Chris Larsen, a co-founder of Ripple, submitted the Notice of Appearance in the ongoing SEC v. Ripple litigation, avoiding a last-minute default.

As the Form C submission deadline draws near, the blockchain firm is seen showing off its strength at the last minute in the ongoing Ripple dispute. One day before the US Appeals Court for the Second Circuit warned the company of procedural default, Chris Larsen, a co-founder of Ripple, finally submitted the Notice of Appearance.

Ripple lawsuit: Chris Larsen makes last moment move

In the continuing SEC vs. Ripple case, the US Appeals Court for the Second Circuit informed blockchain company Ripple on Tuesday, October 22, of the potential default. This was essentially a notice that the time for filing the Form C cross-appeal against the US SEC was approaching. However, Chris Larsen submits the Notice of Appearance at the last minute.

NEW: 🇺🇸 Chris Larsen Has Filed, Next Move Is Ripple Form C — Due October 24! pic.twitter.com/5U1osNjZTK

— Good Morning Crypto (@AbsGMCrypto) October 23, 2024

Following the court’s announcement of a $125 million settlement earlier this year, the XRP litigation has gained significant attention. Ripple and the SEC, however, have been dragging out the matter until the very last minute.

The US SEC may no longer choose to appeal, according to prior rumors that surfaced last week that the agency missed the time to file the appeal. The SEC spokeswoman subsequently acknowledged, nevertheless, that they had filed Form C for the appeal in the Ripple case.

Stuart Alderoty, the Chief Legal Officer (CLO) of Ripple, subsequently affirmed that the SEC’s Form C did not contest the decision that XRP is not a securities. Alderoty declared, “That ruling is the law of the land.”

Stuart Alderoty further stressed that it is unlikely that Judge Torres’s initial decisions will be overturned by the appeal. He pointed out that a remand could be the best course of action for the SEC in the Ripple case. When Judge Torres decided against them, the SEC may ultimately claim that she lacked “ordinary intelligence.” “Awkward,” he remarked.

The next Form C filing deadline

Ripple has until October 24 at 11:59:59 p.m. EST to submit Form C for its cross-appeal to the US SEC. However, take notice that Ripple’s lawyers will not get another opportunity to present oral arguments in this matter if they do not provide the necessary papers.

Due process has not been broken by Ripple Labs, and it is doubtful that it will in the future. The company’s goals in the case against XRP are still quite obvious. The cross-appeal seeks to definitively terminate the SEC’s enforcement operations, according to Ripple officials.

The SEC vs. Ripple case has been keenly anticipated by the XRP community. The price of XRP would then be able to rise to its highest point ever, $3.84. For a very long time, the price of XRP has been below $1. This hasn’t prevented investors from forecasting a $17 price increase for XRP, though.

Buenos Aires partners with ZKSync for blockchain-based digital identity

A new partnership between the City of Buenos Aires and ZKSync has been established, enabling 3.6 million residents to adopt blockchain technology for their digital identities. This site provides access to more than 60 papers.

The new system, QuarkID, is based on an earlier digital identification program and uses trustless blockchain technology to provide more security and privacy.

Argentina’s blockchain platform

On October 22, Buenos Aires and ZKSync unveiled QuarkID, pledging to put user privacy first. QuarkID will provide 3.6 million eligible residents with expanded access to government services through the use of zero-knowledge encryption and blockchain technologies.

