Crypto markets are preparing for what is likely to be 2024’s most turbulent week. There are three upcoming US macroeconomic data events that might have a big impact on investors’ portfolios.

Since the fourth quarter (Q4) has traditionally been favorable for the trailblazing cryptocurrency, Bitcoin (BTC) is now trading below $70,000 with the potential for further rises.

US elections: Donald Trump vs. Kamala Harris

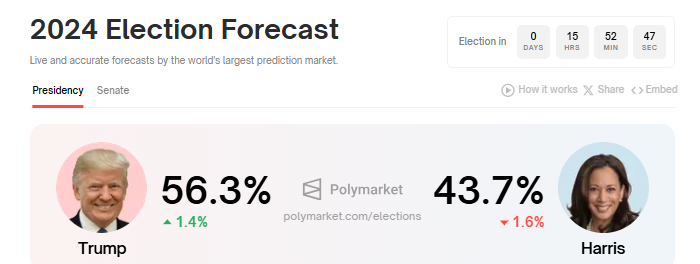

On Tuesday, November 5, the US market is getting closer to the conclusion of the political battle between Democratic candidate Kamala Harris and Republican candidate Donald Trump. The US elections are just hours away, and Trump is leading by a slim margin, according to statistics on Polymarket.

However, Trump leads by 52% compared to Harris’ 48% in Kalshi, Polymarket’s industry counterpart in the prediction market, which has a nearly same margin. The disparities in the user bases of different platforms are reflected in this disparity. Nevertheless, many predict that Bitcoin will have a turbulent day.

The outcome of the US election may have a big impact on investor mood, regulatory frameworks, and economic policies. The winner may influence cryptocurrency policies, which might impact the price of Bitcoin and have an impact on other cryptocurrency tokens.

I’m expecting this week to be a real firecracker, with lots of volatility. The Key day will be Tuesday, as the US election voting comes to a close. If there is no clear winner as the day progresses, it could get quite scarry for #Bitcoin.

This weeks key economic… pic.twitter.com/rGMO9rTjsw

— AlphaBTC (@mark_cullen) November 4, 2024

Initial jobless claims: Labor market gauge

Crypto markets will keep an eye on the first unemployment claims on Thursday, November 7, in addition to the US elections. This economic data aids in determining how tight or soft the US labor market is. Despite the softening of the labor market, absolute unemployment rates are still low.

The number of new unemployment insurance applications submitted by US residents decreased from 228,000 to 216,000 during the week ending October 25. Nonetheless, a consensus prediction of 220,000 exists.

The Thursday report’s high first jobless claims point to a deteriorating labor market and growing economic distress. Consumer spending and investments in conventional assets like stocks and bonds may decline as a result. As a result, in order to protect themselves from economic instability, some investors may resort to alternative assets like cryptocurrency.

FOMC interest rate decision and Jerome Powell speech

Jerome Powell, the chair of the Federal Reserve (Fed), will react when the Federal Open Market Committee (FOMC) releases the minutes of its most recent meeting on Thursday. The Fed is tasked with maintaining full employment and keeping inflation, as determined by the Consumer Price Index (CPI), at 2% each year.

Next Wednesday and Thursday are the FOMC’s November meeting, and analysts are speculating about the prospect of another rate decrease. The US CPI fell to 2.4% at the last meeting, prompting the Fed to lower interest rates by 50 basis points (0.5%).

As inflation approaches the Fed’s 2% objective and the unemployment rate has increased from 3.7% to 4.1% this year, suggesting a possible weakening of the labor market, another rate decrease may be imminent.

Powell hinted at more rate reduction to assist economic growth before things become worse when he recently stated that the downside risks to employment had grown. Furthermore, according to the FOMC’s September prediction, the federal funds rate may drop by a further 50 basis points before 2024 is done.

