The SHIB price has surged significantly due to the Shiba Inu volume burst and whale activity, with bulls aiming for more 100% gains in the near future.

Shiba Inu (SHIB), the second-largest meme coin in the world, has surged 23% in the previous day and is getting closer to $0.0000191, igniting another frenzy in the cryptocurrency market. It’s interesting to note that the SHIB Price increase coincides with a 240% increase in daily trading volumes, surpassing $1.36 billion, which is reminiscent of the massive bull run of 2021.

Shiba Inu FOMO kicks in again

The Shiba Inu (SHIB) has had a significant 43% increase over the previous nine days because to the increased on-chain activity, according to data from the cryptocurrency analytics site Santiment. The significant volume spurt, robust SHIB circulation, and the spike in SHIB whale transactions to 10-week highs are key indicators of this rally. In addition, traders are experiencing a high case of FOMO (fear of missing out) as a result of the growing social dominance of SHIB.

Moreover, the Santiment data indicated that a local peak would be possible as a result of the significant price increase. Shiba Inu is currently the 13th biggest cryptocurrency on the market with a market cap of $11.3 billion and a price of $0.00001901 as of the time of publication. A breakout over $0.000020 with robust trading volumes is required by the bulls in order for the SHIB Price to reach the high of $0.000043 set in February.

The second-largest meme currency in the world’s derivatives data demonstrates strength as well, with open interest rising by 65% to surpass $60 million. Furthermore, according to Coinglass statistics, the amount of Shiba Inu liquidations completed in a 24-hour period has increased to $2.23 million, of which $1.29 million are short liquidations. Additionally, the chart below demonstrates a sharp increase in the financing rate, indicating that traders of SHIB futures are feeling positive.

SHIB price rally to continue?

As previously said, there may be a 100% increase in price in the next weeks if the bulls are able to achieve a SHIB Price breakthrough over $0.20. Investors are want to see, though, if the meme coin will repeat the 2021 bull run, which saw a 45000% increase in value between January and May.

The Shiba Inu has been called to rally to $1, but an exponential volume spike would be required for this to happen. Furthermore, billions of SHIB remain in circulation despite the burn attempt, which would complicate such a large rise.

However, the SHIB ecosystem has been moving forward with the development of the SHI stablecoin. In addition, the Layer 2 network Shibarium’s total value locked (TVL) has increased to a record-breaking $3.64 million.

Bitcoin buyers throw $366M into US ETFs as BTC pushes above $65K

On September 26, late trading saw Bitcoin surpass the $65,000 barrier, and US-listed spot Bitcoin ETFs saw inflows of almost $360 million that day.

Spot Bitcoin exchange-traded funds had a daily inflow of the highest amount in over two months in the US as the commodity went above $65,000 in late trading on September 26.

According to early statistics from Farside Investors, the eleven spot Bitcoin ETFs in the US had an aggregate inflow of $365.7 million on September 26.

The massive ETF inflow is the most since a $486 million influx on July 22. Additionally, it is the sixth trading day in a row that institutional investment products have seen inflows.

With an inflow of $113.8 million, the ARK 21Shares Bitcoin ETF (ARKB) took the lead, closely trailed by the BlackRock iShares Bitcoin Trust (IBIT) with $93.4 million.

With $184.4 million, BlackRock saw its biggest inflow day in over a month on Wednesday, September 25.

Inflows into the Bitwise Bitcoin ETF (BITB) totaled $50.4 million, the VanEck Bitcoin ETF (HODL) received $22.1 million, and the Fidelity Wise Origin Bitcoin Fund (FBTC) had inflows of $74 million.

The Invesco, Franklin, and Valkyrie ETFs saw slight inflows at this time; they had respective values of $6.5 million, $5.7 million, and $4.6 million.

The single withdrawal, $7.7 million, came from the Grayscale Bitcoin Trust (GBTC), raising the total outflow since it changed to a spot ETF in January to $20.1 billion.

With this most recent capital infusion, the total amount of money invested in all eleven spot ETFs since their launch has reached $18.3 billion.

President of ETF Store Nate Geraci said the following in a post on X on September 27, in response to the massive influx:

“For context, out of 500 ETFs launched in 2024, less than 25 have taken this amount in for the *entire year*.”

Spot Bitcoin ETFs are “92% of the way to owning 1 million Bitcoin and 83% of the way to passing Satoshi as the top holder,” according to remark made by Bloomberg ETF analyst Eric Balchunas on September 25.

Following the Fed’s interest rate reduction, the spot price of Bitcoin (BTC) has increased by about 13% over the last two weeks.

Spot Ethereum (ETH) ETFs, however, don’t have the same traction as nine funds had a $100,000 withdrawal on September 26, according to Farside Investors.

The withdrawal occurred in spite of the fact that Fidelity and BlackRock both saw inflows of more than $15 million into their respective spot Ethereum funds. The high-fee Ethereum Trust (ETHE) offered by Grayscale is still losing money; on Thursday, it lost an additional $36 million.

Robinhood and Revolut eye stablecoin market as regulation threatens Tether’s dominance

Both Robinhood and Revolut are thinking about launching stablecoins since the EU’s Markets in Crypto-Assets (MiCA) regulation might challenge Tether’s dominant position in the industry.

