The arrangement will see all of the Bitcoin from the Osprey Bitcoin Trust transferred to Bitwise’s Bitcoin ETF, subject to closing conditions.

$120 million in Bitcoin (BTC) will shortly be sent to the Bitwise Bitcoin ETF (BITB) as part of an agreement to buy the Osprey Bitcoin Trust’s assets (OBTC).

An Asset Purchase Agreement was signed by Bitwise Asset Management and Osprey Funds as part of the agreement, which was made public in a joint statement on August 27.

As part of the deal, holders of OBTC units would get shares in BITB in exchange for their OBTC units. It is anticipated to close “later this year,” subject to closing conditions.

Osprey Funds, a Connecticut-based company, has been offering its over-the-counter (OTC) offerings to US clients since February 2021. The fund charges a 0.49% management fee.

Before GBTC finally changed to a spot Bitcoin ETF, it was a rival to the considerably bigger Grayscale Bitcoin Trust at the time.

In January 2023, Osprey even filed a lawsuit against Grayscale, alleging that Grayscale’s deceptive marketing and advertising gave it the upper hand in a “two-participant market.”

When Osprey discovered that trust units were selling for less than the value of Bitcoin in March, the company stated it had started thinking about a possible sale or liquidation.

“We wanted a solution that worked for all and this seems to be the best option,” Osprey Funds founder and CEO Greg King wrote in an Aug. 27 X post. OBTC’s website shows its asset under management is around $120.7 million at the time of writing.

I appreciate that. We wanted a solution that worked for all and this seems to be the best option. 🙏🏻

— Greg King, CFA (@GregKingOsprey) August 27, 2024

Investors with longer time horizons in OBTC may have seen that, based on statistics from Barchart and Yahoo Finance, the trust’s three-year return is now around 9.5%, whilst Bitcoin has returned 23.5% during the same period.

“This announcement follows Osprey’s prior communication regarding its exploration of strategic alternatives,” Osprey and Bitwise wrote in a statement.

“The acquisition by Bitwise represents a significant step in that process, offering OBTC unitholders the opportunity to benefit from the scale and expertise of Bitwise.”

The previous month, according to YCharts data, OBTC’s discount to Bitcoin has remained between 3% and 5%. With a premium or discount to NAV approaching 0%, Bitwise’s BITB has been trading substantially more in line with Bitcoin.

Bitwise’s spot Bitcoin ETF has witnessed $2 billion in inflows of investor funds since its introduction seven months ago. It has a management cost of 0.20%, which is far less.

Still, it hasn’t performed as well as BlackRock’s iShares Bitcoin Trust (IBIT), which has drawn around $21 billion in capital from investors since January.

Notcoin (NOT) approaches all-time low amid sharp decline in buying activity

Since Telegram CEO Pavel Durov was arrested on August 24, the price of Notcoin (NOT) has fallen precipitously. As of the time of writing, the cryptocurrency was trading at $0.0088; its value has subsequently dropped by 20%.

NOT is at danger of dropping to its all-time low of $0.0046, which was last observed on May 24, due to increasing selling pressure.

