A wallet started burning about $21 million worth of coins, which caused the Shiba Inu burn rate to increase by over 16600%. This happened during the current SHIB price drop, and the limited supply may cause the price to rise later.

Due to a sharp rise in its token burn rate, Shiba Inu (SHIB) meme coin—named after its canine mascot—has recently attracted a lot of interest in the cryptocurrency market. Shibburn, a platform that monitors the burning of SHIB tokens, reports that on Tuesday, June 4, there was an astounding increase in the burn rate of around 16,600%. But this increase coincides with a drop in the price of SHIB, raising the possibility of a future rise.

Shiba Inu community initiates $21.5M SHIB burn

The increase in SHIB token burning has made traders and investors quite excited. It lowers the total amount of SHIB in circulation, which might increase its value. According to Shibburn, the SHIB token burn rate increased by 16593.83% over the previous day.

A total of 21.5 million SHIB tokens were burnt by the community during this time through a variety of transactions. Furthermore, one wallet address came to light as the primary cause of the increase in Shiba Inu burn rate.

The noteworthy donor that used wallet address 0x498 In one transaction, a staggering 21.31 million SHIB tokens were moved to a dead wallet. Token burning were also carried out by other members of the Shiba Inu community, which increased the burn rate.

The total quantity of SHIB tokens burnt as a result of these significant transactions is an astounding 410.72 trillion. One important element that may raise the SHIB token’s value is the reduction in supply. Additionally, there may be greater benefits if demand stays the same or rises.

In economics, for example, a decrease in supply combined with a steady or increasing demand usually results in price appreciation. SHIB is one of the cryptocurrencies that fall under this rule. The community of Shiba Inus has experienced a surge of hope as a result of the latest events.

SHIB price tumbles

Shiba Inu pulled away from the critical resistance level of $0.000025 today, plunging below the critical support of $0.000024. As of this writing on Tuesday, June 4, the SHIB price dropped 3.30% to $0.00002388. At the same time, the meme cryptocurrency’s market value was $14.09 billion.

But on the last day, the SHIB trade volume increased 42.35% to $659.67 million. Even though the burn rate has raised investor confidence, the price of Shiba Inu won’t rise till the meme currency breaks beyond the $0.000025 threshold.

Check Out the Latest Prices, Charts, and Data of SHIB/USDT

The price of SHIB may rise beyond this barrier and hit $0.000030 or perhaps $0.000050. Furthermore, Shiba Inu may reach the long-eyed $0.0001 objective, which some detractors believe is unachievable, provided the bullish momentum continues. The derivatives data, however, showed a different story.

The SHIB futures open interest dropped 13.95% to $89.77 million, as reported by Coinglass, showing a dip in interest among derivatives traders. Additionally, there were no significant short liquidations despite Shiba Inu long liquidations rising to about $1 million, suggesting additional falls as a result of the sell-off.

CFTC appoints Aptos Labs CEO to its digital assets committee

The hiring of Shaikh strengthens Aptos’ credibility. Aptos Labs is getting ready to release an extra 11.31 million tokens, worth $103 million, next week.

The CEO of Aptos Labs, Mo Shaikh, has been selected by the U.S. Commodities and Futures Trading Commission (SEC) to its digital assets subcommittee, in an apparent effort to close the divide between the traditional financial markets and the digital assets sector.

CFTC’s digital assets markets subcommittee

A key player in influencing the CFTC’s rulemaking on global commerce and business is the Global Markets Advisory Committee’s (GMAC) Subcommittee on Digital Assets Markets. Comprising of top financial executives from major corporations such as Citadel, Goldman Sachs, and HSBC, the GMAC was established in 1998.

Prominent executives from BNY Mellon, Polygon Labs, Uniswap Labs, and BlackRock are among the 34 members of the subcommittee. The CFTC receives invaluable guidance from these industry representatives, which aids in navigating the complexity of digital asset regulation. Shaikh, a member of the subcommittee, reportedly applied in writing for his job, according to DL News.

Aptos represents Web3

With Shaikh’s selection, Aptos, a Layer 1 blockchain that debuted in October 2022, gains even more credibility. The network was created by former workers of Facebook’s parent firm, Meta Platforms. Prior to its discontinuation in February 2022, Facebook’s blockchain project Diem was the focus of both Shaikh and co-founder Avery Ching’s efforts. Shaikh stated:

“Not only do we represent L1s, but we also represent a lot of the projects in the Web3 space — and [are] happy to be a voice for them along the way.”

Move, a programming language that was first created for Diem, is used by Aptos to power a blockchain network that is intended to execute transactions more quickly than Ethereum. Notable venture capital firms Andreessen Horowitz and Jump Crypto have contributed $400 million to Aptos Labs investment.

