Today, $2.29 billion worth of Ethereum and Bitcoin options contracts will expire on the cryptocurrency market. Short-term price action may be impacted by this significant expiry, particularly given the recent declines in both assets.

With Ethereum (ETH) at $344.92 million and Bitcoin (BTC) options worth $1.94 billion, traders are preparing for possible turbulence.

Crypto options expiring today

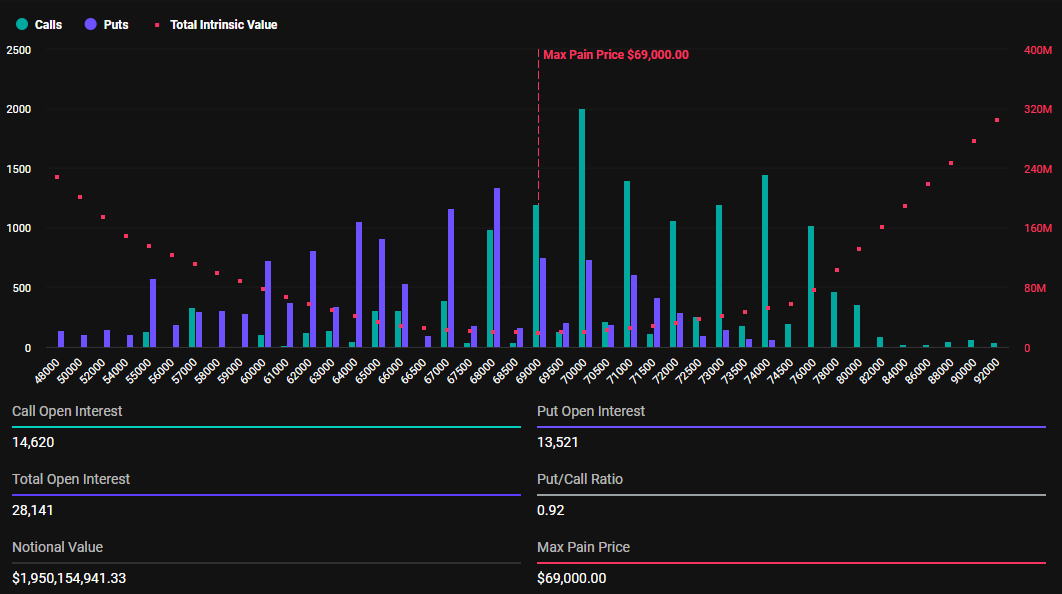

Deribit data indicates that 28,125 contracts are involved in this Friday’s Bitcoin options expiry. There are 137,866 contracts of expiring options for Ethereum.

The put-to-call ratio on these expiring Bitcoin options is 0.92, and the maximum pain price is $69,000. Despite Bitcoin’s 4% decline, the Put-to-Call ratio is below 1, indicating a largely positive mood. Their Ethereum equivalents, in contrast, have a comparable market outlook with a put-to-call ratio of 0.69 and a maximum pain price of $2,550.

Greek.live experts claim that recent price drops and outside variables, including the approaching US elections, have caused implied volatility (IV) to slightly increase. They do note, meanwhile, that the maximum pain point of Bitcoin is at an annual high, and that the market is now offering excellent trading chances.

1 Nov Options Data

28,000 BTC options expired with a Put Call Ratio of 0.92, a Maxpain point of $69,000 and a notional value of $1.97 billion.

137,000 ETH options expired with a Put Call Ratio of 0.69, a Maxpain point of $2,550 and a notional value of $350 million.

Bitcoin hit… pic.twitter.com/skJ4ofhpOk— Greeks.live (@GreeksLive) November 1, 2024

Data indicates that Ethereum is presently trading at $2,503 and Bitcoin is currently trading at $69,268, respectively. This puts ETH below its maximum pain point and BTC above it. According to the Max Pain hypothesis, options prices often move in the direction of strike prices, or max pain points, where the greatest concentration of contracts are scheduled to expire worthless.

This suggests that Bitcoin may decline back toward its maximum pain threshold of $69,000, which would probably cause short-term market turmoil. Although options expirations frequently result in brief price fluctuations, markets usually level out shortly after.

Given the huge volume expiry today, traders could expect comparable swings that might influence short-term cryptocurrency movements. After Deribit settles contracts at 8:00 UTC on Friday, the price pressure on Bitcoin and Ethereum will lessen.