Notcoin whales see an opportunity

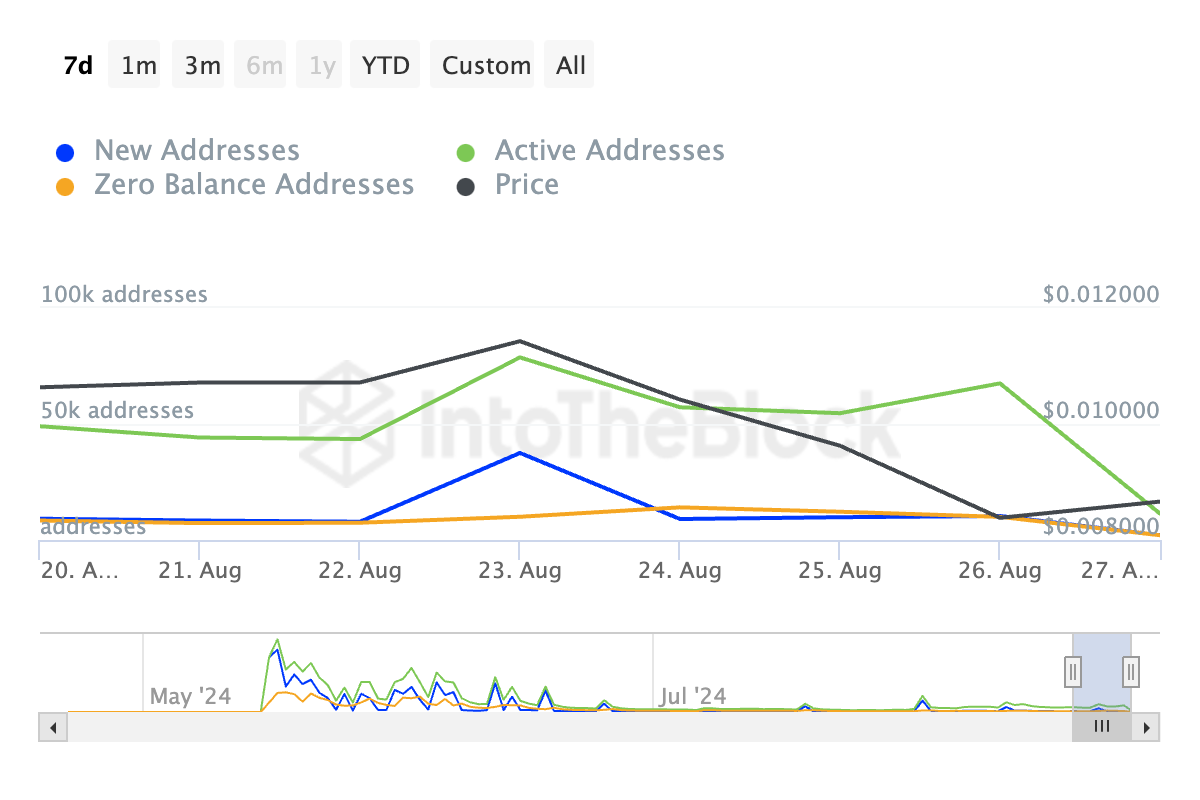

Over the last seven days, there has been a steady decrease in the number of active addresses trading NOT due to its current price problems. There has been a 76% drop in the number of unique addresses that have completed at least one NOT transaction over this time, according to data from IntoTheBlock.

In a same vein, the altcoin’s demand has declined. The amount of new addresses generated to trade NOT has decreased by 77% in the last week, according to the on-chain data source.

A decrease in the number of daily active and new addresses associated with an asset indicates a dip in interest among users, which in turn indicates a deterioration of market sentiment.

