Shortly after MicroStrategy’s $4 billion acquisition, the Japanese company Metaplanet purchased more than 124 BTC, which caused the stock price to rise by 15%.

On Tuesday, the publicly traded Japanese company Metaplanet said that it had just acquired 124 Bitcoins for a total investment of 1.75 billion Japanese yen. As a result, the business currently owns more than 1,100 BTC, and its stock price has increased by a whopping 15% today. Furthermore, with its latest Bitcoin acquisitions, the company has been correctly following MicroStrategy’s Bitcoin adoption roadmap.

Metaplanet purchases more Bitcoin, stock shoots 15%

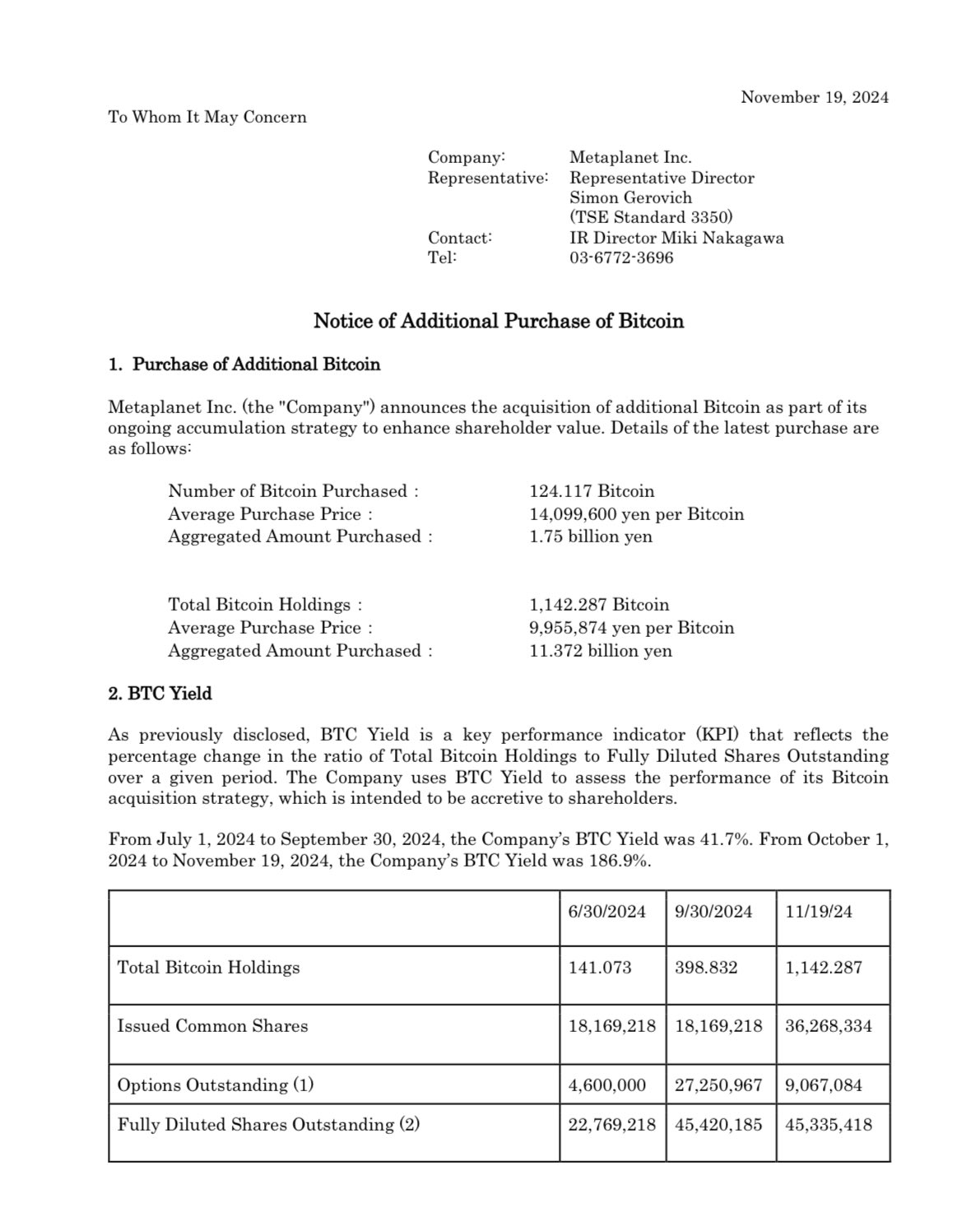

Simon Gerovich, the CEO of Metaplanet, has declared that he will pay 1.75 billion yen to acquire an extra 124.117 BTC. At the time of the most recent purchase, the average price of Bitcoin was 14,099,600 yen. The entire amount of Bitcoin that Metaplanet has as of November 19, 2024, is 1,142.287 BTC, which was purchased for about 11.372 billion yen. Additionally, the average purchase price per Bitcoin is 9,955,874 yen.

The company’s quarterly-to-date (QTD) Bitcoin yield of 186.9% has increased dramatically as a result of Metaplanet’s strategic purchase. It’s interesting to note that MicroStrategy made an incredible investment of nearly $4 billion by purchasing 51,780 BTC the day before.

In a huge positive breakout beyond the crucial resistance of 2,000 JPY, the Metaplanet stock price jumped more than 14% in the immediate aftermath of the news, surpassing 2,300 JPY levels. This creates the conditions for the stock to rise another 30% to reach its peak of 3,000 JPY in 2024.

The Japanese company revealed its bond offering to purchase additional Bitcoin on Monday. Similarly, following a huge 400% increase in 2024, MicroStrategy has been repurchasing MSTR shares to finance its Bitcoin acquisitions. The Japanese company has also embraced Michael Saylor’s Bitcoin strategy, which has benefited both its stockholders and financial sheet.

MicroStrategy creates snowball effect

Dylan Leclair, Metaplanet’s Bitcoin acquisition strategist, has called attention to a paradigm change in business tactics. According to him, Bitcoin represents Wall Street’s new “stock buyback.” LeClair declared, “Wall Street has been placed on notice.”