Nevertheless, there are rival companies, and neither company has provided any definitive guarantees.

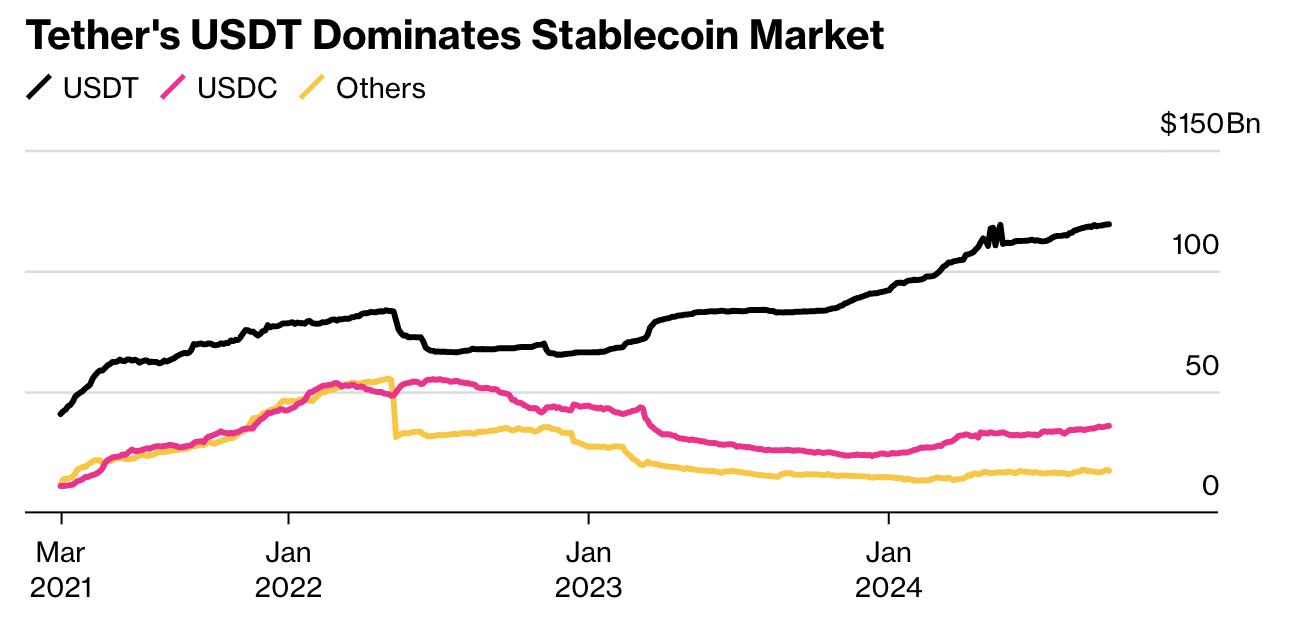

Tether’s market domination

According to Bloomberg, two significant fintech companies, Robinhood and Revolut, are thinking about getting into the stablecoin space. The two businesses want to challenge Tether’s hegemonic position in the stablecoin industry. No staff members have spoken out on the record, and neither business has formally made any concrete promises on the matter.

Even so, the moment is perfect. Not just Revolut and Robinhood, but other large capital businesses would also be investigating stablecoins.

A new stablecoin backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) was introduced by Ethena Labs on Thursday. By linking the value of this stablecoin to BUIDL, a fund that consists of US dollars, short-term US Treasury bills, and repurchase agreements, it is intended to mimic the stability of regular stablecoins.

MiCA: A huge opportunity

There’s a straightforward explanation for this intense curiosity. The EU’s new comprehensive crypto legislation, known as MiCA, will shortly go into force and have strict guidelines for stablecoins.

Although Circle already has the necessary licenses to conduct business in the EU, it hasn’t presented a significant threat to Tether’s hegemony in more than two years. The whole EU market would be open to new competitors if Tether is unable to comply with regulations. That’s an offer too good to refuse, particularly for large companies like Revolut and Robinhood.

“Many businesses have looked at the likes of Circle and Tether and the figures they’ve posted. It sounded like a beautiful business model, and there are many out there that might want to replicate tha,” Thomas Eichenberger, Chief Product Officer at Sygnum, said.

After all, Tether employed about 100 workers when it made a $5.2 billion profit earlier this year, according to Bloomberg. In terms of assets under management (AUM), it is extremely large.

Globally, the demand for stablecoins is expanding, particularly in developing nations. A growing number of users are utilizing stablecoins for regular transactions or as a value store. There has also been a lot of interest in their potential to assist users in avoiding US sanctions.

Investors were drawn to the prospect of upending Tether and Circle’s duopoly even prior to the unique potential presented by MiCA. For this very reason, PayPal introduced its own stablecoin a year ago, and as of right now, it is getting close to $1 billion. However, Tether has about $120 billion. There won’t be a lack of competitors if the EU as a whole has the opportunity to surpass it.

However, neither Robinhood nor Revolut have yet to make any official promises. But they’ll need to move quickly if they want to benefit from MiCA. There are still certain exchanges in the EU that have not fully delisted Tether stablecoins.

Tether intends to function within a legally ambiguous region, yet Circle is already compliant anyway. There is a fairly broad spectrum of probable results.