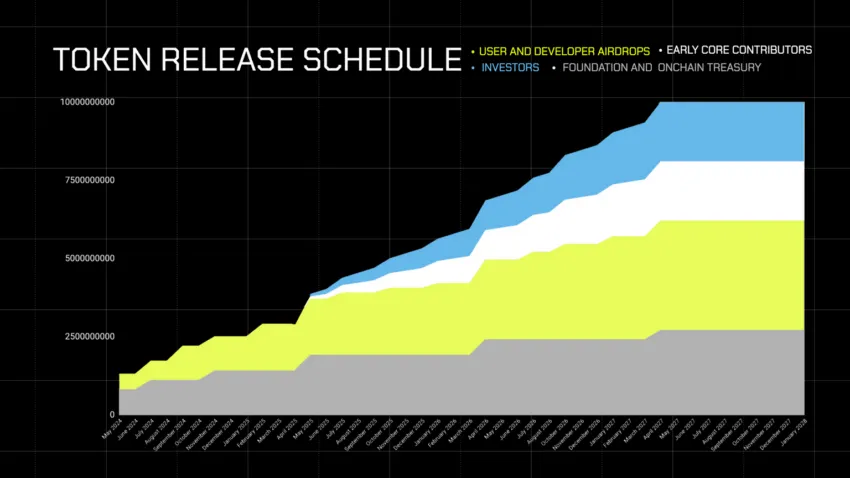

The MODE token has two purposes. Both ecological development and governance are facilitated by it within the network. With 1.3 billion tokens in circulation at launch, the total amount of MODE tokens is set at 10 billion. The foundation, treasury allocations, and prior cryptocurrency airdrops are the sources of this.

In terms of distribution, users and developers will receive 35% of the MODE tokens through cryptocurrency airdrops. Additionally, in the first quarter, 5.5% of those will be issued.

Additionally, investors and early contributors receive 19% of the tokens, which are subject to a 24-month linear release after a 12-month lock-up. To support ecosystem incentives through governance mechanisms, the foundation and treasury retain 27 percent of the tokens.

Top donors will be subject to initial claim limits in order to reduce early sell-offs. If they keep their assets in the network, they will be able to claim 50% of their tokens right away and the remaining 50% after 90 days.

Optimism and Mode Network are working together to construct the Superchain. In order to become Mode Flare, a special Layer-3 network devoted to DeFi services, it combines Celestia’s data availability (DA) technology. By sharing contract money, this structure enables improved user-decentralized application (Dapp) collaboration.

With its current total value locked (TVL) of $603 million, the network is ranked in the top 10 Layer-2 networks, not far behind leaders like zkSync Era and Linea, who lead by about $200 million.

The network supports more than thirty native and external apps as of the first quarter, with a concentration on DeFi services. Examples of these applications are LayerZero and The Graph. It also provides information on around 20 million transactions and about 450,000 active addresses.

Grayscale GBTC Outflow resumes as Fed official suggests maintaining high interest rates

Withdrawals from the Grayscale Bitcoin ETF (GBTC) have started up again, suggesting that the market is still apprehensive about the Fed’s planned rate reduction.

The celebration for the Bitcoin ETF comes to an end on Tuesday, May 7, when net outflows resume after two days of nonstop inflows. The Grayscale Bitcoin ETF (GBTC) alone reported $28.6 billion in net withdrawals, while the US Bitcoin ETFs had net inflows of $15.7 million, according to statistics.

Grayscale GBTC outflows commence again

Grayscale’s GBTC has once again seen withdrawals following two days of inflows last week. The total withdrawals from Grayscale’s GBTC are coming up just shy of $17.5 billion as of Tuesday’s closure.

There is a widespread belief that institutional investors have been pulling out of GBTC as a result of Grayscale’s exorbitant management costs. But according to the most recent SEC documents, asset management Susquehanna International held more over $1 billion in Bitcoin during the first quarter of 2024 in Grayscale’s ETF (GBTC). This indicates that despite significant withdrawals, institutional investors are still interested in the Grayscale Bitcoin investment program.

As inflows have returned, the price of GBTC shares (NYSEARCA: GBTC) has increased by 10% in the past week. On Tuesday, though, it saw some little pressure and closed the trading day at $56.11. Grayscale unexpectedly withdrew their Ethereum ETF application on Tuesday as well.

Will the Fed maintain current interest rates?