He also emphasized that the long-awaited game theory dynamics in the financial sector are what lead to the acceptance of Bitcoin by significant institutions.

In addition, a snowball effect was produced by Michael Saylor’s candid disclosure of the Bitcoin strategy. Marathon Digital and Semler Scientific, in addition to MicroStrategy, revealed their future ambitions to acquire and buy Bitcoin. Not to mention, the choice to include Bitcoin on Microsoft’s balance sheet will be decided by a shareholders’ vote in December.

With a market valuation of $1.816 billion, the price of Bitcoin (BTC) is up 1.33% at $91,763 as of this writing. The stage for a rally above $100K will probably be established by a daily closing over $91,900.

Paul Tudor Jones expands Bitcoin ETF stake to 4.4M shares

Under the direction of well-known hedge fund manager Paul Tudor Jones, Tudor Investment Corporation has greatly expanded its Bitcoin holdings.

As of September 30, 2024, the company had more than 4.4 million shares in BlackRock’s iShares Bitcoin Trust ETF, according to a recent 13F filing with the Securities and Exchange Commission (SEC). This is a significant increase from the 869,565 shares it disclosed in June to 4.4 million.

Tudor investment corp increases holdings by 400%

The stakes were valued at around $160 million in June. By the end of September, this investment had increased to around $230 million. The increase is a result of both the company’s acquisition of more shares and the continuous surge in Bitcoin prices.

Paul Tudor Jones has continuously argued that Bitcoin is an essential inflation hedge. Growing faith in Bitcoin’s long-term worth is demonstrated by his company’s increased investment in BlackRock’s Bitcoin ETF. This action is consistent with Jones’ prior remarks emphasizing the value of Bitcoin in safeguarding money in unpredictable economic times.

Billionaire hedge fund manager Paul Tudor Jones:

“All roads lead to inflation … I’m long gold, I’m long Bitcoin, I’m long commodities”

pic.twitter.com/CRM5nA0vp3— Michael Burry Stock Tracker ♟ (@burrytracker) October 22, 2024

The biggest asset manager in the world, BlackRock, is still pushing for institutional adoption of cryptocurrencies. Through a well-known and regulated instrument, its iShares Bitcoin Trust ETF gives investors access to Bitcoin.

