Crypto traders prepare for impact as over 18,300 Bitcoin options and 163,170 ETH options expire, but on-chain analysts believe the big crypto selloff has yet to begin.

Bitcoin bears gained control of bulls when investors panicked and sold their BTC holdings in response to Mt. Gox, the US government, and the German government’s actions on Bitcoin. The Bitcoin price has dropped to $53,400, a level last seen in February. Bitcoin and Ethereum options expire today, putting more pressure on the crypto market, as on-chain data indicates that the true panic has yet to begin.

Bitcoin and Ethereum set to expire today

The crypto market meltdown saw the global crypto market capitalization fall by more than 13% in 48 hours, costing investors more than $250 billion.

Over 18,300 Bitcoin (BTC) options worth $1 billion are slated to expire on Deribit, with a put-call ratio of 0.65. The maximum pain is $61,500, down from $63,500, as Bitcoin remains under selling pressure. BTC price went below $55k support and might fall to $52k if it fails to recover.

Notably, the put/call ratio in the previous 24 hours is 0.88, as put bets increased dramatically after the crypto market drop. The 24-hour put volume exceeds 19,552, while the 24-hour call volume approaches 22,088. Additionally, Historical Volatility and the BTC Volatility Index (DVOL) experienced a significant 10% increase. This shows that options traders have gone quite pessimistic on Bitcoin.

Meanwhile, 163,170 Ethereum (ETH) options with a notional value of $472 million are slated to expire. The put-call ratio is 0.35, with a maximum pain price of $3,350, signaling enormous losses for traders as ETH went below $2,890. In the previous 24 hours, the put volume grew to 98,643, while the call volume stayed higher at 126,788. The put-call ratio equals 0.78.

$700M liquidated from crypto market

According to a CryptoQuant-verified on-chain expert, the true panic has not yet begun. He expects it to start when orange bars emerge on the BTC Daily Realized Profit Loss Ratio 30DMA meter. “In the current situation, 47K doesn’t look as terrible as it did three weeks ago when we were at 70K,” he told me.

According to Coinglass statistics, crypto liquidations totaled more than $700 million. Over 235k traders were liquidated, with the highest single liquidation order on cryptocurrency exchange Binance worth $18.48 million after someone traded ETH.

Over the previous 24 hours, the cryptocurrency market has lost more than $600 million in long holdings and $100 million in short ones. Along with the leading cryptocurrencies, significant liquidations occurred in PEPE, PEOPLE, ORDI, WLD, LTC, FIL, ADA, BCH, and others.

Mt. Gox, the beleaguered cryptocurrency exchange, has begun repaying $10 billion in BTC and BCH, according to an official declaration made on July 5. According to Arkham, Mt. Gox traded 47.229k BTC for $2.97 billion today.

German lawmaker wants government to HODL Bitcoin (BTC), not sell

German legislator Joana Cotar has criticized the government for consistently selling Bitcoin while it is meant to HODL.

The German government’s regular transfer of Bitcoin (BTC) to exchanges has many crypto fans uneasy, and a few have expressed their worries.

Stop German government’s Bitcoin transfer

In recent weeks, the German government has conducted a large number of transactions involving the transfer of Bitcoin. Earlier on Thursday, the German government purportedly sent an additional 1,300 Bitcoin (BTC) to key cryptocurrency exchanges.

Notably, Arkham Intelligence reports that Bitstamp received 500 BTC valued $29.05 million. Similarly, the German government sent 400 BTC worth $23.24 million to Coinbase and an additional 400 BTC to Kraken. Arkham Intelligence said that the entire unloading amounted to roughly $76 million. It is worth mentioning that the Bitcoin price fell below $58,000 quickly after the big sale, increasing fears of a further plunge.

In reaction to this liquidation, Joana Cotar, an independent member of the Bundestag, blasted the government’s actions and demanded that it halt its Bitcoin selling binge. Cotar sent her concerns to Michael Kretschmer, one of the CDU’s deputy chairman; Christian Lindner, the Federal Minister of Finance; and Chancellor Olaf Scholz. She describes the conduct as “counterproductive.”

Statt #Bitcoin als strategische Reservewährung zu halten, wie es in den USA bereits debattiert wird, verkauft unsere Regierung im großen Stil. Ich habe @MPKretschmer, @c_lindner & @Bundeskanzler @OlafScholz darüber informiert, warum dies nicht nur nicht sinnvoll, sondern… pic.twitter.com/v9FpzmfLbp

— Joana Cotar (@JoanaCotar) July 4, 2024

She feels that Bitcoin offers “a unique opportunity” for investors to diversify their holdings, and she did not hesitate to express her views to officials. Cotar compared the capabilities of the top cryptocurrency to those of traditional assets. She added that the former might assist reduce the hazards associated with investing in the latter and being too exposed.

In addition, she invited them to her future talk. The event is slated for October 17 and will include Bitcoin enthusiast Samson Mow in attendance.