The Bitcoin market has been ecstatic during the last several trading sessions, believing that the Fed would soon start reducing interest rates in response to rising unemployment numbers.

The Federal Reserve Bank of Minneapolis’s president, Neel Kashkari, stated that the bank would likely keep interest rates at their present levels “for an extended period” until it is certain that inflation is approaching its objective. Speaking on Tuesday at the Milken Institute Global Conference, Kashkari also added:

“The most likely scenario is we sit here for an extended period of time. If inflation starts to tick back down or we see some marked weakening in the labour market then that might cause us to cut back on interest rates.”

If this is the case, the selling pressure on Bitcoin (BTC) will persist with each increase, maintaining the bound of the Bitcoin price range. Since April of last month, the price of Bitcoin has fluctuated between $60,000 and $70,000. It is expected by analysts that this will go on for a few more weeks until there is one last breakout rise to new all-time highs.

More than $16B at risk: FTX’s proposal to pay debts

FTX Trading Ltd. and the related creditors submitted an amended Plan of Reorganization on May 7. They submitted it to the Delaware-based United States Bankruptcy Court.

Examining FTX’s plans for financial recovery and repayment

According to the restructuring plan, FTX has obtained a payback of between $14.5 and $16.3 billion. The money was obtained through the liquidation of a variety of assets, including those under the control of many international organizations participating in the proceedings.

Even with the significant asset shortage that was discovered at the start of the bankruptcy, the plan guarantees that non-governmental creditors would be paid in full. They will start receiving interest from the beginning of the bankruptcy cases, up to 9%.

A “convenience class” is created under the technique for creditors with claims totaling $50,000 or less. It is anticipated that 98% of these creditors will be able to obtain around 118% of the claim amount if the court accepts this agreement. This will happen 60 days after the plan is activated.

But from the beginning of the Chapter 11 cases until distribution, it allows interest payments to primary customers and creditors classes of up to 9%, so superseding the rights of governmental creditors. Furthermore, additional payments may be made from the Supplemental Remission Fund to some debtors.

A number of agreements with important parties are a fundamental part of the bankruptcy exit plan. The goal of this plan is to streamline the payback procedure and strengthen FTX’s position.

A $24 billion IRS claim from prior to the Chapter 11 lawsuits is resolved in these ongoing court-approved settlements with a $200 million payment and a $685 million subordinated claim. Additionally, the Plan suggests putting similar claims from the Commodity Futures Trading Commission (CFTC) and post-Chapter 11 Internal Revenue Service (IRS) tax claims under a higher priority.

Pending further information, these subordinated claims will use a dedicated fund to finance further payments to certain consumers and creditors.

A possible agreement with the Department of Justice (DOJ) is also described in the Plan. Through this agreement, creditors will receive approximately $1.2 billion in forfeiture revenues without incurring additional fees or waiting periods. Giving consumers significant attention, it validates agreements with the Official Committee of Unsecured Creditors, the Ad Hoc Committee of Non-US consumers, and Class Action Claimants.

Customers of FTX.com can satisfy their claims through another settlement in Chapter 11 or through FTX Digital Markets, Ltd.’s liquidation. This arrangement provides comparable financial results. The final item is a previously authorized settlement with BlockFi, the biggest creditor of FTX.

The Chief Executive Officer and Chief Restructuring Officer of FTX, John J. Ray III, thanked the company for its initiative in an official statement.

“We are pleased to be in a position to propose a Chapter 11 plan that contemplates the return of 100% of bankruptcy claim amounts plus interest for non-governmental creditors. On behalf of FTX’s independent Board of Directors, I want to extend our deepest appreciation to the numerous governmental agencies. […] Finally, I want to thank all the customers and creditors of FTX for their patience throughout this process,” Ray stated.

As FTX proceeds with its planned strategy, the US Bankruptcy Court plays an increasingly important role. Judge John Dorsey will have the opportunity to examine and maybe approve the voting processes and disclosure statement during a hearing in late June. Additionally, the efficacy and equity of the repayment plan will be evaluated by this choice.

This move comes after the FTX estate sold out tokens, including Solana. According to research, the estate started selling tokens in its second round, with prices ranging from $85 to $110. Demand is still strong despite the reduction to current market pricing, with companies like Galaxy and Pantera Capital taking part.

How to earn with FMC & FMCPAY: https://news.fmcpay.com/how-to-earn-with-fmc-fmcpay.html