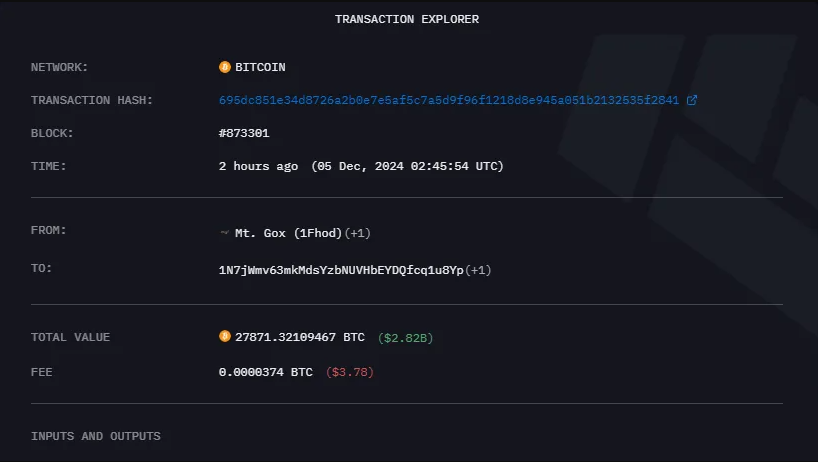

Mt. Gox, the collapsed cryptocurrency exchange, transferred BTC worth around $2.43 billion to a new wallet after the Bitcoin price surpassed the psychological $100,000 barrier.

This transaction transfers 24,052 BTC to a fresh wallet and 3,819 BTC to an internal cold wallet.

Mt. Gox moves 24,052 Bitcoin

According to the most recent update, Mt. Gox transferred 24,052 BTC worth $2.43 billion to a new wallet on Wednesday night. The transaction took place after Bitcoin reached $100,000 for the first time in history.

The unmarked wallet address “1N7jW…1u8Yp” got approximately 24,052 BTC from Mt. Gox’s other cold wallet storage. This is the exchange’s first significant transfer since November 12.

It’s unclear whether this transfer is part of the collapsed exchange’s anticipated payouts to creditors. Spotonchain believes that the new wallet is likely an internal address. According to the on-chain analytics tool, Mt. Gox presently possesses 15,826 BTC, worth about $1.63 billion, spread among 31 known wallet addresses.

Mt. Gox transferred 24,052 $BTC ($2.43B) to a new wallet, “1N7jW,” an hour ago, right after the $BTC price broke through the $100K milestone.

However, the new wallet is likely just an internal address.

Currently, Mt. Gox still holds 15,826 $BTC ($1.63B) across 31 known wallet… pic.twitter.com/W1kyoSDEHc

— Spot On Chain (@spotonchain) December 5, 2024

Nonetheless, transactions of this volume tend to jolt the market. Such fluctuations frequently precede repayments via controlled exchanges.

Mt. Gox recently postponed its repayment deadline by a year to October 31, 2025, following the repayment of several creditors. Meanwhile, the remaining Mt. Gox creditors are awaiting their BTC repayments.

Wow, $2.4 billion is no small move! 🤯 Curious to see where it lands. Hope it’s not another wild ride for everyone involved! What’s your take on the climb to $100k?

— VinTheApe (@freakalabenni1) December 5, 2024

Several factors are contributing to Bitcoin’s rise beyond the $100,000 mark. Among these are Federal Reserve Chair Jerome Powell’s comments at the New York Times DealBook Summit in Manhattan, which compared Bitcoin to gold.

Second, Paul Atkins has been appointed as the new SEC (Securities and Exchanges Commission) head, as Gary Gensler prepares to step down. Finally, Russian President Vladimir Putin welcomed Bitcoin as the government makes progress in its crypto reforms.

Taken together, these events show that financial institutions and governments are recognizing the potential of digital assets and their role in reshaping the national economy. According to statistics, BTC is trading at $102,456 as of this writing, signifying a 7.6% increase since the Thursday session began.

Kyle Chasse, a Bitcoin veteran, believes Bitcoin’s rise beyond $100,000 would stimulate FOMO (fear of missing out) purchases among retailers. Such a result might push BTC higher.

RETAIL IS GOING TO SEE $100K AND FOMO SO HARD.

— Kyle Chassé / DD🐸 (@kyle_chasse) December 5, 2024

Shiba Inu developer teases Shifu, the latest addition to token lineup

The Shiba Inu ecosystem is about to be shaken once again with the introduction of a new coin, Shifu.

