Bitwise, an asset management, is preparing to launch a spot Solana ETF as enthusiasm increases about Donald Trump’s crypto-focused transition this month.

Bitwise Invest is the latest asset manager to submit documentation for the spot Solana ETF registration. With this submission, Bitwise is now competing with other market participants such as VanEck and Canary Capital to bring the SOL ETFs to market. The filing comes as the SOL price is barely 10% away from reaching a new all-time high.

Bitwise files for spot Solana ETF

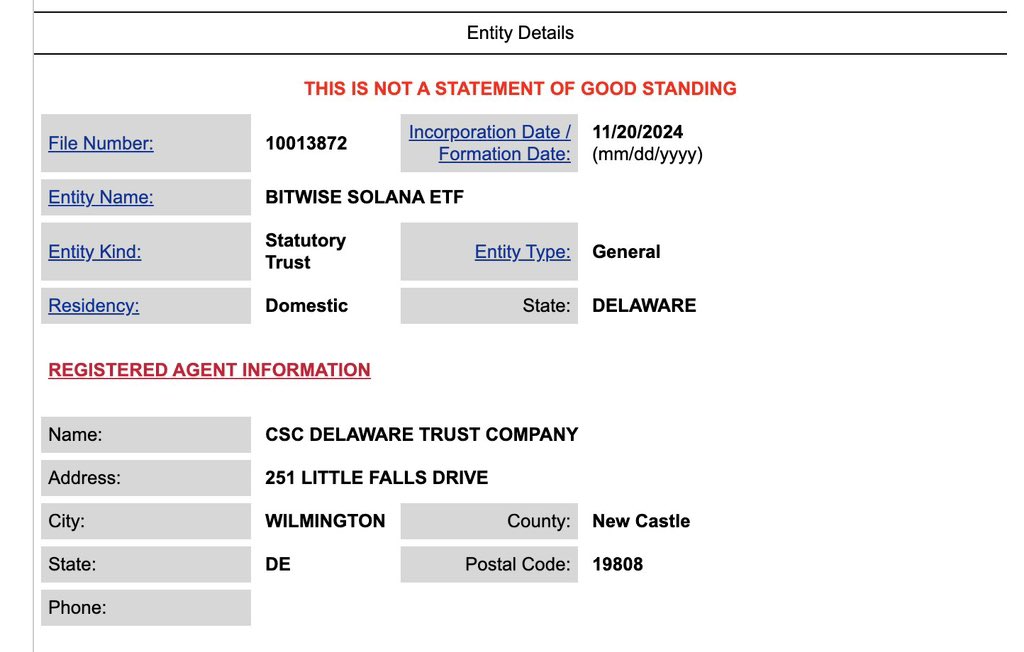

According to the State of Delaware’s Division of Corporations website, Bitwise has currently filed a statutory trust for its intended Solana exchange-traded fund (ETF). Notably, this is only registration, and the asset management must complete further preliminary filings with the United States Securities and Exchange Commission (SEC).

To compete with VanEck and Canary Capital in the Solana ETF competition, Bitwise must submit the 19b-4 and S-1 filings to the US Securities and Exchange Commission. However, the asset management has remained steady in its approach to cryptocurrency ETFs, with the Bitcoin ETF (BITB) and Ethereum ETF (ETHW) now trading on Wall Street. Last month, the asset management filed for a spot XRP ETF.

With Donald Trump due to take over the White House in January 2025, the frenzy around spot Solana ETF has grown dramatically. Under the Trump administration, there is renewed optimism for a cryptocurrency regulatory framework and greater transparency. The Trump-Vance transition team is meeting with crypto industry leaders to establish a White House office to investigate crypto policies.

Demand grows for XRP, HBAR, DOGE ETF

Citing the recent wave of advancements in the crypto ETF industry, ETF Store President Nate Geraci stated that numerous prominent cryptocurrencies, including Solana (SOL), Ripple’s XRP, and Hedera (HBAR), are now registering for spot ETFs. Canary Capital submitted the first spot HBAR ETF application last week.

He also stated that ETF providers might broaden their products to include assets such as Cardano (ADA) and Avalanche (AVAX). Bloomberg’s senior ETF analyst Eric Balchunas commented on this, predicting that a DOGE ETF filing will be available by December 31, 2024. This comes amid a massive Dogecoin (DOGE) price increase so far in November.

I would view it as a marketing expense if I were an issuer…

No brainer.

— Nate Geraci (@NateGeraci) November 21, 2024

Solana prices stayed solid at their critical resistance level of $240. Market analysts forecast a new all-time high for SOL, with a surge exceeding $300 before the end of the year. Currently, it’s a battle between the bulls and the bears, as the market waits for another trigger for additional surge amid anticipation for the spot Solana ETF.

Elon Musk, Vivek Ramaswamy outline bold D.O.G.E US workforce plan: details

Elon Musk and Vivek Ramaswamy want to shrink the government workforce by reducing rules during Donald Trump’s presidency.