More entities sees BTC as inflation hedge

Cotar believes Bitcoin may operate as a hedge against inflation and currency depreciation owing to scarcity. To a great extent, she is not alone in her feelings regarding the flagship cryptocurrency. Jeremy Allaire, CEO of Circle, a renowned financial technology startup, has emphasized Bitcoin’s rising popularity as a hedge against global economic volatility.

Anthony Scaramucci of SkyBridge Capital once disagreed with Peter Schiff, a leading proponent of gold, on Bitcoin’s use as an inflation hedge. While Schiff argued that Bitcoin’s poor speed and hefty transaction costs were impediments to its daily usage, Scaramucci countered by citing the coin’s fixed quantity and the ability to store value for a long period.

Altcoins suffer heavy losses as BTC recedes 8%

On July 5, the majority of altcoins, including PEPE, BRETT, JASMY, and FLOKI, lost more than 20%, while Bitcoin, the largest crypto asset, declined 8% in 24 hours trading.

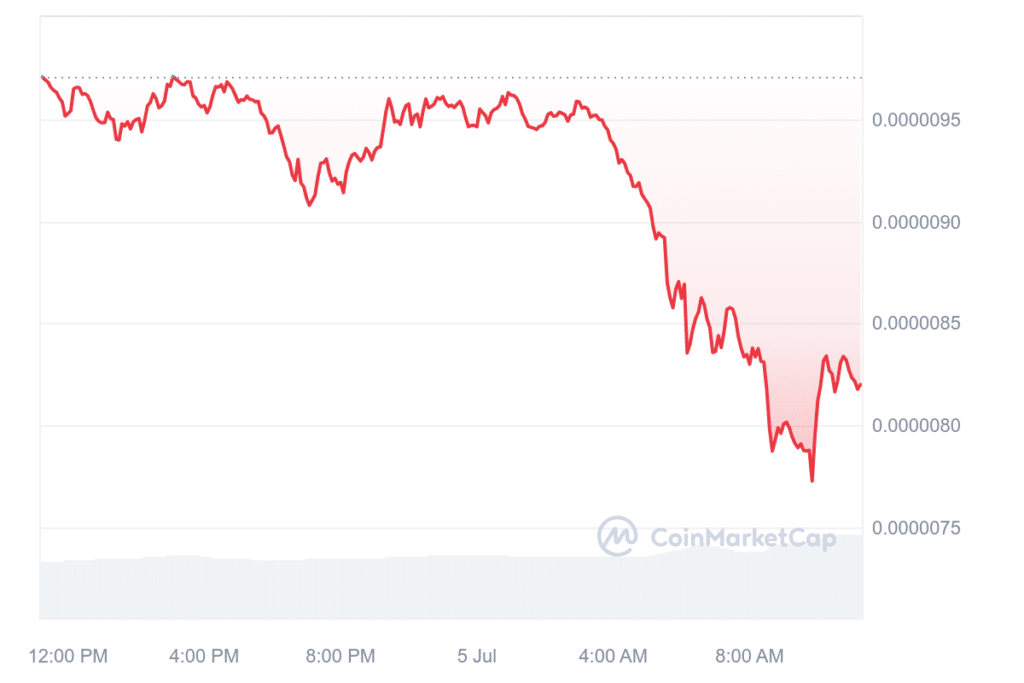

At the time of writing, the Ethereum-based meme coin, PEPE, has fallen 15% in the previous 24 hours, with hands exchanged at $0.0000082. During the same span, the daily trading volume of crypto assets averaged roughly $1.29 billion. Meanwhile, its market capitalization had fallen by 15%, to $3.46 billion.

