The perpetrator of a $71 million cryptocurrency fraud messages the victim over the Ethereum blockchain, gives back 51 ETH, and asks for their Telegram login credentials.

Before passing over 51 ETH, or around $151,600, the victim was approached by the cryptocurrency fraudster behind the poisoning assault, who was able to take wrapped bitcoin (WBTC) worth $71 million. The victim was requested for their Telegram details.

The exchange, which took place on the Ethereum blockchain using an input data message (IDM), a kind of peer-to-peer transmission, was disclosed by the crypto investigator ZachXBT.

Crypto scammer contacts victim and sends 51 ETH

The fraudster wrote to the victim twice, offering their Telegram contact based on on-chain data obtained from Etherscan. The scammer’s message said, “Leave your telegram, and I’ll call you tomorrow.”

This outreach is a response to the victim’s May 5 demand that 90% of the money that was taken be returned. About 4.2% of the desired amount is represented by the 51 ETH that the scammer returned.

#PeckShieldAlert The scammer took ~$71 million worth of WBTC through a poisoning scam and has now sent 51 ETH to the victim, along with a message pic.twitter.com/GL1I6eubWf

— PeckShieldAlert (@PeckShieldAlert) May 9, 2024

Through an IDM, the victim replied to the fraudster, alerting him to the money’ traceability and requesting a 90% refund.

“There’s no turning back after this,” the victim wrote, adding, “We both know there’s no way to clean these funds. You will be traced.”

The deadline was set on May 6, 2024, at 10:00 am UTC, and the victim granted the con artist one day to deliver.

Details of the poisoning attack

On May 3rd, the con artist sent 1,155 WBTC, or $71 million, to his address, which is when the heist happened. This type of fraud, known as a “poisoning attack,” happens when the perpetrator sends the victim an excessive amount of blockchain transactions.

The intention is to trick the victim into repeating the address of the fraudster instead of their own. To commit an error, attackers typically take advantage of vanity services or create multiple digital wallets using the victim’s address.

WBTC, an ERC-20 token, is dependent on the price of Bitcoin. Nevertheless, despite these problems, WBTC was worth $62,410 at the time of writing, up 0.26% over the previous day.

The victim realized that it would be impossible to trace and lingerie such a huge quantity of money, therefore she sought the return of the majority of the stolen money. The scammer’s return of 51 ETH can be seen as an attempt to compromise or an acknowledgment of the challenges involved in spending the money that was taken without being discovered. The scammer’s half payback and desire for direct connection are still mysterious, though.

Meanwhile, blockchain expert ZachXBT pointed out that such a public fraud is rare in that it uses a communication method and only returns a portion of the assets.

Notcoin’s listings on Binance and OKX spark a market frenzy

Leading international cryptocurrency exchanges OKX and Binance recently revealed that Notcoin (NOT) would now be listed on both of their platforms.

Will Notcoin enhance the TON blockchain ecosystem?

Token holders of Toncoin (TON) will be able to stake their currencies for NOT tokens via OKX’s Jumpstart platform for new cryptocurrency projects. A maximum of 4,000 TON may be wagered by each player. The staking procedure will begin on May 13, 2024, at 6:00 UTC.

Notcoin was also unveiled by Binance Launchpool as its 54th project. By staking BNB and First Digital USD (FDUSD), users may farm NOT. The farming will begin at 00.00 UTC on May 13, 2024.

A popular Telegram tap-to-earn game first helped to popularize Notcoin, a community currency on the TON Blockchain. There are 35 million players in this game. Additionally, it has piqued consumers’ interest and exposed them to Web3 technology.

Right now, Notcoin is concentrating on creating an ecosystem. A game platform and tools for exploring Web3 projects are currently under focus.

Still unknown, though, is the official launch date for Notcoin. However, the listings on CoinMarketCap and CoinGecko indicate that the launch is about to happen.