Elon Musk and Vivek Ramaswamy have outlined a thorough proposal for decreasing the government workforce under President-elect Donald Trump’s leadership. Their proposal stresses a large-scale decrease in government personnel, which they claim would be possible with the repeal of various rules.

Elon Musk and Vivek Ramaswamy unveil plan to slash US workforce

In a recent Wall Street Journal article, Elon Musk and Vivek Ramaswamy, designated co-heads of the newly established Department of Government Efficiency (D.O.G.E.), described their strategy to simplify the government workforce. This ambitious proposal suggests converting certain federal employees to “Schedule F,” which would strip them of customary job protections. The move will eventually shrink the size of the government workforce.

The Wall Street Journal op-ed corresponds with Supreme Court rulings, which the duo claims give the next government the authority to make broad changes.

The proposal as presented is strongly related to the Trump administration’s overarching aims of lowering federal spending and bureaucratic bureaucracy. The Tesla CEO and Ramaswamy argue that by reducing government restrictions, many federal positions will inevitably become redundant.

The pair emphasized their devotion to the work ahead, saying,

“We will serve as outside volunteers, not federal officials or employees. Unlike government commissions or advisory committees, we won’t just write reports or cut ribbons. We’ll cut costs.”

They also said that a partnership with Trump’s transition team is now underway. This collaboration will assemble a group known as “small-government crusaders.” These professionals will work with the White House Office of Management and Budget.

Regulatory reduction and its impact on federal employment

Elon Musk and Ramaswamy argue that decreasing the amount of federal rules will directly affect the number of government workers. They contend that fewer restrictions necessitate fewer staff to enforce them. This will result in a decrease in the government workforce.

The policy is mainly based on previous Supreme Court decisions that uphold the president’s right to remove regulations that go beyond the authorities assigned by Congress.

Elon Musk and Ramaswamy elaborated on their D.O.G.E method, citing two specific Supreme Court cases: West Virginia v. Environmental Protection Agency (2022) and Loper Bright v. Raimondo (2024). These examples, according to the couple, highlight the limits of federal regulatory bodies’ capabilities.

Implementing Elon Musk and Ramaswamy’s strategy will result in one of the government’s most substantial restructurings. According to a recent article, Ripple CLO Alderoty’s plea to D.O.G.E. may result in a full inquiry of the SEC’s financial activity.

SHIB burn rate surges 2200%, Shiba Inu coin eyes parabolic rally ahead?

SHIB burn rate skyrocketed 2200%, indicating that the Shiba Inu currency is poised for a parabolic run, aided by recent positive on-chain statistics.

The recent SHIB burn rate statistics has spurred significant bullishness in the famed dog-themed meme currency, Shiba Inu. On Thursday, the token’s burn rate increased by an astounding 2200%, amid speculations of a probable asset price surge ahead. For background, recent on-chain indicators have investors optimistic about the meme token’s potential for a parabolic climb, owing to the continuing bull run in the larger industry.

SHIB burn rate pumps 2200% delivering massive blow to supply

According to an X post from the official tracker Shibburn on November 21, the SHIB burn rate increased 2225% intraday, with 14.58 million coins burned. This large burn rate rise has a significant impact on the meme token’s circulating supply.

According to the statistics, the total supply at the time of reporting was estimated at 589.26 trillion tokens. Simultaneously, the weekly burn statistics revealed that 50.06 million coins were torched in the previous seven days.

HOURLY SHIB UPDATE$SHIB Price: $0.00002395 (1hr -0.08% ▼ | 24hr -7.14% ▼ )

Market Cap: $14,066,105,964 (-7.54% ▼)

Total Supply: 589,262,168,453,842TOKENS BURNT

Past 24Hrs: 14,582,917 (2225.34% ▲)

Past 7 Days: 50,067,595 (-92.03% ▼)— Shibburn (@shibburn) November 21, 2024

Overall, the large burning chronicles have boosted market sentiment for the top dog-themed meme coin as supply continues to dwindle. Notably, the SHIB burn mechanism attempts to eliminate the token’s excess market supply by sending tokens to a null address. In turn, the token anticipates a strong market mood due to the law of supply and demand, as these null-address tokens can never be utilized again.

Shiba Inu parabolic rally ahead?

Despite the aforementioned burn rate rise, the Shiba Inu coin’s price declined 2% intraday and is now trading at $0.00002386. The token’s 24-hour low and top prices were $0.00002311 and $0.00002478, respectively. Although the declining trend created concern among investors, it is worth noting that the monthly chart showed gains of 30%. This larger positive direction is consistent with the monthly SHIB burn rate statistics, which showed 192.78 trillion tokens burned this month.

Simultaneously, a new SHIB price research has fueled market excitement for the coin. A crypto price projection highlights significant reasons why investors should not sell the coin, particularly in the context of a larger meme coin bull market.

Furthermore, new on-chain data suggests that the meme sector is primed for a significant boom. This research has also raised hopes for a continued surge in top meme currencies like as SHIB, DOGE, PEPE, and others. Notably, meme currencies like as PEPE and DOGE have increased by 90% to 169% during the last month.