Additionally, Aptos Labs will see a token unlock next week. On June 12, 2024, Aptos will issue a further 11.31 million tokens, valued at around $103 million, after its last token unlock.

The blockchain network intends to release 105.63 million tokens into the market between May 2024 and October 2026, according to the tokenomics portal Token Unlocks. On July 12, 2024, 11.30 million APT tokens are expected to be unlocked and put into circulation.

Crypto miner Core Scientific inks $3.5B deal to diversify into AI

Core Scientific and CoreWeave, a cloud service provider supported by Nvidia, have inked a $3.5 billion, 12-year deal.

With this important alliance, Core Scientific is taking a bold step into machine learning and high-performance computing (HPC) as it expands its business beyond Bitcoin mining. Additionally, CoreWeave will improve Core Scientific’s current infrastructure, enabling it to support sophisticated applications of artificial intelligence (AI).

Crypto miners diversify into AI

The two companies’ prior partnership is extended under this agreement. The plan is to transform Core Scientific’s buildings into state-of-the-art data centers tailored to certain applications. These improvements are essential for the sophisticated computational operations that contemporary AI technologies require.

As per the financial conditions of the collaboration, CoreWeave will take care of all first capital investments, which include a substantial $300 million set aside for infrastructure improvements. Through hosting fees, these investments will be carefully recovered, relieving financial pressure and lowering risk exposure.

With the contracts expected to bring in around $290 million a year in revenue, Core Scientific expects a substantial increase in profitability that will increase shareholder value. In the meantime, Core Scientific’s stock has increased 40% so far this year.

CEO Adam Sullivan emphasized this diversification’s strategic vision.

“Our expanding relationship with CoreWeave creates a pathway for Core Scientific to diversify our business model and balance our portfolio between Bitcoin mining and alternative compute hosting, positioning us to maximize cash flow and minimize risk while maintaining our significant exposure to Bitcoin’s upside potential,” Core Scientific CEO Adam Sullivan said.

Given that Core Scientific recently emerged from bankruptcy due to the collapse of the Bitcoin market in 2022, the timing of this acquisition is critical. The corporation has overcome financial difficulties under Sullivan’s direction by reorganizing debt and making a shift to more viable commercial strategies.

Additionally, the deal has opportunities for additional growth, enabling CoreWeave to expand its capabilities at the locations of Core Scientific. The goal of these continuing talks is to get more contracts that would greatly expand Core Scientific’s capabilities.

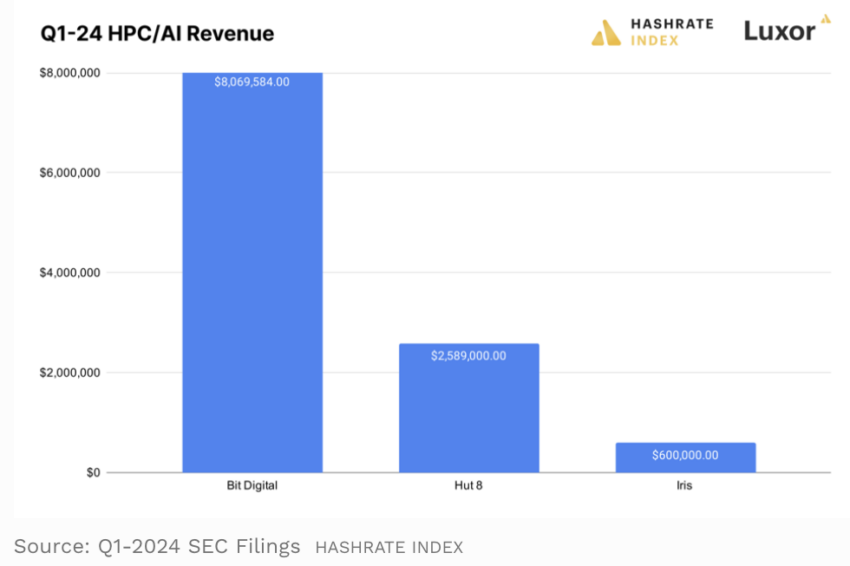

The rising need for AI infrastructure, spurred by ground-breaking technologies like OpenAI’s ChatGPT, is what is driving the trend towards AI and HPC hosting. Investments in the industry have soared as a result of this upsurge, and several businesses—including Core Scientific’s competitors Bit Digital, Iris Energy, and Hut 8—are expanding their income sources beyond Bitcoin mining.

Experts in the field confirm that while AI activities need a larger initial outlay, they also generate bigger earnings than Bitcoin mining. The strategic benefit for Bitcoin miners was highlighted by James Butterfill, Head of Research at CoinShares.

“Bitcoin miners, often stationed in energy-secure and energy-intensive data centers, find these facilities ideal for AI operations as well,” Butterfill said.