The price of Ethereum (ETH) has risen 20% in the last week, marking an incredible climb. A large ETH outflow from exchanges has contributed to this surge, indicating that holders’ confidence is rising. Additionally, whale accumulation has increased, suggesting a rise in bullish sentiment.

But after some recent little declines, ETH is currently at a critical juncture when it will test its levels of support and resistance to decide its next course of action.

ETH net transfer volume reached 128,000 on November 10

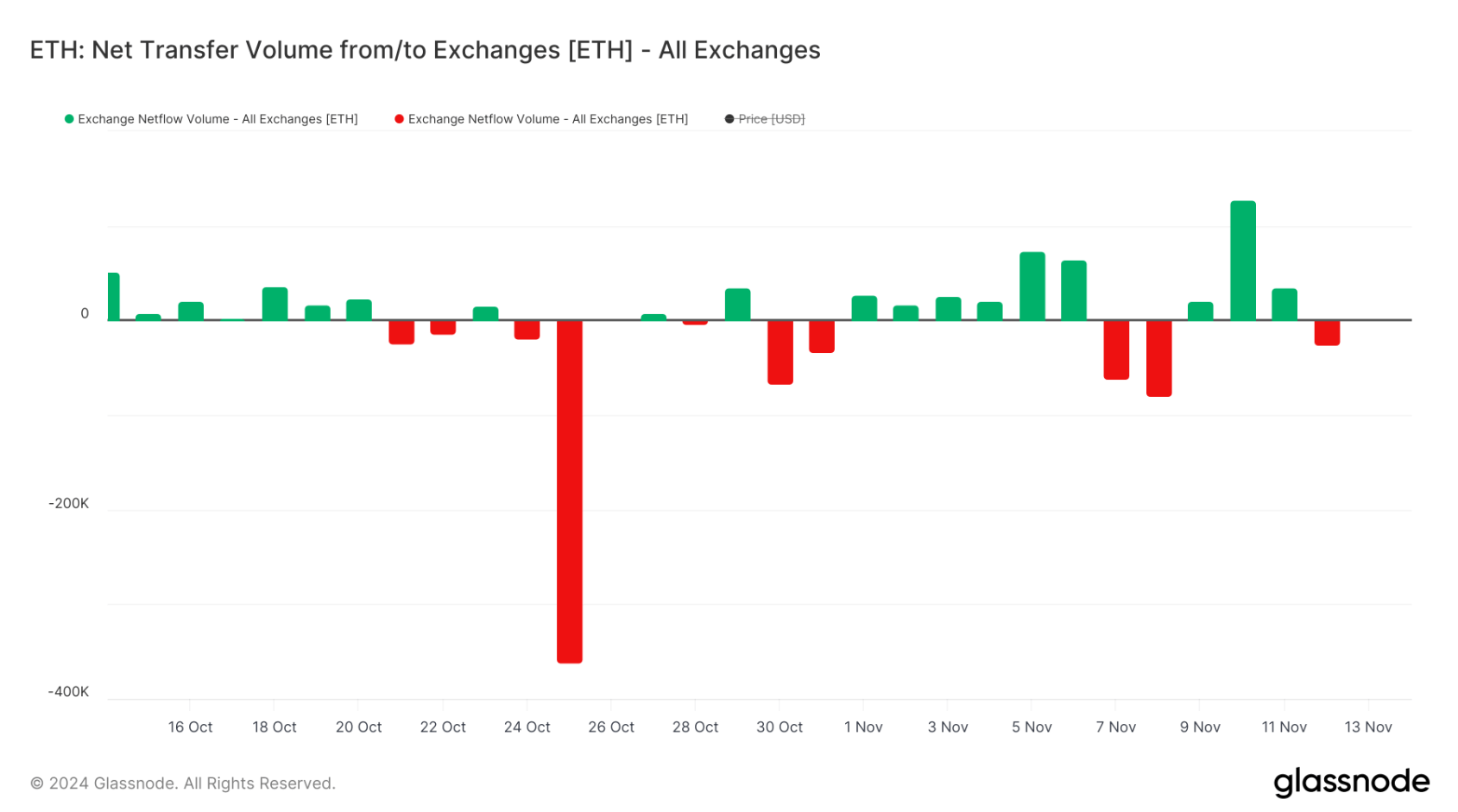

With a 20.10% increase over the last seven days, ETH has been on a robust run. On October 25, over 361,000 ETH left exchanges, a significant outflow that suggested holders’ confidence was rising prior to the current rise.

A significant shift like this usually indicates that investors are transferring their holdings to personal wallets, raising the possibility that they want to keep rather than sell.

It is usually optimistic when a large number of coins depart exchanges since it suggests that customers are less inclined to sell. On the other hand, it might be negative when a lot of coins enter exchanges since holders may be getting ready to sell.