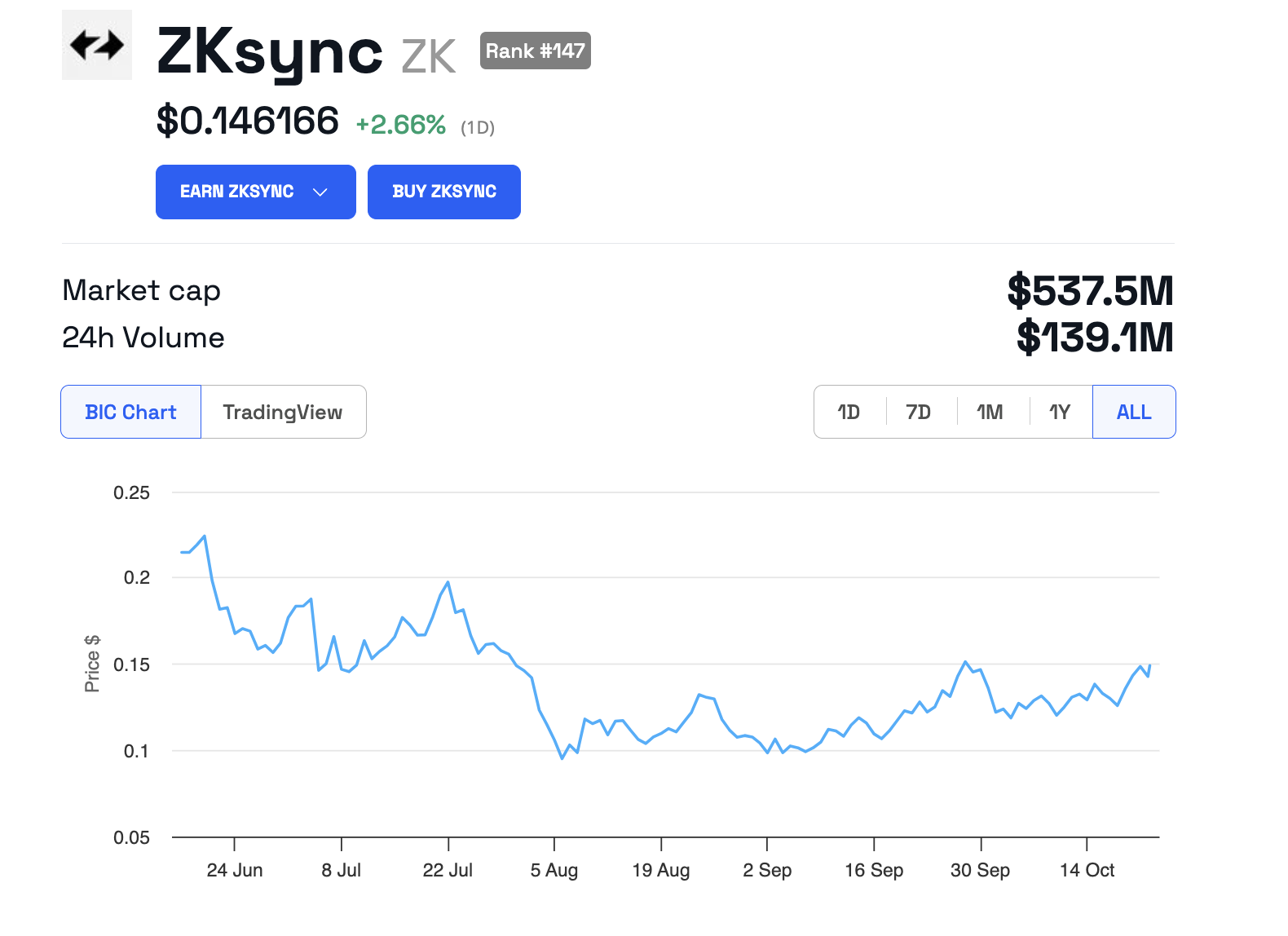

ZkSync entered this project during a phase of record low valuations. The network’s active addresses fell by 66% by July 2024, and the ZK token has been on a persistent downward trend ever then. Such a new, high-profile partnership may help the business gain more recognition and aid in its recovery.

Buenos Aires’ existing digital profile platform, miBA, served as the foundation for this QuarkID effort. This blockchain solution, which provides several enhancements, is now available to all miBA users. To put it briefly, QuarkID concentrates on backend improvement; the user experience is comparable, but personally identifiable information is kept off government servers by trustless software running in the background.

The incorporation of zero-knowledge blockchain technology into the City’s digital identity system is…[a] milestone that positions us globally… and… demonstrates that… Buenos Aires is at the forefront of innovation. [It] is a fundamental step toward… more secure and transparent digital solutions,” said Jorge Macri, Chief of Government of the City of Buenos Aires.

In Argentina, the broad adoption of blockchain and cryptocurrency is just one step away from this digital identification initiative. Numerous new initiatives under the Web3 umbrella have started there after pro-Bitcoin candidate Javier Milei won the presidential election last year. Argentina’s capital, Buenos Aires, is therefore a logical place to launch such projects.

To sum up, QuarkID wants to provide millions of people with a safe choice for a variety of government services. There will be more than 60 papers available, including driver’s licenses, vaccination records, birth, marriage, and death certificates, and tax information. Furthermore, all of this information will remain confidential for Argentineans because to ZkSync’s trustless blockchain technology.

Tether pushing dollar supremacy in emerging markets: Ardoino

The CEO of Tether reaffirmed the stablecoin issuer’s desire to supply US dollars to the billions of people who lack access to banking globally and voiced hopes for supportive policies.

As the firm continues its internal efforts to promote transparent standards, Tether CEO Paolo Ardoino said delegates of DC Fintech Week that the company sees improvements in U.S. crypto policy.

Members of the U.S. House of Representatives have proposed legislation that would publicly acknowledge and encourage stablecoin issuance in the United States. New players like Ripple have already introduced offers in anticipation of measures that have not yet become law.

Politicians like Patrick McHenry and Maxine Waters have proposed regulations that would allow banks to produce stablecoins, which may put Tether’s hegemony in the market in jeopardy.

Tether’s global coopreration and expansion

Christopher Brummer, the creator of the event, was informed by Ardoino that the payment provider had ties to more than 180 law enforcement organizations in 45 jurisdictions. Brummer and Dan Gallagher, the CLO of Robinhood Markets, have been floated as potential successors to Gary Gensler, the current head of the Securities and Exchange Commission.

According to Ardoino’s comments, Tether’s primary priority continue to be preventing the illegal usage of cryptocurrencies and protecting blockchain payment systems.

In other developments, the issuer of USDT may expand its traditional financial activities beyond short-term debt and US Treasuries. The company has considered lending its billions of dollars in income from mining Bitcoin (BTC) and Treasury interests to TradFi institutions.

A swarm of new customers onboarded in Q3 2024 and record revenues in the first half of the year may have influenced its choice. Last quarter, more over 36.25 million new USDT addresses were registered. In other areas, Tether investigated shifting its focus from its cryptocurrency mining business to additional advancements in artificial intelligence. Supported by USDT’s issuer, Northern Data may sell its cryptocurrency mining division to fund wagers on artificial intelligence.