DFSA approves Ripple’s plan to cooperate with NYU Abu Dhabi and the DIFC Innovation Hub to provide payment services in the United Arab Emirates.

The Dubai Financial Services Authority (DFSA) has given Ripple permission in principle to grow its blockchain-based payment services throughout the United Arab Emirates (UAE). With this permission, Ripple’s footprint as a regulated company in the Middle East is greatly increased since it may now operate out of the Dubai International Financial Centre (DIFC).

Ripple Gains Ground in UAE with Strategic DFSA Authorization

The XRP firm announced its success in obtaining in-principle clearance from the DFSA in a recent post on the X platform. The business may now introduce its cutting-edge payment solutions, such Ripple Payments Direct (RPD), in the United Arab Emirates thanks to this significant milestone. The expansion is a component of a larger plan to expand the company’s worldwide reach by incorporating compliant blockchain technology into significant financial centers.

The DIFC Authority’s Chief Business Development Officer, Salmaan Jaffery, emphasized the approval’s strategic importance. Jaffery expressed his gratitude for the events, saying,

“At DIFC, we are committed to fostering a future-focused financial ecosystem that supports innovation and growth. We are proud to welcome Ripple’s continued expansion in the DIFC as they work to drive the growth of blockchain technology in the region.”

Furthermore, the XRP business, which already holds over 55 licenses worldwide, is firmly establishing itself as a leader in the blockchain payment sector with this latest DFSA certification. These include approvals from important organizations including the Central Bank of Ireland (CBI), the Monetary Authority of Singapore (MAS), and the New York Department of Financial Services (NYDFS).

The CEO of Ripple, Brad Garlinghouse, stressed the significance of adjusting to the regulatory frameworks of various geographical areas. He emphasized that blockchain technology is here to stay and gave DFSA credit, saying,

“With its forward-thinking regulatory approach and clear guidance for innovative businesses seeking to invest and scale, the UAE is positioning itself as a global leader in this new era of financial technology.”

Commitment to Fintech Innovation in the UAE

Ripple has established a renewed strategic cooperation with NYU Abu Dhabi through the University Blockchain Research Initiative (UBRI), further solidifying its commitment to the area. The financial amount has been extended to almost $1 million by the XRP firm. Numerous blockchain-related research projects and student activities will be supported by this effort.

Additionally, as part of its worldwide 1B XRP Fund initiative, Ripple has collaborated with the DIFC Innovation Hub. Through the connection of up-and-coming developers with DIFC’s vast network—which includes more than 1,000 tech companies, digital laboratories, and venture capital firms—this partnership seeks to enhance blockchain and digital asset innovation in the United Arab Emirates.

This set of actions and regulatory successes highlights the company’s commitment to developing a digital economy in the United Arab Emirates and abroad. But the XRP business has been dealing with legal issues, especially with the SEC’s continuing litigation, which has lately gained more attention as the deadline for a potential SEC appeal draws near.

The benefits that the SEC may receive should it choose to file an appeal have been brought up most recently by former SEC attorneys. These developments coincide with expectations and conjecture around the launch schedules for the XRP firm stablecoin. In order to refine the process of minting and burning the tokens in advance of its planned debut, Ripple simultaneously coined 80,000 RLUSD.

Bitcoin all-time high target remains as BTC price bounces back to $64K

After 7% gains in September, bitcoin traders anticipate more upside and view any falls in the price of BTC as buying opportunities.

After setting a new high for September’s monthly closing, the price of Bitcoin (BTC) retargeted $64,000 on October 1.

BTC price defies “Rektember” with 7% gains

Data indicated that following a brief dip below $63,000, BTC/USD was rising.

According to statistics from tracking resource CoinGlass, the September monthly closing, which came in at $63,300, secured 7.3% price gains for Bitcoin. This was the currency’s best-ever ninth month of the year.

Bulls managed to hold onto a significant mid-term trend line in the shape of the 21-week simple moving average (SMA), while not being able to move $65,000 back to support after touching it last week.

Less than 2 hours to go before Bitcoin’s Monthly/Quarterly close.