The net transfer volume to and from exchanges has been alternating between positive and negative since October 25. On November 10, it reached 128,000. Given that the market is under a combination of purchasing and selling pressure, this suggests uncertainty.

Ethereum whales are accumulating again

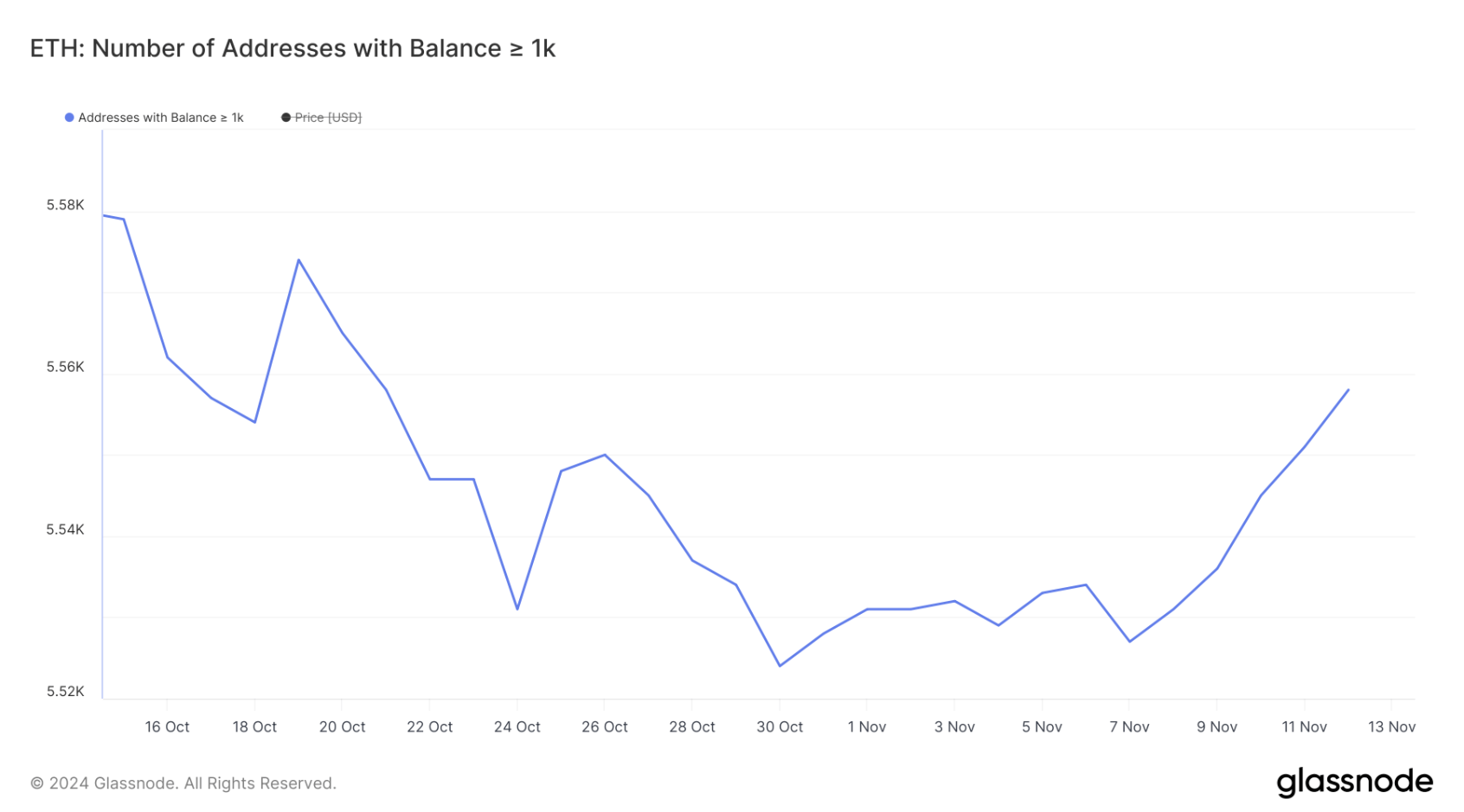

The number of whales owning at least 1,000 ETH has now begun to increase once more after declining for weeks. From 5,527 on November 7 to 5,558 on November 12, the number has been steadily increasing every day since this trend reversal started on November 7.

Large holders’ growing confidence in the price of ETH is indicated by the whales’ increased accumulation, which points to a change in mood.

Because their actions have the potential to greatly impact market patterns, it is imperative to monitor these whale wallets. Since whales tend to sway markets, their accumulation frequently indicates a possible price increase.

