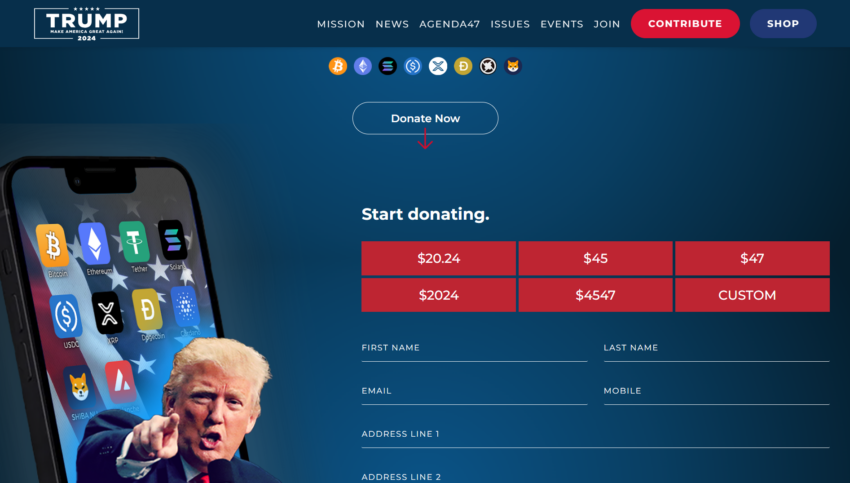

The presidential campaign of former US President Donald Trump opened a fundraising page on May 21. Through Coinbase Commerce, federally authorized contributors can now make bitcoin contributions.

Trump’s campaign accepts up to 8 cryptocurrencies

The campaign has announced that supporters may donate cryptocurrency to the Trump campaign by visiting the designated website. The Federal Election Commission’s guidelines shall be followed for all contribution caps and transparency obligations regarding cryptocurrency donations.

Trump’s campaign highlighted in the statement that he wants “to reduce government control over Americans’ financial decision-making.” He also sees accepting crypto donations reflects his “commitment to an agenda that values individual freedom over increased socialistic government control.”

“Biden surrogate Elizabeth Warren said in an attack on cryptocurrency that she was building an ‘anti-crypto army’ to restrict Americans’ right to make their own financial choices. MAGA supporters, now with a new cryptocurrency option, will build a crypto army, moving the campaign to victory on November 5!” The announcement reads.

Considering that MAGA is a joke currency with a Trump motif, the comment mentioning it is very noteworthy. It appears that Trump intends to use this item to represent the campaign’s support of cryptocurrencies.

Bitcoin (BTC), Ethereum (ETH), Solana (SOL), USDC, XRP, Dogecoin (DOGE), 0x (ZRX), and Shiba Inu (SHIBA) are among the cryptocurrencies that are accepted by the campaign. Donors may specify their own donation amounts or choose from preset ranges, which include $20.24, $2,024, $45, $47, and $4547. Trump’s campaign slogan, “I was the 45th president of the US and I want to be the 47th,” is symbolized by the numerals 45 and 47.

Check Out the Latest Prices, Charts, and Data of XRP/USDT

It’s crucial to remember that although Trump was billed in the announcement as the “first major party nominee” to take cryptocurrency contributions, he won’t actually be the nominee until July. Furthermore, Republican Senator Rand Paul took Bitcoin contributions for his 2015 presidential campaign.

This action comes after Trump promised supporters they could make cryptocurrency donations during a recent Mar-a-Lago event. In addition, he promised to welcome the cryptocurrency sector more warmly, labeling the present regulatory measures in the US as “hostility.”

His most recent political action, which is centered on cryptocurrency, coincides with President Joe Biden’s government taking a more assertive stand against the digital asset sector. This change is noteworthy since, from 2017 to 2021, throughout his first administration, Trump was a skeptic of cryptocurrencies.

However, a lot of people think that Trump’s administration will benefit the cryptocurrency sector. According to research, Standard Chartered expert Geoffrey Kendrick said that the Trump administration would impose less restrictive regulations on cryptocurrencies than the Biden government does.

This possible change in policy could persuade foreign authorities who purchase US Treasury bonds to look into other financial instruments like Bitcoin. Its price may rise as a result of this investigation.

Check Out the Latest Prices, Charts, and Data of ETH/USDT

BlackRock’s Bitcoin ETF hits 6-week inflow high amid early-week BTC rally

More money entered BlackRock’s IBIT on Tuesday than the fund has seen in the previous 21 trading days put together—$290 million.

95% of the overall inflow into US spot Bitcoin exchange-traded funds (ETFs) on Tuesday came from BlackRock’s spot Bitcoin (BTC) ETF; these funds collectively brought in over $300 million in net inflow.