If BTC bulls can’t muster the momentum to push back above the 2021 Mid-Cycle Top. If they can’t do that, they at least need to hold onto the 21-Week MA. Failure to do so opens the door for a retest of the lows. pic.twitter.com/m6z1qWmDWJ

— Keith Alan (@KAProductions) September 30, 2024

“Losing the 200-Day MA is not a good sign, but holding the 20-Week MA (for now) is. Losing them both would be a sign of weakness,” he summarized previously in a post on X.

Popular trader Daan Crypto Trades eyed changing order book liquidity, this stacking at $62,700 and $67,000, marking support and resistance levels, respectively.

“Testing the Daily 200 Moving Average after breaking above it yet another tiime,” he continued, agreeing with Alan.

“So far this year it has struggled to hold on to that level. Whether $BTC trades above or below is a good mid/high timeframe momentum and strength indicator.”

Roman, a fellow trader, was also optimistic about further upside continuing on shorter timeframes.

“Some nice bull divs now forming on H4,” he told X followers, referring to a bullish divergence between price and the relative strength index (RSI) indicator.

“Expecting some upward movement /chop which will hopefully give us upwards consolidation instead of our 1D deviation,” Roman forecast.

Bitcoin dịp-buying plans in full swing

Others recommended “buying the dip” as a viable short-term tactic, even though the current progress has plateaued at $65,000.

“Bitcoin officially made a higher high by closing above $65,000 – on the weekly as well,” trader, analyst and podcast host Scott Melker, known as “The Wolf of All Streets,” noted.

“Now we look for dips to buy as it potentially establishes another higher low. Altcoins largely look the same, backtesting their own key breakout resistances as support.”

Meanwhile, cryptocurrency trader, analyst, and businessman Michaël van de Poppe reaffirmed his prediction that Bitcoin will reach a new all-time high in the near future.

“Took the liquidity above the recent highs, and is coming back down,” part of an X post read before the monthly candle completed.

“I think we’re in a new uptrend, which means that dips are for buying. In that sense, if we get a retest at $60.5-61.3K, I’m interested before we test the ATH.”

