The number of daily network users on Solana’s blockchain has surpassed prior milestones.

Despite the fifth-largest cryptocurrency going back to its lows between April and January, Solana (SOL) registered the most daily active addresses in blockchain history, according to statistics from Artemis.XYZ. A single SOL coin was valued around $136 at the time of publication.

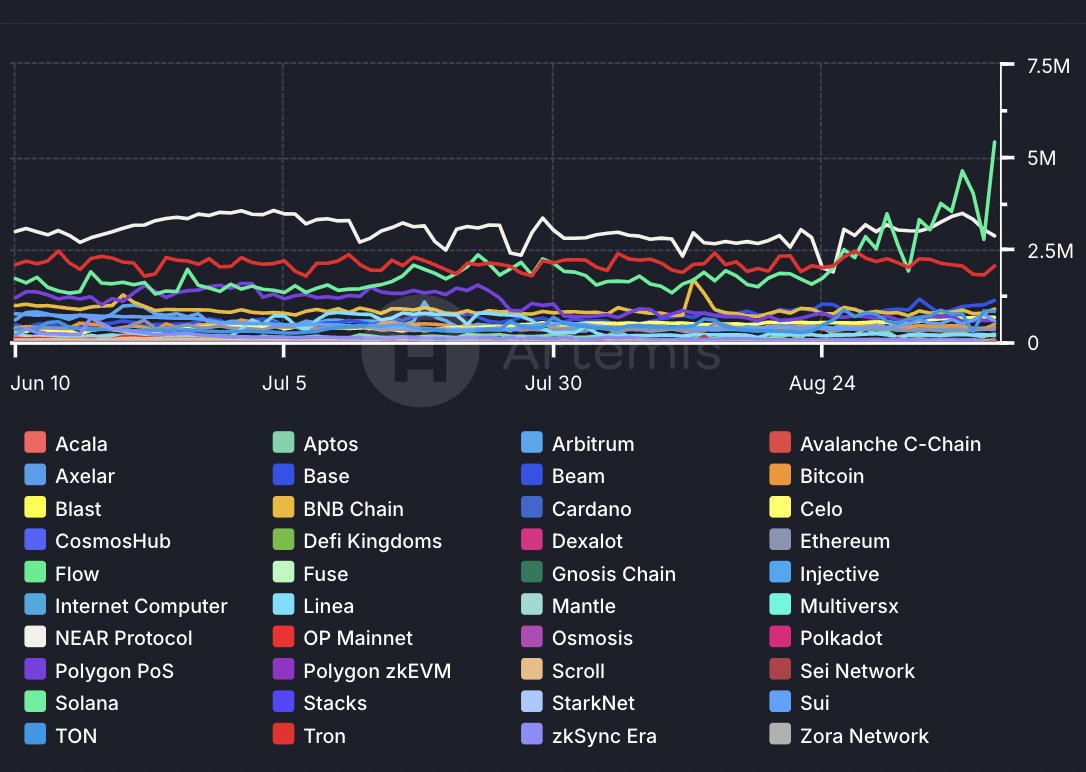

On September 10, Artemis reported that SOL’s 24-hour users surpassed five million, although the closest competitor in the chain had slightly more over 2.5 million daily active wallets on the same day.

Solana’s activity surges, but memecoin sector slips

Despite a decline in activity in the memecoin sector, Solana achieved its milestone of having active addresses. More specifically, since its peak in late July, Pump.fun has produced less revenue.

Data from last week verified an 80% drop in the launchpad’s earnings from memecoin. There has been a significant decline in general SOL fees and pricing since July, which suggests a relationship between SOL revenue and Pump.fun activity.

Is the Pump.fun casino crashing?

Pump.fun’s regression may indicate a diminishing trend for Solana memecoins, even while overall crypto values are still unstable. With a revenue of $100 million, the protocol became the fastest decentralized finance platform to reach this milestone in just seven months. Though many disagree on whether the platform was ultimately beneficial for cryptocurrencies and DeFi, its peak may have gone.

When Pump.fun was at its peak, developers could release more than 500,000 tokens in a single month. Memecoins swamped SOL-based exchanges such as Raydium, making quick millionaires out of speculative investors or erasing 99% of money in a matter of seconds in other cases.

Memecoin pioneers like Vitalik Buterin voiced worries about the behavior as SOL’s chain became as a hub for the cryptocurrency. The main concerns were about Pump.fun’s viability and the casino-like atmosphere it fostered.

