Amid growing concerns over debt, Robert Kiyosaki warns of hyperinflation and projects that Bitcoin might reach $1 million as it reaches a new all-time high of $109,424.

The author of Rich Dad Poor Dad, Robert Kiyosaki, has strongly cautioned about the status of the American economy. With Bitcoin hitting a new all-time high today, Kiyosaki has forecast that the price of the cryptocurrency might rise to between $500,000 and $1 million in response to these worries.

Robert Kiyosaki’s concerns over the U.S. bond auction

The May 20 U.S. Treasury bond auction catalyzed Robert Kiyosaki’s recent remarks. The author of Rich Dad Poor Dad stated that the Federal Reserve had to purchase $50 billion worth of bonds itself, as no bidders showed up for the auction.

But according to figures supplied by the U.S. Treasury Department, the bid-to-cover ratio was 2.97, with $212.58 billion in bids and $74.38 billion accepted. Official documents show that just $4.38 billion was given to the Federal Reserve’s account. This implies that more people participated than Kiyosaki suggested.

Robert Kiyosaki cautioned, however, that this incident points to a more serious problem with the financial system. He called the Fed’s move “fake money buying fake assets” and claimed it signaled a collapse in confidence in US debt.

Hyperinflation warning amid rising market pressures

According to Robert Kiyosaki, the US is currently experiencing hyperinflation. He thinks that if the government keeps producing money, the value of the dollar will rapidly decline.

“Hyperinflation is here,” he stated on X. “Millions, young and old, to be wiped out financially.” According to him, savings will lose value rapidly, and traditional financial systems may not be able to protect wealth.

In the past, he has cautioned that excessive debt and the lowering of the US credit rating could lead to a serious financial disaster. His most recent remarks continue the theme of economic collapse.

Bitcoin, Gold, and Silver as wealth protection

Robert Kiyosaki, the author of Rich Dad Poor Dad, thinks investors will turn to assets with limited supply in reaction to what he perceives to be a falling dollar. He anticipated that Bitcoin may reach between $500,000 and $1 million, despite his earlier prediction that it would hit $250,000. He predicted that silver may reach $70 an ounce and gold might reach $25,000.

In periods of rising inflation, he believes that these assets make better repositories of wealth. Purchase more. He urged people to hang onto their Bitcoin and cautioned them against selling. In a previous piece, he referred to Bitcoin ETFs as “toilet paper” and cautioned against relying on them.

In order to preserve money, Robert Kiyosaki, who has long backed Bitcoin, frequently counsels his followers to invest in “real gold and silver and Bitcoin.”

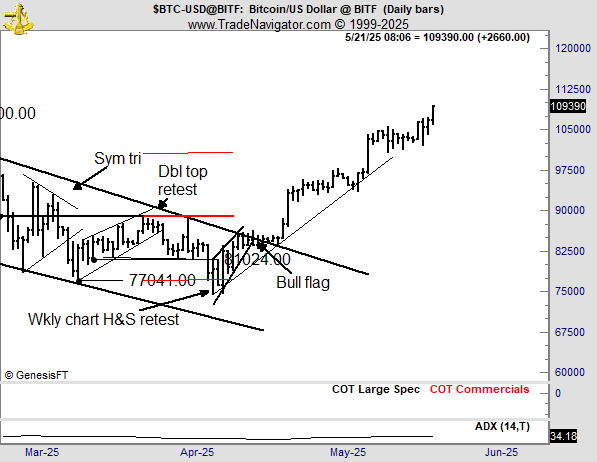

BTC price hits new ATH

As of this writing, the price of Bitcoin has risen to a record high of $109,424. Growing institutional interest, especially from inflows into Bitcoin ETFs, is reflected in the milestone. The cryptocurrency has entered price discovery mode, according to analysts, and fresh highs could be reached.

Bitcoin hitting all-time highs is a typical aspect of a bull market cycle, according to Bitcoin analyst Peter Brandt. By the end of August, he projected a possible peak of $125,000 to $150,000. Jim Cramer cited gold and Bitcoin as safe investments during this trend and urged composure in the face of growing worries over US debt.

As a result, even though Robert Kiyosaki’s top prediction of $1 million is more ambitious, it is consistent with the general bullish attitude in the cryptocurrency market. He thinks this increase will be accelerated by the current financial crisis.

Ripple’s potential Circle acquisition could shift power in stablecoins – and sideline XRP

With a fresh offer of up to $11 billion, Ripple is attempting to buy Circle, the company that issues the USDC stablecoin.