Additionally, by lowering the supply on exchanges, their purchases may increase the pressure on Ethereum’s price to rise.

ETH price prediction: Is a rally to $4000 possible?

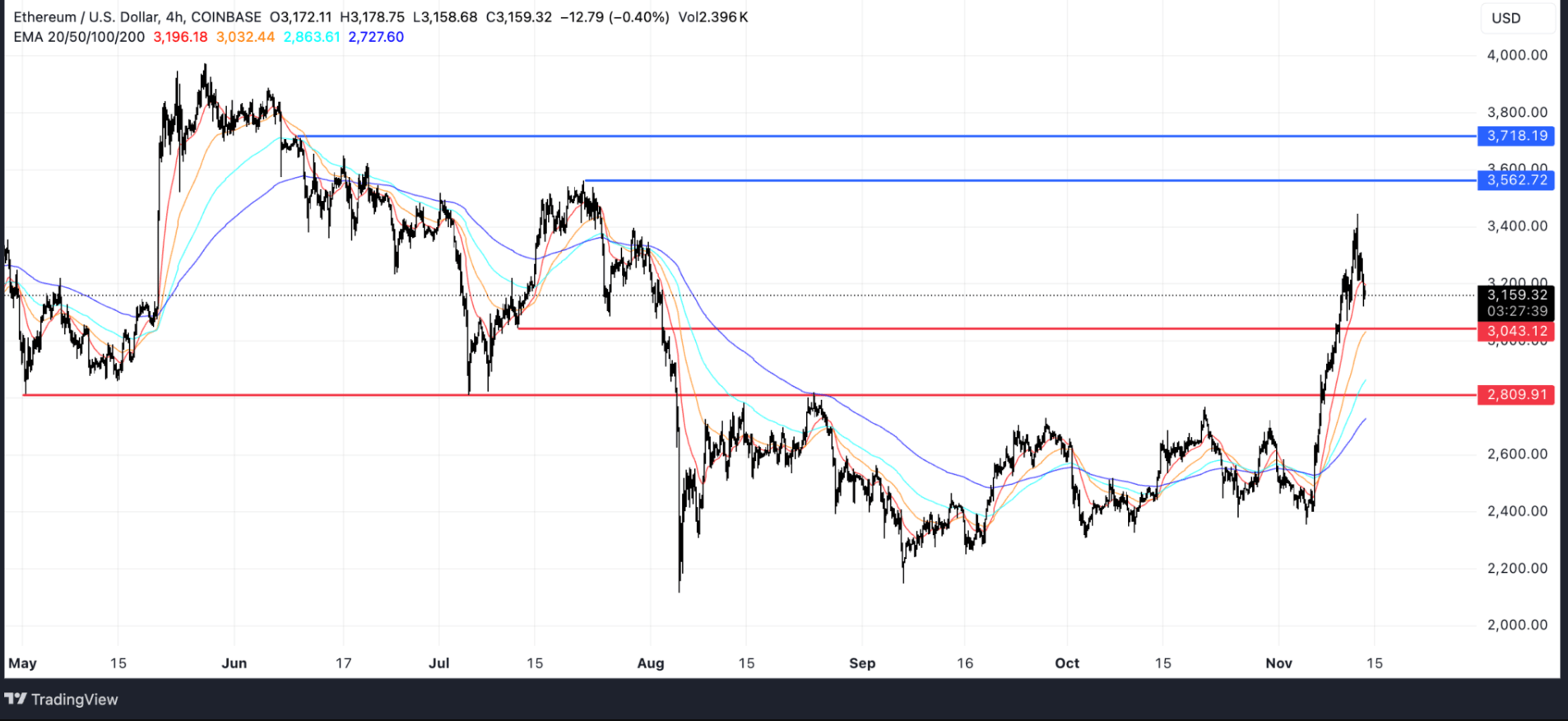

In recent days, the price of Ethereum (ETH) has experienced a little pullback following a robust surge. The EMA lines are still positive, showing an overall rising trend with the short-term lines staying above the long-term ones.

The price has fallen below the shortest EMA line, though, which raises the possibility that the present upward trend is waning.

The current nearest resistance level for ETH is about $3,500. If this resistance is overcome, the price of ETH may rise to $3,700, which would be its highest level since June and a potential 17.9% increase.

Conversely, if the upward trend turns around, the price of ETH can retest the $3,000 support level. The next level of help would be about $2,800 if that doesn’t work.

BlackRock’s BUIDL expands to 5 major blockchains

The largest asset manager in the world, BlackRock, has announced the growth of its USD Institutional Digital Liquidity Fund, or BUIDL, which is tokenized.

BlackRock is expanding access to the fund by establishing new “share classes” on these platforms (Aptos, Arbitrum, Avalanche, Optimism’s OP Mainnet, and Polygon).