The announcement, made by Shiba Inu’s principal developer Shytoshi Kusama on X, marks an exciting expansion for the dog-themed memecoin family.

Shytoshi Kusama teases Shifu token

Shifu will join a growing list of assets, including SHIB, LEASH, BUBBLE, and the IO NFT, with an airdrop scheduled for these holders.

The announcement, initially made by influencer Lark Davis and verified by Kusama, comes at an important time for Shiba Inu. Over the last 30 days, SHIB has increased by 80%, beating several other coins and signaling renewed investor confidence. This expansion is most likely driven by a combination of conjecture about the ecosystem’s future and increased community interaction.

🔥 ATTENTION SHIBA INU HOLDERS 🔥

The devs behind $shib are bringing a new dog to crypto.

SHIFU! The Master Of All!

A legit meme coin launched by the second biggest meme coin by market cap and community in all of crypto!

There will be an insane airdrop to holders of… pic.twitter.com/UBLWpFgEXm

— Lark Davis (@TheCryptoLark) December 4, 2024

Shifu’s debut broadens the Shiba Inu ecosystem while also implementing the goal of rewarding faithful holders via unique airdrops. This strategy builds community loyalty while potentially increasing interest in SHIB and related tokens. The timing is appropriate for SHIB’s current price momentum, making the airdrop announcement a possible stimulus for more market action.

The OG token, which powers everything, has recently increased in value. Over the previous 30 days, SHIB’s price has increased by 80%. This trend parallels the fast growth of the meme currency business, which has lately seen a bull run.

This development demonstrates Shiba Inu’s ongoing transformation from a memecoin to a diverse ecosystem. With SHIB gaining traction and Shifu on the horizon, the Shiba Inu family is solidifying its position as a dominant force in the memecoin market. The issue now is whether Shifu will launch a new surge or redefine what it means to invest in this growing collection of dog-themed tokens.

