A postponement of its judgment involving the Invesco Galaxy spot Ethereum exchange-traded fund (ETF) has been issued by the Securities and Exchange Commission (SEC).

The SEC stated in a statement that the Ethereum ETF would either be approved or disapproved by the commission by July 5, 2024.

“The Commission finds that it is appropriate to designate a longer period within which to issue an order approving or disapproving the proposed rule change so that it has sufficient time to consider the proposed rule change and the issues raised therein,” said the SEC in the filing shared on May 6.

Franklin Templeton’s Ethereum ETF decision delayed

The SEC said in April that it will postpone making a judgment on Franklin Templeton’s proposed spot Ethereum ETF until June 11, 2024. This information is based on a publicly available file, thus the future of this financial instrument is still unknown.

A number of issuers, including BlackRock, 21Shares with Ark, Fidelity, and Invesco in addition to Galaxy, Grayscale, VanEck, Hashdex, and Franklin Templeton, have submitted proposals for Ethereum ETFs.

On May 23-24, the SEC is anticipated to reject applications for spot Ethereum ETF

The SEC postponed deciding whether to approve the BlackRock spot Ethereum ETF in March. VanEck has submitted an Ethereum ETF application to the SEC, which has until May 23 to accept or reject it. Ethereum is the second-largest cryptocurrency in the world.

Analysts from Bloomberg Intelligence have said, “Many analysts have speculated that the SEC will reach a final decision on whether to approve or deny a spot Ether ETF for listing and trading on U.S. exchanges in May, during deadlines for applications from several asset managers.”

Expectations have been dampened, though, by the recent SEC delays. James Seyffart, an analyst for Bloomberg Intelligence, has voiced doubt and hinted that the current batch of Ether ETF filings may wind up being rejected.

It was revealed in April that Joe Lubin’s Ethereum development company Consensys has sued the SEC for allegedly enforcing “overzealous regulation” of the Ethereum network.

Lubin stated that Consensys has made a significant move to “maintain access to ether and, by extension, the Ethereum (ETH) blockchain in the U.S.” in a statement posted on the social media site X. In retaliation for the SEC’s excessively aggressive regulatory overreach, we are suing it.

Crypto wallet developer Exodus gets approval for NYSE American listing

According to the business, Exodus Movement’s EXOD will be uplisted on the NYSE American market on Thursday.

Exodus Movement, a provider of cryptocurrency wallets, declared on Monday that it has been given the go-ahead to float its common stock on the NYSE American. On May 9, the stock will begin trading on the marketplace under the symbol EXOD.

“Trading on the NYSE American will allow Exodus to create greater long-term value for our stockholders by increasing our presence within the investor community and, in turn, increasing liquidity,” Exodus CEO and Co-founder JP Richardson stated.

NYSE American, which was originally called the American Stock Exchange (AMEX), serves businesses that are worth less than the market capitalization of the NYSE.

Exodus’ equities will be “uplisted” to the NYSE after receiving the most recent permission, after they were previously listed on the OTCQX market. The business further said that prior to the NYSE American listing, current owners are not required to take any action. The 2015-founded Exodus Movement creates self-custodial wallet solutions for ether, bitcoin, and other digital assets.

The digital equivalent of the company’s Class A EXOD common shares, the EXOD security tokens have been tokenized on the Algorand blockchain and are controlled through the Exodus wallets. According to Exodus, it is the only US firm whose common stock has been tokenized on the blockchain.

Exodus reported $29.1 million in sales in its preliminary assessment for the first quarter of 2024, an increase of 118% over the same period the previous year. In the first quarter, there were about 1.69 million monthly active users.

Market Cap for Tellor (TRB) soars above 70% – What is initiating the increase?

The decentralized oracle network Tellor (TRB) doubled its market valuation in the first few days of May, far exceeding forecasts. The market value of TRB was $143.32 million as of April 30. In Asia market hours on May 7, this amount had increased to a staggering $247.81 million by the morning.

