OpenAI introduced a new update to its artificial intelligence models, generating significant interest across a variety of industries, including the cryptocurrency industry.

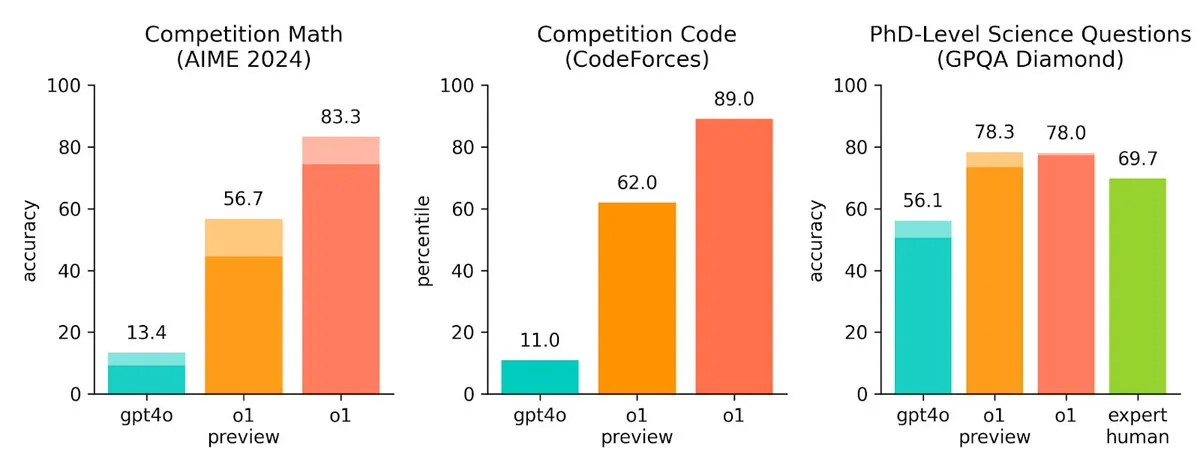

The new model, known as OpenAI o1, differs significantly from the company’s earlier generations. It offers increased thinking ability and proficiency on complicated problems.

Worldcoin price surges 16%

OpenAI claims this new series of AI models is adept at “thinking before responding.”

“We’ve developed a new series of AI models designed to spend more time thinking before they respond. They can reason through complex tasks and solve harder problems than previous models in science, coding, and math,” OpenAI said in a blog.

Despite its size, the smallest unit in this new model series apparently outperforms the GPT-4o in numerous crucial areas. These are AI testing benchmarks designed to emulate PhD-level issues.

However, the benefits have been less noticeable in creative realms like as literature and artistic efforts. This level of detail in improvement has piqued the interest of tech enthusiasts and professionals eager to use these AI technologies for niche purposes.

Financially, this technical leap had an instant impact on the cryptocurrency economy. The aggregate market capitalization of AI-related coins has increased by 2.1% during the previous 24 hours.

Meanwhile, Worldcoin (WLD) had a strong jump, rising around 16% after the news. However, as of this writing, it has steadied at a 9.5% rise, trading at $1.518.

This spike is especially noteworthy because Sam Altman is a co-founder of both Worldcoin and OpenAI. Despite this relationship, Worldcoin has been a source of contention in the cryptocurrency industry owing to its tokenomics.

According to the most recent CoinMarketCap numbers, only 434 million of the total amount of 10 billion WLD tokens are now in circulation.

This carefully restricted quantity will expand with the daily issuance of 2 million tokens beginning July 24. Each batch is worth around $3 million at current pricing.

As a result, this slow release method is expected to create selling pressure in the market, reflecting the low float ratio of 0.02 identified in a CoinGecko article from May 2024. Such a low ratio implies that just a small number of tokens are accessible for trade, which might lead to increasing volatility as additional tokens enter the marketplace.

Critics, notably on-chin sleuth ZachXBT, have spoken out on venues such as X (previously Twitter). The narrative around Worldcoin varies from cautious optimism to outright pessimism.

$WLD has the worst tokenomics right now and is programmed to slow rug 📉🩸.$WLD currently has a daily unlock of 3.4 Million tokens ($4.75 million) and monthly unlock of 102 million tokens ($140 million).

Worldcoin investors receive 1.3 million WLD daily and worldcoin team… pic.twitter.com/s8vol3fk7c— Marius.capital (@AltbriMarius) September 11, 2024

XRP news: Ripple moves 150M coins as price soars 6%. What’s the deal?

XRP News: Ripple’s 150 million currency transaction has sparked skepticism amid recent community developments. The XRP price rises 6%.

XRP News: Ripple, an American blockchain payments startup, sparked much discussion on Friday with its huge 150 million XRP transfer. The blockchain firm’s huge transfer coincided with a stunning 6% increase in XRP pricing today. This phenomena has attracted significant interest among investors. Meanwhile, recent community initiatives have fueled confidence about the coin’s price moves.