Today’s nonfarm payrolls (NFP) on the first Friday of November should also cause market turbulence. Together with Tuesday’s US elections, this US macro data may potentially determine the following trend.

We have NFP tomorrow and the US election next week, so do not force any trades until then.

Watch the market, and only take clear A+ setups – anything less isn’t worth it anyway.

— BullproofTrader (@bullprooftrader) October 31, 2024

Donald Trump’s World Liberty Financial cuts WLFI presale goals by 90%

Donald Trump-backed World Liberty Financial (WLFI) has lowered its $300 million presale target to $30 million.

Sales have slowed after a robust first day; thus far, the initiative has raised close to $15 million. But WLFI has a lot of problems behind the scenes, which slows down its progress.

WLFI’s presale flop

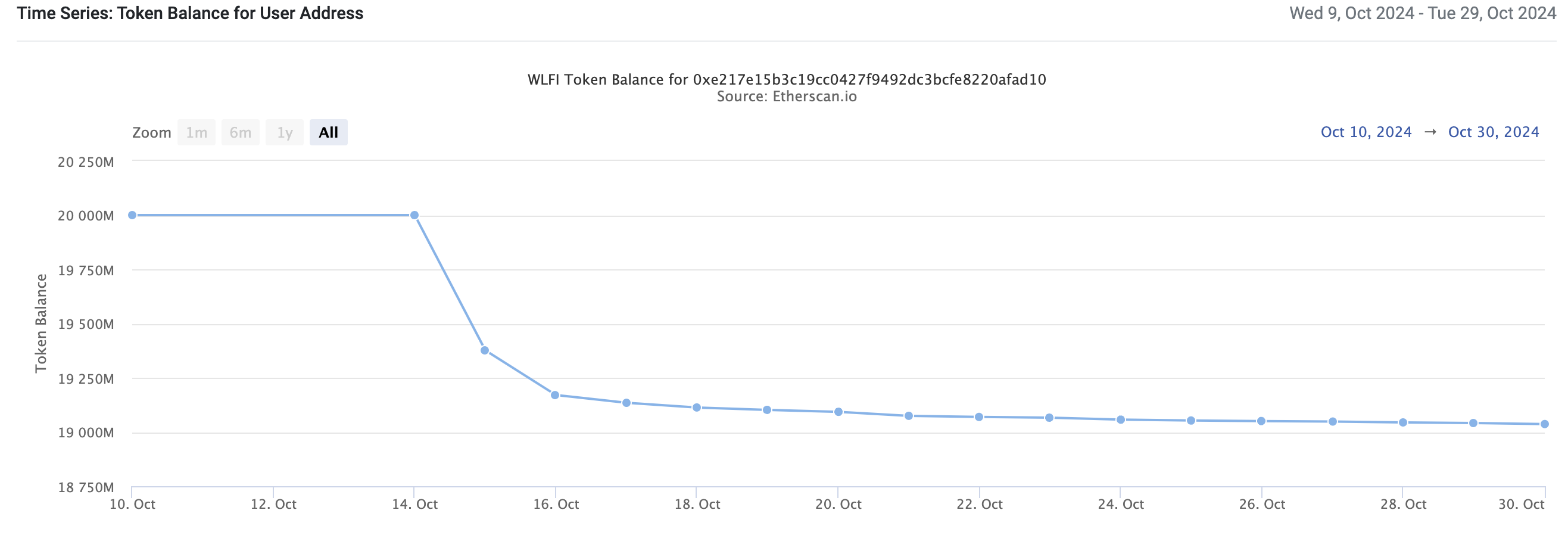

Donald Trump-backed World Liberty Financial has slashed its fundraising targets by 90%. On October 15, the WLFI token presale began, generating $5 million in the first hour before encountering immediate technical issues. This presale had a $300 million target. On the other hand, substantially lower expectations are described in an October 30 SEC filing.

“$288,501,188 is the maximum inventory available for sale. The company currently only plans to sell tokens up to $30 million in the offering before terminating sale. $2,703,786 reflects assets received by the company, including assets whose fair market value is approximated,” it stated.

Stated differently, World Liberty intends to end its presale after just achieving 10% of its original target. The initiative created a lot of buzz prior to debut, which affected Trump’s chances in the Polymarket. On-chain data, however, shows that token purchases instantly fell. Of the 20 billion tokens it first sold, WLFI now owns more than 19 billion.