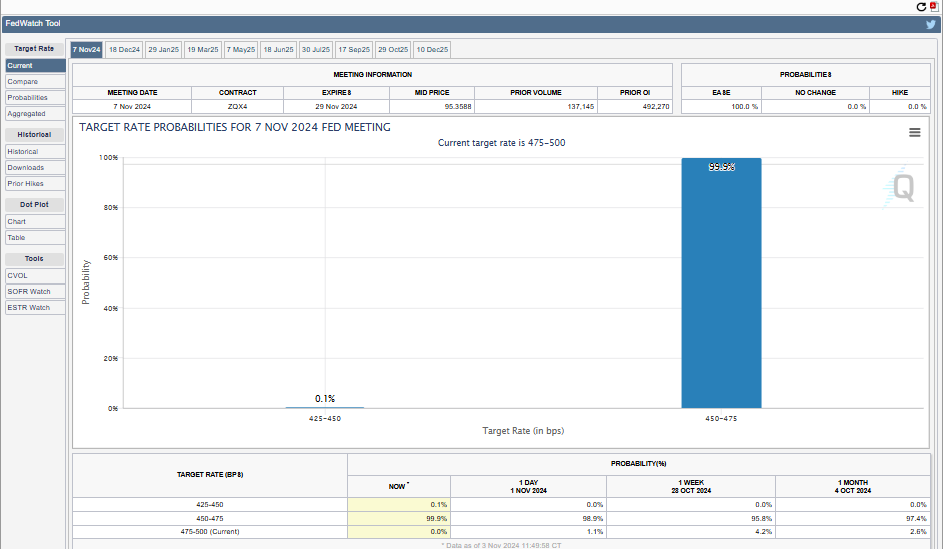

With just the November and December meetings left, two 25-basis-point cuts are probably already in motion. In light of this, the CME Fed Watchtool indicates a 99.9% chance of a 25 basis point rate decrease in the US economic data release on Thursday.

After the US elections and the FOMC meeting, Spotonchain expects Bitcoin to rise even further, aiming for a price of $100,000 in 2024. Regardless matter the outcome of the elections, Spotonchain said the demonstration will take place.

The market is entering its most volatile week with the U.S. election and FOMC meeting, but this rally may be here to stay.

Historically, the real bull run begins post-election, and we believe that whether Trump or Harris becomes the next president, $BTC will continue its upward… pic.twitter.com/7cvCo8QxGK

— Spot On Chain (@spotonchain) November 4, 2024

As of this writing, Bitcoin (BTC) is trading at $68,698, representing a little increase of 0.34% from the start of the Monday session.

Will PEPE’s 15% plunge creates “opportunity zone” for buyers

The price of PEPE has been under pressure lately and has had difficulty holding onto $0.00001000, which was formerly a crucial support level. The meme currency is now more susceptible to losses as a result of this failure, which has increased pessimism surrounding it.

Technical indicators and investor behavior give conflicting indications about the possibility of a rebound as PEPE fights to regain equilibrium.