The community is worried that this deal might have unfavorable effects, such as causing a panic in the market or damaging XRP’s position. What does this signify for the cryptocurrency industry, and why is Ripple so intent on purchasing Circle?

Why is Ripple acquiring Circle?

The business that created XRP, Ripple, has long positioned itself as a cross-border payment solution with the goal of displacing established systems like SWIFT. Nevertheless, XRP’s significance has been eclipsed by the swift ascent of stablecoins, such as USDC, and their bright future.

Ripple has the money to bid for Circle solely due to dumping XRP.

They are trying to buy Circle because stablecoins make the usecase XRP was supposed to fulfil utterly useless. They know this, they’ve known it for years while they dumped billions of dollars worth of XRP on… https://t.co/qV28WzPzHC

— Rex (@R89Capital) May 20, 2025

Referencing the protracted Ripple-SEC case, this user also implied that Ripple’s readiness to invest massively in Circle is due to the fact that it has “dumped billions of dollars worth of XRP on retail.” Many other X users have agreed with this viewpoint.

“There has never been a bigger grift in crypto than Ripple. It’s one of the largest frauds in the history of finance,” R89Capital added.

The price stability of stablecoins and their extensive use by conventional financial institutions (TradFi) support the claim that USDC may make XRP obsolete. With a $61 billion market valuation, USDC is supported by significant institutions and serves as a bridge between blockchain technology and traditional finance.

In this regard, purchasing Circle for as much as $11 billion may enable Ripple to take advantage of USDC’s position instead of continuing to compete with it. Additionally, Ripple’s reputation in the online finance industry might improve if it owned USDC. Additionally, the business has recently made a number of acquisitions. In contrast to USDC, Ripple just introduced its own stablecoin, RLUSD, which has a $310 million market capitalization.

By purchasing Circle, Ripple would be able to include USDC into its ecosystem and increase its market share by taking use of Circle’s connections with significant financial institutions. This action may also lessen Ripple’s need on XRP, which stablecoins and other payment methods are posing a serious threat to.

Benefits and risks

But the acquisition has raised serious worries in the crypto world. GwartyGwart, an X user, compared Ripple’s purchase of Circle to “Hooli buying Pied Piper,” implying that there would be unfavorable outcomes similar to those in the television show Silicon Valley.

As Ripple’s dominance of USDC may consolidate power and threaten the decentralized character of the stablecoin ecosystem, X user 0xShual cautioned that the deal might cause “mass panic” in the market. The community worries that if Ripple takes over USDC, it would put its own interests first, undermining the openness and confidence that USDC has established.

Notwithstanding these reservations, Ripple has prospects as a result of the transaction. With competitors like Tether (USDT), Ripple might emerge as a significant force in the stablecoin market if the acquisition is successful.

Ripple will have a difficult time closing the acquisition, though, given Circle’s initial refusal and pressure from rivals like Coinbase. The Ripple-Circle acquisition is a calculated move in the current cryptocurrency market and a test of Ripple’s resolve to change the course of digital finance.

Worldcoin sells $135 million in WLD tokens to a16z and Bain Capital Crypto

By buying WLD tokens directly from a16z and Bain Capital Crypto, Worldcoin was able to raise $135 million. WLD’s overall circulating supply increased in tandem with this.

These monies will be used by the business to keep collecting biometric data in the United States. Eye-scanning physical infrastructure was just launched in six US cities, and it intends to open many more.

Worldcoin fundraises with WLD tokens

This WLD auction was promoted on social media by Worldcoin, the iris-scanning identity verification initiative founded by OpenAI creator Sam Altman.

As Worldcoin extended these activities in May, the business stated in a news statement that the $135 million investment will mostly go to biometric identification verification in the US.

The funding comes from two of World’s earliest backers and long-term holders — a16z and Bain Capital Crypto.

This wasn’t a venture round. It was a direct purchase of non-discounted liquid tokens.The circulating supply of WLD has thus increased correspondingly.…