The SEC’s reference to sales of more than $2.7 million does appear to be a little inconsistency. On the other hand, according to World Liberty’s official website, these tokens are worth $0.15 and sold little under $1 billion. The remaining WLFI tokens are valued at $285,797,402, according to the SEC record, meaning they have sold little under $15 million thus far. At least these numbers add up.

Stated differently, it is now unclear if World Liberty intends to sell an extra $15 million or $28 million before scrapping the deal. In any event, it appears that cryptocurrency investors have good reason to be skeptical about the initiative. Current holders are unable to cash out their bought WLFI tokens for more fungible assets since they are locked.

In fact, according to Galaxy Digital, existing WLFI holders only possess “a governance token for [an] as-yet-unlaunched protocol.” Despite World Liberty’s attempt to launch on Aave‘s Ethereum mainnet, the discussions appear to be at a standstill. WLFI may never take off due to lackluster sales and unmet expectations.

XRP whale dumps 31M coins as Ripple lawsuit nears major decision

Amidst Ripple vs. US SEC legal disputes and ETF anticipation, the price of XRP remains close to $0.50 as a huge 31M coin transfer causes market anxiety.

It was discovered that 31.1 million XRP tokens, valued at around $15.8 million, were being transferred in bulk from an unnamed wallet to the cryptocurrency exchange Bitso. The XRP community has taken notice of this significant transaction because it aligns with significant developments in Ripple’s ongoing legal dispute with the U.S. Securities and Exchange Commission (SEC).

XRP whale dumps 31M coins

Amid increased market activity and conjecture on Ripple’s future, the significant transfer was detected by blockchain surveillance firm Whale Alert. When so much XRP moves into an exchange wallet, it frequently indicates an upcoming sell, which might drive down the price of XRP.

A U.S. judge recently ordered Ripple Labs, its CEO Brad Garlinghouse, and other parties to think about a possible “alternative resolution” before the lawsuit goes any further. This action follows that order. The order follows Ripple’s request for a final ruling regarding class-action allegations of breaches of securities laws.

Crypto expert Egrag Crypto has posted observations on social media site X amid these legal ambiguities, suggesting that XRP may be about to see a surge. On the price chart of XRP, he saw a symmetrical triangular pattern, which is frequently a sign of upcoming volatility as the asset price approaches a convergence point.

The breakthrough goal set by Egrag Crypto is $0.5930, which is significantly higher than the current trading price of Ripple’s currency, which is about $0.5183. According to his research, if XRP crosses this barrier, it may encounter resistance at $1.5000, with additional upside potential to reach $7.5000. Compared to current levels, this would indicate a 1,347% rise.

Grayscale receives acknowledgment from US SEC

There is increasing interest in the possible approval of an exchange-traded fund (ETF) with an XRP focus amid current legal procedures. Grayscale’s proposal to convert its Digital Large Cap Fund (GDLC) into an ETF, which includes exposure to Bitcoin, Ethereum, Ripple’s token, and other significant cryptocurrencies, has been formally accepted by the U.S. Securities and Exchange Commission.

If the SEC approves the conversion, Grayscale’s decision to incorporate Ripple’s cryptocurrency into its ETF proposal may provide institutional investors regulated access to XRP.

Grayscale’s submission comes after Bitwise and Canary Capital recently applied for XRP ETFs. Brad Garlinghouse, the CEO of Ripple, has often stated his belief that an XRP ETF is “inevitable,” particularly in light of the acceptance of Bitcoin (BTC) and Ethereum (ETH) ETFs.

XRP price struggles near support level

Concerns about possible volatility are heightened by the recent whale movement, as the price of XRP has been trading close to a critical support level at $0.50. On the 4-hour chart, technical analysis reveals that XRP has created an inverse head-and-shoulders pattern, which is typically seen as a bullish reversal signal.

A trend reversal may be indicated if the price of the Ripple coin is able to maintain above the $0.50 support and break above the neckline at about $0.58.

The Chaikin Money Flow (CMF) indicator, on the other hand, is presently neutral, indicating little purchasing pressure. Additionally, the asset has been under downward pressure recently, as shown by the Relative Strength Index (RSI) being close to the oversold area. Increased buying interest will be required for XRP to see a long-term recovery, particularly in light of the current legal uncertainties and whale behavior.