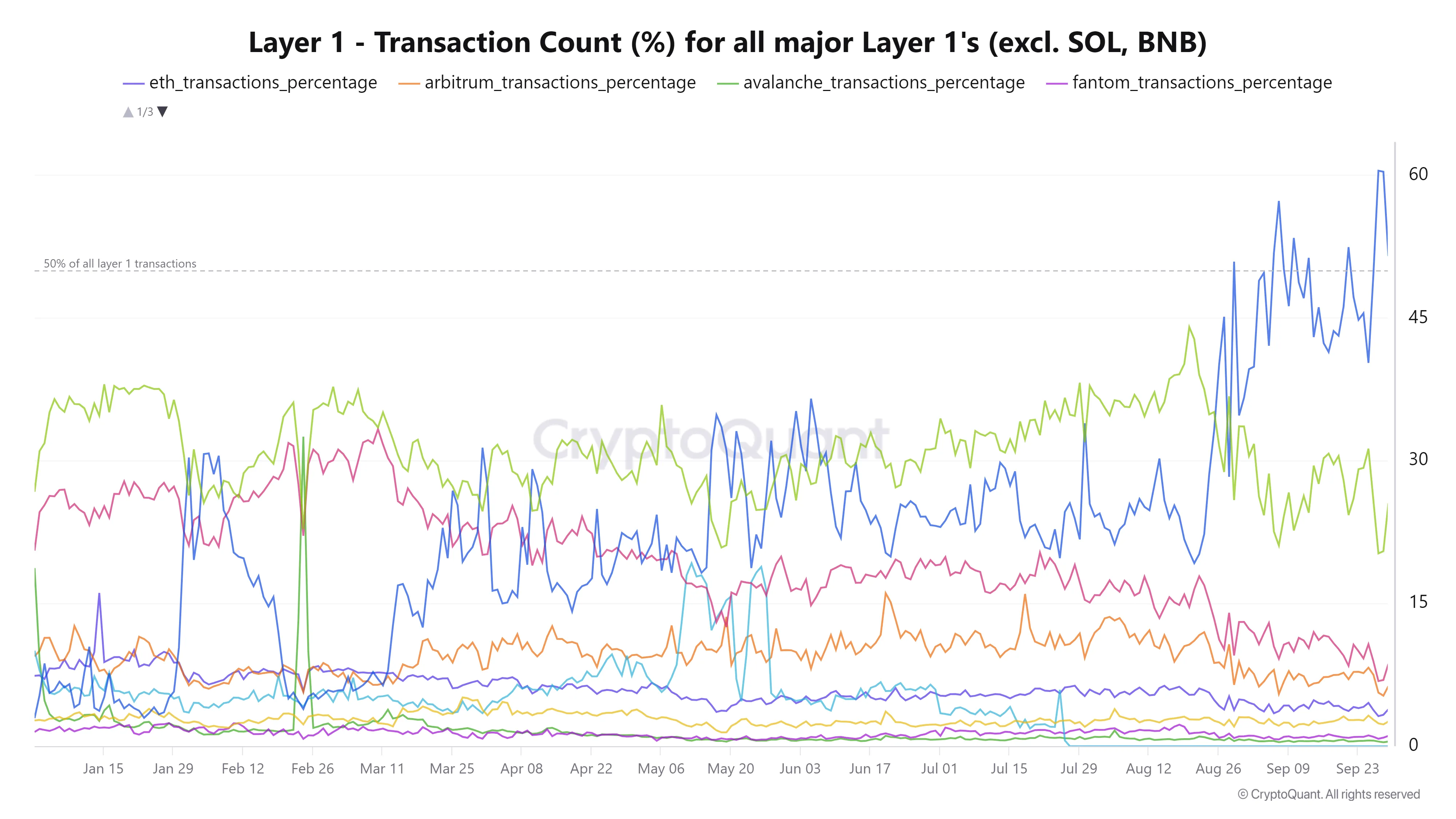

TON Blockchain captured 50% of layer-1 transaction amid major token listings

Among Layer-1 networks, The Open Network (TON) takes the lead, handling a sizable share of transactions in the L1 sector in September.

In 2024, TON blockchain became well known due to several Telegram-related projects that were introduced on its network.

TON Blockchain leads L1 transactions in September

According to transaction volume metrics, TON is the most widely used L1 according to CryptoQuant statistics, holding 50% of the market in the previous month. The research attributes its popularity to significant token releases on its network, such as the well-known tap-to-earn games Catizen and Hamster Kombat, as well as other initiatives like DOGS and Watbird.

In fact, the TON ecology has grown significantly as a result of these clicker games. Shortly after its introduction on The Open Network, the DOGS meme coin hit 17 million token claims, as reported by BeInCrypto.

Additionally, in August, it crossed 5 million unique wallets and reached 28 million monthly active users (MAU), making it one of the most well-liked meme currencies according to holder count. It distinguishes itself from other memecoins and increases participation within the Telegram community.

In a same vein, Hamster Kombat saw a sharp increase. Soon after its release, it became the third-fastest app in history to achieve 150 million users. Since its launch in March, the game has amassed over 300 million users as of late July, setting a spectacular milestone in Web3 game development.

Likewise, the TON blockchain’s success has been greatly aided by Catizen. The native coin, CATI, was accepted by the exchanges Binance and Coinbase during its meteoric rise in popularity. The TON blockchain now controls the majority of L1 transaction volume due to the individual and collective achievements of these projects, among others.

Collin Wu and WuliGy contrasted TON and other projects in a recent podcast to help identify advantages and disadvantages. They claim that TON is the leader in GameFi, luring players in with erratic prizes for increased participation.

“The ecosystems behind these tokens have huge potential, especially in regions like CIS, South Asia, and areas where credit cards are less common. As they gradually embrace Web3 and crypto payments, the growth potential is immense,” Collin Wu and WuliGy said.

Total value locked (TVL) on the blockchain increased by over 40% in September, rising from $311.66 million to $431.98 between August 27 and September 30, according to DefiLlama statistics, with TON controlling the gaming industry.