Analyzing the increase in market capitalization of Tellor

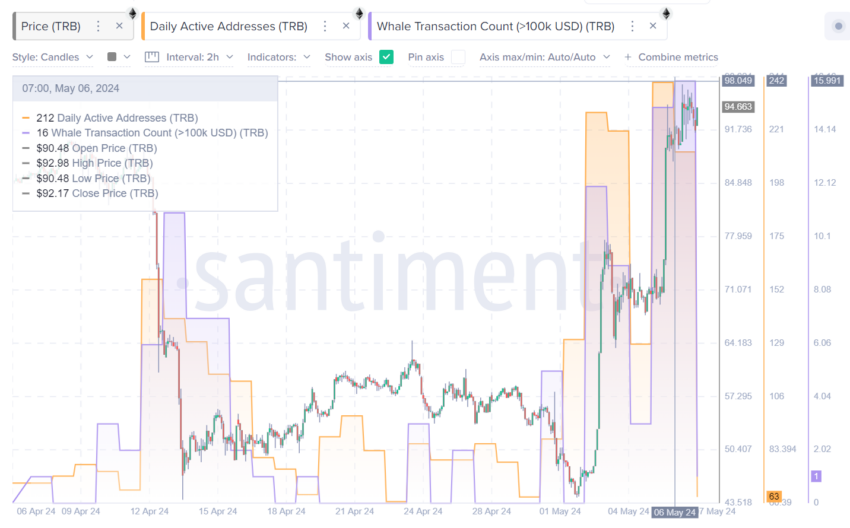

There has been an increase in transactions and active addresses using TRB by crypto Whales, according to data from the blockchain analytics platform Santiment. In particular, on May 6, there were 16 whale transactions totaling more than $100,000, and there were 212 daily active addresses.

On May 1, there were just 131 active addresses and no noteworthy crypto whale transactions. This is a sharp contrast to the current situation. This action, however, suggests that investor interest in TRB is increasing as well as the possibility of profit-taking.

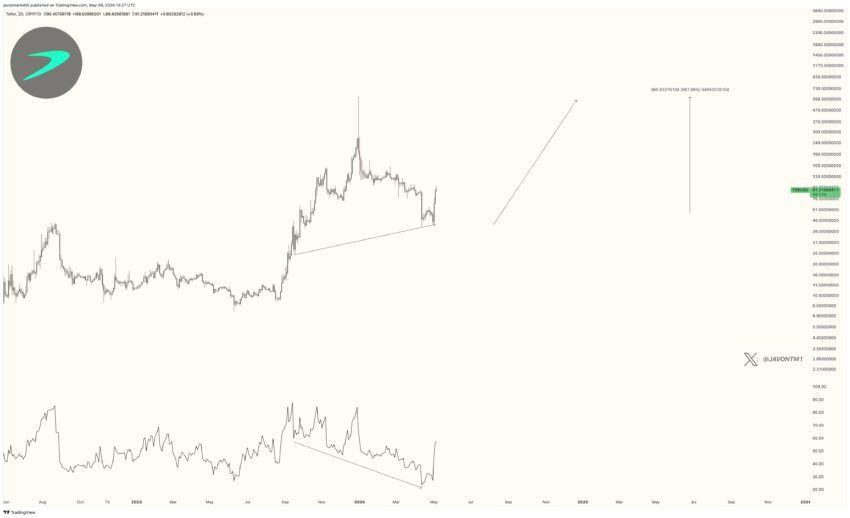

Crypto specialists are yet upbeat about TRB’s price trend in spite of this. Highlighting Tellor’s market dominance, analyst Javon Marks predicts that the trend will go up.

“TRB (Tellor) is now starting to display major strength after holding a bullish pattern and can still be getting ready for a massive, [above] 315% move back to [over] $261,” Marks commented.

After that, he restated his optimistic assessment while emphasizing how TRB prices are sensitive to current trends. The technical trends found further corroborate this bullish interpretation. A bullish continuation for TRB is suggested by the emergence of higher lows in the price action and lower lows on the momentum oscillator.

Tellor is currently trading at $95.78, up 4.7% over the previous day, according to the most recent reports. But in the last seven days, the total price gain has risen by more than 70%, indicating a robust rising trend that may continue as market analysts have projected.

How to earn with FMC & FMCPAY: https://news.fmcpay.com/how-to-earn-with-fmc-fmcpay.html