BlackRock in the digital assets ecosystem

Applications and users can communicate directly with BUIDL on-chain on any supported blockchain. BUIDL’s multi-network strategy offers near-instantaneous, round-the-clock peer-to-peer transfers, flexible custody, and increased on-chain yield. The technology is quite flexible since it also provides on-chain dividend accrual and distribution.

It also enables developers to incorporate BUIDL into the blockchain ecosystems of their choice. By making this change, BlackRock is able to reach a wider audience and provide a more adaptable investing platform. Securitize’s tokenization of the fund’s expansion attempts to increase accessibility.

“Real-world asset tokenization is scaling, and we’re excited to have these blockchains added to increase the potential of the BUIDL ecosystem. With these new chains we’ll start to see more investors looking to leverage the underlying technology to increase efficiencies on all the things that until now have been hard to do,” Securitize and co-founder Carlos Domingo said in a press statement.

BlackRock is becoming more and more significant in the digital currency industry outside of BUIDL. With the introduction of the largest spot Bitcoin (BTC) ETF, the iShares Bitcoin Trust (IBIT), the company has garnered media attention. IBIT sparked a surge of institutional interest in the Bitcoin ETF market when the US SEC approved it in January. IBIT has had large capital inflows during the current Bitcoin boom, reaching $40 billion in assets in record time.

This is big.

Some of these were under heavy SEC scrutiny – now the BlackRock stamp of approval has been extended.

Another sign that the SEC reign of terror is ending. pic.twitter.com/Zg9Y2u1KSr

— Yano 🟪 (@JasonYanowitz) November 13, 2024

BlackRock’s foray into bitcoin ETFs and tokenized funds reflects a trend of fusing blockchain technology with conventional assets. BlackRock presents investors with a hybrid approach that combines the stability of traditional finance with the innovation of digital assets through products like BUIDL and crypto ETFs.

Investors may access on-chain assets more easily and flexibly with tokenized funds like BUIDL. In the meanwhile, ETFs give conventional investors a comfortable way to get started in the world of digital assets.

Pepe coin whale dumps 500B, brace for meme coins selloff: report

As on-chain data indicates that meme currencies like DOGE, WIF, and FLOKI may see a selloff, Pepe Coin Whale sells 500 billion tokens.

In the 24 hours after the Coinbase and Robinhood listings, the price of Pepe Coin (PEPE) skyrocketed by 75%. On-chain data, however, indicates that whales will probably book gains, which will lead to a selloff in meme currencies. A Pepe Coin whale made around $45 million in profit while dumping almost 500 billion tokens.

Pepe coin whale dumps massive holdings

Whales and early PEPE investors have begun to register profits. According to a November 14 Lookonchain article, a PEPE whale sold 500 billion PEPE coins for $11.8 million. Between May 5 and September 10 of last year, the smart money acquired 2.01 trillion PEPE tokens, first investing 1,170 ETH, which was valued at $2.12 million at the time.

The whale still has 1.48 trillion PEPE, or $33.2 million, notwithstanding the present deposit to Coinbase. With a projected total profit of $45 million, this indicates that the whale has generated 20 times returns on the initial investment.

After the massive listing on Coinbase, Robinhood, and Upbit, the price of PEPE shot up to a new all-time high, gaining 75% in a single day. Daily trade volumes have increased 200% to almost $20 billion in the current frenzy as PEPE surpasses the $10 billion market value.

According to Coinglass statistics, 24-hour liquidations have increased to $48 million, while PEPE open interest has increased by 63% to $316 million.

A meme coin selloff ahead?

Since Donald Trump won the US presidential election last week, the meme coin industry as a whole has done incredibly well. In just one week, the popular meme currencies Dogecoin (DOGE) and Pepe Coin (PEPE) recorded rises of over 100%. Amid the meme coin craze, dogwifhat (WIF), Bonk (BONK), and Floki Inu (FLOKI) all saw gains of 60–70%.

However, according to Santiment on-chain statistics, the meme currency frenzy has been at an all-time high level, with FOMO and greed catching up quite soon. Additionally, the social discourse surrounding meme currencies has intensified, indicating that a selloff is imminent.

Commenting on the current frenzy in the meme space, popular economist Alex Kruger stated:

“Bitcoin aside, crypto now is mostly about memecoins. That’s what people wants. Full-stop. And exchanges are giving it to them. That’s what the Binance listings of PNUT and ACT and the Coinbase listings of PEPE and WIF tell you”.

In addition to Pepe Coin, the price of PNUT has increased by a staggering 200%, bringing its weekly gains to almost 1600%. As the market continues to rise despite positive enthusiasm, the prices of DOGE and WIF are trading at $0.392 and $4.18, respectively.