XRP news: Ripple moves 150M coins, whale dumps 43M

According to Whale Alert’s on-chain insights on X, dated September 13, Ripple transferred a stunning 150 million XRP, worth $85 million, to an unknown wallet address rP4X2hTa7A. This transaction has aroused major debate in the worldwide crypto community, after the recent establishment of the new Grayscale XRP trust.

Meanwhile, the well-known whale address…Rzn sent 43.3 million coins, worth $24.34 million, to the exchanges Bitstamp and Bitso in a series of transactions during the last day. Despite the significant drop, the native token of the American blockchain payments startup is up almost 6% today.

As previously stated, the recent establishment of the Grayscale XRP trust looks to have triggered a surge of excitement for the Ripple-backed cryptocurrency. Furthermore, a recent investigation into SEC Chair Gary Gansler has fueled excitement about the cryptocurrency’s potential price swings.

XRP price pumps 6%

As previously stated, the recent establishment of the Grayscale XRP trust looks to have triggered a surge of excitement for the Ripple-backed cryptocurrency. Furthermore, a recent investigation into SEC Chair Gary Gansler has fueled excitement about the cryptocurrency’s potential price swings.

Meanwhile, Ripple’s XRP price has risen about 6% in the last 24 hours, defying the overall market trend, and is now trading at $0.5699. The coin’s intraday low and peak were recorded at $0.5355 and $0.5809, respectively. Notably, the 24-hour trading volume for the asset increased by a stunning 109% today.

Simultaneously, Coinglass data showed a 7% increase in XRP futures OI to $642.02 million. Furthermore, derivatives volume increased by 327.22% to $2.93 billion today. This large jump in the futures market signaled increased investor interest in the asset. Furthermore, evidence suggests that XRP is now on an upward trend, which is consistent with the price increase.

Overall, recent XRP news, such as community developments and Ripple’s on-chain actions, has sparked substantial investor interest in the digital currency.

Spot Bitcoin ETFs rebound with inflows, Ethereum ETFs extend outflows

As previously stated, the recent establishment of the Grayscale XRP trust looks to have triggered a surge of excitement for the Ripple-backed cryptocurrency. Furthermore, a recent investigation into SEC Chair Gary Gansler has fueled excitement about the cryptocurrency’s potential price swings.

Spot Bitcoin exchange-traded funds in the United States had inflows on September 12, reversing the previous day, while Ether ETFs suffered withdrawals for the second day in a row.

According to SoSoValue statistics, the 12 top Bitcoin ETFs had net inflows of $39.02 million, compared to outflows of $43.97 million the day before. ARK 21Shares’ ARKB led the pack, with reported inflows of $18.3 million. This comes after the fund had $54 million in withdrawals the day before.

Fidelity’s FBTC followed with $11.5 million invested in its fund. Notably, the ETF was the only fund to receive net inflows for four consecutive days, with $115.9 million entering. Grayscale’s Bitcoin Mini Trust raised $5.18 million.

As previously stated, the recent establishment of the Grayscale XRP trust looks to have triggered a surge of excitement for the Ripple-backed cryptocurrency. Furthermore, a recent investigation into SEC Chair Gary Gansler has fueled excitement about the cryptocurrency’s potential price swings.

VanEck’s HODL, Franklin Templeton’s EZBC, and Bitwise’s BITB all had net positive flows of $4.9 million, $3.4 million, and $2.2 million, respectively, on the day.

Grayscale’s GBTC was the only spot bitcoin ETF to post withdrawals, with $6.5 million exiting the fund, totaling $20.04 billion since its inception.

Meanwhile, the remaining seven BTC ETFs, including BlackRock’s IBIT, had no trading activity on the day. Notably, IBIT, the largest spot BTC ETF by net assets, has not received any net inflows since August 27.

As previously stated, the recent establishment of the Grayscale XRP trust looks to have triggered a surge of excitement for the Ripple-backed cryptocurrency. Furthermore, a recent investigation into SEC Chair Gary Gansler has fueled excitement about the cryptocurrency’s potential price swings.

On September 12, total trading volume for the 12 BTC ETFs fell to $896 million, a considerable decrease from the $1.27 billion observed the previous day. These funds have had a total net inflow of $17.03 billion since their establishment. Bitcoin (BTC) was trading at $57,874 as of this writing, according to crypto.news.

Meanwhile, the nine US-based Spot Ethereum ETFs had net withdrawals totaling $20.14 million, marking the second day of net outflows. Grayscale’s ETHE accounted for all of the daily net withdrawals, while the remaining eight ether funds had no flows on September 12.

The trading volume for these investment vehicles fell to $106.14 million from $126.22 million the day before. To far, the spot Ether ETFs have had a total net outflow of $582.74 million. At publishing, Ethereum (ETH) was trading at $2,346.