Crypto trading on centralized exchanges soars to $10 trillion in November

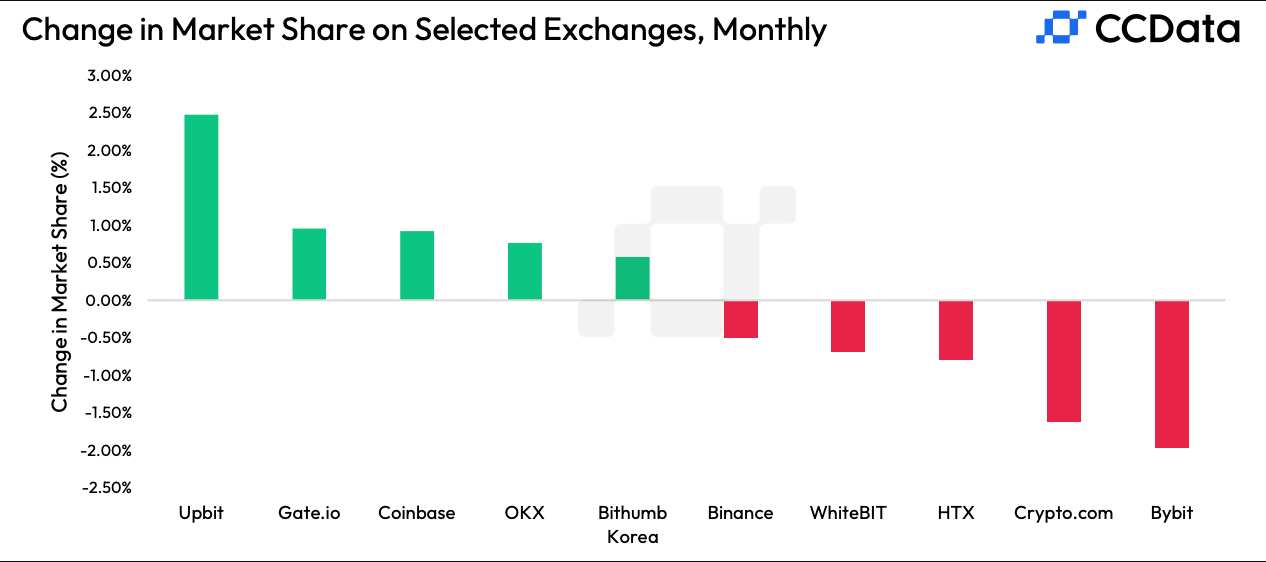

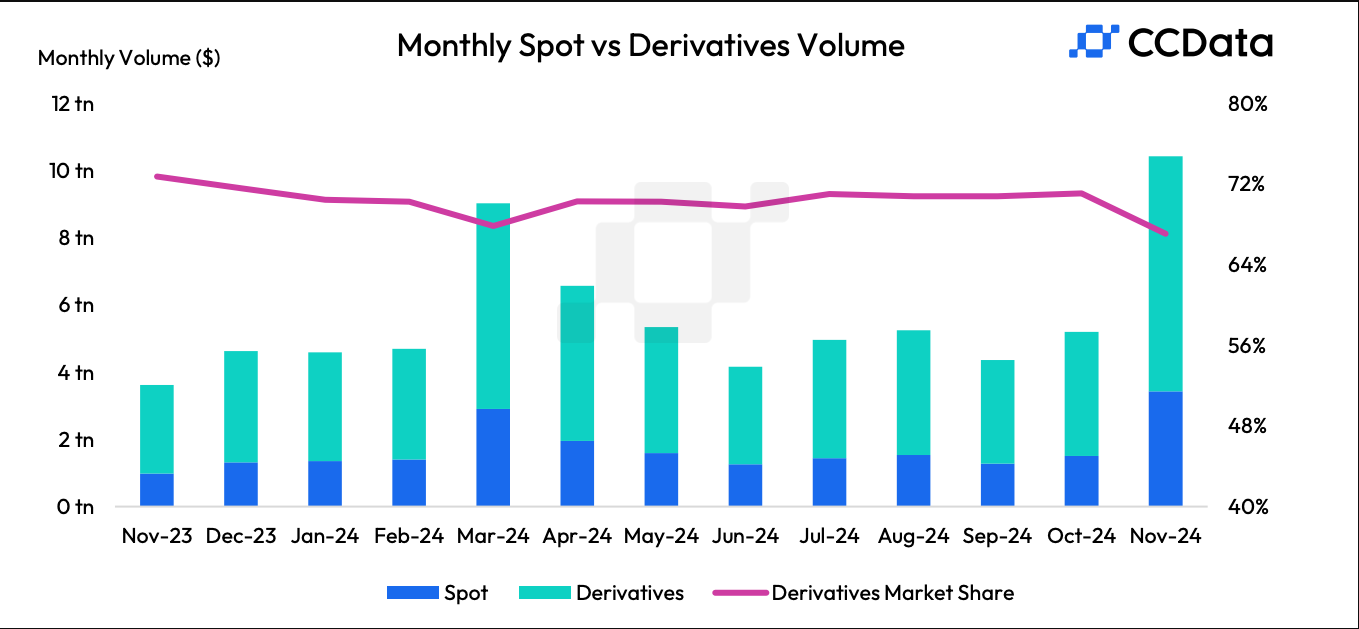

According to a recent analysis from CCData, global trading volume in the cryptocurrency market reached an all-time high of $10 trillion in November. Donald Trump’s pledges of regulatory friendliness fueled rapid development.

Derivatives trading contributed significantly to this rise, accounting for the vast bulk of centralized exchange traffic.

CCData exchange report

The paper examined trade data from centralized exchanges and discovered numerous interesting features in this development pattern. For starters, Donald Trump’s election victory was significant, as the business anticipated a more favorable regulatory climate. Jacob Joseph, a senior research analyst at CCData, told Bloomberg about this trend:

“This sentiment is evident in the increased appetite for assets like Ripple, which has historically faced heightened regulatory scrutiny. Optimism is also evident on the institutional side, with CME volumes seeing a significant uptick and substantial inflows into spot Bitcoin ETFs over the past month, Joseph claimed.

However, the corporation made it clear that this increase was not limited to US-based enterprises. In actuality, CCData said that the fastest-growing exchange was Upbit in South Korea, with monthly spot trading increasing by 358%. Amazingly, these improvements occurred despite South Korean regulators charging Upbit of 600,000 KYC breaches.

Crypto options trading also grew significantly, contributing to the total profits. CCData reported that options volumes on the Chicago Mercantile Exchange (CME) reached an all-time high, with $5.54 billion in Bitcoin options alone.

This indicates a 152% increase, while other assets had comparable gains. Derivatives transactions accounted for the vast bulk of total volume.

The OCC permitted Bitcoin ETF options trading in November, which is expected to encourage further options trading. CCData only examined direct crypto traffic through centralized exchanges, therefore ETF volumes are not included in their findings. Nonetheless, these options produced significant volumes, with BlackRock exceeding $425 million on the first day.

The aggregate spot and derivatives trading volume on controlled exchanges increased by more than 100% from October to November. CCData calculates the ultimate sum to be $10.4 trillion. This amazing milestone helps to explain the huge bull market in the cryptocurrency world.