Pump.fun is still operational nonetheless, producing a large number of memecoins every day. According to a crypto.news research, poor average gains were associated with meme token oversaturation. From the speculative bets, less than 1% of memecoin traders made over $1,000.

MAGA price tanks 10% as Trump Harris debate skips crypto talks

Shortly after the Polymarket data revealed a 3% decline, the MAGA price decreases. After the Trump-Harris debate, Trump’s odds of winning the election.

Shortly after the Trump-Harris debate concluded on Tuesday, MAGA (TRUMP), the well-known meme currency with a Trump motif, has seen extreme selling pressure. Currently trading at $2.88 with a market capitalization of $126 million, the MAGA Price is down 10.72%. Following the first Trump-Harris presidential debate, this occurred as the likelihood of Donald Trump winning the election decreased.

MAGA price tanks more than 10%

All of the Trump-themed meme coins have seen a sharp increase in value this year as a result of Donald Trump’s extensive use of cryptocurrency throughout his presidential campaign. In early June of this year, the price of MAGA exceeded its highest point, which was $17.1. But since then, its value has dropped by more than 80%, and it is presently less than $3. It is still selling 4513% higher than the current market price in spite of this.

The price of MAGA has just dropped, and Polymarket data indicates that the likelihood of Trump winning the election has drastically decreased, from 3% to 49%. In contrast, Kamala Harris had a 3% increase in support during the first presidential debate.

The debate ends with Trump and Harris tied.

55 days to go. pic.twitter.com/MGpsIl6It8

— Polymarket (@Polymarket) September 11, 2024

Trump Harris debate skips crypto talks

There was no mention of cryptocurrency during the first Trump-Harris debate, which was moderated by ABC News on Tuesday, September 10, which left the whole community a little let down. Donald Trump has an advantage over the vice president in this particular sector. As CoinGape noted, Kamala Harris made policy judgments that totally disregarded cryptocurrency.

The two presidential candidates sparred on important topics at yesterday’s debate, which was also tainted by some personal jabs. To early this year, cryptocurrency companies have contributed $119 million to super PACs like Fairshake PAC in order to promote the candidate of their choosing.

Although former President Donald Trump has been more accepting of cryptocurrency challenges, this was regrettably not discussed during the debate. As a result, there is some selling pressure on other cryptocurrencies with a Trump theme in addition to the MAGA price. If elected again in November 2024, Trump has pledged to put a stop to the “un-American and unlawful crackdown” on the cryptocurrency business.

On the other hand, the Crypto4Harris campaign, which aims to enhance the Vice President’s image, is an attempt by the Kamala Harris team to connect with the cryptocurrency sector. To yet, though, she hasn’t lived up to the rhetoric, since representatives of the cryptocurrency business have stated that the Harris administration hasn’t taken any significant action.

LayerZero becomes BitGo’s official interoperability protocol for WBTC

LayerZero has been chosen by BitGo to be the official interoperability supplier for the Wrapped Bitcoin token by the digital asset custody company.

LayerZero stated on September 10 that BitGo’s Wrapped Bitcoin now adheres to LayerZero’s Omnichain Fungible Token standard. Among the projects that currently use OFT are EtherFi, Swell, and Ethena.

BitGo expands WBTC to BNB Chain and Avalanche

With the intention of integrating Bitcoin (BTC) into the DeFi ecosystem on Ethereum (ETH), BitGo and its partners introduced Wrapped Bitcoin in 2019. In order to access decentralized financial apps for lending, borrowing, trading, and other services, Bitcoin holders can utilize WBTC.

LayerZero was chosen by BitGo concurrently with the company’s expansion of its WBTC token, a valuable asset in the decentralized financial field, to two other blockchain networks: BNB Chain and Avalanche.

WBTC is now accessible on a number of networks, including Osmosis, Tron (TRX), Base, and Ethereum. According to DeFiLlama, the two most recent integrations, BNB Chain and Avalanche, are ranked fourth and seventh, respectively, in terms of total value locked.

Native WBTC minting

LayerZero claims that BitGo’s use of the OFT Standard for WBTC permits native token usage and cross-chain transfer.

On the supported chains, users will be able to mint WBTC natively without having to worry about the dangers involved with token bridging from Ethereum. In addition to omnichain composability, unified supply and modular security are advantages of utilizing LayerZero for WBTC interoperability.

BitGo will establish its own decentralized verifier network as part of the partnership with LayerZero, which will be crucial in making sure that each and every omnichain WBTC transaction is validated. BitGo will work on the DVN with LayerZero Labs and Polyhedra.