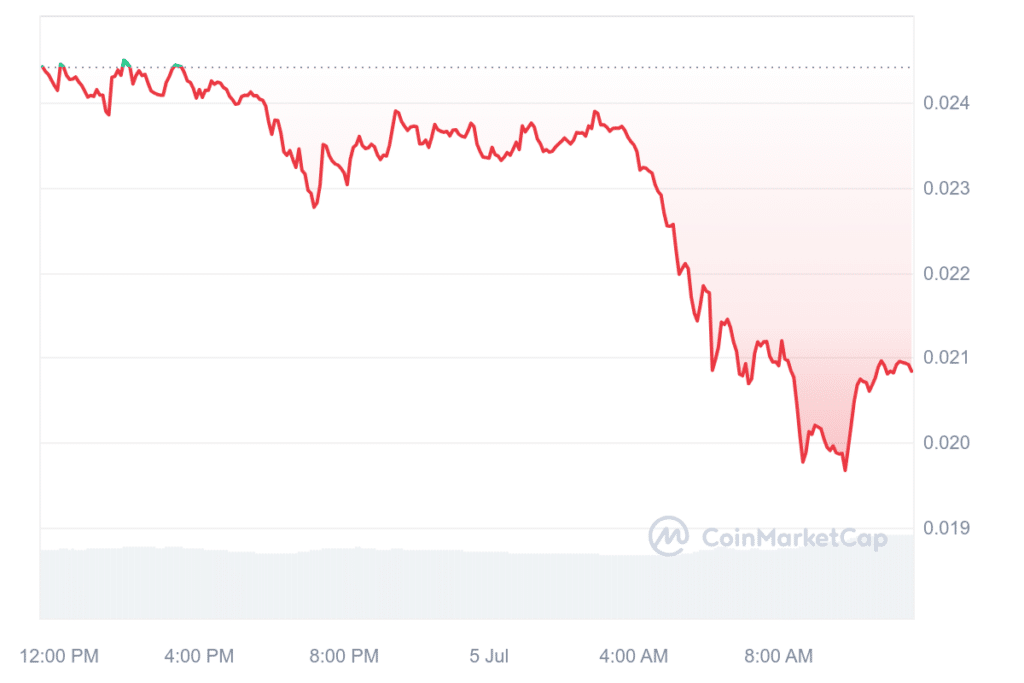

BRETT, the memecoin that debuted four months ago, also fell 20%, trading at $0.1143, according to CoinMarketCap (CMC). During the same period, the meme currency, which was inspired by a character from the “Boy’s Club” comic, had a daily trading volume of $71.3 million.

Meanwhile, the crypto asset’s market capitalization decreased to $1.13 billion, placing it as the 59th largest cryptocurrency, according to CMC.

JASMY, the native cryptocurrency that powers all operations inside the Jasmy ecosystem, is likewise impacted by the current Bitcoin price movement. At press time, it was down 15% in the previous 24 hours, trading at $0.02083 on a daily volume of $177 million. The token’s market capitalization has dropped to $1 billion.

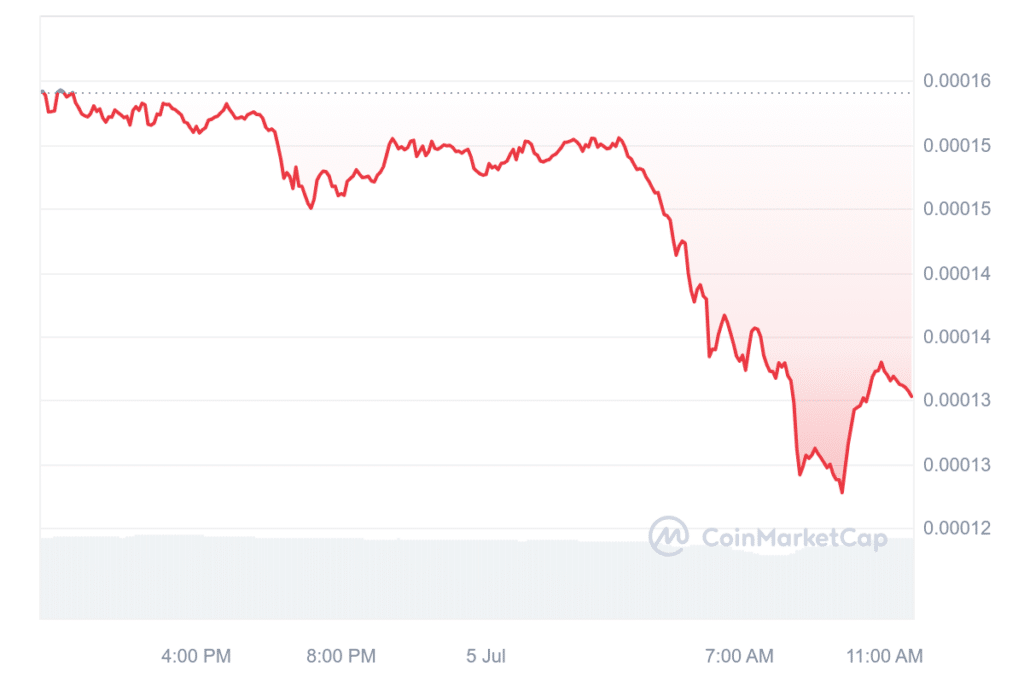

FLOKI, a meme coin based on solana, was also in the red, down 15% and trading at $0.00013 as of publishing. Its daily trading volume was $309 million, and the token’s market capitalization dropped to $1.25 billion. The crypto asset has slid to 55th place among the top 100 cryptocurrencies.

The broad drop in all of these cryptocurrencies coincides with the loss in the biggest cryptocurrency by market capitalization, Bitcoin, which fell by 8% in the previous day to $54,426 on Friday morning. The 24-hour low and high were $53,717 and $58,591, respectively.

The decrease in Bitcoin’s price corresponded with Mt. Gox moving 47,229 BTC worth $2.7 billion to an unnamed wallet. Additionally, US spot Bitcoin ETFs had outflows of $20.45 million, raising investor fears.

Bitcoin’s dominance increased by 0.58% from the day before, indicating a significant decline in altcoin market activity.

Ethereum, the largest cryptocurrency, has fallen 11% in the past 24 hours and was trading at $2860 at the time of posting.

The precipitous decrease in the altcoin market is sometimes attributed to Bitcoin’s performance because to its substantial influence and market domination.

When Bitcoin’s price falls significantly, it tends to cause a ripple effect throughout the cryptocurrency market, resulting in broad losses in altcoin prices as investor confidence fades and market sentiment turns negative.