PEPE investors have opportunity

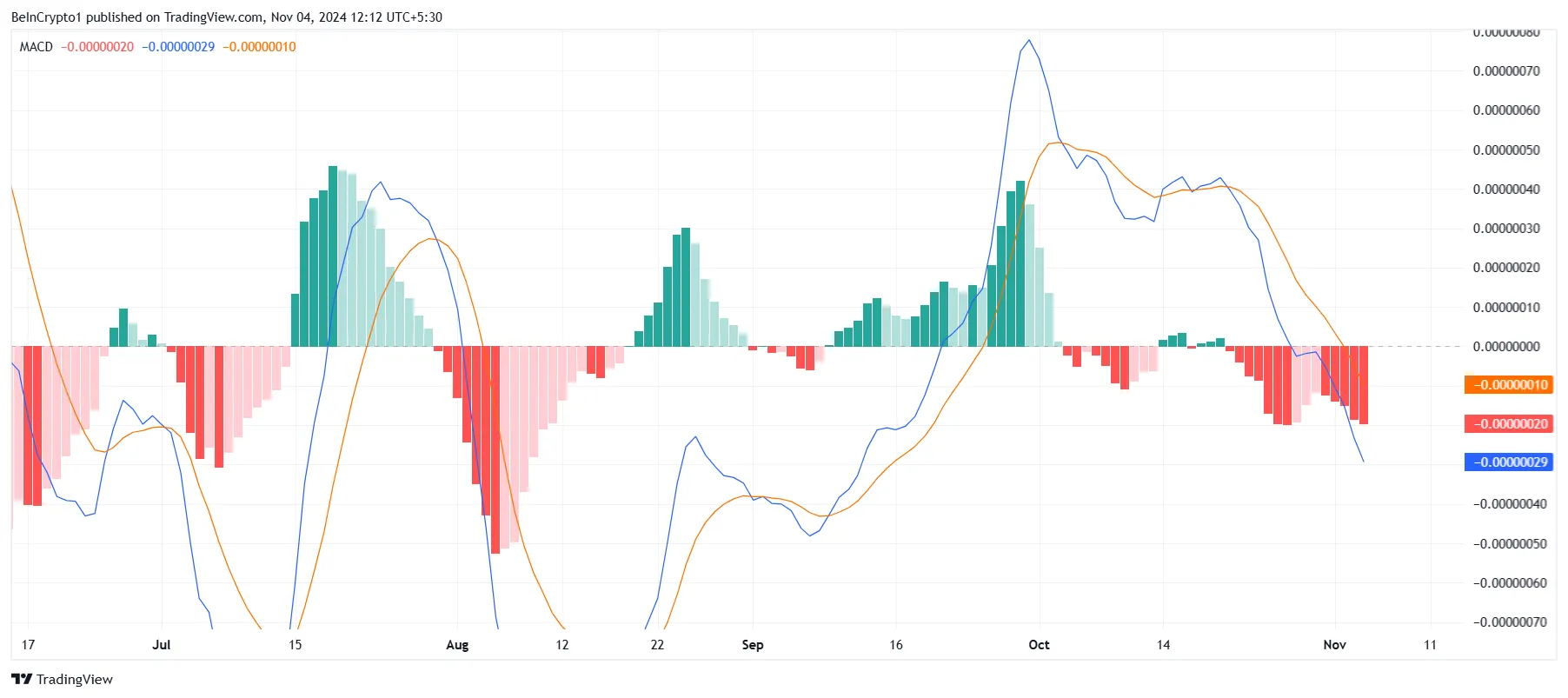

The Moving Average Convergence Divergence (MACD) indicator indicates that PEPE’s macro momentum is now exhibiting significant negative overtones. The downward slope of the MACD indicates a strengthening negative trend for PEPE. Downward-pointing MACD lines usually indicate ongoing selling pressure, and PEPE has seen this pattern for a long time. This implies that until a reversal signal appears, the meme coin’s downward trend may continue.

The MACD’s indication of negative momentum highlights market prudence and may put off short-term investors. Typically, long-term negative indications alert investors to potential further losses.

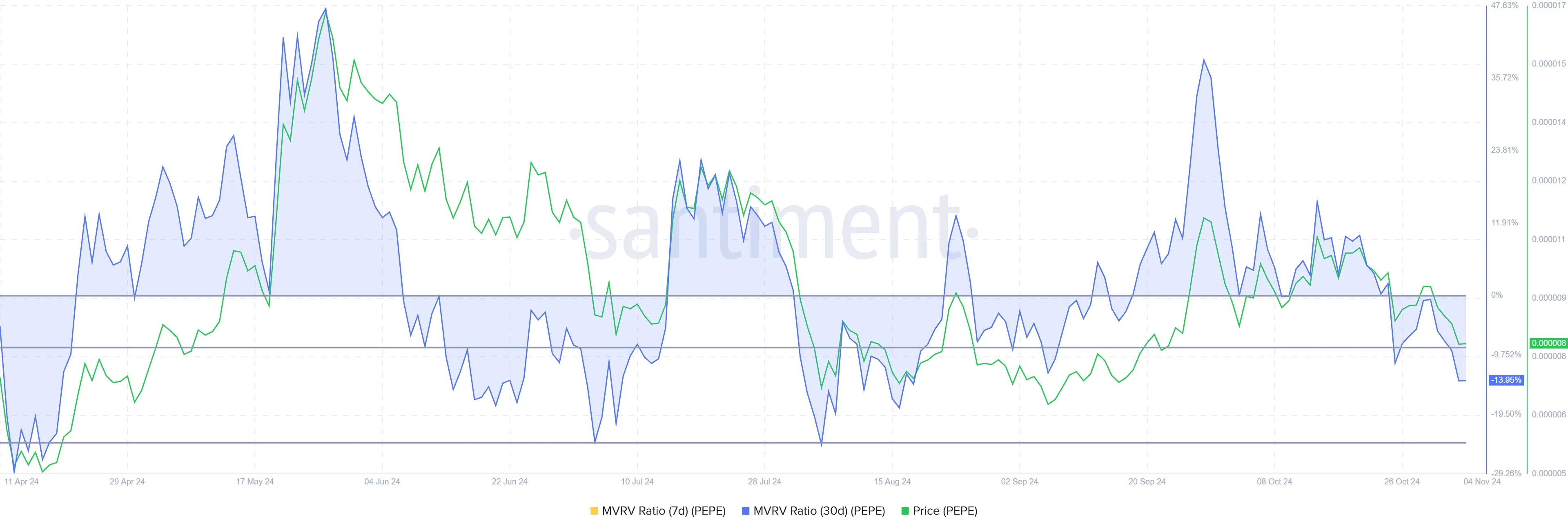

PEPE’s Market Value to Realized Value (MVRV) ratio is showing indications of alleviation despite the robust negative momentum. The “opportunity zone,” which ranges from -8% to -24%, is where the MVRV ratio, which determines whether investors are making money or losing money, has fallen. The MVRV ratio historically indicates a possible reversal point when it enters this range, indicating that prices are more attractive for accumulating than for selling.

