Popular in the cryptocurrency world, XRP attorney John Deaton will go up against anti-crypto Elizabeth Warren in the US elections.

The choice of pro-XRP attorney John Deaton as the Republican primary nominee to represent Massachusetts in the 2016 US Presidential Elections is a significant milestone for the cryptocurrency sector. According to the findings, Deaton defeated the other Republican contenders in the contest by a sizable majority of 65% of the vote.

John Deaton to take on Elizabeth Warren

“Only in America, it’s someone like me be elected to take on one of Washington’s most entrenched elites,” Deaton said to the audience after defeating Elizabeth Warren, his Democratic opponent, in the Massachusetts primary elections.

XRP lawyer John Deaton has been very popular within the crypto industry for his pro-crypto views and has been actively supporting Ripple in SEC’s XRP lawsuit over the past few years. Several crypto industry leaders cheered Deaton’s win! Caitlin Long, the CEO of crypto-friendly Custodia bank stated: “CONGRATS John Deaton… Gonna be fun to watch you take on Elizabeth Warren in the general election. I hear she’s on the outside in the Dem Party these days…”.

However, Elizabeth Warren, a crypto-skeptic, has also announced her candidacy for the Democratic party. Ever since he made the decision to oppose Elizabeth Warren’s anti-crypto measures, Deaton’s career and popularity have taken off. Super PACs that support cryptocurrency have also contributed to Deaton’s campaign this year.

Thank you, Massachusetts Democrats! I’m grateful to be your nominee for the U.S. Senate, and I will keep fighting by your side to put Washington on the side of working people.

— Elizabeth Warren (@ewarren) September 4, 2024

Why is the crypto industry supporting the XRP lawyer?

John Deaton has advocated for the creation of legislation that are supportive of cryptocurrencies and the innovation that is occurring inside the sector. His views are remarkably similar to those of Donald Trump, who has pledged to back Bitcoin and other digital assets in an effort to establish the United States as the global center of cryptocurrency.

Moreover, Deaton has long supported the cryptocurrency sector. Leading political analysts with well-established election models, according to pro-XRP attorney Bill Morgan, are unable to forecast the impact of candidates such as John E. Deaton because they choose to overlook his prominence in the crypto community, particularly his vocal support of the XRP community in the SEC v. Ripple case.

Morgan therefore underlined the rising significance of cryptocurrency in politics, particularly in view of Senator Elizabeth Warren’s adamant opposition to it. He penned:

“John Deaton has come from nowhere to obliterate his opponents today in the Republican primary. He understands the issues of everyday people more than Warren due to his own life experience as his autobiography shows”.

The previous day, Bill Morgan, the attorney representing XRP, questioned the SEC’s use of language when referring to digital assets and asked for a unique S-1 registration specifically for the cryptocurrency sector.

DeFi protocol Penpie loses $27M in hack, PNP token sinks 40%

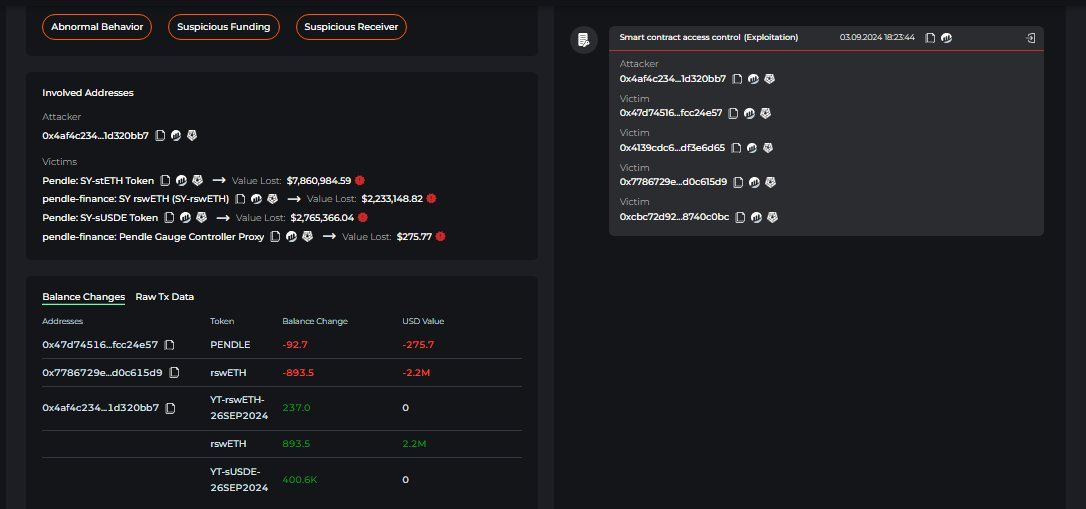

Blockchain data indicates that on Wednesday, the Penpie decentralized finance (DeFi) protocol—which was developed on the Pendle yield platform—was compromised, leading to the loss of almost $27 million in cryptocurrency holdings.

A variety of tokens were taken by the attacker, including wrapped USDC, Ethena’s sUSDE, and staked Ethereum (ETH). Later, the money was sent to a new address after being converted to ETH using the Li.Fi protocol.

$27M stolen in Penpie hack

Cyvers, a blockchain security company, discovered unusual behavior related to Penpie’s contract and reported the matter. The study claims that the address that received funding from a cryptocurrency mixing service carried out a fraudulent transaction and obtained digital assets valued at almost $27 million.