Institutional interest on the rise

Tudor’s investment coincides with growing hope that spot Bitcoin ETFs would be accepted in the US. For conventional investors, these ETFs—which include BlackRock’s upcoming application—promise simpler access to Bitcoin. They may pave the way for much greater institutional involvement if they are accepted.

#Microstrategy bought another 51,780 #Bitcoin

Do you understand how crazy this is?

MSTR bought more Bitcoin than Germany had in TOTAL earlier this year@saylor is going to push Bitcoin to $100K on his own https://t.co/hO5H8k6T0K

— Rajat Soni, CFA (@rajatsonifnance) November 18, 2024

There are other institutional players on the hunt as well. Mining company MicroStrategy bought $4.6 billion worth of Bitcoin on November 18 alone, while MARA Holdings announced $700 million in convertible notes to expand their Bitcoin reserve. Additionally, it was claimed that last week, cryptocurrency inflows jumped to about $2.2 billion.

Tudor Investment Corporation has improved its presence in the cryptocurrency market by increasing its ownership of BlackRock’s iShares Bitcoin Trust ETF by four times. Investments like this may mark the next significant step in connecting traditional finance and digital assets as use increases and legal clarity improves.

Floki announces huge marketing campaign in India ahead Coinbase listing

The meme coin In an effort to draw attention to its play-2-earn (P2E) game Valhalla, Floki Inu has announced a marketing campaign in India before to its Coinbase listing.

Renowned dog-themed meme cryptocurrency Floki Inu has revealed a marketing campaign in Delhi NCR, India, in an effort to increase market optimism. According to the meme token’s community, the marketing effort focuses mostly on introducing Valhalla, the ecosystem’s highly acclaimed PlayToEarn MMORPG game, to the Indian Web3 market. Market observers are nevertheless interested in what future moves may hold in light of recent happenings, even if the coin is currently on a rally and has shown incredible weekly and monthly increases.

Floki Inu brings Valhalla to India with massive marketing campaign

In a November 18 X post, the Floki Inu community disclosed that it is “bringing its groundbreaking PlayToEarn MMORPG game Valhalla to the heart of India with an explosive marketing campaign across Delhi NCR.” According to the statement, this campaign began on November 18 with the goal of attracting Indian space to the project.

VALHALLA TAKES OVER DELHI NCR, INDIA WITH MASSIVE MARKETING CAMPAIGN#Floki is bringing its groundbreaking PlayToEarn MMORPG game #Valhalla to the heart of India with an explosive marketing campaign across Delhi NCR.

Starting November 18th, 2024, $FLOKI‘s Valhalla will dominate… pic.twitter.com/oUeiPdeNu3

— FLOKI (@RealFlokiInu) November 18, 2024

By focusing on strategic locations like Delhi Airport, South Delhi Extension, and Connaught Place, the campaign hopes to reach over 650,000 individuals every day and raise awareness of the meme cryptocurrency and its endeavors. Given that the campaign increases attractiveness throughout the Indian crypto ecosystem, this recent development has, all things considered, generated a great deal of investor interest and paved the way for an optimistic future for cryptocurrency.

Notably, a notable number of traders and investors engage in cryptocurrency trading in India, despite the country’s ambiguous position on digital assets. This statistic raises hopes for the future of the most popular meme coin.

Meme coin’s price on a rally?

The weekly chart for the meme currency showed increases of 32% at press time, boosting excitement among investors. Additionally, a robust rebound was indicated by the monthly chart, which reflected gains of 61%. The intraday chart, however, showed a 2% decline in FLOKI price, hitting $0.0002521, generating divergent investor conjecture about the token’s potential future moves. However, it’s important to note that the meme token is largely portrayed in a bullish light by larger events.

It is stated that the meme coin’s price surged after Coinbase recently included it in its listing plan. This breakthrough, together with the most recent marketing effort, has increased hope about future moves. Following a continuing bull market and the aforementioned occurrences, cryptocurrency market aficionados are still keeping a watch on the coin for more price movement swings.