This “buy zone” usually promotes purchasing activity while lessening selling pressure. Historically, low prices in this area have deterred investors from selling and encouraged them to accumulate instead. If past trends continue, this change in market sentiment may give PEPE the boost it needs to recover from its present lows.

PEPE price prediction: Bearing losses

PEPE price has fallen 15% in the last several days, hitting a monthly low of $0.00000818 and falling below the crucial support level of $0.00000839. Since losing the support level might indicate further loss if investors don’t intervene, this fall underscores the difficulties PEPE confronts.

In the event that investors react to the MVRV “buy” signal, PEPE may reverse and recover the support level of $0.00000839. Regaining this price floor would probably indicate a resurgence of bullishness and might push the meme currency closer to reaching $0.00000999, a crucial milestone that would signify a more robust rebound.

PEPE may continue to be susceptible to additional falls if this purchasing impetus does not materialize. Any positive prognosis would be called into question by a decline below $0.00000800, which would indicate the possibility of prolonged losses and maybe refute the present recovery theory.

Kraken launches crypto derivatives suite for Australian wholesale clients

Through futures contracts, institutional clients can now be exposed to fluctuations in bitcoin prices thanks to Kraken’s new derivatives product.

Following a recent court setback in Australia, U.S.-based cryptocurrency exchange Kraken has launched a new suite of crypto derivatives specifically for wholesale clients in Australia. These derivatives are meant to comply with regulatory standards.

The exchange stated in a blog post on Monday that the launch demonstrates Kraken’s dedication to the Australian market and its attempts to provide institutional investors safe and legal services in the face of shifting regulatory requirements.

With Kraken’s new derivatives offering, institutional clients may use futures derivatives to get exposed to changes in bitcoin prices without having to hold the underlying assets.

Kraken’s new derivatives product include multi-collateral support

Multi-collateral support is provided by the service, which covers more than 200 tradable assets in a highly secure custodial system and accepts collateral in fiat, stablecoins, and cryptocurrency.

The debut comes after Australia’s Federal Court ruled in August against Bit Trade Pty Ltd, Kraken’s local subsidiary.

Kraken’s General Manager for Australia, Jonathan Miller, stated that “Australian wholesale clients are looking for the ability to execute advanced trading strategies using a licensed broker backed by Kraken’s high security standards.”

“Our new premium product meets our clients’ trading needs and helps them to advance in their crypto journey.”

Hey Australia 🇦🇺 – big news!

We are now offering access to crypto-based derivatives for eligible wholesale clients via our Australian financial services licensed broker.

Read more here:https://t.co/beFhgGaGGm pic.twitter.com/wl1jbfMVjE

— Kraken Exchange (@krakenfx) November 3, 2024

Individuals must have net assets of at least AUD $2.5 million (USD $1.64 million) and gross yearly income of at least AUD $250,000 (USD $164,000) for the previous two years in order to be eligible for Kraken’s derivatives products.

Existing clients may verify their eligibility via the Kraken Pro app, while eligible clients can start exploring the new service on Kraken’s help website.

Kraken raises concern about lack of regulatory in Australia

Kraken has voiced worries about Australia’s unclear regulations after a Federal Court decision rejected their fiat margin trading product.

According to the exchange, investors and cryptocurrency companies in Australia are still operating in a “confusing and uncertain regulatory environment.”

The court’s ruling highlights the wider problem of regulatory uncertainty in the nation’s attitude to cryptocurrencies, the exchange said.

“This ruling makes it clearer than ever that bespoke crypto regulation is urgently needed.”

Bit Trade, a division of Kraken’s parent firm, Payward Incorporated, was the target of legal actions brought by the Australian Securities and Investments Commission (ASIC) last year.

Bit Trade was charged by ASIC with not fulfilling legal obligations, including determining its target market before making its margin trading product available to consumers.

The agency also emphasized that Bit Trade’s offering broke laws by functioning as a credit facility, allowing Australians to get a five-fold credit extension of the asset’s value.

In late August, the Federal Court issued a decision against Bit Trade.

The court’s decision said that the platform had violated section s994B(2) of the nation’s Corporations Act from October 2021.

Over the past several years, there has been a notable increase in the ownership and acceptance of cryptocurrency in Australia.

According to reports, Australia has a 17% cryptocurrency ownership percentage, greater than the 15% global average.