BlackRock’s iShares Bitcoin Trust (IBIT) saw a substantial inflow of $290 million on May 21, per Farside Investors’ preliminary statistics. $305.7 million was the net inflow for the eleven ETF issuers together.

The BlackRock ETF has seen its largest inflow since April 5; this breaks a trend of either nil or extremely low inflows over the previous six weeks or so.

The most recent amount is also higher than what the fund has received in total during the previous 21 trading days.

Amidst a bumpy Bitcoin rise, nearly $1 billion has been reinvested in spot Bitcoin ETFs over the last four trading days.

Check Out the Latest Prices, Charts, and Data of BTC/USDT

According to Farside Investors, the BlackRock fund has received $16 billion in inflows since its introduction with the addition of the most recent daily numbers. Nevertheless, the product’s official website indicates that $19 billion in assets are under administration.

According to the official website, this places BlackRock’s IBIT extremely close to the market leader Grayscale, which has $20 billion AUM for its GBTC spot ETF.

On May 21, however, GBTC recorded a zero flow, making it five trading days without an outflow. Over the last five days, the fund has witnessed inflows totaling $72.5 billion, breaking a four-month trend of steady outflows.

Tuesday’s large influx number was not without some hemorrhage, though. $5.9 million was pulled out of the VanEck Bitcoin Trust ETF (HODL), and $4.2 million was pulled out of the Bitwise Bitcoin ETF (BITB).

$25.8 million was a little inflow into the Fidelity Wise Origin Bitcoin Fund (FBTC); the remaining funds were zeros.

The excitement around Bitcoin ETFs has been fueled by a 12% increase in BTC prices over the last week.

Bitcoin (BTC) fell below the $70,000 mark in early trading on May 22, when it was selling for $69,444 at the time of writing. On May 21, BTC reached a six-week high of $71,600.

The idea that spot Ethereum ETFs could be approved by the Securities and Exchange Commission in the US has also boosted cryptocurrency markets this week.

Shiba Inu coin burn rate soars 570% amid rally. Where’s SHIB price heading?

With four large transactions in the last day, the Shiba Inu burn rate surged by approximately 570%, thereby raising the possibility of reaching the $0.0001 milestone as the SHIB price increased.

With its most recent advancements, Shiba Inu (SHIB), the well-known meme coin, has once again drawn interest from the cryptocurrency world. Shibburn, a tracker for Shiba Inu token burning, reports that on Wednesday, May 22, the burn rate for the meme coin increased by around 570%. Traders and investors became bullish about the market due to the rising burn rate.

SHIB coin burn rate spikes drastically

Shiba Inu’s market supply has decreased due to the notable rise in burn rate, which may have favorable long-term effects for its tokenomics. According to Shibburn, the burn rate increased dramatically by 569.50% on the previous day. Furthermore, the community burned a total of 12.70 million SHIB tokens in a number of transactions. Notably, this surge was mostly caused by four distinct wallet addresses.

4.6 million SHIB were transferred to a dead wallet via two massive transactions that were recorded a few hours ago by the wallet address 0xa9d1. Moreover, at the same time frame, 1.01 million SHIB were sent to a dead wallet by another wallet address, 0x608…. The recent increase in Shiba Inus’ burn rate may be attributed in large part to these significant transactions.

Furthermore, 1.04 million Shiba Inu tokens were transferred via another community wallet, 0xc66.., to a defunct wallet, therefore causing the burn rate to increase. Thus, the staggering 410.72 trillion SHIB tokens have been incinerated in total. Furthermore, the decrease in supply brought on by these burn transactions is seen to have the ability to raise the value of SHIB.

In this scenario, any asset, including cryptocurrencies, may see price gain in response to a decrease in supply and a rise in demand. The Shiba Inu community is feeling more optimistic as a result of this development, and many traders and investors are keeping a careful eye on meme coin’s advancement.

Check Out the Latest Prices, Charts, and Data of SHIB/USDT

Will SHIB surge to $0.0001?

The price of the Shiba Inu has effectively broken beyond the $0.000025 barrier, which acted as a critical resistance level. The SHIB price was up 1.39% to $0.00002562 on Wednesday at the time of writing. The market capitalization of the second-biggest viral cryptocurrency, meanwhile, was $15.11 billion.

Additionally, SHIB’s 24-hour trading volume increased 33.58% to $1.17 billion. As previously observed, if the SHIB price stays above the aforesaid crucial resistance level, it might rise as far as $0.00003 or perhaps $0.00005. Furthermore, if the bullish trend holds, a long-term advance to $0.0001 might be anticipated.

Amidst the general upbeat mood in the market, the price of Shiba Inus has increased dramatically. As a result, according to Coinglass, the SHIB futures open interest increased by 9.24% to $90.77 million. But with $471,170 liquidated, longs led the liquidations, which might drive the SHIB price down. However, as shorts make up about half of these liquidations, their influence is minimal.