In fact, Etherscan data reveals that, just hours prior to the breach, the exploiter’s address received an initial deposit via Tornado Cash for 10 Ethereum (ETH), or around $25,000. This transaction assisted in hiding the attacker’s identity.

Although Pendle acknowledged that there had been a system breach, it assured consumers that their money was still secure on Pendle. But as a precautionary move, the business temporarily suspended all contracts, closely collaborating with the Penpie team to evaluate the damage.

🚨UPDATE🚨Announcement from @pendle_fi 👇@pendle_fi has confirmed that its funds are secure after an investigation.

However, a security issue has been found in @Penpiexyz_io , a separate protocol built on @pendle_fi .

To address this, all contracts have been paused… https://t.co/zFX85sKHpH— 🚨 Cyvers Alerts 🚨 (@CyversAlerts) September 3, 2024

According to statistics, Penpie’s native token (PNP) fell 40% as a result of the hack. The 8% decline in Pendle’s token (PENDLE) exceeded losses in the overall cryptocurrency market.

One illustration of the increasing number of cryptocurrency attacks in 2024 is the Penpie vulnerability. According to a new research from Immunefi, hackers have taken over $1.2 billion in 154 different incidents so far this year, revealing the pervasive flaws in DeFi protocols and other cryptocurrency systems.

According to security company PeckShield, cryptocurrency breaches cost over $313 million in damages in August of 2024 alone. The biggest two events of that month were responsible for the theft of $55 million in DAI and $238 million in Bitcoin (BTC).

Phishing assaults have also increased; according to a Scam Sniffer study, financial losses increased by 215% in August. Even though there were fewer assaults than in July, there was a rise in the quantity of money taken; one phishing scam brought in $55 million.

Trader turns $5k into $670K on Ethereum pump.fun rival Ethervista

For a brief while, the native VISTA token of the system surged to a value of up to $30 million, making a sizable profit for one trader.

Purchasing the native token of Ethervista, the newest decentralized exchange and token minting marketplace to debut on Ethereum, has allowed a cryptocurrency trader to lock in enormous profits.

The trader bought $5,000 worth of VISTA tokens as soon as the Ethervista protocol became live. With this acquisition, they acquired around 5% of the VISTA tokens that are now in circulation. The tokens were made available for trade on August 31.

According to a Sept. 3 X post from crypto intelligence platform Arkham, the dealer then divided his VISTA holdings among seven other wallets to sell them off, generating nearly $670,000 in profit in Ethereum (ETH) after only two days.

$5K TO $670K ON ETHERVISTA IN JUST 48 HOURS

Trader 0x430 bought the launch of @ethervista, spending $5K to secure just over 5% of the supply.

He distributed his VISTA holdings across 7 different wallets to sell them off, and after 2 days realized over $670K of profit into ETH.… pic.twitter.com/CdAXlE1XRO

— Arkham (@ArkhamIntel) September 3, 2024

Ethervista is a brand-new Ethereum-based token minting marketplace that lets users design and release their own tokens, mostly memecoins.

Ethervista: Ethereum’s “answer” to Pump.fun

Some analysts of the cryptocurrency space have referred to Ethervista as “Ethereum’s answer” to its rival Pump.fun, a memecoin launchpad located in Solana that has had astronomical growth since its launch in January.

In an effort to deter early rug pulls, the retro-themed Ethervista platform introduced a “fair launch model” in which 100% of its native VISTA tokens were distributed to liquidity providers and frozen for five days.

With a one million token supply cap and ongoing token burning to lower supply and increase the price floor, it features deflationary tokenomics.

Some have, nonetheless, reported unsuccessful attempts to withdraw liquidity.

As many bloggers are shilling @ethervista (calling it the new Pumpdotfun), transactions fail when trying to remove liquidity from the ETH/USDT pool.

Transfers are also disabled.

Unfortunately, I had to test this myself.

$2K is gone, but I hope my experience saves your money. pic.twitter.com/Fdezx7GJqT

— Stacy Muur (@stacy_muur) September 3, 2024

While acknowledging the liquidity lock, cryptocurrency analyst Stacy Muur stated that “it’s the ETH/USDT pair, not a newly created token that needs anti-rug protection,” and that customers were not informed via a disclaimer.

Ethervista collects fees in native Ethereum, which are split between liquidity providers and token producers, in contrast to conventional DEXes and markets.

The platform, which requires ETH for network fees, has seen a sharp increase in gas consumption over the last 24 hours, ranking third in gas consumption after Tether and Uniswap with 22.5 ETH, according to Etherscan.

In order to compete with competitor networks Solana, Base, and Tron—which have recently drawn millions of dollars in income from legions of memecoin degenerates—and to close a gap in the Ethereum DeFi market, Ethervista was founded.

According to DexScreener statistics, the native token’s market valuation reached as high as $30 million just two days after its introduction, demonstrating the significant interest that players in the cryptocurrency market have been paying to the Ethervista platform.

As of this writing, the price of VISTA has increased 33% in the last day to $21.19, according to CoinGecko. Only a few days after its introduction, on September 2, the new coin reached a height of $28.80; nevertheless, volatility may arise from the liquidity unlock on September 4.