— World (@worldcoin) May 21, 2025

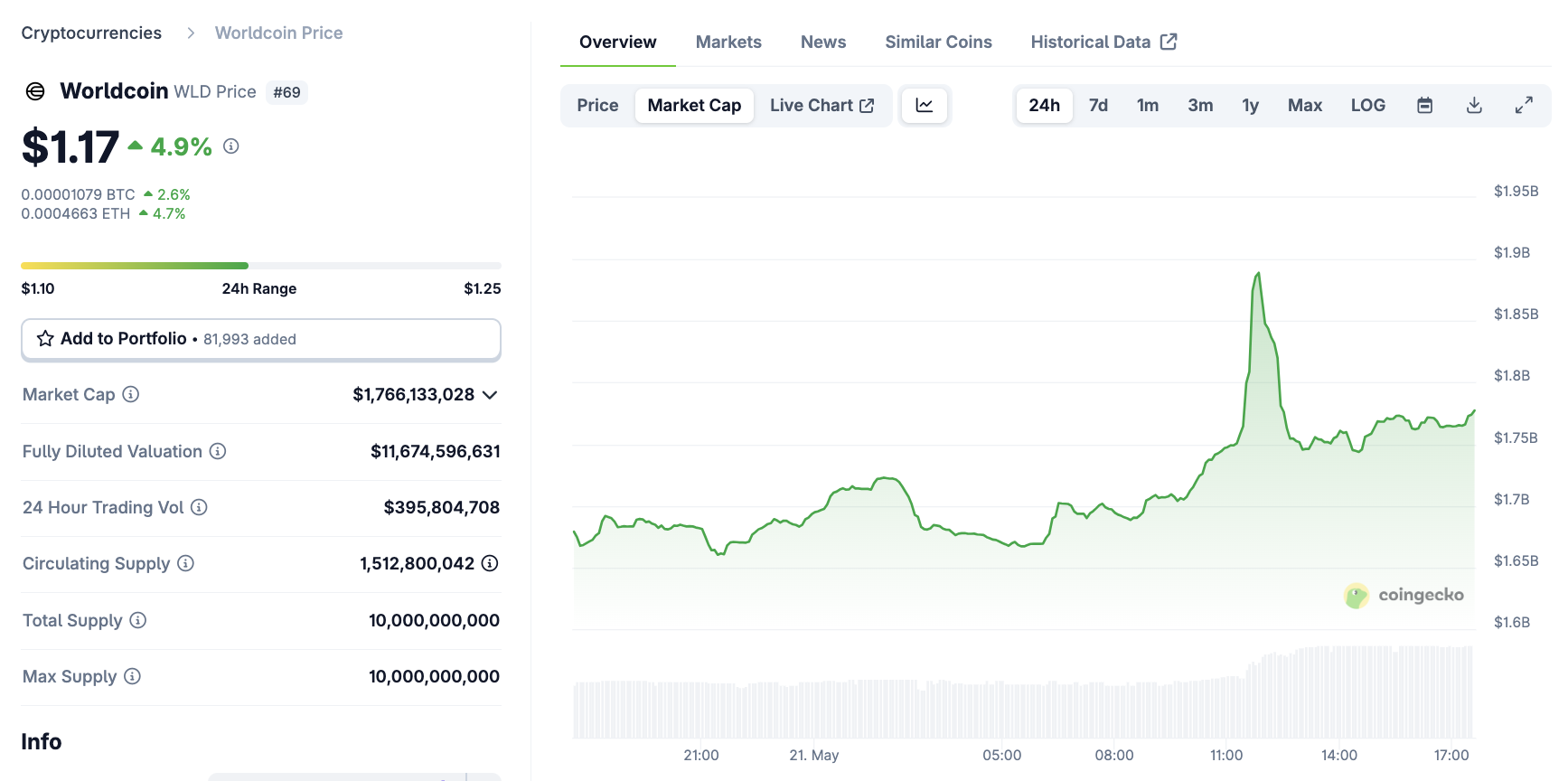

In fact, this Worldcoin investment agreement is relatively noticeable in publicly available price data because it significantly boosted the supply of WLD tokens.

Prior to the public release, WLD’s market value rapidly increased by $135 million in less than an hour. This is a rather amazing coincidence if it has nothing to do with the investment arrangement.

In any case, Worldcoin may benefit greatly from this significant WLD investment. German officials rejected the company’s data collecting last December, and this month, Kenya and Indonesia also came to similar decisions.

Rumors about OpenAI social media integration caused WLD to rise recently, but nothing came of it.

Worldcoin listed a couple additional donors in addition to a16z and Bain Capital Crypto, both of which have made significant cryptocurrency investments in recent months.

Arctic Digital, Selini Capital, and Mirana Ventures took part in a conventional investment round for Worldcoin that reportedly did not use WLD coins.

This significant investment will allow Worldcoin to continue expanding its activities in the United States and increase the visibility and circulation of WLD.

The business talked of expanding its user base, building out its physical infrastructure, and exploring the potential of AI technology in general, but it made no further concrete promises about the $135 million.