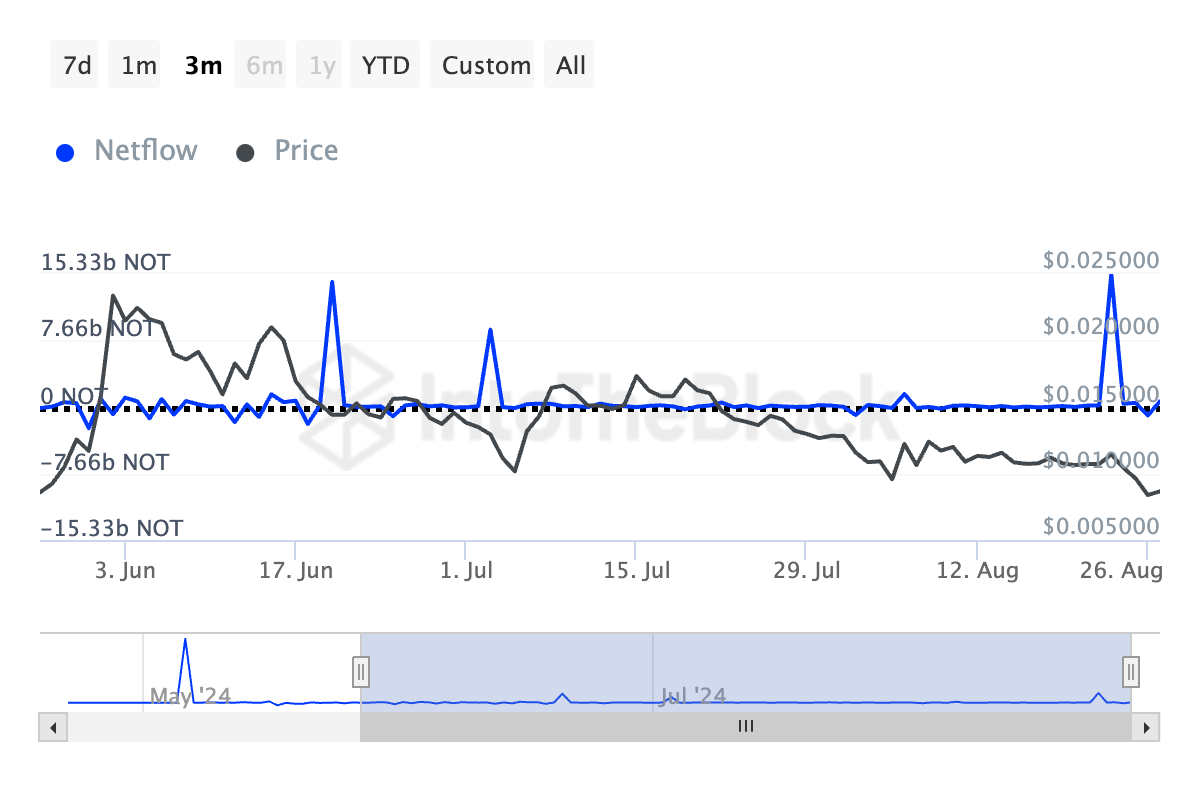

It’s interesting to see that NOT whales have increased their accumulation in spite of this drop. Over the last seven days, the netflow of major holders of the token has increased by 312%. To put things in perspective, on August 24, this indicator hit a three-month high of 15.33 billion NOT in response to the news of Durov’s arrest, which sent the value of Telegram-based assets plunging.

Addresses holding more than 0.1% of an asset’s circulating supply are considered large holders. Their netflow calculates the difference between the quantity of coins they purchase and sell over a given time frame. A spike in the big holder netflow suggests that whale addresses are adding more assets to their portfolios overall.

NOT price prediction: Bad times are not over

The technical configuration of NOT indicates that the token’s value may drop much more. The 30-day low for the Chaikin Money Flow (CMF), which is still declining, is -0.22.

The money flowing into and out of an asset is measured by the CMF. A number less than zero denotes a weakening of the market and suggests that liquidity is leaving the market, which is sometimes interpreted as an indication of impending price decreases.

Furthermore, the token’s Relative Strength Index (RSI), which is presently lying at 35.50, is below the neutral 50 line. This supports the gloomy view by showing that selling pressure is greater than purchasing activity.

The altcoin’s value may fall to its all-time low and maybe much lower, to about $0.00031, if NOT’s selloffs continue. However, NOT’s price may rise to $0.013 if market sentiment changes and there is a significant increase in demand for the token.

Robinhood wallet adds support for Solana

With the formal addition of Solana support to its Wallet, Robinhood has increased the variety of cryptocurrencies it offers.

Thanks to this connection, users will be able to self-custody Solana and perform transactions via the Solana blockchain, as stated by Johann Kerbrat, General Manager of Robinhood Crypto.

Robinhood 🤝 Solana

Just in: Robinhood Wallet has added support for Solana! https://t.co/Qxsu8mrVTE pic.twitter.com/7VumKVvCgT

— Solana (@solana) August 27, 2024

This action is consistent with Robinhood’s overarching plan to improve its Web3 wallet through the integration of more blockchains and digital assets, building upon its earlier integrations of networks such as Ethereum (ETH), Polygon, and Bitcoin (BTC).

Robinhood and crypto

Robinhood showed an increasing interest in the cryptocurrency market earlier this year. Interestingly, it bought Bitstamp, a cryptocurrency exchange.

In the United States and Europe, Robinhood began offering cryptocurrency futures using its recently acquired Bitstamp license. Although talks are still ongoing, the business intends to bring Bitcoin and Ethereum futures trading to the United States. An official launch date has not yet been determined.

This action came after Robinhood acquired Pluto Capital in July, which enhanced its cryptocurrency capabilities and drew in retail cryptocurrency customers.

Users of Robinhood Wallet will be able to transfer, receive, and securely keep SOL with more efficiency with to the integration of Solana.