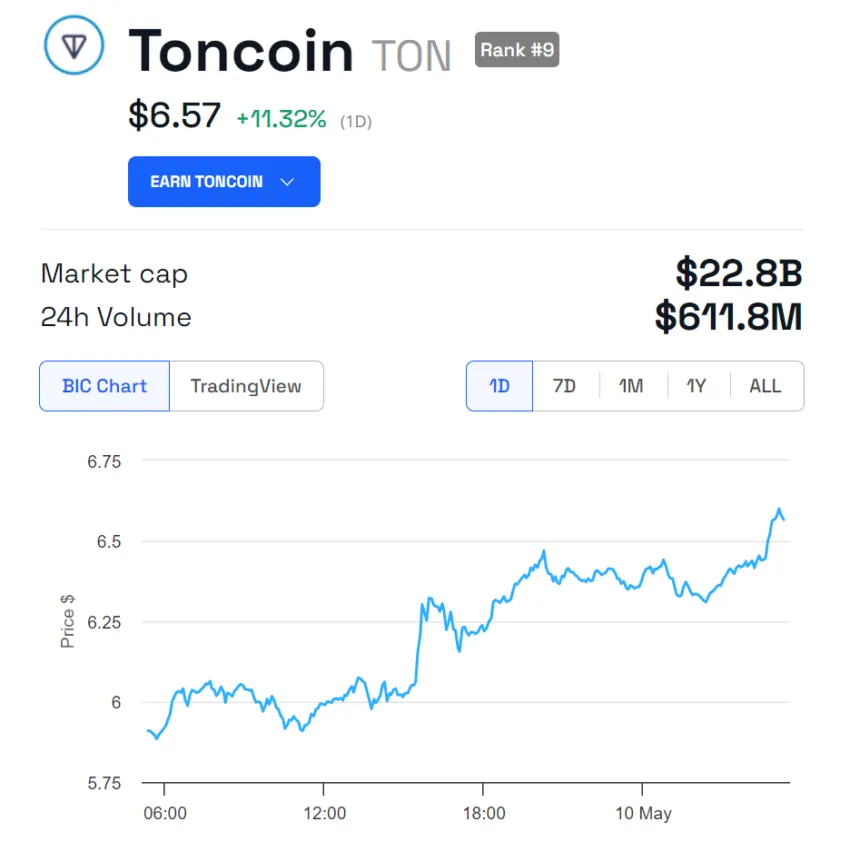

The native cryptocurrency of the TON Blockchain, Toncoin, has benefited from this evolution. In the last day, its price has risen by around 11.32%, and as of this writing, it is trading at $6.57.

Aside from the much awaited introduction of Notcoin, TON Blockchain has been in the news recently for a variety of reasons, most notably its partnership craze. One of the noteworthy developments is Pantera Capital’s large investment. Pantera Capital declared that TON is their “largest investment ever,” although the sum is undisclosed.

Dan Morehead, the CEO of Pantera Capital, recently shared his thoughts on the revolutionary potential of blockchain technology, some of which were informed by his conversations with Pavel Durov, the inventor of Telegram. Morehead emphasized Durov’s dedication to the openness and freedom that underpin the Telegram network and, thus, the TON Blockchain.

“We are honored to partner with people of such strong conviction. Pantera recently made the largest investment in its history in TON,” Morehead stated.

Another partner at Pantera Capital, Ryan Barney, offered his opinions. He went on to elaborate on the reasoning of their TON investment.

“Telegram is a community integrating blockchain technology. That’s just got to be easier. They’ve begun rolling out a blockchain wallet to their 930 million users,” Barney outlined.

Tokens with a gaming theme are becoming more and more popular in the Web3 and cryptocurrency industries. For example, a lot of attention was drawn to Binance’s listing of SAGA, the native currency of the layer-1 (L1) game blockchain Saga. Saga stated that in the 24 hours following its introduction on Binance Launchpool, more than $13 billion worth of BNB and FDUSD had been staked.

The Web3 gaming sector is also still being shaped by venture funding. The industry’s increased interest is seen in the massive investments made in Web3 gaming initiatives by businesses such as Andreessen Horowitz (a16z).

BlockFi to shut web platform this month, will let users access funds via Coinbase

BlockFi clients will be able to access crypto withdrawals via Coinbase after the platform shuts down this month.

Centralized lender BlockFi declared that following the closure of its online platform, qualified BlockFi clients would have access to cryptocurrency withdrawals through Coinbase.

This agreement with Coinbase guarantees that holders of BlockFi accounts will be able to continue withdrawing cryptocurrency once the platform’s first window for qualifying estate money closes.

“BlockFi is pleased to announce that we have engaged Coinbase as our distribution partner to ensure continuity of crypto withdrawals available to our eligible BlockFi Interest Account (BIA), Retail Loan, and Private Clients,” the firm stated.

It also stated that the BlockFi online portal will close this month.

The company made it clear that customers may still access their funds by opening or utilizing an authorized Coinbase account if they missed the deadlines of May 10 for verification via the BlockFi platform and April 28 for withdrawals.

This implies that the assets of these consumers won’t be turned into cash right away. Instead, if they have a Coinbase account that has been approved, they will be allowed to withdraw their cryptocurrency.

On the other hand, assets will be converted to cash and dispersed in accordance with the plan if a client is qualified to withdraw cryptocurrency but misses the deadline and does not have a verified Coinbase account.

According to the company, BlockFi’s plan administrator will keep using Coinbase for all upcoming payouts, including any recoveries from FTX.

Notably, BlockFi and the estates of FTX and Alameda Research had agreed a $875 million in-principle settlement.

How we got here

In November 2022, BlockFi initially stopped allowing client withdrawals. Shortly after, the company filed for Chapter 11 bankruptcy. The bankruptcy court accepted BlockFi’s Chapter 11 plan in September 2023, allowing it to reimburse its ten thousand creditors.

BlockFi was a centralized lender that provided interest-bearing deposit accounts. But, it functioned similarly to a bank, lending user money to cryptocurrency customers.

After a turbulent year for centralized crypto lending services in 2022, which saw the bankruptcy of several companies like Celsius, Voyager Digital, and Genesis as a result of the collapse of players like Terra, FTX, and Three Arrows, the centralized lending sector experienced severe setbacks.

How to earn with FMC & FMCPAY: https://news.fmcpay.com/how-to-earn-with-fmc-fmcpay.html